In a Nutshell: Access to financial products and services can be limited and costly in emerging markets. That’s why Airfox is leveraging mobile technology to expand the financial options of those underbanked populations — starting with Brazil. Through its stored-value mobile wallets, proprietary cryptocurrency, and alternative credit scoring system, Airfox provides traditional and digital services to demographics in need. By learning from its early experience in Brazil, Airfox hopes to expand its reach to other emerging markets around the world and create equal access to essential services.

Victor Santos was born in Brazil to a low-to-middle income family. During his childhood, he saw his mother use many alternative means to meet family expenses, including borrowing money from family members and getting quick cash from pawn shops.

The difficulties his family experienced, and the lack of access to traditional financial services they encountered stayed with him after he came to the United States at age 12. As an adult, Santos saw an opportunity to deliver those much-needed products and services through digital technology. He dubbed the solution Airfox.

“We’re building financial services for the underbanked in emerging markets,” said Katie Sedat, Airfox VP of Marketing. “Our goal is to provide services that can include more individuals. Typically, there are billions of people in this world who don’t have access to traditional financial services.”

Katie Sedat, Airfox VP of Marketing, spoke with us about the platform’s growth in Brazil.

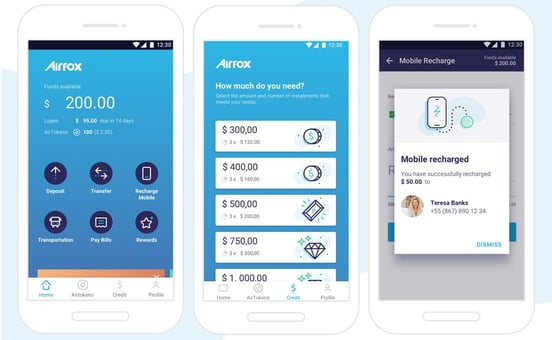

Airfox offers users a mobile digital wallet they can access through their smartphone. The funds in their wallets can be used to pay bills, send money to friends or family members, and charge and pay for goods and services. Airfox also aims to offer an extended microlending program backed by its AirTokens — Airfox’s proprietary cryptocurrency developed on the Ethereum blockchain.

Airfox is currently developing and deploying its services in the Brazilian market. Already, 20,000 people have engaged with the platform, and the company has already issued more than 1,000 microloans.

These are all substantial steps in Airfox’s bold journey to create a new, more egalitarian financial services model to suit the needs of consumers in emerging and underserved markets.

How the Mobile App Makes It Easy to Deposit, Pay, and Borrow Money

The Airfox app grants users access to a stored-value mobile wallet. It’s designed to meet the needs of those who primarily use cash because financial services are inaccessible to them. Airfox has partnered with more than 300,000 physical locations throughout Brazil — including post offices and banks — that allow users to transform funds from physical to digital currency. Airfox customers can walk into a location, make a deposit, and see the value added to their mobile wallet. The funds are made available for use within 48 hours.

“You can then use the money to pay for your utility bills, top off your mobile phone, transfer it to other people, pay for your public transit card, and also pay for many other everyday goods and services,” Sedat said.

Airfox is also in the process of developing an alternative credit rating system. As it explains in its in-depth white paper on AirToken, the Airfox app gathers information on financial transactions and collects data on other interactions from the user’s smartphone. This data is then analyzed by Airfox’s proprietary machine-learning algorithms, which examine the user’s financial and behavioral trends to produce a credit-worthiness score.

Airfox can use this score to evaluate risk when a customer applies for a loan or line of credit. This alternative to traditional credit scores offers more financial opportunities to those in primarily cash markets. And it can drastically expand access to both personal and small business loans, lines of credit, and other financial commodities that aren’t readily available to the unbanked.

Brazil is a Proving Ground for Inclusive Financial Service

While many Brazilians don’t have easy access to physical banking institutions or financial services, almost everyone has access to a mobile device.

“Even though Brazil has 200 million people, there are actually more mobile connections than people, and 80% of them are using smartphones,” Sedat said. “Mobile technology provides so much opportunity for us to get a financial service into people’s hands and into their homes without needing the overhead that having physical locations requires.”

This strategy of using established communications infrastructure to develop an alternative financial system enables more people to access services that are inaccessible through traditional means. According to Sedat, Brazil’s established banking system requires extensive paperwork and even a credit check to open a savings or checking account.

The Airfox app helps users take charge of their finances digitally, even if they are accustomed to using cash.

“It’s also expensive. It ranges anywhere from $10 to $50 to do all the transactions we take for granted at a bank in the U.S., whether it’s checking or person-to-person transfers or even having a debit card that you can use at an ATM,” Sedat said. “If you have a thin file or no file, banks aren’t even going to look at you. But if you manage to get a loan or a credit card, you’re potentially paying up to 400% APR on that.”

The Airfox app, available on Android, represents an alternative to that costly and narrowly circumscribed financial system that is available only to a particular segment of Brazil’s population. By leveraging mobile technology, the blockchain, and machine learning, the company can provide both traditional and innovative digital services at prices accessible to a much more significant portion of the nation’s population.

Partnering with Casas Bahia to Enhance Reach and Trust

Airfox’s partnership with Casas Bahia, a Brazilian retailer that specializes in furniture and home appliances, holds distinct benefits for Casas Bahia and Airfox users. Airfox helps the furniture chain process its customer payments more quickly and efficiently. And Airfox users can directly engage with service representatives at Casas Bahia locations, meaning Airfox can still avoid the overhead of maintaining physical branch locations.

Additionally, the Casas Bahia stores give Airfox another level of accessibility. In a market where Airfox is just beginning to make a name for itself, people may be understandably reluctant to trust the service with their hard-earned money.

“That was a tough thing to overcome,” Sedat said. “We needed an established brand to work with.”

Casas Bahia is a well-known and reputable brand in Brazil, and one that is already associated with financial opportunity. Through its parcelas (portions) program, it was one of the first retailers to allow customers to pay for purchases through monthly installments. For consumers who find themselves in need of an expensive item — including home appliances like a refrigerator or oven — but can’t afford it at full price, Casas Bahia’s parcelas are a welcome alternative.

Airfox users speak with a customer service representative at a Casas Bahia location in Brazil.

Airfox plans to support this program by enabling customers to make their payments digitally rather than traveling to a store, negotiating paperwork, and paying in cash. This payment method debuted at two pilot stores, where the Airfox team spent a week engaging directly with customers and employees as well as working with focus groups. The company garnered valuable feedback on the new service.

“The people are great to talk to. They really want to give their opinion on how things are going,” Sedat said. “It’s good to see how people are responding to — and even enjoying — a process that can be painful when they have to deal with traditional banks.”

Emerging Markets Represent New Opportunities for Airfox

In 2019, Airfox will focus its efforts on perfecting the in-store experience and expanding it to additional Casas Bahia locations. It hopes to increase engagement, gain consumer trust, and enhance user understanding of the app’s functionality as it deploys in Casa Bahia’s 800 locations throughout Brazil.

Airfox is also working on moving away from stored-value digital wallets and instead functioning more like a digital bank. That’s why Airfox plans to introduce a debit card for each account. This will make a user’s money even more accessible, allowing the user to make purchases in stores and online, and to withdraw cash from ATMs.

The company is also turning its attention to microlending technology. In particular, Airfox plans on using the blockchain to build capital to fund microloans. The company shares the burden of risk with its customers — similar to a lending club.

Although these efforts are currently concentrated on the Brazilian market, the overall goal of Airfox is to develop the platform so that it can seamlessly extend to other Latin American countries — and the rest of the world. Its focus is on providing mobile banking and alternative credit scoring services to other companies that are already established and familiar with the markets.

“We’re building it in a way that we can expand it, not just in emerging markets but also anywhere with an underbanked population,” Sedat said.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.