In a Nutshell: In a digital world, we’re accustomed to instant access to everything — including our financial information. And that accessibility is precisely what CountAbout users can count on. The financial management platform makes it easy for users to track — and understand — their finances. CountAbout subscribers enjoy an ad-free experience, and their information is protected by robust cybersecurity measures and never sold to third parties. And soon, the CountAbout mobile app will offer users even more of the same functionality that the website provides, further enhancing the accessibility and security of their financial information.

Imagine it’s 2012, and you’re out shopping for a new desk chair for your home office. When you start to think about what kind of chair you can afford, you realize that all of your detailed financial information is stored on a desktop computer at home.

You call your significant other to ask if there’s enough money in the budget for the purchase, but he or she is at work and doesn’t have access to the information, either. Do you go home, check your financial software, then come back if you have sufficient funds? Or do you buy the chair without knowing if it fits into your budget?

That was the problem encountered by Joseph Carpenter, Co-Founder of CountAbout, and his wife when outfitting her office. And that experience inspired him to start thinking about a more convenient, cloud-based financial management system.

“I discussed it with my neighbor, Alex Wong, a computer developer who became my co-founder. We initially asked, ‘Can we make an app that would work with someone’s Quicken account?” Carpenter said. “By that point, I had thoroughly vetted all the solutions out there and realized there was absolutely nothing similar. As people who are gluttons for punishment, we decided the next best thing was to build our own.”

CountAbout launched in 2012 with two goals. The first was to bootstrap itself through subscriptions, not by relying on investors whose interests could compromise CountAbout’s mission of service and quality. The second objective was to maintain a focus on user privacy and to subsist solely on subscription revenue rather than selling user information to other companies.

Joseph Carpenter co-founded CountAbout after seeing a void in financial management apps.

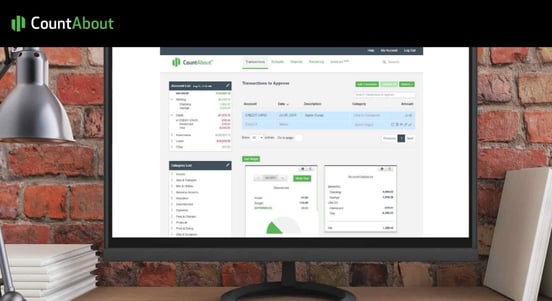

The platform and mobile app help users take an active approach to managing their finances. The developers have been attentive to suggestions and requests from subscribers, and have created a product that meets both common and unique needs. As a cloud-based app, it allows users to access their information anywhere — from any device. And most importantly, CountAbout ensures that private user information remains secure.

“We approached it thinking, ‘If we grow slowly, that’s great, as long as we continue to improve the product to benefit the user,’” Carpenter said. “It was pretty bare bones when we launched, and we have continually added features — to the point that, now, we want to be careful not to add too many features.”

Taking an Active Approach by Reinforcing Mindfulness

Keeping up with personal finances is essential. Allowing yourself to fall behind can land you in a tough situation and even damage your financial independence. For example, missing a utility bill or credit card payment can lower your credit score, making it more difficult to qualify for prime loans and lines of credit.

To ensure users don’t miss a beat, CountAbout imports existing data from applications like Quicken and Mint, allowing new users to get organized and running quickly. But unlike Mint, which categorizes users’ transactions for them, or Quicken, which automatically downloads and categorizes transactions, CountAbout takes a hybrid approach to money management.

“I think reviewing transactions is a critical part of the process. With CountAbout, you have to actually review a transaction and approve it before it shows up in your register,” Carpenter said. “You can’t bypass that to run reports or look at your graphs or account register because reminding someone they went out and spent $100 on a meal is an important aspect of personal finance.”

This system empowers users to take a more active approach to finance. It provides important reminders of recent spending habits simply by making users review and acknowledge expenditures. This process reinforces financial mindfulness and keeps users actively in touch with their situations.

To ensure users understand their information, CountAbout provides color-coded graphs. These visual representations serve as indicators of how far users are straying outside their established budget or average spending.

“Not everyone’s a budgeter,” Carpenter said. “So, people who aren’t budgeters still have a way to get feedback on their spending patterns.”

User Feedback Drives Development and Functionality

All of CountAbout’s features are user-driven. And by only implementing in-demand functions, developers avoid bloating the software with extraneous tools. Letting users guide the app’s development enables CountAbout to maintain a simple, straightforward functionality.

“We have a forum where our users make feature suggestions and then vote on them. That way, we can focus on offering the things that most people need,” Carpenter said.

Carpenter said the most popular aspect of CountAbout is its customizability. The platform allows users to organize their income, spending, and savings information however they wish.

“If you want 10 categories, you can have 10 categories. If you want 1,000 categories, you can have 1,000 categories,” Carpenter said. “Other platforms allow you to add categories, but you can’t remove categories that they’ve pre-populated. And you can’t go more than two levels deep.”

CountAbout users can create a customized experience and control their finances from anywhere.

For example, a CountAbout user can create a category called “income.” Within that category, he or she can create a sub-category for personal income. Beneath that could be tertiary categories for individual jobs. CountAbout can accommodate any organizational needs and allows users to tailor experiences to their needs rather than working within a pre-defined framework that a company thinks is most useful.

Getting started with CountAbout is just as simple; users need only add an account. CountAbout will import the financial data through a straightforward process that takes about two to three minutes.

“There’s nothing magical about the Quicken data. We don’t import investment transactions, which is where the bulk of its data storage originates. The transactions themselves — simple credit card transactions or checking transactions — don’t amount to much data,” Carpenter said.

Plans and Features to Fit a Variety of Needs and Budgets

CountAbout offers two tiers of service — Premium and Basic. Premium users can link their accounts and automatically download transaction data, whereas Basic users must enter the information manually.

“That’s the only difference between basic and premium,” Carpenter said.

And all users can purchase additional features. Popular add-ons include Attachments, which allows users to include images with transactions and costs; and Invoicing that enables small businesses and self-employed users to create and send invoices and track receivables.

CountAbout is sustained entirely by these subscription and add-on fees, so users will encounter no advertisements, ensuring they enjoy a visually clean and hassle-free experience. Just as importantly, they can rest assured that their data will not be sold to third parties.

CountAbout differentiates itself from other solutions by importing Quicken and Mint data.

CountAbout also takes steps to keep user imported data safe from malicious third parties. The app uses Amazon Web Services for its server space as well as its digital security requirements. And a third-party data aggregator is employed for retrieving and transferring users’ financial information.

“Those data aggregators are the key to the whole product,” Carpenter said. “They are the ones that have the relationships with the banks and the security of passing the credentials to the banks to get all the transactions.”

Using a data aggregator instead of handling the data in-house means that cybersecurity specialists protect user information. Once the aggregator delivers the data, CountAbout deploys multiple levels of encryption to keep that data safe on its servers.

Enhanced Mobile Functionality Will Bring Greater Efficiency and Control

In 2012, the Carpenters ended up buying the chair without going home to check their budget sheet. But today, that’s not a dilemma for CountAbout users.

“What’s attractive about our platform is that we built it to serve the needs of the customer,” Carpenter said. “We find that, once they’re on, we probably have a dedicated user for life.”

To provide users with more convenience, CountAbout is overhauling its mobile app to function more like its web-based platform. Currently, mobile functionality is limited to viewing account information and approving and adding transactions. While those functions are useful for getting an instant snapshot of your financial situation, soon the app will allow users to actively manage their money and take greater control.

The app will also feature multi-factor authentication to further protect user information. If users ever encounter a problem connecting with their bank, they have to re-enter their password or a verification code. Currently, this can only be done on the CountAbout website, but future versions of the mobile app will also allow users to navigate this security safeguard.

“In the future, once you set up an account on our site, you may never have to go back to it again. You can do most of what you want to do from the app, and we’re excited to introduce that,” Carpenter said. “And we plan to continue growing by serving our customers, which is the most important aspect of what we do.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.