In a Nutshell: Unanticipated expenses can send budgets into disarray, and many short-term loans are accompanied by exorbitant interest rates that put borrowers in a worse financial position than when they started. Wise Loan specializes in providing loans for customers with subprime credit scores, but the company also says it focuses on helping them improve their financial lives in the long term. With each Wise Loan that is paid off, the company rewards customers with a cash deposit into a Nest Egg account and reports the positive payment history to the credit bureaus. Customers can cash out their Nest Egg funds or apply them toward a future loan payment. As a result of its responsible lending philosophy, Wise Loan garners positive customer reviews.

When you’re on a tight budget, unplanned costs can not only put a squeeze on your wallet — they can increase stress, strain relationships, and even impact your health. And, unfortunately, studies show that about 40% of Americans can not afford an unanticipated $400 expense without selling something or going into debt.

Finding quick cash via loans tends to be associated with payday lenders that charge astronomical interest rates that can trap already desperate consumers in a crushing debt cycle.

But thanks to companies like Wise Loan, consumers can take on debt at more affordable rates. Wise Loan specializes in providing quick loans for as much as $2,000 to qualifying borrowers.

But thanks to companies like Wise Loan, consumers can take on debt at more affordable rates. Wise Loan specializes in providing quick loans for as much as $2,000 to qualifying borrowers.

But Wise Loan is a far cry from the usual quick-money lenders. The company not only provides small loans at reasonable rates, but it also works to help its customers regain control of their financial lives rather than watching it spiral downhill.

“It is an installment product, but we built the company on a little different premise than most people in the space,” Wise Loan President Tommy Glenn said. “And that differentiator is that we’re actually trying to improve the customer’s financial life.”

Serving Customers with Bad to Fair Credit Scores

Glenn said Wise Loan was designed with consumers who fall into the deep subprime credit category in mind.

“These are often people with credit scores below 600 who have limited credit options,” he said. “Oftentimes, these consumers simply need a quick loan between $500 and $1,500.”

Wise Loan makes it easy for customers who have limited credit options to find out if they qualify for a loan from the company. The application takes less than five minutes, and some loans can be approved on the same day and funded by the next day, according to the company website.

Tommy Glenn is the President of Wise Loan.

In some cases, loans can be funded within minutes. In these instances, the applicant must have a debit card associated with a checking account, must apply and be approved before 5:30 p.m. Central Standard Time, and must meet normal loan qualifications, according to the company website.

Additionally, there are no hidden fees, and terms and conditions are written in clear language, which is not the case with predatory lenders.

“Installment loan costs are clearly stated and easy to understand,” according to the Wise Loan website. “Getting credit shouldn’t be confusing. Clear and easy-to-understand terms educate our customers on the best ways to borrow money.”

Wise Loan’s services are currently available to residents in Texas, Utah, Missouri, Idaho, Mississippi, Wisconsin, Illinois, Missouri, Utah, Glenn said. For borrowers in states where Wise Loan does not currently operate, the company can still help connect the consumers to a lender within its network that may be able to meet their needs.

“With a valid bank account and contact information, your application is quickly processed, with the money deposited directly into your account.”

How Wise Loan’s System Helps Customers Get Better Rates and Improve Their Credit Scores

Wise Loan’s philosophy to actually help improve the financial lives of its customers is an extension of the vision of its parent company — Essential Lending.

“With our loans, we aim to carve out a brand new territory in the short-term lending space where the products we offer actually help establish a launch pad from which our clients can grow and build a new financial life built on security and stability,” according to the Essential Loans website.

Wise Loan’s Nest Egg account gives borrowers the potential to earn cash back for paying off their loans.

The company approaches loans as opportunities rather than obstacles for the consumer. Glenn explained how borrowers can use Wise Loan as a foundation for improving their financial outlook.

“We built our platform so that if you continue to come back to us the price goes down, so you continue to get lower and lower pricing,” Glenn said. “And then, with each loan that you pay off, we report the positive pay history to the (credit reporting) bureaus so you can improve your credit score over time.”

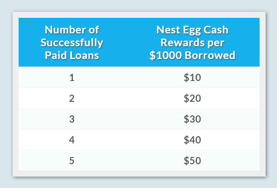

One of Wise Loan’s standout features is its Nest Egg program, where borrowers can actually make money by paying off their loans.

“If you get a loan from us for $1,000 — and depending on which loan it is — we’re going to pay you 1% to 5% of that back at the end of the loan, assuming you paid according to terms,” Glenn said. “So you could potentially get up to a $50 rebate on the loan after you’ve paid it off. And we put that into this account called the Nest Egg.”

Glenn emphasized that the Nest Egg is not a savings account, but the funds can be withdrawn by the borrower or applied toward a future loan.

“I think the big advantage is that we’re going to help you leverage your loan experience to not only get a better product from us but hopefully put you in a position that you could get a better product from someone else,” he said.

An Easy Application Process and Responsible Lending Leads to Positive Customer Reviews

Wise Loan positions itself as maintaining a philosophy of responsible lending, and Glenn elaborated on what this philosophy means and how it is evident in the platform’s day-to-day operations.

“One is that, the details of the transaction you’re getting into is clear — like, this is how much it costs. It’s not a cheap loan, we make that clear,” Glenn said. “It’s an expensive form of credit that needs to be used in an emergency or in times when you don’t have other options.”

Furthermore, the company emphasizes that it’s important to pay the loan back as soon as possible, he said, because that loan will likely be one of the most expensive “purchases” one makes.

“We consider this part of our educational process, to make sure our customers know all those things,” Glenn said. “When they become our customer, the people in our call center have to say that on the phone so the customer is clear about it.”

He said the company continues to reiterate these points whenever it is in touch with the customer.

“Another part of it is the extra services that we provide that actually can improve the customer’s financial life,” Glenn said, referring to the company’s Nest Egg feature and reporting positive payment history to the credit agencies.

Wise Loan’s efforts to educate its customers and provide a positive experience that can improve their financial lives is reflected in the company’s reputation.

“Grateful for programs like Wise Loan, during hard times they have proven to be very helpful,” wrote customer Sara S. on the Wise Loan website. “Highly recommend Wise Loan for anyone needing a loan with good rates and flexible payments. Thanks Wise Loan!”

This is just one of many similar testimonies from customers who had a positive experience with Wise Loan. The company maintains a 4.5-star rating on Google reviews.

With its responsible lending philosophy and its strategy of viewing small loans as opportunities instead of setbacks, Wise Loan’s services may be worth considering the next time you need quick access to cash.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.