In a Nutshell: Security deposits can pose challenges for both renters and landlords. That’s why Obligo developed a more convenient way to make the process more intuitive. Obligo adopted a model that has been used for decades in the hospitality industry which includes a preauthorized hold placed on a guest’s existing credit or debit card. Obligo adapts that strategy by using open banking technology to provide the same security to a landlord as a cash deposit. At the same time, this approach eliminates unnecessary time and effort on cash management and keeps funds available to renters to help pay off consumer debt.

Many workers live in rented housing because homeownership is out of reach. But instead of being a stopgap on the way to purchasing a home, renting can trap consumers in a cycle of debt, keeping the goal of homeownership further out of reach.

Since rental properties are commercial ventures, the cost of renting covers more than the landlord’s payments and expenses. Most renters are also required to pay a security deposit and first and last month’s rent upfront.

Those advances on rent go toward securing the accommodations and providing the landlord with peace of mind. In addition to that front-end investment, the security deposit can be a hefty sum that remains tied up and unavailable for the duration of the renter’s stay at the property. That is money that can’t be put into a savings account or used to pay off consumer debt.

Obligo provides a welcome alternative based on long-standing practices in the hospitality industry. Obligo’s solution is similar to the temporary hold — a security deposit, so to speak — that hotels place on a credit line. It assures landlords of payment while also giving renters financial flexibility.

“It’s no mystery that tenants or renters do not like to have to put up that traditional lump sum of cash that they will not have access to until they move out,” said Casey Winter, VP Business Development and Partnerships at Obligo. “But, at the same time, landlords ask for deposits for very good reasons.”

The biggest reason is to cover damages to the property while the tenant lives there. Another purpose for the deposit is to test the renter’s liquidity and prove his or her ability to continue paying rent over the contract term. Security deposits also help ensure that renters are invested in their living arrangement and will maintain the property so they receive the entire deposit back when they move out.

However, security deposits are no more efficient. Individual deposits must be held in separate accounts in some states, which creates more paperwork for the landlord. With funds on hold, the banks have a larger balance sheet to lend against, but the landlord and the renter do not see any interest on the money while it’s in the account.

When the renter moves, the landlord has a specific time frame within which to return the deposit. However, the renter may not have left a forwarding address, or the address could be inaccurate.

“So there’s all this kind of friction. It’s unnecessary,” Winter said. “The current process is antiquated and inefficient.”

Despite the reasons for requiring security deposits, they remain burdensome to renters. Obligo provides both parties with a refreshing option that provides security for the landlord and liquidity for the renter.

Lessons from the Hospitality Accountability Model

Obligo offers a more efficient model based on the ones traditionally used by hotels and car rental agencies.

In the early days, customers would provide a cash deposit that was held in a safe at the hotel or car rental agency. Then, when they checked out or returned the car, the company would return their deposit.

Today, that system has shifted from cash deposits to a credit-based system. When consumers check into a hotel or rent a car, the business verifies their identity, runs their card, and they sign a preauthorization agreement.

“You preauthorize the hotel or car rental agency to put a hold of a certain amount of funds in your bank account or on your credit line,” Winter said.

The hold remains in place until the customer checks out of the hotel or returns the rental car. The hotel or car rental company inspects the room or vehicle for any damage or incidental costs and applies the necessary charges to the credit line. The bank then pays the hotel or rental agency, and the cardholder pays the balance back to the creditor.

“The bank is going to do its job and keep the cardholder accountable because you have to pay off your credit card, or it’s coming through your bank account,” Winter said. “Those elements of the deposit — accountability and coverage — are maintained, and they don’t have to pay cash.”

Preauthorized Charges Let Renters Keep Money

The difference between renting hotel rooms and cars and renting an apartment is the duration of the rental. A preauthorization on a credit card can only hold funds for a limited time — a small fraction of the term of a typical lease. After that, the hold must be released.

“That was our big obstacle when we decided to replicate that model,” Winter said. “Fortunately, there’s been some advances in financial technology. Those advances, specifically open banking, let us create a very simple model for what we’re doing.”

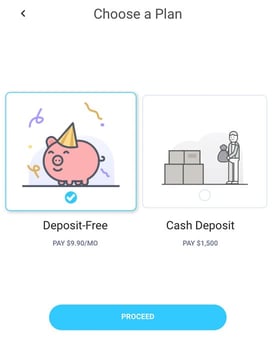

With Obligo, renters can either pay the security deposit upfront or preauthorize the landlord to charge their bank account for any amount up to the security deposit. In the latter case, there is no hold on the account; renters still have access to the funds that would have been deposited. Obligo maanges the full collection process for that amount if the bank account is closed or contains insufficient funds when the renter moves out.

“When renters go through our workflow, and they choose to go deposit free, they connect their bank account for open banking,” Winter said.

Debt amounts often play a significant role in qualifying for a lease. Those still factor into Obligo’s decision-making process, but the company takes a more holistic approach to evaluate renter risk.

Someone who defaulted on a mortgage, for example, could have a very low credit score even though that mark is 10 years old. Obligo goes deeper to determine debt liabilities and ensure renters can easily make monthly housing payments.

Landlords Benefit from Streamlined Workflows

Obligo’s security also benefits landlords, who can expand the pool of renters they can accommodate while knowing they have the rental deposit in hand. Obligo also eases other pain points for landlords.

The legal regulations surrounding cash deposits can make them as much of a liability as they are a security. Laws governing security deposits are designed to prevent people’s money from being unavailable, and so landlords are tasked with minimizing the amount of time those funds are tied up.

“An estimated $45 billion in security deposits is sitting in escrow accounts in this country, essentially collecting interest and working for nobody,” Winter said. “But we don’t just offer a deposit alternative. There are other pain points around deposits that we solve.”

For example, if a renter chooses to make a cash deposit, they can go through the same electronic workflow as Obligo’s deposit alternative. The funds transfer immediately and directly. And renters don’t need to obtain a money order or a cashier’s check.

Landlords can return funds just as easily when the renter moves out. There’s no risk of returned checks and no lengthy waiting periods for mail delivery.

“Once we see that they closed out the financials after the move, we know exactly what amount to return to the former renter. That renter receives an automated email that says, ‘Get your deposit back now,’” Winter said. “They click the link, verify their bank account and ID, and we wire the money directly to their bank. And now they’ve got some extra cash in their pocket.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.