In a Nutshell: Transportation is crucial to improve and maintain financial wellness. Those who live in large cities often have the benefit of access to mass transit systems, but soaring property values in major metropolitan areas mean people often need a car to commute to work. However, an auto loan can seem out of reach for someone in a less-than-ideal financial situation due to past credit missteps. LendingArch is helping Canadians bridge this gap by matching them to the best available rates from a network of dealers and lenders who offer affordable auto financing. The right loan on a vehicle and responsible repayment can have a far-reaching impact on your credit score, and LendingArch goes further by providing the financial education resources necessary to get borrowers into the fast lane toward better financial health.

Life in the suburbs is quiet and affordable, but the best job opportunities are often found in larger cities.

Each morning, you wake up, get dressed, eat breakfast, and walk to the bus stop; in the winter, you get the added perk of walking through snow. The bus takes you to the train station, where you ride, transfer lines, and then — 90 minutes later — you finally get to work. After putting in eight hours, you get to do it all over again. Using public transit to commute to and from a job is uncomfortable, inconvenient, and it quickly erodes your personal time.

Wouldn’t it be easier to drive?

Of course, it would. Unfortunately, many people don’t own vehicles and have credit histories that pose hurdles to being approved for car loans. But, what if, while you’re sitting on the train, you were able to get pre-approved for auto financing — and then never have to sit on that train again?

If you live in Canada, then you’re in luck, because LendingArch, a leading financial products comparison platform, can help you do exactly that.

Founded in 2015, LendingArch is a marketplace that allows Canadian consumers to comparison shop for credit cards, personal loans, home insurance, small business loans, and auto loans. This model is well-established in the US, where large FinTech companies are already well-established. Thanks to companies like LendingArch, Canadians are now seeing similar benefits.

“It’s relatively new. It’s something that’s only been around for the last few years,” said Paul Hadzoglou, President of LendingArch. When the platform launched, Canadians were already familiar with sites that allowed them to compare individual products like credit cards, loans, and insurance. “But there really wasn’t a site that has everything. So that’s what we created,” he said.

![]()

Although it caters to a range of financial products, auto loans represent LendingArch’s biggest market. “Canadians spend a lot of money every year buying vehicles and financing vehicles,” Hadzoglou said. “It’s in the billions every year. It’s a huge market, with people constantly buying and then trading in for something newer. So there’s this constant churning of vehicles and people looking for vehicles.”

This isn’t just the well-to-do buying and trading in their cars, though. “We cover absolutely the entire credit spectrum,” Hadzoglou said. “Any type of scenario — recent employment versus well-established employment, existing vehicles with negative equity that you need to roll into a new vehicle — you name it.”

Maybe you’re fresh out of school and in need of a car so you can get to work and build your credit and savings. Maybe you have a job, a consistent work history, and good credit, but you want a new car. Or maybe you have credit issues and need a vehicle so you can get to work and improve your financial standing. Whatever your situation, LendingArch is ready to help connect you with an affordable loan to get the vehicle you need.

“What we’ve done is created a network of auto dealers and auto lenders to be able to service all the different types of people who are looking for an auto loan,” Hadzoglou said. LendingArch provides borrowers with a variety of options and goes further with financial education resources to ensure they choose the best offer. “Generally, our lenders and our dealers have programs available to be able to get pretty much anyone a vehicle.”

Car Ownership Offers Reliability and Convenience to Workers

Canada’s urban centers have continued to grow, and mass transit in these areas has likewise evolved to meet commuter needs. “As major cities, especially in this country, expand their mass transit and cover more parts of the city, it’s generally easier to navigate,” Hadzoglou said.

However, not everyone lives in the city or near transit stations, and making their way through the transportation network can become costly and time-consuming.

“In a lot of cases, having a vehicle — especially in the winter months — is really critical,” Hadzoglou said. “You want to be able to get to your job safely and on time, so it’s really important.”

Whereas mass transit can be unreliable and downright unpleasant, cars provide a sense of personal control and freedom.

“Everybody’s dream is to have a car so they can be free and do what they need to do, go to work, and live their life. So, it’s generally becoming more and more important,” Hadzoglou said. “I think that’s probably one of the reasons that — in this country — car sales generally increase over time, and people have a huge appetite for vehicles.”

The Financial Post reports over 2 million new automobiles were sold in Canada in 2017. “People want to make sure that what they’re driving is safe and reliable and allows them to live their lives,” Hadzoglou said. With LendingArch’s fast, easy online application process, Canadians can do exactly that.

Simple, Streamlined Applications and Timely Approval

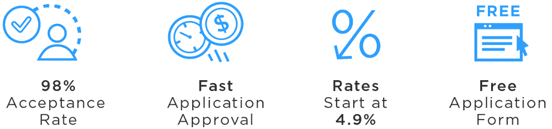

LendingArch’s application process allows borrowers to get pre-approved online and over the phone. Applying on the website takes only a minute or two, and applicants are asked to respond to a few questions to determine their eligibility. Their application is then sent to a customer care center.

If the application is made during business hours, an agent will review the information and then call the applicant to verify that everything is correct. The representative will also gather some additional information regarding the applicant’s financial situation and the sort of vehicle he or she is looking for. Based on that information, the borrower will be matched with the dealer or dealers geographically closest to them.

The customer service agent will then connect the borrower with a contact person at the chosen dealership, who will help them complete the process. The borrower needs only go to the dealership, find a vehicle he or she likes and that fits the loan parameters, complete the sale, and drive home.

If the application is made outside of business hours, the borrower will receive SMS and email notifications that their information has been received. The platform’s back end will then automatically determine the best dealership and lender, and forward the applicant’s information directly to them. They will contact the borrower the next day to conclude the process.

Through LendingArch, Canadians can expect to get the best possible deal on a vehicle that suits their situation and needs. “Our lenders and our dealers won’t put you in something you can’t afford,” Hadzoglou said. “They’re not going to put you into a car you’re going to have trouble repaying. That doesn’t make sense for them, and it doesn’t make sense for you.”

Informed Applicants are Prepared Borrowers

LendingArch doesn’t merely seek to serve people across the financial spectrum by providing access to important financial products. It wants them to understand the importance of adequate research and comparison shopping. Through these relatively simple actions, every borrower can better understand their options and make well-founded financial decisions.

To facilitate these well-informed choices, LendingArch provides free educational content that helps applicants prepare to shop for a loan.

On LendingArch’s website, users can learn about current market conditions, what they should look for in a loan, actions that can impact their credit score, and the various pitfalls to beware of when dealing with finance. LendingArch doesn’t simply want borrowers to get a loan; it wants them to get the best loan and the knowledge to make the most of it.

Continuing Education for Canadian Car Buyers

Given current trends and buying habits, Canadians’ demand for cars is unlikely to abate anytime soon.

So, to ensure consumers stay up to date on the auto loan market, LendingArch is growing its online library of educational content. This will provide Canadians with more abundant and current information on credit and borrowing, further helping them get an auto loan that will keep them on the road to financial success.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.