In a Nutshell: Consumers shopping online for loans and other financial products may feel overwhelmed with so many choices. That’s why the team at Goalry brought a wide variety of essential money management tools and services together in one comprehensive mall-style marketplace. Goalry simplifies the loan shopping process and helps consumers learn more about financial products and connect with others to achieve their goals.

Even in today’s digitally connected world, there’s still something refreshing about shopping at the mall. When consumers want to browse for a perfect gift, or for something to treat themselves, a stroll around the mall can be a satisfying way to find it.

At the mall, consumers can shop, have lunch, and get their nails done or eyes checked without ever having to move their car. The choices are also curated, so people can find what they need without getting bogged down by too many options.

Shopping for loans online is quite a bit different, however. In fact, it can be an exercise in frustration with hundreds of providers competing for attention and products seemingly designed to be hard to compare.

Goalry is an innovative online marketplace that aims to change that dynamic by curating all the essential finance companies in one platform — similar to stores in a mall. It aims to simplify shopping and decision-making for consumers.

The company also supplements its collection of stores, located on the third floor of its digital mall, with an array of financial education resources found on the second floor, and a social community on the first floor.

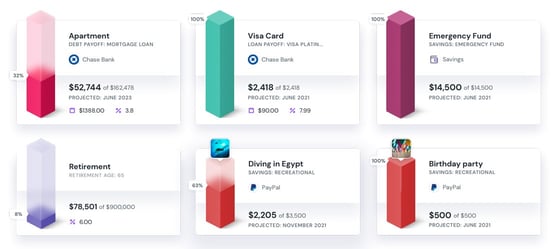

Users visit the Goalry Mall, they receive premium access to tools for setting and achieving goals in each store.

Goalry users can learn about their options and find what they need while setting and sharing financial and life milestones with others. That’s the point of spending and saving wisely, after all — to get more of what you want out of life.

“We help you manage your goals for the things you want to accomplish,” said Ethan Taub, Goalry Founder and CEO. “Finance is just the fuel to get there.”

Shop, Learn, and Socialize in a Unified Financial Platform

Goal setting tools make Goalry much more than just a marketplace. Goalry combines the advantages of manageable choices with the opportunities and social benefits of a unified financial platform.

“Whether you want to go to college, pay off debt, build an emergency fund, or save for your dream house, motivating people toward those achievements is what Goalry is all about,” Taub said.

Any of those reasons may lead users to one of the third-floor finance stores. Those searching for bill tracking tools may find themselves at the Billry store, for example, while those looking for budgeting tools wind up at Budgetry.

There’s a Goalry store for every aspect of financial management, and they’re all interconnected.

Interested users can sign up to enjoy free access to all the premium services in one of the stores and upgrade to premium access to experience other goal-setting tools.

Learning successful strategies from top financial experts happens on the second floor in finance education. The area offers more than 2,000 published articles in 11 different blog categories, and the mall cinema has more than 400 videos to cover all the financial bases for members.

In the social community on the first floor, members can find advice and apply what they’ve learned by connecting with other members and sharing their goals.

“Someone can come in for budget info, but they don’t know how budgets relate to debt or cash flow management,” Taub said. “We’ve got individual components, but it’s all one platform, one brand.”

Users Can Track Spending and Find the Best Loans

Access to the first store is free, but a small monthly or annual fee unlocks all of the platform’s offerings. Members can connect their bank accounts and create as many goals as they want throughout the mall.

Within that structure, Budgetry performs a central role in budgeting, saving, and meeting monthly goals.

“You create savings goals, and then you use the tools within each of the stores to help you take action to achieve your goals,” Taub said.

Throughout that process, Goalry’s AI streams in different insights to inform members about ways to manage their budgets. If a member sets up a budget for achieving a dream home, Budgetry can offer insights about where to save and where to spend.

“Our budget bubble tool enables users to see if they’re overspending,” Taub said. “Budgets are created automatically every month. You can enhance them. You can add to them, or you can use the automated features.”

In keeping with the mall concept, Goalry stores treat financial tools — including loans — like the products they are. A loan is similar to many other consumer products, and some offer a better deal than others.

Loanry is Goalry’s store for loan shopping.

“You go to the Loanry store to shop for loans just like you go to a shoe store in the mall to shop for shoes,” Taub said.

Loanry works with participating lenders to offer members the best loan deals. Members answer a few qualifying questions before Goalry’s search engine matches them with the right products. Loanry even provides tools to help members drill down to a final selection.

With the right loan, Goalry members can put themselves in charge of making the most of their finances.

Goalry: Money Management Tools for Modern Consumers

Until Goalry came along, shopping for financial services online was not like the curated shopping experience at the mall.

Goalry also offers members a financial strength score, which symbolizes the performance at the center of the platform. It works like a credit score to measure financial strength in terms of goal achievement.

“It’s a finely tuned AI-powered scoring tool that gives you insight into why your score is the way it is,” Taub said. “You can monitor your score and take action using the stores to improve it over time.”

The financial strength score is also known as the heart score, especially when members share it in the Goalry social community.

Users can also earn badges and trophies for achieving goals.

“It’s a fun way to create memories,” Taub said. “Every year, we deliver a memory book, which is a collection of things that they’ve achieved over the previous year.”

Badges and trophies earn users mall credit to purchase services or extend membership.

“There are points and rewards, and building memories and socializing, and all the different things that we’re building within the community in the mall,” Taub said.

The ultimate goal isn’t necessarily money, but the things that money makes possible. A savings goal, for example, might reference a vacation in Venice. In the Goalry mall, it’s the trip to Venice that motivates the savings.

“People should celebrate their wins, and we want to be part of that,” Taub said.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.