In a Nutshell: First Financial Bank plays a fundamental role in the well-being of rural communities and small towns across Texas, and its legacy of support in these markets stretches back more than 130 years. The Abilene-based institution prides itself on offering financial opportunities to all, including non-English-speaking immigrants and refugees. It provides affordable home and consumer loans to help customers put down roots and build lasting wealth. And its commitment to financial education fosters inclusiveness across the state. First Financial Bank builds on its legacy to help all Texans move forward.

Sometimes the most significant contributions banks and credit unions make to communities happen beyond their products and services.

At First Financial Bank, which manages more than $13 billion in assets across 79 branch locations in Texas, the little things are what often count the most.

Abilene-based First Financial has offered banking services to small and rural Texas communities for more than 130 years. And in every one of those years, the bank has turned a profit. Maybe that’s because of how the bank’s leaders, including current Chairman, President, and CEO Scott Dueser, and staff members handle the details.

One evening in February 2023, First Financial’s Fort Worth Region team hosted an appreciation reception for realtors, investors, and builders to thank them for their partnership in bringing the bank business from Fort Worth’s Stop Six area, where 78% of residents earn low-to-moderate incomes and the unemployment rate is 2.5 times the city average.

First Financial’s Affordable Home Mortgage and ITIN (Individual Tax Identification Number) Loan programs — the latter designed for people without Social Security numbers — have been instrumental in increasing homeownership in Stop Six.

During the celebration, a recipient of one of those loans spoke about her experience. She told the crowd of more than 150 that several banks had turned her down before she approached First Financial. She was a Spanish speaker and immediately felt at ease because the bank had staff who could do business with her in Spanish.

“We helped her work through the application and explained what she needed to do to qualify,” Dueser said. “And now she’s in a home.”

That small win for First Financial won’t move the bank’s numbers much. But it’s a big victory for Stop Six and a life-changing event for the customer. And it happened because the bank could deal with her as a person.

“Many today paint banks in a negative light,” Dueser said. “But it’s really not the case.”

Affordable Lending Can Help Build Generational Wealth

Texas is always in flux. But today more than ever, Texans need bankers who can meet them where they are and help them reach the next level.

That goes for English speakers, Spanish speakers, old-timers, new immigrants, and refugees establishing permanent residence.

The ITIN Loan Program (here’s the same info in Spanish) ably reflects that aspiration at First Financial. First Financial ITIN loans provide up to 95% financing and a maximum loan amount of $450,000 for owners of single-family residences that are owner-occupied as a primary residence.

“Many banks don’t do that, but we do, and it’s proven to be a good product,” Dueser said.

The Affordable Home Mortgage Program performs essentially the same function for more established folks. It offers 100% financing on a max loan of up to $350,000 to borrowers with an annual gross household income of no more than $100,000. Here are the details in Spanish.

The ITIN loan’s 10% down payment may come from a grant, gift, or another verifiable source. The Affordable loan also requires only 10% down and offers extended terms.

Homeownership is part of the American Dream and a surefire way to build wealth across generations. The ITIN and Affordable loans help First Financial put more Texans into homes they can afford to keep.

It doesn’t stop there at First Financial. The bank offers a range of consumer loans, including home improvement and auto loans, that increase personal opportunities and quality of life for low-income borrowers and ultimately enhance communities.

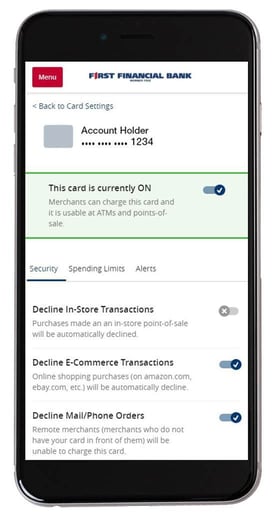

And with free checking, First Financial extends digital outreach with a mobile app that offers free bill-pay services and credit score reports with tips for improving credit scores.

“We say, let’s get you on free checking, let’s get you on digital — we’ll teach you how to do that,” Dueser said. “And then you’ll have tools at your fingertips to help you manage your money.”

Educational Initiatives and Tools Promote Inclusion

The debit card with free checking provides convenient access to a deposit ATM network. That system is a much more constructive way to deal with check cashing because customers keep every dime they earn.

“We certainly prefer them coming to us than going to someone who will take a percentage of their checks,” Dueser said. “Yes, we charge for check cashing, but the cost is much lower, and if it’s an on-us check, it’s always cash without any charge.”

First Financial’s approach to offering checking and loan products provides a window into its mission of inclusion. The bank’s dedication to financial education and literacy starts at the product stage.

The home loan customer who celebrated with the Fort Worth team is a prime example. First Financial helped her understand where she fell short in qualifying and worked with her toward success.

Digital tools help, but the personal approach is best. The bank looks at the customer’s accounts and financial status and finds ways to win. Whether it’s paying down cards, making more timely payments, or decreasing monthly outlays, there’s always a way to improve.

“One of our loan officers taught me years ago to never turn a loan down, never say no,” Dueser said. “We always say, this is what you need to do to get to a yes.”

First Financial also goes out into communities with that message. Messaging starts with an online resource center devoted to cybersecurity issues. But team members also meet community members face to face at seminars where they address a wide range of success strategies promoting homeownership, reaching financial goals, and the all-important topic of protecting assets and identities.

“Fraud is epidemic today,” Dueser said. “We have customers who simply can’t afford to lose their money.”

Helping All Texans Achieve Financial Independence

The Fort Worth celebration also allowed First Financial to recognize team members who helped make the Stop Six community more prosperous.

The bank awarded Fort Worth Region President Marcus Morris its highest honor for making Fort Worth one of the company’s strongest-performing regions. Craig Zemarkowitz earned the Fort Worth Region’s Community Connector of the Year Award for promoting the ITIN and Affordable Home Mortgage loan programs in the Fort Worth area.

Community connectors are First Financial’s not-so-secret sauce, Dueser said.

“They’re champions we designate to go out and build the market in a specific area,” he said. “We build relationships with developers, builders, and realtors who bring potential customers to us.”

First Financial isn’t the only bank with this problem. Many prospective financial customers are uncomfortable in relatively formal bank environments and uneasy about communicating in a second language or about complex financial topics. The difference is First Financial does something about it.

“When Spanish-speaking customers realize we speak Spanish, it becomes a really good relationship,” Dueser said.

First Financial carries that approach into everything it does. Spanish is spoken in all but a few of its bank branches. The bank’s call center follows suit, with more than a quarter of call center employees being native Spanish speakers.

The bank’s hiring generally reflects Texas as it is today. People from minority communities comprise 42.5% of First Financial’s workforce, and 72% of its employees are women. It draws workers from the neighborhood and moves them up the ladder.

“We’re always going to mirror the communities we’re in,” Dueser said. “In a place like Hereford where 80% of the community is Hispanic, so is 80% of the bank.”

Dueser’s no different. With 47 years of service at First Financial, he started on the bottom rung in life and worked his way up. He knows stereotypes of uncaring bankers aren’t true.

“I tell my personal story at every new employee orientation,” he said. “They see a guy who made it to the top and realize they can too.”