In a Nutshell: Finerio is making critical financial resources available to help people manage their money. With its open banking platform, Finerio users see all of their financial accounts in one place. No more scrambling to log into every savings, checking, or loan account just to see how much money you have or how much you owe. Finerio takes the data from the accounts and uses it to categorize spending. The company also offers tools to create a budget and understand. With its mobile application, Finerio’s services are available in the palm of your hand.

In Latin American countries, there are few solutions to easily maintaining your finances. If you have bank accounts, loans, credit cards, and accounts with different banks, trying to figure out where your money is can be daunting.

Finerio aims to disrupt the mobile banking game with its mobile banking solution that puts all of your finances in one place.

Finerio Founder and CEO José Luis López got his start working with companies to help them understand thier finances and show them where they can save money. López told us his company reduced up to 80% of costs for some of its clients.

López used his company’s technology to identify areas where he could save money and knew it could be a critical resource for so many in his home country of Mexico.

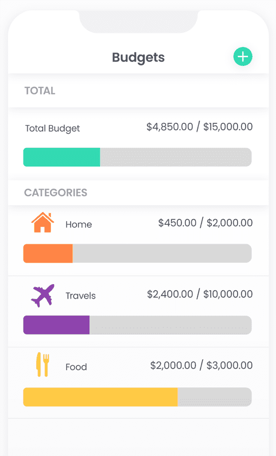

López got to work and created Finerio. The app pulls all of the user’s financial information and neatly shows it all in one place. It separates your spending into specific categories and shows just how much you’re spending on coffees or Ubers every month.

López told us the app’s novel technology pulled in more than 250,000 users to become one of the largest Fintech apps in Mexico.

“There were no apps on the market that automated your finances,” CEO and Founder of Finerio José Luis López said. “There weren’t any other companies doing open banking. So we decided that this was the perfect idea because we can help people save, keep track of their expenses, and build budgets.”

Creating Solutions for Accessible Banking

Using Finerio is as easy as logging into regular online bank accounts. Users log into the app with their regular credentials, and the app’s dashboard populates with your finances.

The app supports 90% of banks in Mexico, Chile, and Colombia, currently the three countries it supports.

Users are not limited to just one bank. They can log in to all of their accounts as long as they are supported through Finerio’s system.

The aggregation data pulls together detailed analyses of spending, saving, and earnings.

Finerio shows how much a user is making, how much they are spending, and how much they are saving. López created the app with the goal to help people in Latin America save more.

A user’s spending is divided into categories to help promote savings through transparency. Users get an idea of where their money is going and what they need to do to grow their savings account.

The user experience is at the forefront of Finerio’s priorities. The company knows it cannot compete without an easy-to-use experience that provides a service to its users.

Many of Finerio’s features have come from customer feedback. The company looks into where it can improve, and sends requests to its dedicated customer success team.

The customer success team takes those requests and ranks how difficult it would be to implement the new features, creates a pipeline to get it done, and delivers a better user experience.

“For us, the most important part was finding the best way to help people,” López said. “There was a big opportunity for loans, but loans are short-term relief. If we really want to make an impact, we have to create a system that manages and automates finances to save money.”

Investments in Powerful Security Protocols

Ensuring that a user’s money is safe is pivotal when dealing with finances. Finerio said it’s never had a security issue, and the company provides financial literacy tools to prevent users from losing their savings.

Finerio works closely with the governments of countries it supports, even influencing and helping draft open banking laws that help people get better control of their finances.

Articles on Finerio’s website show the benefits of open banking and how people can get started. The website also has calculators to help people build a budget, find out what their year-end salary bonus will be, and give people an estimate on how much they can borrow through a loan.

To protect user information, Finerio has a comprehensive privacy policy and data agreements with everyone who signs up.

Users can request that all nonessential data be deleted, and all requests to share data with partners have to go through Finerio’s data protection policies and local laws to make sure applications meet every requirement.

Finerio wants to be transparent not just with finances, but also in how it protects users and their data.

“Security is one of the most extensive parts of our platform,” López said. “We have invested a lot of resources and have never had a security issue. We care about customers’ safety and take it very seriously.”

Impactful Tools for Personal and Business Use

Finerio’s consumer tools also work for businesses offering them even more accessibility to financial services. Business accounts hold data to track finances across different accounts to verify that information is correct and coming from trusted sources.

Brazil and Peru are next on the list to receive the Finerio app, with plans for more countries to follow soon.

For countries that don’t support a typical credit score type of system, Finerio is partnering with Visa to create an equivalent for consumers and businesses.

The system uses information such as income and payment history to come up with the score. Lenders can then use that information when considering whether to approve a loan.

Finerio plans to take the next step with its credit scoring system and use analytics to provide specifics for loans. These would include interest rates, loan terms, and how much someone can borrow.

The company also told us it wants to better automate its services with one-click tools that will make saving easier for its business and consumer accounts.

“If you really want to make an impact, you have to create a system that reaches the most people and really manages your finances,” López said. “We are doing that because our focus is the customer and the impact we can have for the customer.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.