In a Nutshell: As consumer fraud continues to evolve, some detection and prevention tools struggle to keep pace. Featurespace uses machine learning and artificial intelligence to track legitimate transaction patterns and identify fraudulent anomalies — which are constantly changing to avoid detection. It also establishes patterns of consumer behavior to spot fraud and identity theft more easily. Consumers should always take steps to protect their data and only transact with reputable businesses, but automated detection is an effective last line of defense. Featurespace’s sophisticated technology and novel approach represent a step forward in mitigating the impact of fraud on consumers.

The FCC’s consumer guide to auto warranty scams warns people that simply owning a vehicle and a phone can make them a target. Like all other fronts for fraud, the auto warranty pitches are nothing more than scammers trying to trick people into handing over valuable personal and financial information.

Because those schemes strive to appear legitimate, they can be hard to detect until the damage is already done. Scammer tactics are also constantly evolving, making it difficult for consumers to keep up with and spot new ploys.

However, the number of fraudulent transactions made using stolen data is relatively low compared to the number of legitimate daily consumer transactions. Those represent a solid baseline against which fraudulent activity can be measured and identified.

Featurespace takes that approach to protecting consumers. The company specializes in machine learning technology that identifies fraudulent behavior so consumers can mitigate it and prevent its negative impact.

“We didn’t start Featurespace with fraud in mind,” said David Excell, Founder of Featurespace. “It was more a question of how to apply machine learning to understand behavior.”

Excell and his team found that identifying fraud was the best way to leverage its AI to benefit businesses and consumers. Featurespace defines scams by comparing them with standard financial behaviors rather than tracking and detecting only acts of fraudulent behavior.

“If you bought a Starbucks on your way to work every Wednesday, that’s a pattern that we can start to identify,” Excell said. “We can see it repeat and start to say, ‘Yes, that’s always the behavior we’d expect on that particular card.’”

Based on those and other purchase patterns, Featurespace can more accurately spot fraudulent activity. The company represents a new, more efficient approach to fraud detection because it doesn’t depend on simply keeping pace with evolving scam tactics.

Catching Fraud Starts with Identifying Typical Behavior

According to Excell, marketing firms often identify behavior patterns in the context of males, females, or specific age groups.

“I was more interested in our behavior as individuals. How do we navigate through a website? How do we play a game? How do we walk down the street?” Excell said. “All of those behavioral things are unique characteristics of individuals.”

David Excell, Founder of Featurespace

Those unique characteristics are much more stable, reliable, and — most significantly — identifiable than the behaviors of fraudsters. Regardless of fraud prevention measures, standard behaviors tend not to change radically or abruptly. However, the tactics and strategies for stealing credit card numbers and other financial information will.

“We’re not looking at capturing the fraud that’s taken place in the past,” Excell said. “You can easily build a system that identifies that fraud, but then the fraudsters change their behavior.”

That approach becomes a game of cat-and-mouse, and the fraudsters always seem to be one step ahead. Catching up to them is also a manual process, where algorithms must be revised and tweaked.

“We reverse that process. Rather than focusing on the bad that changes, let’s look at what’s good,” Excell said. “Typically, more than 99% of activity is good behavior. It’s good consumers interacting with a bank or buying something online or at the shop. So that was the premise. Let’s focus on building a detailed understanding of good consumer behavior, understanding how you interact as an individual, and then using that to identify anomalies.”

Decision Points in the Payment Process Can Help Safeguard Consumer Finances

Featurespace’s work begins when a consumer, business, or financial institution transmits data. For example, a bank customer may be applying for a new credit card or to open a new account.

“That information will be sent into our system,” Excell said. “We’ll analyze that information and make a determination, effectively issuing a score for if that application is legitimate or not.”

The same is true of payments made using credit cards. However, in that case, the verification process becomes a more complex data puzzle.

That is because there are two disparate data sets — one from the retailer and the other from the consumer.

“On the merchant side, you only have the interaction of what the cardholder has done with that merchant, and you don’t know what the cardholder has done on the rest of their transaction history,” Excell said. “And then, on the other side, you know the full history of the cardholder, but you don’t necessarily know what they’ve purchased, among other pieces of information.”

Analyzing, correlating, and leveraging all of that data can be a challenge, especially for financial institutions. They may have significant amounts of data for vast numbers of consumers. They also constantly revise the online banking apps through which those consumers generate data.

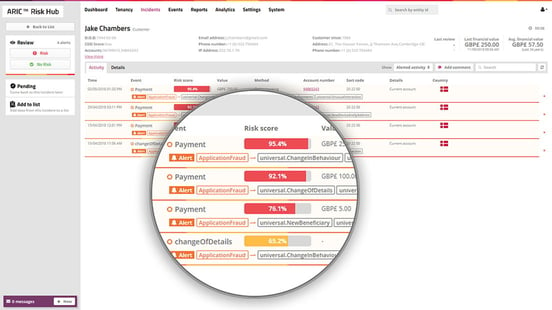

Featurespace’s ARIC™ Risk Hub offers risk scores for transactions and surfaces potential fraud.

“And then the criminals are just getting more and more sophisticated, especially as we look at the movement to real-time payments,” Excell said. “The decisioning on transactions needs to happen in real time because, otherwise, the money is moving out of your account when you hit submit. So banks don’t have that same opportunity to review.”

Featurespace leverages its award-winning ARIC™ Risk Hub, a platform that runs its proprietary Automated Deep Behavioral Networks model which uses machine learning technology to keep pace. Rather than a data science team modifying the model and telling the system what to learn about, it can adapt on its own in response to authentic transactions.

“That model learns from the data and understands what’s most important so it can learn the trends of how you interact and what that fraud is,” Excell said.

Education Aims to Prevent Scams Before They Start

When a scammer steals a credit card number or hacks into a bank account, consumers can get a new one. It’s inconvenient and time-consuming, but it’s an effective solution. But when their name or Social Security number is compromised, they may be in a much more difficult situation.

“Your identity is hard to change,” Excell said. “If your fingerprint gets compromised, you can’t go and get a new fingerprint, and you don’t want to get a new name or date of birth or a Social Security number. All of those things are relatively intrinsic to who we are. So I think the value of that information is huge.”

When proactively fighting fraud, the first step is consumers knowing who is receiving their information. The next step is to avoid providing any unnecessary information. Autofill is a convenient feature of many web browsers, but it will fill in every field presented, often providing more information than is required for a transaction. The more personal data floating around the internet, the more vulnerable people become to theft and fraud.

Featurespace provides consumers with tips on awareness and proactive steps they can take through its Insight Center.

Another critical defense tool is using unique passwords on different sites and platforms — ideally, never using the same one twice. Obviously, between social media, ecommerce, and various other venues, accounts and passwords can proliferate at a startling rate, making them difficult to keep track of.

“Use things like Password Safe,” Excell said. “You can create those unique passwords and make sure they’re strong.”

Finally, consumers should be mindful of what links they follow and what emails they open. Before supplying information or credit card numbers on any website, verify that the URL or email address is legitimate and associated with a legitimate company or organization.

“That’s one of the easiest ways for fraudsters to compromise your data is to get you to click on a link and pretend to be a merchant website that you trust,” Excell said. “Or they use that to install malware on your computer that would make that data available.”

Featurespace: Keeping Pace with Changing Times

The COVID-19 pandemic created more opportunities for scammers. With widespread concern about personal and public health, fraudsters preyed on consumer fears and sympathy on a scale unprecedented in the digital age.

“The criminals have been out to exploit the pandemic as well, either through scams like selling vaccines or pretending to be charities,” Excell said. “They’re trying to prey on a lot of those messages to get people to transfer money or buy services that aren’t legitimate. They’ve used that in some of their messaging in their scams that they’ve gone to market with.”

But fraudulent tactics aren’t the only things that are changing. Consumer behavior has also shifted substantially, including what people buy, how they buy it, and their interactions with providers.

“Over the March to April 2020 time period, the number of card-not-present transactions increased by 81%, so it was a big swing. And then the value also increased by 77%,” Excell said. “It was a big shift in how all of us as consumers interacted with our financial services, including buying things and even going into branches.”

Legitimate transactions and consumer behavior are the baselines against which Featurespace measures potentially fraudulent behavior. With so much flux, some may wonder how well its system managed to keep up.

“Within a week, our models had adapted to the new normal in some sense. They were back to the same rates of identifying fraud and reducing customer friction, and they evolved without us needing to manually go in and tweak the algorithms or the decision points,” Excell said. “It was a testament to what we had built and how we had simulated and tested that. We saw it take place in real life with such a big change in consumer and business spending.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.