In a Nutshell: First Commonwealth Bank was founded in the 1880s, and it has steadily evolved to help modern consumers with online financial education sessions. The bank conducts many sessions in partnership with local organizations that have identified particular needs in their communities, including credit education and improvement. First Commonwealth Bank also assists small businesses with loans and lines of credit, ensuring hard-working entrepreneurs have access to the capital they need to sustain themselves and the communities they call home.

Small financial institutions typically offer a down-home feel and a welcoming environment where employees often know customers by name. However, many of these situations aren’t positioned to compete with the offerings of larger banks that have more resources to attract new customers and provide enhanced services.

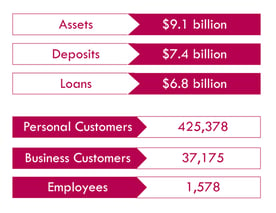

That is not the case with First Commonwealth Bank, which serves financial consumers in Pennsylvania and Ohio.

“We are a bank that is small enough to get to know our customers,” said Anna Frank, Financial Education Program Coordinator at First Commonwealth Bank. “But we’re big enough to go toe to toe with any bank in terms of products and services.”

First Commonwealth Bank has deep roots in the region that extend back to the 1880s. Today, its history spans more than 140 years, its coverage area includes 120 branches.

“Though our roots might be in old-school banking, customer preferences have changed,” Frank said.

A significant part of that change has been the move toward digital services. That has been a trend in banking for some time, but the COVID-19 pandemic has only accelerated the shift.

“We are always looking to meet our customers where they need us because no matter how people bank, they still need to bank. No matter what the world looks like, they need access to information and their money,” Frank said. “That’s really important for us.”

First Commonwealth Bank is committed to the financial wellness of its members and communities, including small businesses. The keys to advancing that mission are not only effective products and services but also financial education in money management and credit.

That’s why the bank aims to help individuals, families, and entrepreneurs make the best use of its financial products and resources.

Digital Sessions Provide Safe, Convenient Education

In the last 10 years, First Commonwealth Bank has educated more than 88,000 people through more than 3,800 sessions.

“We have found that since our whole mission is to improve the financial lives of our neighbors and their businesses, one of the most concrete things we can do is to have a real organized effort of getting this information out there,” Frank said.

Before the COVID-19 pandemic, First Commonwealth Bank conducted educational sessions in person. Under pandemic conditions, however, the sessions have been almost entirely online. Surprisingly, that has been a boon for learners and First Commonwealth Bank educators as well.

First Commonwealth Bank offers financial education resources to its large base of personal and business customers.

“Nobody has to get in the car and drive anywhere anymore, so there have been time savings — especially for me,” Frank said. “But also for all of our bankers, too, because bankers are really busy people, and their hearts are in it. And they want to do it, but they sometimes don’t have the hours in the day to take 45 minutes to drive to teach a session.”

Through virtual sessions, educators can log on to a call wherever they are with no worries about commutes and transit. And the same benefit extends to people who need those sessions to improve their financial knowledge.

“People can hop on a Zoom call with kids in the background. That’s our lives right now,” Frank said. “In the future, we’re going to keep being committed to financial education. But at some point, I’m sure there will be a return to some in-person sessions. But it’s going to be nice to have these virtual tools in our toolbox.”

Going Back to Basics Can Help Ease Financial Hardship

First Commonwealth Bank’s educational efforts seek to provide the information learners need most. It conducts many of its sessions in partnership with local nonprofit organizations that have identified specific areas where beneficiaries need education.

For example, in tandem with Goodwill of Southern Pennsylvania, First Commonwealth is conducting a program to help father figures learn to better manage their finances. And Goodwill is not the only organization assisting communities through these difficult financial times.

“With the pandemic, we have seen an increase in the need not just for specific programming, but also with the Housing Authority, the people who run the food bank, and those who work with folks who are unhoused,” Frank said. “We have done more financial education with nonprofits in 2020 than we have in the years before, for sure.”

The bank provides the information those people need. Now, it sees significant demand for the basics of financial literacy, including how to develop a budget, track spending, and manage credit under financial stress. These topics are essential given the reduced work hours, furloughs, and layoffs that the COVID-19 pandemic has brought on.

“We need to help people find a place to start. It can be completely overwhelming if you don’t even know where to find a credit report — much less how to dispute something,” Frank said. “Our goal is not to have a two-hour session jam-packed with information. We boil it down to what is relevant and important right now and have people find one thing they can do today. If you can do that, you can get there tomorrow.”

Secured Cards Can Build Positive Habits and Credit

Credit issues are one of the biggest reasons consumers seek out financial advice and information. Many people come to First Commonwealth with the same fundamental question: How do I fix my credit?

“The answer to that question is you don’t fix your credit. You fix your budget and your savings,” Frank said. “What are the most important things with your credit? Paying your bills on time and being able to pay down existing debt.”

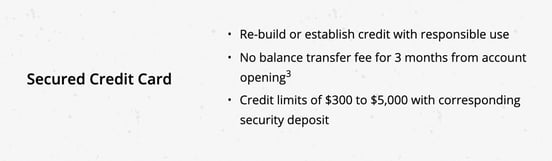

One product that helps people begin tackling these tasks is a secured credit card. Along with other measures, secured cards can help those with low credit start building toward a higher, more desirable score. First Commonwealth Bank stands ready to help them with the process.

First Commonwealth Bank offers reasonable rates on secured cards to help customers build credit.

“What makes our secured card very helpful for folks is that the minimum amount that you need to save up and deposit to open this credit card is $300. I think that is a lot more manageable than $500 or certainly $1,000,” Frank said. “It’s a good place for us to start a credit conversation with somebody who is looking for that.”

Consumers can use a secured card to pay for things already in their budget and pay back those expenditures on time. That record of timely payments can help them improve their credit score. Eventually, they can move up to an unsecured card, which will be much more manageable thanks to the knowledge and positive habits gained through hands-on financial learning.

Enriching Communities by Supporting Local Initiatives

First Commonwealth Bank provides plenty of financial products and educational resources, but it doesn’t stop supporting them once they’re done. The bank continues to assist customers in a variety of ways, including with its program for homebuyers, which helps ease a stressful process with guidance and support.

“It is a program more than just a product because it has a really strong educational component in it,” Frank said. “We mandate an educational piece because just getting somebody to sign on the dotted line is barely half of it. The other thing we want to do is make sure people can be successful homeowners.”

Successful homeownership, of course, is a means of building wealth over time. And another means of wealth-building is entrepreneurship and small business ownership. Supporting those ventures is another significant piece of First Commonwealth Bank’s mission to promote community wellness.

“Small businesses are the lifeblood of communities, and we are a community bank, and we cannot exist without communities,” Frank said. “We’ve always been very dedicated to helping small businesses explore the Small Business Administration loans.”

First Community Bank’s entire team is committed to its mission, and that helps differentiate it from larger institutions that take more traditional approaches to business finance.

“No person is the same as another, and everyone’s money questions might be a little bit different, but exponentially more so when it comes to small businesses,” Frank said.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.