Consumer attitudes about money have shifted following the coronavirus outbreak, according to a recent survey from Debt.com and HerMoney. The poll revealed that 45% of respondents cut spending by at least a quarter, while 38% say they now use a budget more strictly.

Though there’s hope for a return to normal living and a more stable economy in 2021, uncertainty remains ahead, and maintaining this positive attitude toward money is crucial for financial security.

If you still need help managing your money, check out this list of 21 ways to save money around your home.

1. Reconsider Some Subscriptions Services

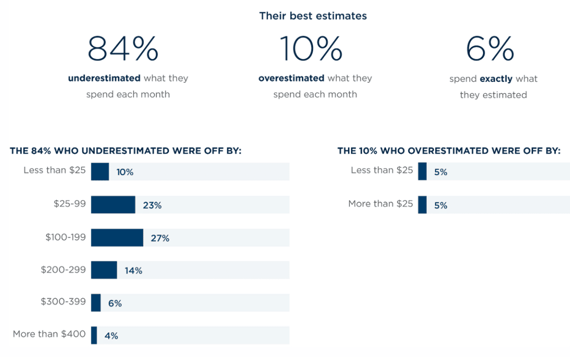

Consumers spend more on subscription services than they realize — around $238 per month — according to a survey on America’s relationship with subscription services from West Monroe.

Most consumers surveyed underestimated what they spend on subscription services each month.

Take time reviewing these recurring expenses to figure out which ones you can live without for the time being.

2. Negotiate With Bill Providers

You can lower the cost of monthly bills you deem essential, including cable, internet, and pest control services. The first step is getting on the phone to chat with a customer service representative.

Inquire about new promotions or find out if the company offers a discount for setting up e-billing or autopay. Or you can use sites like BillCutterz to do the haggling for you.

3. Time Chores Strategically

Electricity prices change throughout the day based on usage and demand. In fact, electricity is often cheaper late at night or early in the morning during off-peak hours when not as many people are using electricity. This is the best time to run large appliances that use a lot of energy to save on your utility bill.

Check with your energy provider about its time-of-day pricing to time your big chores accordingly.

4. Start Meal Planning

The average U.S. household wastes nearly 32% of the food they buy, according to a report published in the American Journal of Agricultural Economics. Food waste costs every American household about $1,866 per year.

The average American household wastes more than $1,800 worth of food every year.

Meal planning is the most effective method to reduce food waste and lower your grocery budget. Subscribe to services that provide meal plans at sites like eMeals.com or TheFresh20.com.

5. Opt For Frozen Produce

Eating healthy is on many people’s New Year resolution list, but the perceived cost of healthy eating could get in the way. One of the best ways to save on healthy foods like fruit and vegetables is to head to the frozen aisle. Frozen produce costs around 30% less than fresh produce, and you don’t have to worry about it going bad.

6. Plant a Garden

Growing your own fruits and vegetables isn’t just convenient, it will help you save on fresh ingredients. Start small by planting just a couple of your favorite herbs and be sure to review gardening tips for optimal conditions.

Even apartment dwellers can grow vegetables in containers, including lettuce, tomatoes, summer squash, eggplants, and peppers.

7. Unplug Unused Gadgets

The average American has access to more than 10 connected devices in their household, including at least two computers and more than two mobile phones, according to data from Statista. These gadgets may provide many conveniences, but they are also running up your energy bill.

Get in the habit of unplugging unused electronics to help save on energy costs.

That’s because gadgets continue to pull energy when they’re plugged in, even when they’re turned off. Get in the habit of unplugging any electronic device or small kitchen appliance that you aren’t using to help save money.

8. Cash In On Clutter

The average American household has 42 items that are no longer being used and that — if sold — could earn more than $700, according to a 2019 survey from Mercari. If you’re feeling overwhelmed by your clutter, spend time sifting through your closets, drawers, and garage to find goods to sell.

A variety of sites make it easy to sell your stuff. For instance, Poshmark.com is a great place to unload clothing and accessories while Decluttr.com pays cash for unwanted tech.

9. Swap Kid’s Clothing

Parents know that keeping up with growth spurts is expensive when it comes to kid’s clothing, but some sites help alleviate the ongoing costs. Check out Swoondle Society, an online member marketplace where you can swap kid’s clothing, shoes, and accessories for just $15 per month.

10. Stick With Generic Medicine

Generic medicine must be the same as a brand-name medicine in terms of dosage, safety, effectiveness, strength, stability, and quality. It must also be the same as brand-name medicine in the way it is taken and used, according to the FDA’s website.

Taking generic medicine instead of name-brand medicine is an easy way to save on health care costs.

Considering both prescription and over-the-counter generic medicine cost less than name-brand medicine, sticking with generic medicine is an easy way to save on health care costs.

11. Unsubscribe From Junk Mail

If you can’t pass up a sale, it’s time to get rid of junk mail. All those store circulars you receive in the mail and newsletters sent to your inbox can tempt you to buy things you don’t need.

Unsubscribing is easy — sign up at Unroll.me to instantly pinpoint and cancel unwanted subscription emails and call 1-888-5-OPT-OUT to stop receiving paper junk mail.

12. Join Buy Nothing Groups

Buy nothing groups have exploded in popularity on social media sites like Facebook and represent a great opportunity to find free or cheap items in your area. Just make sure you’re reciprocating by posting items you no longer need for free to the community.

13. Track Prices On Purchases

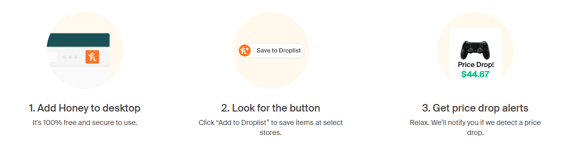

Retail prices are constantly fluctuating and you could miss out on savings if you aren’t tracking sales. Use Honey’s Droplist to get notifications when something on your shopping list goes on sale so you know the best time to buy.

The Honey browser extension will notify you when an item goes on sale.

Meanwhile, the Paribus app will notify you when something you purchased goes down in price and it will even request a price adjustment on your behalf.

14. Use Cash Back Plug-Ins

With more shopping being done online, earning cash back on purchases is easier than ever when you download a cash back plug-in like Cently to your browser. The tool will notify you when a cash back deal is offered, and money will be deposited into your online account once the sale is posted.

You can then redeem this extra cash directly to your PayPal account for use toward other online transactions.

15. Unplug From Social Media

Social media is great for staying in touch with family and friends you can’t see in person these days, but it can also have negative effects on your personal finances.

If the images filling up your feeds make you want to spend more, it’s time to take a break and unplug. Find other ways to fill your time, such as reading a book, taking an online course, or simply spending more quality time with your family.

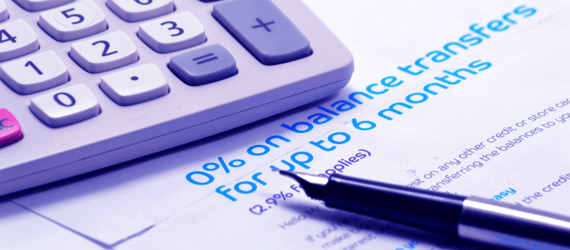

16. Apply For a Balance Transfer Card

Interest charges will get in the way of paying down your debt. Not to mention, they’re a total waste of money.

Applying for a balance transfer card can help you save on credit card interest charges.

Get ahead by transferring your current credit card debt to a new card offering 0% interest on balance transfers. This way, each payment goes toward the actual principal balance, helping you get debt-free faster and saving you money on interest fees. Just make sure to compare balance transfer cards before applying.

17. Wipe Away Bank Fees

The average monthly checking account fee is around $15 per month if the account holder doesn’t meet certain balance requirements. However, plenty of free checking accounts are available these days, so shop around and make the switch.

Don’t forget to link a savings account to your checking account to avoid hefty overdraft fees. Just make sure you’re not dipping into your savings for discretionary purchases.

18. Switch to a Lower-Cost Mobile Data Plan

You likely aren’t using as much data as you’re paying for on your mobile plan if you’re still working remotely and traveling less. Use your home WiFi for mobile data and request to switch to a lower-tiered data plan to save on your monthly cellphone bill.

If you do go on a trip, download any music playlists, videos, and directions at home to reduce streaming needs on the road.

19. Raise Your Insurance Deductibles

If you have money sitting in savings, raising the deductible on both your homeowners and auto insurance policy can provide a considerable discount on your monthly bill.

Opting for a higher deductible can help you save on your insurance policies.

Call your insurance providers to inquire about your options and use the money you save to build up a maintenance fund for both your car and home.

20. Start a Side Hustle

Sometimes the only way to get ahead financially is to find ways to make more money. If asking for a raise or getting a better-paying job are not options, look for side hustles.

You can do many jobs right from home, from pet sitting to virtual tutoring to content writing. You can also find remote job opportunities at remote.co or search for freelancing gigs at Flex Jobs or UpWork.com.

21. Snag a Lower Mortgage Rate

Mortgage rates have hit historic lows, and this is a great time to refinance to reduce the amount of your monthly payment and or length of time you have left on your loan. Lender-paid loans make this very affordable, and you can rollover any closing costs into your loan amount to avoid paying any cash out of pocket.

Just make sure you’re shopping around for lenders just as you would comparison shop for big-ticket items, as rates can vary by as much as 1 percentage point.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.