In a Nutshell: Wall Street Bound is fighting the lack of diversity in the world of finance and investing by providing urban youth the opportunity to realize their dreams to work on Wall Street. The nonprofit organization has developed a series of programs designed to help young adults from lower socioeconomic conditions learn the hard skills of finance and the soft skills of corporate culture so they can reach their goals. As they progress through the training, they will have access to finance internships, full-time job opportunities, and trading capital for a select few.

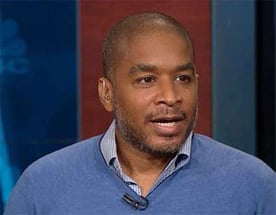

Troy Prince, CAIA, Wall Street veteran and the founder and CEO of Wall Street Bound, grew up in one of the most impoverished areas of all of America, on the border of the South Bronx. But that never stopped his passion for trading. He graduated from high school at 16, and his favorite reading material in his early days was “Market Wizards” by Jack Schwager. By 18, he was working for Salomon Brothers while attending Stern School of Business.

“I knew what I wanted to do,” Prince recounted. “Why get a part-time job delivering pizzas, when I know I want to be on Wall Street?”

Less than two weeks after graduating from Stern, Prince was on a plane bound for the Far East working for Credit Suisse and moving about pretty much everywhere around the globe afterward.

But as his career progressed, Prince noticed something was amiss in terms of representation. Even in the early 2000s, he could see there was still an obvious lack of diversity on Wall Street. “I just had this idea that either Wall Street did not have the will or the means to find this raw talent we know is out there.”

In the summer of 2019, Prince returned to the US from Vietnam after five years there working as an angel investor and shared some ideas with a professor at Medgar Evers College in Brooklyn. Those conversations helped develop their first curriculum geared toward teaching urban youth how to access the capital markets and careers in finance. There was no intention of him getting paid or forming an organization of any kind, but it did ultimately lead to the launch of the nonprofit, Wall Street Bound, Inc.

Tackling the Lack of Diversity in Finance

Studies have shown that very few women and minorities hold prestigious roles in the world of finance. That trend is even more prevalent on Wall Street. While the percentage of women holding leadership roles in financial services has about doubled since 2003, their representation on executive committees and boards in that sector still only stood at 20% and 23% in 2019, respectively.

The numbers are quite stark for minorities. According to recent financial advisor demographics, only 4% of more than 87,000 certified financial planners in the United States are Black or Hispanic . The discrepancy in having so few minorities in these roles drastically undercuts national demographics. In fact, the U.S. House Committee on Financial Services found that, while the number of non-white employees at major U.S. banks reflects the demographics in the overall population, most of these employees are entry-level and not part of senior management.

The battle for representation in financial services jobs holds some hope. Many Wall Street institutions are currently trying to implement incentives that encourage diverse hiring methods, including diversity fellowships that offer signing bonuses to undergraduates and MBA students who meet certain criteria.

Having a diverse workforce has great benefits, Prince said . “It’s clear that having diverse thought leads to better results, period. It’s just the right thing to do.”

According to data released by McKinsey, there is a strong relationship between diversity on executive teams and the likelihood of financial outperformance over time. The report also provides new insights into how inclusion matters, showing that companies should pay far more attention to inclusion, even when they appear to be relatively diverse.

“It’s clear that, at a minimum, diversity of thought is proven by data to lead to better decision-making. And when you look at boards, board makeups, it’s also proven to have bottom-line results in greater profitability, period,” Prince said.

Investment Opportunities for Underserved Youths

Wall Street Bound training programs include three courses for students to choose from. The “Introduction to Wall Street” Bootcamp is a 25-hour capital markets and finance career path introduction, held virtually or live on college campuses nationwide. The course exposes students of color to the financial services industry, along with the requisite hard skills of finance and soft skills of corporate culture.

Wall Street Direct is an intensive 10-week virtual program designed to teach finance technical and professional skills. The program also prepares urban college students for competitive Wall Street summer internship interviews and internships, and helps for recent college and university graduates prepare for full-time jobs.

The third program is Diverse Trader Training, which Prince personally leads. It is built as a one-year training course, developed by Wall Street Bound and Maverick Trading to recruit, train and mentor diverse talent to trade and manage up to $250,000 of live capital. The program’s focus on Stock/Options and FX allows participants to keep 70% – 80% of the profits they generate. This is a major part of Wall Street Bound’s overall mission, which is to take the skills the students learn and apply them to real-world success and change the landscape in leadership by acquiring more management roles.

“Stronger communities come from stronger employment,” Prince said, and these programs help deploy those skills.

Wall Street Bound is turning students into finance leaders.

After starting its operations in the New York City area, Wall Street Bound has now branched out nationally. The pandemic has forced the nonprofit organization to hold its programs virtually, for the most part. But Wall Street Bound is still gaining much success, attracting students from 25 different colleges around the country to attend the most recent Bootcamp session last summer.

And it continues to expand.

Wall Street Bound recently absorbed the finance operations of a small nonprofit doing similar work in Oakland, California, and now has a physical and staff presence in Northern California.

Fostering Agents of Positive Change on Wall Street

While Troy Prince knows more work is needed to achieve the nonprofit’s goals, he believes Wall Street Bound is headed in the right direction based on the success of its students.

A kid from the projects who has the right mindset and develops the ability to trade the markets should have the chance to do so, he said.

Prince said that he’s not asking traders and partners to change their expectations of risk-adjusted returns. But if a talented young person from a less than traditional background has the ability to trade the markets, why not give him the chance?

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.