In a Nutshell: Despite expanding access to bank accounts and digital payment tools, consumers in India still lack access to credit cards, meaning cash remains the primary payment method. But MoneyTap has emerged as a comprehensive solution for those consumers. The company offers access to lines of credit, enabling users to secure microloans at favorable rates. Users also have access to credit card products, and can pay their balances using funds from a line of credit, so they can avoid high-interest fees. And due to the product’s success in India, MoneyTap is expanding its offering to other locations in Southeast Asia, empowering more consumers with vital financial tools.

In the United States, many people take credit cards for granted. According to JP Morgan, credit card penetration per capita in the United States was 4.45 in 2018. In India, on the other hand, penetration per capita is a meager 0.02.

In other words, the average U.S. citizen holds four credit cards, while only 2% of the Indian population has access to those financial tools. But despite the lack of credit availability, people in India still enjoy access to traditional financial services and fintech solutions.

“India’s gone through a pretty large revolution over the last five or six years. We’ve now opened 800 million bank accounts,” said Anuj Kacker, Co-Founder and COO of MoneyTap. “People now have bank accounts and access to digital money. We have a very, very high penetration of digital money in terms of payments via mobile phone or QR code, much like China. The financial regulations are all tuned toward that, so that gives us a large push by the government for financial inclusion.”

MoneyTap is helping spread that financial inclusion in India through its app-based credit line tool and card products. Approved users can request microloans whenever their income falls short of meeting their needs, or when unexpected expenses arise. The platform also offers a credit card linked to the same line of credit, providing users with more flexibility around their payments and debt.

“India is going through a large boom in terms of getting people online,” Kacker said. “The regulations are becoming stricter but easier. Stricter in the sense that they ensure compliance all around, the data is secure, et cetera, but obviously opening up as much as they can to digital technologies. Credit is underserved in the country, and there lies the opportunity for MoneyTap.”

A Service that Meets the Consumer Need for Funds

“Credit cards are actually used for credit in the U.S.,” Kacker said. In India, people use them as payment instruments. The small percentage of prime customers who do get them view it as an option to pay credit for convenience.”

Indian card holders typically pay back their charges within the prescribed 30-day, no-interest period to avoid paying rates of 40% to 50% interest. Unsurprisingly, Trading Economics reported that India’s household debt-to-GDP ratio was only 12% in Q3 2019. In comparison, U.S. households had a ratio of 76%, according to Statista.

Due to the lack of credit in India, most people use cash for payments. Enhanced access to bank accounts and proliferating options for making digital payments has helped that remain the status quo. But in light of the widespread lack of access to credit, the question arises: When people don’t have cash, how can they get it?

Everyone is going to find themselves in that situation at some point or another. They need anywhere from $10 to $1,000 so they can pay unexpected expenses and make ends meet when times are tight. Then, they can pay the sums back in short order when their situations improve.

But they certainly don’t need $5,000 with a repayment term of five years, which is how banks make their money on loans. And so these products are unsuitable to consumer needs, which is why. MoneyTap steps in to fill the gap between existing products and the needs of Indian consumers.

Lines of Credit Provide Fast, Affordable Access to Cash

“In India, lines of credit typically existed with businesses,” Kacker said. “If I am a steel manufacturer, I need a line of credit to make some money to make payments to my vendor, to my supply chain. It’s like a working capital loan. But a line of credit product never existed for ordinary people, and that’s where we thought there’s the best opportunity for us.”

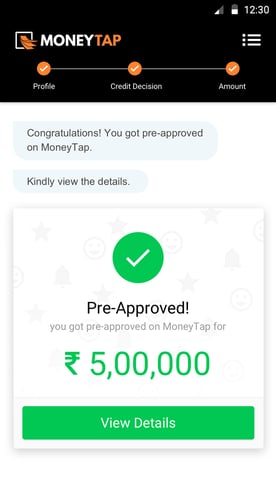

The MoneyTap app provides users with quick access to a line of credit.

MoneyTap’s lines of credit — developed based on interviews and feedback from more than 1,000 customers — enable individuals to access cash on an as-needed basis. According to Kacker, the average ticket size is $1,500.

From this store of funds, an account holder can take out $20 here or $200 there, all through the MoneyTap mobile app.

Any money that users draw from their line of credit is transferred directly to their bank account, making it readily accessible to them. An additional benefit, on the business side, is that MoneyTap doesn’t have to front the full value of a loan to the customer.

And by the same token, borrowers need only to pay interest on the money they use rather than on the full value of the credit line — as they would with a large loan.

“This is like a line of credit available to you 24/7, at the price that you want, and with the convenience and flexibility of whatever you want to pay back. And you don’t pay any interest if you don’t use the line,” Kacker said. “This money we provide is going as cash into your bank account. But along with this, we’re also giving you a credit card.”

Credit Cards Offer Flexible Payment Options

MoneyTap issues a credit card to all users who open a line of credit. The money available through each of these is governed by the same pool of funds.

“You can go to the market and swipe this card for about $600, come back home, take cash out for another $500,” Kacker said. “That’s $1,100, and you could still have $200 left.”

Anuj Kacker, Co-Founder and COO of MoneyTap.

Ideally, a customer who accrues that $600 balance on their credit card will be able to repay it within 30 days, and so they will avoid paying interest on the debt. But if not, they can use the MoneyTap app to convert the debt accrued on the credit card into an equated monthly installment (EMI) plan. That arrangement allows users to pay it off over a longer period at a lower interest rate.

The product is functionally a credit card with the built-in option of consolidating any accrued debt into a loan carrying lower interest. Meanwhile, users still enjoy direct, easy access to cash through the line of credit.

“If you want cash, you don’t need to take the credit card and shove it into an ATM because it’s very, very expensive in India. And you don’t need to revolve on the credit card,” Kacker said. “If you can’t pay it back by the 30th day, simply open the app and convert it into an installment plan. Complete flexibility is with you, whether you need cash or to transfer it to your wallet — whatever you want.”

MoneyTap: Expanding Access Across Southeast Asia

Even in the heavily saturated U.S. market, not everyone carries a credit card. While using a credit card responsibly is an effective way of building creditworthiness, not everyone qualifies for the financial tool. Extending credit is a risk for the lender, so they have to make their decisions wisely.

And that is one reason why credit penetration in India remains so low. Credit bureaus operate in India; Indian consumers have credit scores; but they simply don’t meet the stringent qualifications necessary to qualify.

“What ends up happening in the credit business is that you reject more than you approve, in which case, everybody walks away disappointed,” Kacker said. “The majority are walking away disappointed.”

MoneyTap launched in 2016, and now disperses more than $35 million worth of funds each month. Far from India being devoid of good credit risks, consumers there can qualify for credit, and when they do, they put it to good use.

That’s why MoneyTap plans to expand its operation into Southeast Asia. The company is confident that its all-inclusive approach can help consumers in other nations access credit products through a single app.

“We own the entire customer journey,” Kacker said. “We are not a backend service provider to anybody else. We are not a white-label solution. We are creating a new category: The line of credit product that works from a customer standpoint and from a business standpoint. We help the customer along the journey, and we are there from acquisition to disbursement to collection.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.