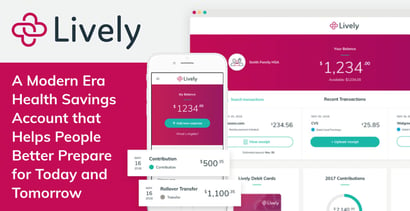

In a Nutshell: Unexpected medical expenses can send household budgets into a tailspin. The founders of Lively experienced this first-hand, which is why they decided to create a health savings account (HSA) for the modern era. Lively is completely free for individuals and families and provides a way to invest and save for future medical costs. The company also has offerings suited for employers, brokers, and other partners. As an HSA created from the ground up to help everyday consumers, Lively continues to value user feedback and takes customer sentiment very seriously when creating new features.

Unfortunately, all too many people in the U.S. are aware of how unexpected medical expenses can seriously damage a budget. Whether it’s a major event, such as a heart attack, or simply an exploratory CT scan, consumer budgets have been seriously sidetracked by health-related costs.

Alex Cyriac and Shobin Uralil both discovered this fact the hard way through their personal experiences, which led them to found Lively and offer a health savings account for today’s world.

“We both separately endured financial hardship due to mounting healthcare costs,” COO Uralil told us. “It started when Alex’s mother was put on disability after a surgery went awry, requiring him to financially support his parents.”

As if that weren’t enough, Cyriac soon discovered the outrageous monthly costs of his parents’ medications, despite them being on Medicare.

As if that weren’t enough, Cyriac soon discovered the outrageous monthly costs of his parents’ medications, despite them being on Medicare.

“He called me to see if I had experienced anything similar — and unfortunately I could relate,” Uralil said. “My wife and I had just welcomed our first child, and were juggling significant, unexpected healthcare costs when we should have been focusing on the most exciting moment of our lives.”

These personal hardships led Uralil and Cyriac to conduct some research into the state of medical expenses and discovered the average couple is expected to pay $369,000 for healthcare in retirement.

The friends knew neither they nor their parents were prepared for those kinds of expenses.

“We started looking for a health product that offered flexibility and long-term dependability and found health savings accounts (HSAs), which act as portable, investable savings account for anyone with a high deductible health plan,” Uralil said.

However, the majority of providers were riddled with fees and made it difficult to access funds quickly in times of need, he said. So the partners set out to create a new, modern HSA provider centered on individuals and families.

“We founded Lively with the hope of providing better saving opportunities to individuals and families all over the U.S.,” Uralil said. “We believe every American should have access to tools that enable them to save for healthcare, which is why we created a truly free consumer HSA that is modern, easy to use, and designed to put more savings into families’ pockets.”

Lively HSAs are Free for Individuals and Families

HSAs are an unmatched saving tool because they allow consumers to pay and save for healthcare tax-free, Uralil said. And, in annual terms, Americans can save 25%-35% (based on the average state and federal tax savings) in healthcare costs.

If you never take money out of your HSA, it operates like a 401(k) with a few exceptions. A 401(k) allows you to withdraw funds with no penalty as early as 59 and a half years old. With an HSA, you can take non-qualified distributions after 65 and not pay a penalty. And HSA funds you use to pay for qualified healthcare expenses are tax-free.

Shobin Uralil is the Co-Founder and COO of Lively.

“Considering any projected investment growth, tax-free savings, and compound interest, we believe HSAs are the only clear path to pay for that estimated $369,000 in out-of-pocket healthcare costs couples will face in retirement (this is on top of medicare coverage),” Uralil said.

With healthcare costs rising, more Americans are finding HSAs to be the best option to save for their long-term health, he said. A high-deductible health plan makes sense for many demographics, particularly young working Americans.

“For example, if you rarely go to the doctor, why pay high premiums for a service you may not use? Rather, take the savings and put it into an HSA. In fact, if Alex and I had known to select a high-deductible health plan and contributed to an HSA in our 20s, we would both be sitting on a balance north of $100k.”

Uralil said anyone with a qualifying high-deductible health plan is eligible to open a health savings account in the U.S. However, with more than 2,000 HSA providers on the market, choosing the right HSA can be overwhelming.

“We created Lively to break from age-old HSA custodians that provide archaic user experiences and high fees,” he said. “We’ve differentiated our offering from traditional HSAs that nickel-and-dime their users, choosing instead to create a 100% fee-free platform, top-notch customer service, and increased accessibility to healthcare savings.”

As a completely free account, individuals and families using Lively never have to worry about hidden costs.

A Streamlined Way for Employers to Digitally Manage HSAs

Uralil and Cyriac also kept employers in mind when creating Lively.

“Lively provides employers and employees a streamlined, digital way to manage their health savings account,” according to the company website. “We’ll do the heavy lifting for you.”

Lively can basically help employers build a better benefits package without adding admin hours. And businesses can manage everything from one place by efficiently reviewing and managing all administrative tasks online in one intuitive dashboard view, according to the company.

Lively offers streamlined HSA options for employers and brokers.

Companies that select Lively can count on dedicated onboarding support.

“Your dedicated onboarding specialist will help customize your setup and readily provide support, even after open enrollment,” according to the Lively website.

Lively’s service also includes automated payroll deductions as the platform seamlessly integrates and syncs with clients’ preferred payroll systems.

“I have been working with HSAs since their inception and pride myself on being an expert in all things HSA, FSA, and HRA related,” wrote Benefits Counselor Jason Cleary on the Lively website. “Lively’s HSA is a step above the rest.”

Lively is also available to brokers and partners.

“Bring scalable HSA innovation to the table. We are invested in your success,” according to the company website. “That’s why we designed customizable and cost-effective partnership options to both meet your clients’ needs and accelerate the growth of your business.”

Uralil said Lively is continuing to refine its offerings.

“We are excited to continue investing in solutions that make it easier for employers to administer their HSA, including additional integrations with Benefits Administration platforms, HRIS systems, and payroll providers,” he said.

Customer Service and a Quality Customer Experience Lies at the Core of the Platform’s Offerings

“We consider our customer experience and service as the core of our offering,” Uralil said. “All of our customer service team members are HSA experts — we don’t outsource this benefit. As a result, we work intimately with our customers to offer a better experience.”

He said Lively is constantly rolling out new features that have been requested by users, which is why its Net Promoter Score is four times that of its closest competitors.

“While the majority of the industry has entered the HSA space by white-labeling third-party software, Lively’s solution is proprietary and built from the ground up,” Uralil said. “This has allowed us to take a user-centric approach to help consumers save for their healthcare expenses.”

Lively works to make sure its customers receive high-quality service and positive experiences.

The Lively team built its own record-keeping technology from scratch, Uralil said, and as such, the company is not at the mercy of anyone else. He said it’s focused on building a contemporary, intuitive product around consumers and their spending, saving, and investing needs.

“Every decision we make is designed to put more savings into Americans’ pockets, from creating free healthcare savings tools to facilitating multiple investment options, to removing all fees for individuals and families,” Uralil said. “We are revolutionizing the HSA experience through transparency, affordability, and innovation.”

He said Lively is proud to be the top consumer-rated HSA provider on HSA Search.

“We are constantly working on new tools to make it easier for users to save on healthcare,” according to Uralil. “In the past two years, we’ve launched debit processing through Visa, mobile apps to track savings and reimbursements on the go, and a health plan cost calculator.”

Lively also provides investments through the TD Ameritrade Self-Directed Brokerage Accounts (SDBA) platform, ensuring that users have access to the most robust set of investment options to grow their health savings through ETFs, stocks, bonds, and mutual funds.

And there are more benefits to come.

“We have spent a long time building the underlying architecture that allows us to build the tools families need to save for healthcare costs in retirement, and we have a number of exciting new offerings that we look forward to sharing soon,” Uralil said.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.