In a Nutshell: In the wake of 2008’s financial crisis, the founders of IOU Financial identified a need in the market for more small business loans. The company combined its tech, financial, and operational expertise to devise an end-to-end system that filled the gap in the market and brought quality loans to small business owners. Applicants know instantly if they are approved, and can often access their funds within 48 hours. Because of its rich data-analyzing technology, the company was able to recently expand its offerings to include businesses with less-than-ideal credit scores. With a convenient application process for brokers and merchants alike, IOU Financial maintains a satisfied customer base.

In 2008, the founding team behind IOU Financial was poised to launch a peer-to-peer lending service similar to that of Lending Club.

The partners — Phil Marleau, Robert Gloer, and Madeline Wade — had realized at a fintech conference that between the three of them, they had the tech, financial, and operational expertise to build a successful lending company.

But when they began looking at the type of potential customers who were visiting their website, they identified a more pressing need in the market.

![]() “Our data showed us that among the people coming to our site looking for loans, there was a large number of small business use purposes,” said Wade, who is the Vice President of Operations at IOU Financial. “This caused us to take a step back. We realized the small business owner was in need of capital.”

“Our data showed us that among the people coming to our site looking for loans, there was a large number of small business use purposes,” said Wade, who is the Vice President of Operations at IOU Financial. “This caused us to take a step back. We realized the small business owner was in need of capital.”

The need in the market was a result of the 2008 Financial Crisis, Wade said. Smaller banks were being bought out or consolidating and were not lending to small businesses as they had done in the past.

“These small business owners were clearly impacted, and there was really a need in the market for quick, accessible loans,” she said.

At that point, the fledgling IOU Financial changed course and focused its innovative tech (brought by Marleau from his earlier company, IOU Central) and financial expertise on delivering loans to small business owners in need of working capital.

Today, IOU Financial is still serving small business owners with fast, online loans of up to $500,000 with repayment terms as long as 24 months.

“It’s been really amazing to how the industry has changed and grown over the years,” Wade said. “It’s incredible to see the size of the industry and the need that still exists out there.”

Instant Approval and Quick Funding at Competitive Rates

Wade attributes a large part of IOU Financial’s success to its proprietary platform that delivers an end-to-end solution for customers.

“The tech was homegrown, built from the ground up,” she said. “And the functionality of the platform really took us by surprise. Robert and I came from the mortgage industry. And in most banking industries, you’re working in multiple systems from CRM, loan operating, loan servicing, reporting, and collections.”

Marleau’s technology brought everything together into one piece and was scalable, she said, which added huge value to the company’s offerings. The platform has evolved over the years, and today Wade said it is basically a supercharged version of its earlier iterations.

Madeline Wade is a Co-Founder and the Vice President of Operations at IOU Financial.

“The things that we’re able to do with the data has really come a long way,” she said. “We can leverage the technology to do the heavy lifting. It allows us to keep our costs low, and ultimately the small business benefits from that.”

IOU Financial offers instant pre-approval for its loans and can provide funds quicker than most other financial institutions.

“IOU Financial has fast, flexible small business loans, always there when you need them,” according to the company website. “Banks take weeks to decide if you qualify for financing. IOU Financial can deliver small business funding in as little as 24-48 hours.”

Wade said the online application process only takes a few minutes. There are no upfront costs to apply (there is a soft credit inquiry in the U.S. that doesn’t impact the owner’s credit score) and IOU Financial loan holders are eligible to apply for loan renewal once 40% of their loan principal is paid.

Businesses can save money by repaying early as well.

New Options to Assist Those with Lower Credit Scores

IOU Financial recently rolled out a new credit expansion product, Wade said, which will allow it to serve an even broader range of small businesses.

“In the past, we have been relatively conservative in the space where we were mostly looking at the most bankable borrowers, with good credit and good cash flow,” she said. “Now, with these rich data points that we have, we can expand the credit scores that we’re able to work with.”

Wade said the data can help IOU Financial understand if a lower-end credit score — as low as 580 — is due to credit utilization rather than delinquency. These borrower characteristics are difficult to determine using only traditional credit scoring models.

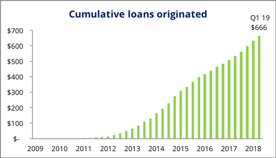

IOU Financial has consistently increased the number of small business loans it originates each year.

“With these kinds of details available, we can see how a borrower may still be a good loan candidate even if their actual credit score isn’t ideal,” she said. “We’re able to reach more borrowers now. We’re super excited about the product.”

Wade said IOU Financial is very methodical about how it approaches its products and ensures that each decision is supported by data that provides a good idea of what the outcome may be.

“So, this was a big step for us,” she said. “And our brokers have really kind of latched on to it because the pricing for the merchants in that tier is going to be in line or less than what you’re seeing from cash advance companies for a high-risk borrower.”

IOU Financial’s other loan requirements include that borrowers must own at least 80% of their business or 50% if owned with a spouse; borrowers must own a business that has been operational for at least one year; and the business must have an annual revenue of more than $120,000 with an average daily business bank account balance of $3,000.

Quality Broker and Merchant Experiences Lead to Satisfied IOU Financial Customers

“We have two different channels through which small business can access our loans,” Wade said. “Our wholesale channel is the primary method, where our loan brokers will come in and enter the application on behalf of the merchant. But we also have our retail channel where the merchant can apply directly.”

She said the application is very quick and painless for brokers and merchants, and they know within seconds if they are approved.

“By the time a loan hits our processing team, it’s already been determined if they meet our criteria, so they’re not spending man hours on anything that’s not going to be up to our minimum standards,” she said. “That means if a loan is submitted this morning, there’s no reason why it couldn’t close this afternoon.”

She said if a loan closes before the wire cutoff time for the day, borrowers could have their money the same day, which has happened many times with IOU Financial customers. Otherwise, the wire will be sent the next business day.

The company is always looking at ways to make the process even more efficient without sacrificing the in-depth data analysis and underwriting that goes into the loans.

“A lot of our small businesses are surprised by how fast the process can go. It’s a pretty awesome experience,” Wade said. “And we provide our brokers with a lot of capability, like their own portal, so they can go in and really look at the offers and select what’s best for their customers.”

IOU Financial maintains a five-star “Excellent” Trustpilot rating with 307 online reviews from customers.

“We went to a bank and tried the conventional route, but after about 6 months they told us we didn’t qualify,” wrote DaVinci’s Pizzeria owner Jason Black on the company’s website. “Luckily I was able to reach out to IOU Financial, and I had my loan in less than a week.”

Black’s is just one of many positive testimonials from happy IOU Financial customers.

Wade said IOU Financial is still riding the wave of excitement about reaching new borrowers with its credit expansion product, but it is also excited about geographic expansion into Canada. IOU has been beta testing in Canada, and earlier this year expanded its product offering and ramped up its marketing efforts in Canada.

“It’s been a little bit difficult for the fintech space to get traction there, in general,” she said. “So we’ve dedicated resources to gain more Canadian merchants as customers. That’s a big focus for us this year.”

IOU has been in business over 10 years and has helped thousands of small businesses grow and success. IOU looks forward to growing in North America over the years to come.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.