In a Nutshell: When students and their parents weigh colleges and degree programs, cost is often a significant factor. GradReports aggregates information about the cost of specific degree programs at institutions and displays them alongside the first-year earnings students can achieve after graduation. That helps prospective students make decisions in terms of cost and ROI on student loans. GradReports offers other useful information, including lists of the most lucrative majors and granular data about earnings broken down by state, ensuring students can make informed decisions about their futures.

Many prospective students think about college strictly in terms of education. It’s a place to develop a knowledge base in preparation for a long-term career. But that preparation is also a significant investment in time and money.

Some students pursue degrees based on a career path they would enjoy taking for the rest of their working life. Others pursue degrees based on a passion or interest. While those may be personally fulfilling courses of study, they often overlook financial implications post-graduation.

“A lot of the advice out there is to pursue your passion when you’re going to college, which is a nice sentiment, but perhaps not that helpful when it comes graduation time,” said Nicole Hopler, Senior Marketing Manager at Optimal, a company that helps students make data-driven decisions. “A lot of students can’t find well-paying jobs or support themselves, and they end up with tons of debt and not being able to pay back their loans.”

Optimal’s GradReports is a platform designed to help students mitigate and prevent those negative outcomes. It provides information about degree costs and salaries across sectors, empowering students to make smarter decisions about a college, a course of study, and student loans so they can maximize their ROI.

“It’s important to set yourself up to make a strong living after college, and having the resources before you decide on a college and a program helps,” Hopler said. “Doing research beforehand can have such a big impact on a student’s future. That’s the main reason that we started GradReports, and our mission is to connect students to transparent, outcome-based data they can use to make better decisions about their education.”

Salary Score Offers Financial Data for Colleges and Majors

“College is an extremely expensive investment, both in money and time,” Hopler said. “It’s critical for students to understand what they can make after graduation and whether they can pay back their degree and make a decent living.”

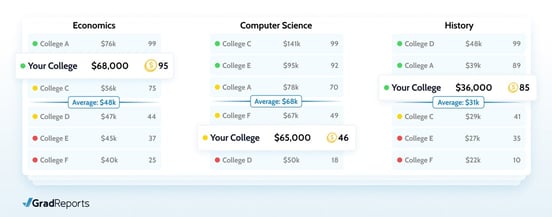

That’s why GradReports came up with Salary Score, a metric that allows students to easily compare colleges based on alumni salary by program. Salary Score compares the starting salaries of a specific school’s alumni with the starting salaries of alumni who completed the same program at other schools.

“Since some majors tend to earn more than others, we only compare alumni earnings from the same fields of study,” Hopler said.

GradReports offers transparent salary comparisons for a wide variety of schools and programs.

Salary Score is a helpful tool for students who have decided on a college, or are working on general education requirements, but have not settled on a major.

The same is true for students who have decided on a major but have not picked a school. They can select a degree program and view alumni earnings compared with those of other schools, helping them pin down their most lucrative choice.

“Our school profiles are important, and I think they are interesting and set us apart,” Hopler said. “You can search for any school you’re interested in and see their overall Salary Score by degree level, and also see the program breakdown. So you can see which majors at the school are doing well, or you might want to consider a different school.”

Actionable Information Sourced from College Scorecard

At the heart of those comparisons is the data. That’s why accurate information about the costs and financial outcomes of degree programs is crucial to GradReports’s mission to empower degree-seekers.

“All the data that we use on our sites is from College Scorecard,” Hopler said. “We try not to rely on schools to provide us with data because we know that they can manipulate it in a lot of cases, so we need to make sure that all the data that we use is reliable. And that’s why we use government sources.”

College Scorecard is an online repository provided by the federal Department of Education. It draws data from salaries reported on individual tax returns, meaning it is verifiable and represents actual outcomes. This information is unaffected by the potential interest or bias that reports from colleges may carry.

GradReports shows the differences in expected salaries based on the type of degree.

The salaries on GradReports reflect earnings in the first year after graduation, not long-term earnings. That helps students get an idea of their baseline income straight out of school, which is crucial to help them determine the viability of individual programs. It’s also a solid starting point for weighing whether they can start paying off student loans quickly as they begin their careers.

“We think that that’s a pretty impactful number to show, especially for people that are entering the workforce,” Hopler said. “That’s when you have to start paying back your loans.”

Students Can Browse the Best Degrees by Salary

Choosing a lucrative major is a top priority for many students particularly because the cost of college continues to increase and the economy is still recovering post-pandemic. That is especially relevant to forward-thinking students — particularly those returning to college after spending time in the workforce. Many have FIRE (financial independence, retire early) in mind as they consider their career options.

GradReports also looks at the most lucrative sectors that require only a bachelor’s degree for entry.

“The top one across the board is engineering, which isn’t all that surprising,” Hopler said. “Pretty much all of the engineering degrees have high average salaries right out of college, as well as computer science.”

Nicole Hopler, Senior Marketing Manager at Optimal, GradReports’ parent company

One surprising result was the earning potential in nursing based on specific program types within the field. It was the third most lucrative industry by major that the GradReports team uncovered.

“That was something that we didn’t expect,” Hopler said. “You don’t usually hear, ‘If you want to go into a high-paying program, choose nursing.’ We found it interesting that it has high average salaries.”

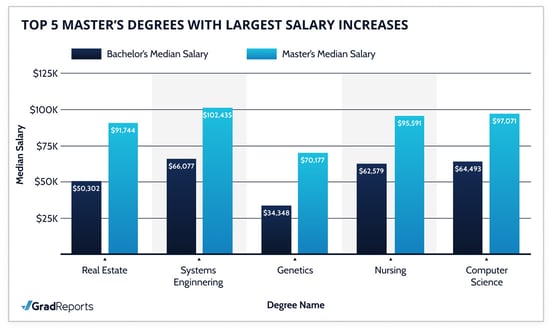

Another option is to pursue a master’s or doctoral degree. Although more costly, graduate degrees typically help students increase their earnings in the workforce and help them pay off student loans faster. Systems engineering is among the degrees that offer a pay bump between undergrad and grad degrees.

“The bachelor’s degree salary is already pretty high,” Hopler said. “But if you pursue that master’s, it’s going to give you an even higher salary. And genetics and nursing are also interesting to see how big of a salary jump those professions could give you if you go on and pursue a master’s degree.”

GradReports: Improving Comparison Shopping in Education

Besides helping students make informed decisions about majors and degrees, GradReports shows students how to weigh other essential considerations when pursuing higher education.

“A lot of the feedback is, ‘I wish I had this when I was making the college decision or deciding which major to pick,’” Hopler said. “I feel like there’s more awareness that people need to do this research beforehand and think about what their life is going to look like after graduation.”

That is true because a degree from a particular school can determine employment opportunities and earning potential. And it may determine ROI for students who rely on loans to pay for their education.

“We’re hoping that the site makes it a lot easier to do that,” Hopler said. “Being able to look at a specific school and compare that to your other options — it should be integral in figuring out if student loans are going to pay off in the future.”

Other important considerations are in-state vs. out-of-state tuition, which can vary considerably. That may require a more significant financial investment. Knowing how well that investment will pay off is crucial in deciding whether to stay in-state or move elsewhere to pursue a degree or employment.

“We have by-state rankings as well, which makes it a lot easier to compare,” Hopler said. “That is pretty useful for people to check out, especially because salary can fluctuate based on the area you’re in.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.