In a Nutshell: When people in Indianapolis need a loan, financial information, or help build savings, they can turn to Financial Health Federal Credit Union. In addition to specialized programs that teach financial independence, the credit union partners with community organizations to support individuals who need a helping hand. That assistance includes loans and savings accounts as well as workshops and free online tools. For its efforts to improve Indianapolis communities, Financial Health FCU has earned our Editor’s Choice Award.

Imagine being in your early 20s living in Indianapolis with poor credit and a low income. You decide to open an account at the same credit union your mother and grandmother used, and you attend one of its financial wellness workshops. After that, you enroll in a program designed to help you build your savings and improve your credit. After a few years of education and guidance, you’re ready to purchase your first home — before you’ve even turned 30.

That is the true story of one young woman who achieved stability and success thanks to the support provided by Financial Health Federal Credit Union, according to its President and CEO Shawn Wolbert. The credit union’s mission is to help people in underserved communities in Indianapolis achieve financial wellness through specialized products, programs, and service.

Financial Health FCU was founded to help hospital employees and now assists communities in Indianapolis with loans and educational resources.

“The credit union was founded in 1971 to serve Indiana University Health Hospital,” said Wolbert. “The board of directors of the credit union determined that, in addition to serving the hospital community of Indianapolis, it would also focus on serving low-income families.”

Financial Health FCU also specializes in member education and financial counseling. Additionally, it assists community partners that share its focus of aiding people through educational resources.

For its commitment to underserved communities in Indianapolis, Financial Health FCU earns our Editor’s Choice Award in recognition of its efforts to improve financial literacy and standing.

Community Partnerships Help Organizations and Beneficiaries Thrive

Financial Health FCU operates programs tailored to helping its partner organizations achieve success in the communities they serve. One way it pursues this mission is assisting with grants those organizations have already earned.

“The grants require a lot of tracking and recording,” Wolbert said. “Through an account, we will facilitate all of the tracking and reporting to the federal government on how the grant is being spent.”

Financial Health FCU offers Individual Development Accounts (IDA) to members of partner organizations that help those account holders save toward a goal like buying a home or pursuing higher education. Financial Health FCU also provides financial counseling for those members. Managers and other credit union staff are certified by the Credit Union National Association (CUNA) to act as financial counselors, enabling them to pull credit reports, discern problems affecting credit, and help set financial goals.

“We won an award last year because we teamed up with Partners in Housing, which is a group in Indianapolis that helps people transition from homelessness into their first apartment,” Wolbert said. “We provided all of the counseling for their properties in the inner city.”

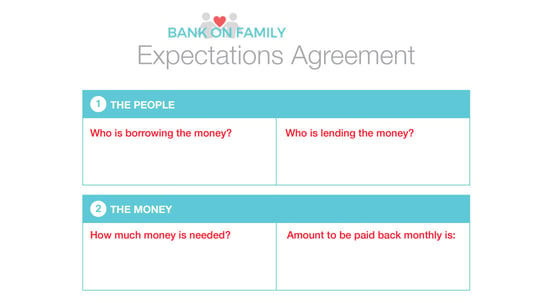

Partner organizations also benefit from Financial Health FCU’s Bank on Family program. When in financial need, people often turn to friends or family members for loans. The Bank on Family program is designed to make that lending process easier on everyone involved.

The Bank on Family program provides a structure and benefits for those loaning money to family members.

Instead of loaning the money, the family member acts as the loan’s guarantor by taking out a certificate of deposit for the same amount that will earn interest during the entire term. The borrower receives a loan through Financial Health FCU, obtaining the money he or she needs, while also building credit. The credit union acts as an intermediary between borrower and family lender by facilitating and tracking payments, which takes the stress out of the situation.

During Bank on Family’s pilot phase, Financial Health FCU found community partners that wanted to facilitate the program. The credit union helps them get grants to fund the program, and the partner organization acts as the lender — thereby earning interest on the loans it guarantees.

“It’s a very innovative way to provide people with low income — who would have trouble qualifying for a loan because of credit history – the ability to get the funds they need and build a positive credit profile,” Wolbert said.

Specialized Programs Let Members Build Credit and Savings

Access to savings and credit — fundamental parts of financial health — are particularly crucial when dealing with emergencies. That’s why Financial Health FCU offers credit-building and savings incentive programs.

In its Credit Builder Loan program, members can select from options designed to suit different needs. Some may opt for a line of credit, which is available two or four times per year depending on their financial situation. Financial Health FCU also offers a refinancing program that allows members to eliminate high-risk and high-cost debt.

“A lot of times, people don’t realize that their debt didn’t happen overnight and it’s not going to be fixed overnight. Members who have $30,000 and $40,000 in credit card debt come to us and say, ‘I need an unsecured loan for $45,000,’” Wolbert said. “Rather than doing that — which doesn’t help the members because a lot of times they get into the same debt — we work with them, one credit card at a time, to pay them off and work toward building healthy financial habits.”

FHFCU teaches members about financial concepts including how compound interest can grow their savings.

By helping them achieve those goals, Financial Health FCU allows them to make real progress toward a healthier financial future.

And for members who need encouragement to build savings, Financial Health FCU offers both emergency fund and savings challenge programs. The goal is to help members save money, and the credit union uses positive reinforcement to teach healthy savings habits.

Members decide how much they want to save over three months and then sign an agreement obligating them to make weekly deposits. Financial Health FCU matches 10% of their deposits, rewarding them for pursuing savings goals and striving for financial independence.

Workshops and Free Tools Empower People to Take Control of Their Finances

Financial Health FCU hosts wellness workshops at its credit union locations and at community partner events about four times per month. They cover topics ranging from overall financial wellness to specific concerns like budgeting, credit scores, and even fraud.

The workshops can run from one hour to three hours. For the longer sessions, Financial Health FCU provides participants with a light dinner because no one, not even credit union employees, want to deal with financial topics on an empty stomach.

While these workshops provide essential information, attendance isn’t necessarily feasible for everyone who’s seeking to improve their financial situation. For busier individuals, Financial Health FCU has developed a suite of free financial health tools, divided into easy-to-navigate categories and that are accessible on its website.

The credit union offers free tools to help members improve their financial situations.

Under Budgeting, users will find tools to track their spending, create a realistic budget, and assess their overall financial situation. In its Credit category, users can conduct a self-checkup to evaluate and improve their credit, calculate a debt-to-income ratio to see what kind of loan they can afford, and find out what credit score they’ll need to get the best rate.

Retirement and Savings tools include a planning quiz, a fund estimator to ensure appropriate savings, and a worksheet that shows how interest compounds over time to grow savings.

Finally, in the Savings, Emergency Funds, and Financial Wellness category, users can find a savings calculator and an emergency fund worksheet to help establish annual savings goals that will help them to maintain financial stability.

FHFCU: Building on a History of Commitment to Community

Before it was Indiana University Health Hospital, it was Clarian Hospital. Before that, it was Methodist Hospital. Through all of those transitions, two things remained constant: the mission to safeguard the health of the community, and the services provided by Financial Health FCU.

Just like IU Health, Financial Health FCU has grown and evolved over the years. Although it was founded to tend to the financial needs of the hospital, its purview grew to encompass the community the hospital serves. And like IU Health, it focuses on both the immediate and the future wellness of its members — albeit financially rather than medically.

“That has been our focus: bringing people financial wellness,” Wolbert said.

Financial Health FCU’s success in that mission is evidenced by its numerous awards and accolades. The credit union has received the Desjardins Award for Financial Education as well as multiple CUNA awards recognizing its financial wellness programs and counseling.

“Over the last five years, we have consistently won awards every year,” Wolbert said. “Our financial wellness program, other than being nationally recognized, helps both our members and community partners.”

From providing loans and guidance when money is short to partnering with community organizations who share its mission of aiding the underserved population, Financial Health FCU stands ready to serve. Through its specialized programs and products, the credit union helps members, organizations, and entire communities achieve financial independence.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.