In a Nutshell: Many Americans who live paycheck to paycheck are vulnerable to financial emergencies, which can make it hard for them to build their savings. H&R Block teamed up with personal finance expert Lynnette Khalfani-Cox, aka The Money Coach, to explain how H&R Block’s free banking app, Spruce, empowers individuals and families to work toward financial security. As a television personality and best-selling author for 20 years, Khalfani-Cox also offers helpful tax preparation strategies and inspiration for getting out of debt and staying on the path to a sustainable future.

Many consumers could use advice and better strategies to protect against sudden financial shortfalls. Some studies show that as many as 60% of American households live paycheck to paycheck. But tax season can be a great time to start down the path to economic stability.

Experts forecast that average tax refunds for the 2022 filing season will approach $3,500. That means many Americans may find themselves with a sizable sum to pay down debt and put a financial cushion in place.

Tax filing can be a frustrating and complex process. The COVID-19 pandemic also brought changes for 2022 that households should be aware of so they maximize their refund.

If a big refund check materializes, consumers may also want to know where it can be most effective. Finding trusted tools and advisors to make those financial decisions is a key step.

H&R Block is a familiar and trusted name in the tax preparation industry, and the company has expanded in the financial world to offer a new banking app, Spruce. The app has built-in functions that help users set savings goals and develop the best tax refund strategies.

And H&R Block teamed up with prominent television personality and best-selling author Lynnette Khalfani-Cox, aka The Money Coach, to highlight Spruce’s features and inspire Americans to set themselves up for success. 2022 is poised to be a year when many more consumers can achieve financial freedom.

“For 20-plus years, I’ve been talking to Americans all across the country about ways to improve their personal finances — how to save, how to get out of debt, and how to better manage their money,” Khalfani-Cox said. “Frankly, Spruce helps people do all of those things, and it’s from a brand I know and trust.”

Spruce: The Banking App with Tools for Reaching Savings Goals

Spruce makes it easy to be good with money because it combines all the conveniences of mobile banking into an app that includes a debit card and a savings account.

It’s free to use, with no hidden fees or minimum balance requirements. Each account includes free overdraft protection of up to $20 for folks who sign up for direct paycheck deposits.

Spruce also offers early paycheck deposits to give users access to their earnings and avoid high-interest payday loans that often do more harm than good. It’s easy to enroll through an employer or financial provider and receive money up to two days early.

“Over the years, I’ve written so much about payday lenders,” Khalfani-Cox said. “For a lot of people, all they need is a day or two to keep the lights on or make that car payment.”

Spruce also helps users get down to the basics of saving — automatically. Spruce budgets and tracks spending, and enables users to decide on savings goals by directly depositing paycheck percentages or dollar amounts in designated savings accounts. Automation makes sticking to goals a lot easier, according to Khalfani-Cox.

“Honestly, since I’ve been working as The Money Coach, I’ve never had a single client who has accurately tracked their budget and spending on their own,” she said.

Spruce also helps people jump-start their savings by reminding them to earmark all or part of their tax refund to specific goals. Putting a tax refund aside can be a great way to maximize its use, Khalfani-Cox said.

“I see it as a really powerful solution for avoiding financial traps,” she said.

Knock Out Debt and Create a Cash Cushion

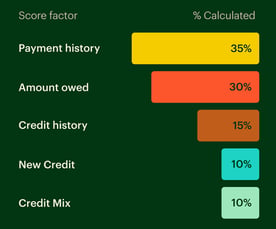

Khalfani-Cox’s personal story is one of triumph over financial adversity. She paid off more than $100,000 in credit card debt in three years during the early 2000s.

That experience led her to publish the New York Times bestseller “Zero Debt: The Ultimate Guide to Financial Freedom” in 2004. She has written 15 personal finance books and has appeared in more than 1,000 news and lifestyle television segments, including on “Oprah,” “The Today Show,” and “The Steve Harvey Show.”

“I definitely know what it’s like to struggle with debt and feel the burden of having credit card bills hanging over your head,” Khalfani-Cox said. “You should absolutely take your tax refund check and knock out a portion of those high rate credit card bills.”

Khalfani-Cox recommended filers set aside at least a third of their tax refund to drill down on credit card debt. For filers receiving the average refund amount, that would be about $1,200.

“If the pandemic taught us anything, it’s that we all need to have an extra cash cushion to deal with the unexpected,” Khalfani-Cox said.

That’s because the unexpected has become the norm. For example, as COVID-19 was beginning to recede in the US in 2021, the omicron variant led to increased hospitalizations and deaths. Then, in March 2022, the Russian invasion of Ukraine sent markets spiraling and prices rising.

Khalfani-Cox recommends people set aside an emergency cash cushion of at least $500 on the low end to as much as $1,500 on the high end.

“That kind of emergency savings fund will cover the vast majority of people for the most prevalent type of emergencies they will experience,” she said.

Slow and Steady Wins the Financial Race

The next step to financial freedom is to set a long-term goal to save enough money to cover household expenses for between three and six months — and build an emergency fund. For example, if household bills are $2,000 a month, the goal should be to have at least $7,500 to as much as $13,500 set aside.

“I know those numbers might scare some people — especially folks who have struggled to save even just a few hundred dollars,” Khalfani-Cox said. “But slow and steady wins the race.”

Many consumers can start by maximizing their tax refunds. Khalfani-Cox’s best advice is not to wait until the last minute to file. People should give themselves plenty of time to collect their paperwork and financial data.

Unfortunately, doing so without assistance is probably not a good idea, especially given that there’s so much free and low-cost assistance available. Changes to the tax code make assistance imperative for those seeking everything they’re eligible to receive.

For example, people receiving unemployment benefits in 2020 could deduct up to $10,000 of those benefits from their taxes, but that deduction went away in 2021. That means that incomes — and taxes — will be higher for people in that situation for the 2022 filing season.

Taking advantage of changes to the child tax credit also requires new income reconciliation procedures. The tax code has also seen changes to age guidelines and other earned income tax credit criteria.

Khalfani-Cox recommended using Spruce to put good habits in place. And then consider a low-cost tax-preparation service to help take the guesswork out of filing.

“Sometimes it’s best not to be penny wise and pound foolish. An expert can actually help you put thousands of dollars back in your bank account,” she said.