When you shift from single to married life, your financial habits and obligations shift with you. When it comes to debt, legal responsibility largely depends on when you acquired the balances, what you spent the money on, and your state of residence.

According to research from TD Bank, one-third of married couples fight about money at least once a month. Because cash and credit issues can be such relationship stressors, it’s best to understand your rights and liabilities before walking down the aisle.

However, it’s never too late to address the issues, and that begins with gaining clarity on where you stand, now and in the future. Here’s what you need to know about what happens to debt after you tie the knot.

Debt Incurred Before Marriage

If you entered the marriage already owing money, whether to a bank, finance company, or your uncle Ned, liability begins and ends with you. None of those lenders have the right to come after your spouse if you stop making the agreed-upon payments or go into default.

That’s because you borrowed the money as an individual. The lender did not assess the other person’s credit history or financial situation and use it when considering whether to extend the loan or credit line. Your spouse was not a cosigner, so his or her name is not on the application or contract.

But as a married couple, your financial picture will probably be commingled, so the debt you brought into the marriage may have an effect on your budget and goals. Assuming you will live, eat, vacation, shop, and do everything else couples do together, the amount you owe may have a serious impact on the other person.

For example, imagine you have student loans, a car loan, and some credit card debt, and that the combined monthly payments are $1,500 each month. Moreover, it will carry on that way for another few years. Such a substantial payment can make it harder for you both to meet necessary expenses, much less do extracurricular activities.

So, while the debt is not technically your spouse’s affair, working together to pay it off as quickly as possible will be mutually beneficial.

Debt Incurred After Marriage

This is where things get a little more complicated.

As individuals, you and your spouse can open credit cards and take out loans in your name only. If those accounts are handled responsibly and they stay in good standing, they will not affect the other person.

There are no merged credit reports. One is created in your name, the other in your spouse’s name, and only your shared account will land on both of your reports. You can open accounts where you are both cosigners or joint owners.

In that case, the two of you are responsible for the payment and any resulting debt. After that, liability for the debt is determined by whether you live in a state with community property laws or one that doesn’t:

Community Property States

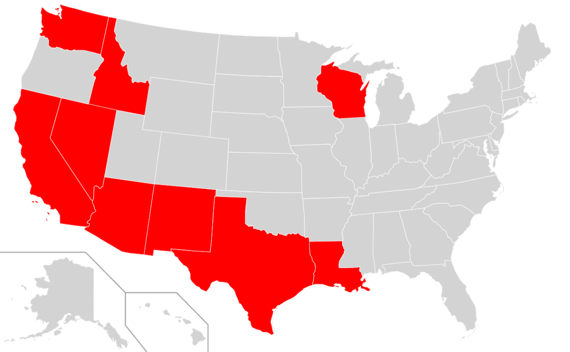

Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin all have community property laws.

If you are married and are a resident of one of these states, assets and liabilities that you acquired during the course of the marriage (and before legal separation) are considered the property of both parties. That means that even if your spouse never knew about a debt, the creditor may be able to pursue him or her for payment. In the event of divorce, the debts can be split down the middle.

There are some exceptions to this rule. For example, if you ran your credit cards up in an extremely irresponsible manner and are getting divorced, your ex may be able to claim that marital waste was involved and can potentially escape liability.

This extends to things you charged that went to a lover, such as a luxurious, romantic trip for two to Hawaii. All will be up to the judge to decide.

Another issue is fraud. If you racked up debt illegally, your spouse could make the claim that he or she is exempt. A lawyer would be a good idea in this circumstance.

If you’d rather not deal with community property, there is a possible loophole. You may be able to draft an agreement that converts community property into separate property in the event of divorce or death. The Uniform Premarital Agreement Act allows spouses to opt-out with a prenuptial agreement, thus changing the division of property.

Non-Community Property States

Splitting up debt is a bit simpler if you live in a non-community property state. In general, accounts you opened and used on your own remain your responsibility. Therefore, if you opened a Nordstrom account, ran up debt, then walked away from it, the retailer can only attempt to collect the amount due from you.

How to Manage Debt During Marriage

Whether your spouse is on the hook for a balance that is his or her sole responsibility, the best way to deal with it is to communicate. Nothing about money should be a surprise.

Here are some tips that can keep you on the right track and mitigate tough credit matters:

- Develop a payoff plan. It’s very important to pay off high interest debt as quickly as possible. You can do this as a couple by creating a budget with your financial obligations in mind. Reduce expenses or increase income so you have more money available to apply toward your debt. Consider creative strategies, such as using 0% APR balance transfer cards. If you qualify, you may have a year or longer to repay high interest balances that you transfer to the new card without having to pay any interest. Most of these offers come with a transfer fee of between 2% and 5%, but the money you save in financing fees can be enormous.

- Hold regular money meetings. Set a convenient time on a specific day of the month to discuss your progress and clear up any problems before they magnify. This quick review can be a game changer. There’s no need to be emotional. Think of it as a business meeting where you look at the numbers and make practical choices.

- Set reasonable rules. Each of you should have autonomy regarding credit and spending, but that doesn’t mean that either of you should abuse the process. Discuss and set certain rules you can live with to establish a respectful system. This is especially important regarding borrowing and repaying debt. For example, you may want to agree that it is best to only apply for new accounts when you’ve run it by your spouse first. Or determine how much each of you can charge on the card before getting the approval of the other. This will be very helpful when credit cards are shared, because if one of you maxes it out and the other needs to use it, conflict will ensue.

- Establish an account manager. One of you may have the time, interest, and acumen to best handle the accounts. If so, that person can take over the nitty-gritty details. Just make sure that both of you have total access to shared accounts and can check up on the statements from time to time.

- Commit to transparency. Unless the loan is from a relative or family member, the account and all its details will be listed on your credit reports. When you know your spouse can see what you’re spending — just as you can view his or her spending — it can keep you from overcharging or skipping a payment. But even if you don’t pull your credit reports and share them with each other, be willing to answer questions about your financial decisions. Expect the same in return.

Finally, bear in mind that everything you do with credit cards and loans will be factored into your credit scores. If you fall behind on payments, use too much of your credit limit, or have accounts in collections, your credit scores will be low.

If you are in the market to purchase a car or a home as a couple, this will impair your ability to achieve those goals. That’s why it is in your best interest to treat credit products in a way that will result in attractive credit scores. Tackle problems early and assertively!

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.