In a Nutshell: As member-owned institutions, credit unions put considerable effort into taking on active roles in educating the communities they serve, especially in regard to financial literacy. However, some go above and beyond what is expected. One example is Sharonview Federal Credit Union, which manages more than $1.4 billion in assets and serves more than 76,000 members through 17 branches in North Carolina, South Carolina, and New Jersey. Part of how it’s grown to become one of the top-200 American credit unions by assets is its focus on members’ financial well-being, which it ensures through community workshops and free access to online tools and resources.

While credit unions and banks offer many similar products and services, credit unions are very different structurally. Whereas banks must balance the interests of stockholders in their decision-making, credit unions are not-for-profit and member-owned.

Sure, well-run credit unions earn profits, but the dividends are reinvested into more competitive rates and financial products that benefit members. Another way credit unions invest in members is through financial literacy education. Since credit unions take a “we’re-all-in-this-together” approach, helping members get on track is better for everyone in the co-op.

We recently spoke with one credit union that’s a particularly good example of this in action: Sharonview Federal Credit Union, which manages more than $1.4 billion in assets and has 17 branches in North Carolina, South Carolina, and New Jersey.

“We know that the more informed and better educated a member is, the more products and services they can take advantage of in helping them grow, improve, and advance their financial wealth and wellbeing,” said HH Guthmiller, SVP of Membership Strategy for Sharonview Federal Credit Union.

Founded in 1955 and named after two neighboring roads in Charlotte — Sharon Road and Fairview Road— Sharonview Federal Credit Union now ranks among the top 200 US credit unions with more than $1.4 billion in assets and over 76,000 members, while maintaining a commitment to competitive rates and member education.

“We really pride ourselves on having great employees who are dedicated to providing a high level of personalized service to our members,” Guthmiller said. “They’re able to help with a member’s financial wellness needs by offering a full suite of loan and deposit products that are very competitive and, often, industry-leading rates.”

Workshops and Online Calculators Help Members Make Better Financial Decisions

Sharonview’s focus on service goes beyond the walls of its 17 branches and out into communities.

The credit union’s Membership Development group partners with Select Employee Groups (SEGs) from different local companies and regularly conducts financial workshops that are tailored to fit the educational needs of each group. Branch managers are often on-hand to provide assistance to attendees.

“We conduct workshops on a very regular basis centered around understanding credit, the importance and ways to save for the future, identity theft, investing for the future, and other topics to kind of help them along the financial wellness path,” Guthmiller said. “We have a list of workshops available, but we can also create something specialized if we need to. We work with a lot of community organizations, libraries, YMCAs, and other groups interested in financial education.”

Guthmiller also shared that Sharonview likes to collect feedback after workshops to find out what attendees enjoyed or didn’t enjoy so they can make improvements. Those who attend also are provided with contact info to follow up if they have other questions or were too embarrassed to openly talk about an issue at a workshop.

“We recognize that education is key,” Guthmiller said. “Not everyone is at the same point or level in that evolution. So that’s why our workshops are personalized based on the audience and the need.”

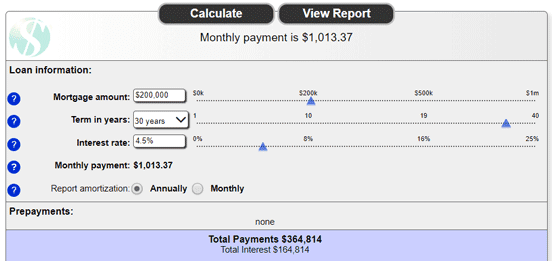

Sharonview’s Mortgage Calculator helps homebuyers better understand the affordability of a home.

Another way Sharonview helps members with financial decisions is by providing online tools and calculators to bring transparency to the process. Among these are calculators for credit card and debt management, budgeting, mortgage affordability, savings, investing, and other helpful online tools.

Members Receive Free Access to Educational Resources Through GreenPath Financial Wellness

Oftentimes, people find themselves in financial straits, but they are too ashamed to talk to friends or family members about it. What they may not realize is these situations are more common than they think.

“People are hesitant to talk about finances, especially when incurring some difficulties and challenges, so we give them extra resources because not addressing it only contributes to the problem,” Guthmiller said.

As part of its commitment to serving members, Sharonview has partnered with GreenPath Financial Wellness to give members an online avenue where they can seek out help from trained professionals. The program gives members access to tools to help them create budgets, track their spending, manage accounts, and even receive helpful tips.

“GreenPath helps our members become more educated about their credit, what things impact their credit, and how improving their credit can allow them access to products and services at better rates,” Guthmiller said. “This is set up to help them build a path to a better credit rating, but it doesn’t always have to be credit-related. Some people just need a little help in building a better budget for themselves. GreenPath’s services range from A to Z. A lot of times people think it’s only there to help those who are credit-challenged, but that’s not entirely true.”

Guthmiller told us member response to GreenPath’s services and tools has been overwhelmingly positive.

“Member will sometimes call us and say that it was an easier process than they thought, but also that they appreciate the professional treatment they receive,” he said.

A Commitment to Members’ Financial Livelihoods

Sharonview recognizes that awareness and education are cornerstones of healthy financial lives, which is why such a high priority is placed on creating different learning avenues.

“The sooner members begin to gain more knowledge and education around financial awareness and wealth, the better off they are,” Guthmiller said.

While education is crucial, people tend to choose financial institutions for other reasons. So it’s important to be well-rounded in other areas, like products and service. Credit unions certainly have their advantages over bigger banks, but one common theme you tend to hear when comparing the two types of popular financial institutions is that banks often are far ahead on technology and accessibility.

However, Sharonview has invested heavily in technology to ensure its members are getting a well-rounded experience with online banking, bill pay, and access to a wide network of co-op ATMs.

“Also, a lot of times, people think credit unions have a very limited product suite,” Guthmiller said. “We have a very full product suite, including investment products, and we’re continuing to improve on technology.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.