In a Nutshell: The housing market shifted significantly in 2020. On the supply side, fewer homes went on the market, which drove prices up. At the same time, the COVID-19 pandemic saw income and credit scores drop, making it difficult for many people to qualify for loans. Aside from increasing earnings, improving credit is one of the most critical steps for people who hope to own a home, according to mortgage research platform HSH. In addition to allowing consumers to get a better mortgage interest rate, a strong credit score can open the door to favorable refinancing terms.

Midway through 2021, the housing market remains challenging for many buyers. While interest rates are favorable, the demand far outpaces supply. Adding to that difficulty is the fact the economy is still recovering from a recession and widespread unemployment.

“Right now, the housing market is a challenging place,” said Keith Gumbinger, Vice President at HSH, a mortgage research platform. “Interest rates are very favorable, but there’s a lot of demand out there and not a lot of supply, and home prices are rising appreciably.”

All of this makes for an especially competitive housing market. Higher prices also mean that potential homebuyers must qualify for larger loans. And to do that, they need assets, income, and a strong credit score.

“Getting your credit organized is probably the key if you want to engage in the housing market,” Gumbinger said. “If your credit is not good, it’s not easy to borrow money these days. Good credit borrowers are well served. But for those folks further on down the ladder, not only does it get more expensive, it gets harder to find any responses from lenders.”

Homeownership is one of the best ways to define a strong financial profile and build wealth. But in the current market, those who own homes are in a better position to get a mortgage than those who don’t.

Owning a home is not out of reach for people with lower credit scores, nor is it something they should dismiss before getting more information. Instead, it’s something to work toward as one aspect of a strong financial future.

“In terms of building wealth, there has been no better way than how your parents and grandparents did it — which is to buy a home. You can settle in, pay your debts down, pay your mortgage down over time, build your equity, and let the market create appreciation and grow that investment,” Gumbinger said. “That gives you tremendous power and leverage when you get further down the road, in terms of using that asset to leverage for other opportunities or to support your retirement.”

Competition and Economic Churn Challenge Homebuyers

The COVID-19 pandemic put the housing market in a unique situation in 2020. On the one hand, an uncertain economy meant fewer people could buy homes. But on the other hand, many people in urban areas saw the merits of leaving cities for less-crowded locations.

Those who pursued that course often found significant changes in the industry. Homebuying has predominantly been an in-person venture, but public health policy prevented the industry from conducting business as usual.

“Remote closings were very popular last year because no one wanted to meet face to face,” Gumbinger said. “But the housing and mortgage industry collectively moved as quickly as it could to adopt remote technologies so you could do remote closings and home sales could continue. So while we did have an early slowdown, we didn’t have a collapse.”

HSH helps both homebuyers and homeowners navigate a variety of issues in today’s market.

Another consequence of the pandemic was that homes didn’t stay on the market for long. That was due, in part, to millennials and early Gen Z coming of age for homebuying and snapping up available properties. However, it’s also due to the financial uncertainty of the pandemic. As a result, demand far outstripped supply and drove up prices.

“We had a tremendous demand already, and then we had the pandemic effects on location desirability, and what sort of space you might need,” Gumbinger said. “Lots of folks were looking for more space to work from home, school from home, and a little more space from neighbors amid concerns about being close together. So it was multiple factors, all contributing to making demand dynamics increase.”

Simultaneously, many people were unable to qualify for home loans. In the wake of layoffs and furloughs, many potential buyers experienced diminished income and increased reliance on credit. The latter hurt credit scores, which, coupled with lower earnings, hindered their ability to qualify for home loans.

“A lot of the folks who lost their jobs worked in service industries,” Gumbinger said. “Those people are aspirational homebuyers, folks who are hoping to get to the point where they could buy a home one day. And then the job market changed underneath them.”

Credit Is an Important Component of a Mortgage

Qualifying for a home loan is contingent on multiple financial factors. Credit scores play a significant role in determining the rate consumers can get on a mortgage, and income affects how much money they can borrow. Together, they determine what’s affordable in a particular market.

“Solid credit scores are important for borrowers who are looking to maximize their opportunities to buy,” Gumbinger said. “A lower interest rate means a lower monthly payment and that more of your income can go towards your mortgage payment. But reliable income and job stability mean you’re less likely to be a risk to the lender, as you’re less likely to default. That’s a good thing, and your income and debt profile also determines how much mortgage you can borrow.”

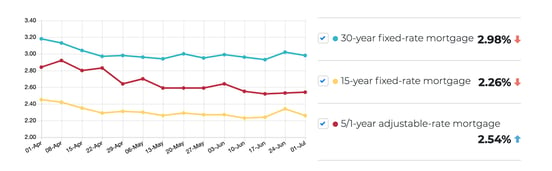

Homebuyers can find more attractive interest rates if they have a good credit score.

A high income makes a borrower an attractive risk to a lender, but a high debt utilization ratio makes them less attractive. High debt means more income goes to paying off preexisting debt, , which limits the size of the mortgage for which they can qualify, but can also impact the borrower’s ability to repay their mortgage. A borrower’s debt can also indicate financial issues that may jeopardize a lender’s return on investment, making it less likely a lender will approve an affordable rate.

“These intersections of income and debt can take you out of the housing market,” Gumbinger said. “You can’t borrow enough money and don’t have enough savings. You can’t buy a home.”

Beyond helping borrowers secure a loan, having a strong credit score can also save them money in the long term. Borrowers spend less money on interest at a lower mortgage rate, which allows them to pay down the principal more quickly.

“It’s not just the interest rate you get. It’s your total cost package when you’re getting your mortgage,” Gumbinger said. “That’s going to be dictated by what you have available in savings and your credit score.”

High Scores Can Earn Better Refinance Rates

The role of credit in homeownership and wealth-building doesn’t end when the loan is made, and the deal is done. By continually working to improve credit after purchasing a home, borrowers open the door to future opportunities.

“Maybe you’ve got a 4% mortgage you’ve had for five or six years,” Gumbinger said. “You can go out into the marketplace and talk to a few lenders. They say, ‘Well, your credit isn’t great, but we can do a cash-out refinance for you. The interest rate’s going to be the same; you’re going to have 4%.’ But because you’re restarting your amortization clock all over again at a new 30 years, and because your monthly payment amount is probably going to be the same or perhaps even a little bit lower, you’ll be able to leverage some cash out of your property.”

One potential use for that cash is to pay off existing debts. That can further improve your score and free up more income that would otherwise go toward paying interest each month.

Another option is to put the money back into the home through renovations and improvements. In addition to improving the quality of the living space, homeowners also contribute to the property’s value, which they can leverage in the future.

“There are ways to improve your financial profile by refinancing, even if your credit is not great,” Gumbinger said. “If you’d rather not have the same interest rate, and you want to get a better interest rate, you’ll want to start making sure that you are making your payments on time over a long period.”

Gumbinger recommends consumers start to work on their score about a year before they want to refinance. The credit ladder has several different steps, and even by shifting a score by a few points, consumers may move themselves up into the next tier and qualify for a better rate.

“You don’t have to improve your credit tremendously to get an improvement in your interest rate. You may only have to improve just a little bit,” Gumbinger said. “That can be managed by just making a few extra payments and making sure your bills are getting paid on time. That is the way you improve your score, so you can get a little lower rate and maybe get a great improvement in cash flow when you refinance.”

As New Home Prices Rise, Good Credit Benefits Buyers

Home prices rose in 2020 due to a shortage of supply. The solution to bringing down costs and meeting demand lies in expanding supply. While developers are building new homes, prices remain high due to some of the same conditions that brought on the spike.

“I think it’s a combination of things that happened,” Gumbinger said. “Because of COVID-19, There have been issues in the lumber supply for homes from reduced sawmill capacity. The labor market has been affected, making it hard to hire the skilled tradespeople needed to build homes. Trade issues and border closings have also played a role; meanwhile, demand here has been very strong for home improvement projects, so lumber prices have gone crazy. This affects the new house market to a greater degree.”

Gumbinger said that the median price of a new home in March 2021 was $330,800. In April, that price had risen to $381,000.

“Month over month, that’s a 15.2% change,” Gumbinger said. “That’s because lumber prices are directly affecting not only what builders can get but, of course, what they can put up. You can’t complete houses more quickly if you don’t have anything to complete them with.”

Beyond raw materials, a labor shortage is also affecting the current prices. When the housing market fell off in 2020, contractors and laborers moved into other areas. Now that they’ve settled into new jobs, they’re less inclined to return to construction.

“So demand and supply-chain issues have caused new home prices to skyrocket,” Gumbinger said. “Until recently, they have been on less of a tear than existing homes prices, but now they are starting to kick up much more quickly. When we’re talking about demand dynamics in the existing home market, it’s mostly because there’s nothing for sale. There’s plenty of people looking to buy homes, but very few available to buy.”

So for the foreseeable future, the housing market will remain competitive. That means if people are looking to buy a home, they should put themselves in the best position to qualify for a loan. And one of the most important steps to take is to start getting their credit in order.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.