In a Nutshell: HomeTown Credit Union offers online and in-person financial counseling to help residents of Faribault, Owatonna, and surrounding communities in Southern Minnesota, regain — and maintain — stability and independence. It also spearheads youth education initiatives in its communities to provide hands-on experience with money management. The credit union and its employees support local charitable organizations to foster social well-being through donations and volunteerism. For its effort and dedication, HomeTown Credit Union has earned our Editor’s Choice™ Award for Community Commitment.

Being on the verge of bankruptcy can be a harrowing situation, especially if you’ve put in the effort to manage your debt, stick to a budget, and attend financial counseling. That’s the situation a Minnesota woman in her late 30s with a teenage son faced. And she had a difficult choice to make — continue fighting off bankruptcy for years or move back in with her parents.

“That’s a really tough decision, and it’s very humbling to see somebody have to make that call,” said Kurt Halverson, Community Education Coordinator at HomeTown Credit Union, about a member he helped get back on the right financial path. “But she knew that by making that tough decision, she could save money and get a better place down the road. I was so proud of her for all the work she’s done.”

While hard, her decision turned out to be worth it because she eliminated rental expenses, paid down her outstanding debts, and gradually regained her financial independence. And HomeTown Credit Union was there every step of the way to provide the resources and peace of mind she needed to feel confident in all of her choices.

HomeTown Credit Union formed in 1996 with the merger of two employee credit unions — one for workers at a wool mill in Faribault, Minnesota, and the other for those at Owatonna Tool Company. These two credit unions had served local communities for decades. The credit union converted to a community charter in 1997.

Since then, HomeTown Credit Union has maintained three public branches, built a membership of more than 18,500, and manages more than $170 million in assets. But it also helps the people in its service areas thrive through education and consultation services — not just financial products.

In recognition of the resources it provides to adults and children in Minnesota, and for its contributions to charitable organizations, HomeTown Credit Union has earned our Editor’s Choice™ Award for Community Commitment.

Online and In-Person Education Empowers Adults to Manage Their Money

Not everyone can fit a meeting with a financial counselor into their schedule. That’s why HomeTown Credit Union partnered with EverFi to provide self-paced, online financial education resources that people can use at home — member or not.

“This is an accessible way that people can do it on their own time, at their own pace, and it’s a great way for them to learn more about personal financial management and the steps it takes to get there,” Halverson said. “EverFi complements that and helps us reach more people.”

Halverson also offers one-on-one financial coaching, and, like the EverFi program, it is open to anyone, not just HomeTown Credit Union members. In coaching sessions, he covers topics like budgeting, establishing a savings plan, building credit, and dealing with student loans. HomeTown loan officers, new account representatives, and local nonprofits refer people to the service.

“We’ve got a local Habitat for Humanity affiliate, and, before somebody can apply to be a potential homeowner partner, they meet with me for some financial coaching,” Halverson said. “I also work with a local women’s shelter, and we were awarded an adult financial literacy award for that work.”

Halverson also works with individuals recovering from addiction. Without the financial strain of feeding a habit, they can put more money to positive use, and Halverson helps them. Whether it’s homelessness, abuse, addiction, or any other problem, HomeTown offers advice and support to help community members dealing with financial struggles back on their feet.

Youth Programs Teach Positive Financial Habits

In addition to its three public branches, HomeTown Credit Union operates a fourth branch at Owatonna High School. This branch is open to staff and students during lunch hours.

“Two student workers run it,” Halverson said. “We also have a full-time employee there that oversees operations and can help if someone needs to open a new account or apply for a loan.”

The credit union also reaches out within the public educational system by conducting in-school presentations delivered to students ranging from kindergarten through high school. The institution also conducts presentations at alternative learning centers and community colleges.

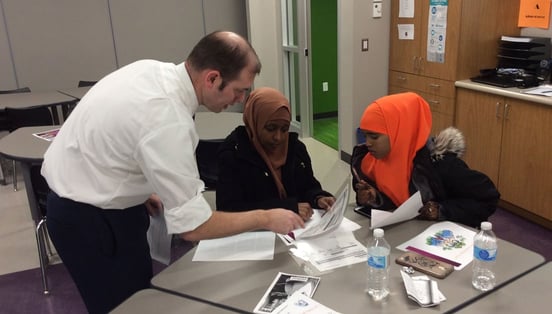

Kurt Halverson, HomeTown Credit Union Community Education Coordinator, talked about the institution’s mission to teach people about personal finance.

HomeTown Credit Union partners with the local Big Brothers Big Sisters to put on an annual reality fair focused on youth engagement. Children in the fifth grade and up may attend this event, and they pair up with a Big Brother or Big Sister who helps them create a budget and works them through different financial stations they’ll face. Those include making decisions regarding housing and transportation.

“Before the fair starts, we talk to the adults and say, ‘Here’s the deal — you’re going to want to tell the kids to make wise financial choices and things like that — but don’t do it. In this simulation, allow them to choose whatever they want to choose, even if it’s not the best choice,’” Halverson said.

“The fair shows students that if they choose to buy a brand new sports car and a large house, that’s going to have a huge impact on your finances when you have to pay for your groceries and other necessities.”

HomeTown’s presentations and opportunities for hands-on experience with real and simulated money help them understand the importance of managing their finances before they make those costly decisions. It can also empower them to grow into prosperous, financially stable adults.

Community Service Improves Quality of Life for Residents of Faribault and Owatonna

In 2017, a woman named Brenda approached Halverson with the proposition of bringing a program called Fare for All to its Faribault branch. Fare for All sells fresh produce and meat at cost to make healthy food more accessible. Participants place their orders and, once per month, pick up their food pack at a distribution location.

HomeTown Credit Union not only took on the responsibility of managing the local Fare for All program, taking orders, and distributing packets, but its employees also deliver the food to recipients’ cars. The program’s success in Faribault led the credit union to partner with a church to offer the same services in Owatonna.

HomeTown Credit Union sponsors local causes through both donations and employee volunteerism.

In addition to managing Fare for All, HomeTown also encourages the public good by providing paid time off for employees to volunteer at local organizations. HomeTown Credit Union grants its employees the autonomy to support causes about which they’re passionate rather than dictating which organizations will receive their time and energy.

“They can take paid time off of work to spend a day at Habitat for Humanity or work for a local Humane Society,” Halverson said. “We’ve got staff members who serve in local Rotary Clubs and Exchange Clubs. I sit on local homeless prevention task force teams, which is a way to network between agencies that have the common goal to end homelessness. I let them know about the financial literacy coaching that I offer for clients they might have in need.”

HomeTown CU: Bringing a Positive Attitude to Financial Education and Wellness

Halverson wears many hats, including financial counselor and guest lecturer. And he can take on all these roles thanks to his position as HomeTown Credit Union’s dedicated Community Education Coordinator. That allows him to advance positive efforts and put a personal touch on financial education.

“Whenever I work with people, I take a Mr. Rogers approach because personal finance can be intimidating. People don’t want to talk about mistakes, and they may be ashamed or embarrassed. So I always try to take a calm, open approach,” Halverson said. “Things happen in life where you get into a position that’s very difficult to get out of — but you can get out of it. There is hope. And I’m happy to take that walk with you.”

This attitude helps make financial problems less intimidating, and it makes success seem more within reach. And Halverson’s demeanor is a warm, welcoming change from the everyday interactions that many encounter in their daily lives.

“I absolutely love the position I have. It’s a great fit for my skills and passion and interests, so it comes naturally to me. Every day, I look forward to coming to work.” — Kurt Halverson, Community Education Coordinator at HomeTown Credit Union

“In this day and age, people are substituting genuine human interaction with things like Facebook, Twitter, and other electronic communication. I feel like it isolates us and makes us not quite as warm and welcoming to our fellow human beings,” Halverson said. “When you share a smile or a friendly comment, it helps to break down those walls and make the world a little bit more humane.”

HomeTown Credit Union serves a rural area, and it may be unusual to see a dedicated agent conducting community outreach and education. Such positions are more common in urban areas with higher population densities. But HomeTown Credit Union and Halverson put forward the effort because of the undeniable benefits it brings to its communities.

“I’m very grateful for the opportunity,” Halverson said. “I absolutely love the position I have. It’s a great fit for my skills and passion and interests, so it comes naturally to me. Every day, I look forward to coming to work.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.