In a Nutshell: Bank On is an initiative operated by the CFE Fund that helps unbanked and underbanked populations access basic financial products, including checking and savings accounts. It certifies products as meeting its rigorous National Account Standards, ensuring consumers won’t have to fall back on expensive alternatives like check cashing, money orders, and payday loans. That access allows more consumers to achieve their short-term financial goals and move on to long-term objectives, including building wealth and securing a healthy financial future.

Access to financial products is vital in the modern world. Consumers with bank accounts can benefit from convenience, safety, and savings instead of turning to expensive, alternative options.

Unfortunately, not everyone has access to standard banking tools. For some, the products they can access fail to meet their needs and aren’t suited to their current financial situations.

Bank On is working to change that dynamic in communities around the United States. It is one of the programs operated by the CFE Fund, a national nonprofit organization pursuing financial empowerment through targeted initiatives in partnership with local governments.

“Part of our role is to provide funding and technical assistance for those programs to take place,” said David Rothstein, Senior Principal at the Cities for Financial Empowerment Fund and leader of the Bank On initiative. “The Bank On program focuses on access to a safe and affordable checking account. We provide funding to the field of local coalitions that include city and county governments as well as nonprofit organizations.”

Bank On’s mission is to help the unbanked and underbanked establish accounts that meet the National Account Standards, as a first step to accessing other important products, including loans and lines of credit.

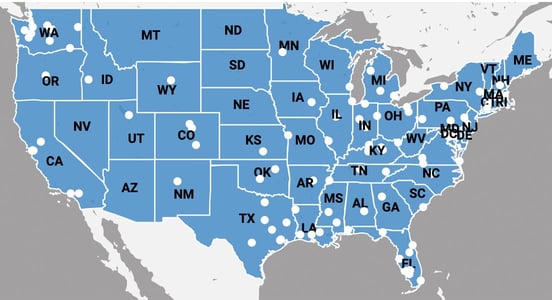

There are currently more than 200 banks and credit unions across the country with accounts that meet the Bank On National Account Standards, and more than 90 local Bank On coalitions that work to connect people in their communities to these accounts.

Financial institutions with Bank On certified accounts now comprise over 56% of the U.S. deposit market share, and 47% of all US bank branches offer a certified account. Over 3.8 million Bank On certified accounts were open and active in 2020, in 80% of US zip codes, according to the Federal Reserve Board of St. Louis’ Bank On National Data Hub.

“We provide technical assistance and help to those coalitions that work with their local and regional banks and credit unions to offer accounts that conform with our Bank On National Account Standards,” Rothstein said.

Standard Products Don’t Meet All Consumer Needs

Having a bank account doesn’t equate to being financially healthy. For some consumers, certain products can even cause more harm than good.

“There are many people who are banked in some fashion but are still paying high fees for things including overdraft fee protection,” Rothstein said. “They are paying high monthly fees for their bank accounts, or they have a bank account, but then they’re also going to a check-cashing store to cash a check or buy a money order because their account isn’t working for them, or it’s expensive.”

Those underbanked consumers have a relationship with a financial institution, but they aren’t reaping the benefits of inclusion. Thriving means having the right banking products that fit specific needs and situations. Unfortunately, people from many different demographics and low-income households fall into this category.

As a result, they may turn to alternative products like check-cashing services, money orders, wire transfers, and payday loans to pay bills. All of these are expensive alternatives to standard financial products, including credit cards and personal loans.

“People are spending hundreds or thousands of dollars a year on banking, and the ironic part is that they don’t have a bank account,” Rothstein said. “They’re spending a ton of money on banking, and they’re not in the banking system. That’s the other piece that we’re also trying to address: to have people save and keep all their money.”

National Account Standards Provide a Template for Better Banking Products

The CFE Fund established National Account Standards in 2014 in collaboration with banks, credit unions, regulators, and consumer groups. Those voices weighed in on which core features the account should have to be considered safe, low cost, transparent, and fully transactional. The CFE Fund, and its Bank On coalition partners, then work with banks and credit unions to offer accounts that meet these Standards.

“Our Bank On effort is to support coalitions that care about this work and want to get people into accounts,” Rothstein said. “We help financial institutions design these accounts or take an existing account they have and get it to fit into the Bank On features.”

With standards in place, Bank On continues the work of actually getting people banked. That’s why the organization often reaches out to recipients of local programs that reimburse people, pay a stipend, provide benefits, or disburse funds in some other way.

When people are receiving a large lump sum of money through one of these means, they have the cash on hand needed to open an account, start saving, and take advantage of products and services to improve their financial well-being.

“Those are the best times to get people into a bank account and to get funds directly deposited into that bank account,” Rothstein said. “One of the other pieces we focus on is around integrating banking access seamlessly into those kinds of programs.”

Having a bank account can make a significant difference in accessing resources, including free tax preparation, job training programs, public benefits enrollment, or economic stimulus payments from the federal COVID-19 relief package.

“So we put a lot of time and energy into integrating banking access into those pieces,” Rothstein said.

Accounts Designed for Affordability and Efficiency

Bank On aims to bring more people into the banking system, so its features and services address the issues that keep people out of that system. It works with banks and credit unions to offer products that meet the Standards and thus fit the needs of the unbanked and underbanked. Fulfilling that mission starts with identifying pain points and remedying them through account design.

“One of the things that we noticed is that people consistently say that they can’t afford it or they don’t think they have enough money to have a bank account,” Rothstein said. “So part of the Bank On account design is that we have a cap on monthly fees.”

That design includes prohibiting overdraft or insufficient funds charges. Likewise, the fee for account maintenance is capped at $5. That fee is all-inclusive and keeps the accounts within the financial reach of low-income consumers. Likewise, an initial minimum deposit of $25 or less makes the accounts easy to open and maintain.

“Having a bank account or a basic checking account is the building block for all other financial empowerment efforts,” Rothstein said. “Specifically, we did a study a few years back of our inaugural class of municipal partners who were providing free counseling to people. We found that those who had a bank account during those counseling sessions were far more likely to hit their goals, whether it was putting together savings accounts, saving money, paying down debt, or improving their credit score.”

Bank On: Expanding Access to Vital Financial Products

NAS-certified accounts are not limited or restricted products. Anything that a standard bank account can do, these accounts can do as well.

“These accounts are fully functional,” Rothstein said. “You can pay bills with them. You can make deposits and withdrawals. You’re part of a surcharge-free ATM network. It’s a fully functioning checking account. These are the types of accounts that people are going online to get from fintech groups that aren’t actually banks.”

However, having a basic bank account offers other benefits. One of those is saving on fees — beyond overdraft and insufficient funds charges. Banking with a financial institution also increases consumer access to other important products.

“Once they’re in the banking system, they can also tap into other resources,” Rothstein said. “They could apply for a consolidated small-dollar loan from a financial institution to pay off high-cost debt. Or maybe they could turn to a product that helps them manage their debt better or even refinance a student loan or a car loan that’s been predatory in the past.”

And banked consumers have access to financial education resources and services offered by their institution. Those can empower them to learn about credit reports and how to improve their credit score and gain valuable insight into long-term goals like investing and saving for retirement.

Additionally, the CFE Fund announced a partnership with consumer reporting agency ChexSystems to facilitate easier access to no-risk, safe, and affordable Bank On certified accounts. ChexSystems is offering a new, Bank On-specific customer review strategy, one that specifically reflects the greatly diminished risk factors in an account designed not to be overdrawn.

“You start to gain access to those at a much greater speed than you would if you weren’t in the banking system,” Rothstein said.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.