As a residential real estate contractor, my friend John spent the first half of the 2000s thriving, taking advantage of the real estate boom that made work both lucrative and easy to find. Work was so good, in fact, that John bought his dream house in 2006 — about a year before everything went sideways.

By 2009, John and his family were living in a small apartment, dealing with not only the lack of work from a floundering industry, but also the unfortunate foreclosure of their home due to an underwater mortgage. Making recovery even more difficult was the huge blemish on his credit from the failed loan, which prevented him from obtaining new credit.

It’s an unfortunate reality that many homeowners end up like John, wondering how long a foreclosure will stay on a credit report, and how long they’ll have to wait before they can once again realize the dream of owning their own home. Luckily, negative marks on your credit don’t last forever — not even foreclosures. In the article that follows, we’ll dive into the world of foreclosures, including just how they can impact your credit and how to dispute outdated accounts on your credit report.

1. Foreclosures Can Remain on Your Report for 7 Years

The bulk of the laws regarding your consumer credit rights are laid out in the Fair Credit Reporting Act (FCRA) of 1970. The FCRA outlines what credit reporting agencies and information furnishers alike can — and can’t — publish on your credit reports, as well as guaranteeing you access to the information therein.

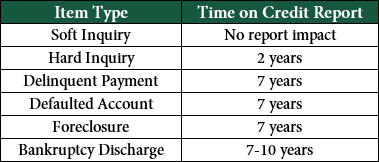

Among the many important rules contained within the FCRA are those that stipulate a statute of limitations for negative credit information on your credit report. In other words, the negative information on your report has an expiration date, and just like you’d remove expired milk from your fridge, that expired information is removed from your credit reports.

The majority of negative information can remain on your credit report — and, thus, impact your credit score — for up to seven years, including foreclosures. In the specific case of foreclosures, that seven years starts from the actual filing date of the foreclosure, not when you start missing payments or receive the Notice of Default.

2. You Can Dispute Outdated Credit Report Accounts

In the event that your foreclosure doesn’t automatically fall off your credit report after seven years, you have the right to dispute its presence on your report. This is thanks again to the FCRA, which requires that credit reporting agencies and information furnishers both address disputed items (and that they do so within 30 days of the dispute).

You can dispute credit report items yourself, either through the mail or through the credit bureau websites. If you have multiple items to dispute or are uncomfortable going through the process yourself, you can hire an experienced credit repair company to dispute items on your behalf. Our favorite credit repair companies have decades of experience helping consumers address credit report problems.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

Since future creditors may check any (or all) of your three credit reports, it’s important to address outdated information on all three reports (one each from Equifax, Experian, and TransUnion). This means filing a separate dispute with each credit bureau to ensure that an old foreclosure isn’t unduly impacting your credit score.

An important thing to keep in mind when considering credit repair is that the process only works to fix inaccuracies or unfair repair reporting, including fraudulent accounts or accounts that should have been aged-off. If a negative account is legitimate and substantiated, no amount of disputing by anyone (even a credit repair company) will result in the account’s removal.

3. Negative Accounts Have Less Impact Over Time

While it can seem like the longest seven years of your life when trying to wait out a foreclosure on your credit report, you may not actually need to wait the full seven years to see your score improve enough to obtain a new loan. In fact, because of the way credit scores are calculated, the impact of that foreclosure on your credit score will actually decrease as it ages.

In essence, credit scoring models grant new information more weight than they do older information, meaning your most recent payment information tends to have significantly more impact on your credit score than information from several years ago. So, the older your foreclosure becomes, the less influence it will have on your score as it is overshadowed by your most recent payments.

“While a foreclosure is considered a very negative event by your FICO score, it’s a common misconception that it will ruin your score for a very long time. In fact, if you keep all of your other credit obligations in good standing, your FICO score can begin to rebound in as little as 2 years.” — myFICO.com

Of course, this is only really helpful to consumers who have made financial changes in their life and adopted better money habits, as replacing negative information with newer negative information isn’t going to do much good. Instead, focus on paying bills on time and as agreed, as well as keeping balances low and being prudent when obtaining new credit.

At the same time, while your foreclosure will have less impact on your credit score over time, it may have impacts on other important aspects of buying another home. In particular, some loans will have their own qualifications as to how long after a foreclosure you need to wait before you can obtain a loan. FHA loans, for instance, require you to wait at least three years after a foreclosure to qualify for an FHA loan.

Foreclosure Isn’t the End of Your Credit

Foreclosure is a rough process, not only because of the financial and credit impacts, but also because of the fundamental pain of losing your home. And the years of forced waiting before you can attempt to find a new home can feel a bit like being kicked while you’re down.

No matter how difficult the process can be to endure, however, foreclosure is not forever — nor is it the end of your good credit score. You can recover from all of the impacts of foreclosure, even those to your credit.

For John, the recovery process took several years, during which time he and his wife worked hard to stay within their means and build up their credit again. They paid all their bills on time, maintained a steady income, and didn’t let their debt-to-income ration get too high. The family also managed to save up for a new house — the very one they call home today.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.