In a Nutshell: Last10K.com provides open access to corporate financial documents so investors can make informed, strategic decisions with their money. The platform focuses on quarterly and annual reports, which are subject to regulatory scrutiny, ensuring that the information is factual and accurate. Last10K.com also offers a host of tools to help investors gain more insight into publicly traded companies’ financial situations and outlooks. The company shows the portfolios of hedge fund managers, allowing small investors to see where the professionals are putting their money.

Investing can be a strange domain for the uninitiated, but it is also an essential strategy for long-term financial wellness. The stock market can be a tool for building wealth and saving for retirement. Dividends from investments can be used to pay off existing debt or investors can accumulate funds so they avoid going into debt in the future.

But before anyone can reap those rewards, they must take the plunge and start investing. That means they need to do their homework to understand which publicly traded companies are safe — and possibly lucrative.

However, a lot of information — and noise — circulates in the financial world, and new entrants may not know where to begin.

Last10K.com is a consumer resource that analyzes potential investment opportunities, and offers trusted answers to many questions. The company furnishes raw financial data straight from the source and provides useful analytical tools for small investors.

“There wasn’t a consumer offering that provided any of these data points,” said Amar Kota, Co-Founder of Last10K.com. “And most people don’t want to spend tens of thousands of dollars on these licenses from big brokerage firms. So that’s why we formed Last10K.com.”

Accurate, timely data helps investors understand the philosophies, strategies, and growth trajectories of companies they are interested in.

Last10K.com collects financial documents filed by publicly traded companies and shares them with consumers at no cost. It also offers interpretive and analytic features that give potential investors deeper insights into annual (10-K) and quarterly (10-Q) reports and documents.

“These documents are hundreds of pages long,” Kota said. “Not everyone has the time to read through all the details. So we provide premium tools that identify the must-read areas of these annual and quarterly reports, and we developed additional features to read these reports more efficiently.”

Reports Provide Insight into Earnings and Objectives

Investors who understand how to review those documents can gain deeper knowledge about an opportunity instead of taking someone else’s word for it. That is crucial in many aspects of life, from voting to shopping, and just as important when investing hard-earned money. Last10K.com compiles information on publicly traded companies to ease the burden of accessing those resources.

“If you’re interested in investing in a company, you’ve got to get to know the company,” Kota said. “At the beginning of these reports, you have the CEOs themselves talking about their one-year, three-year, five-year plans. So you get an understanding of what the company is all about and where they’re looking to go. Based on that, you can make a much more sound decision.”

Investors can take an in-depth look at companies through Last10K.com’s reporting tools.

Plenty of company information circulates in online forums and social media. But investors may not know who is providing that information or their motives.

When someone seeks medical advice, they won’t trust a random person in the pharmacy aisle; they would want advice from a professional. The same is true with investing. When people put their financial futures in someone else’s hands, it should be someone with expertise. Otherwise, they risk worsening their consumer debt profile based on hearsay.

“I’m not saying the community is always wrong,” Kota said. “It’s just that you don’t know who those other users are. At least you have a government agency on your side when it comes to finding out information on publicly traded companies.”

Analytical Tools Highlight Key Financial Facts and Figures

Last10K.com provides access to quarterly and annual reports, and those 100-plus page documents contain plenty of detailed, actionable information. But for the casual investor, poring through those documents can be an intimidating and time-consuming prospect.

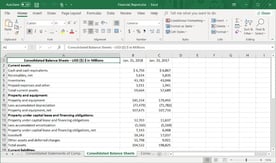

That’s why Last10K.com offers tools that help subscribers quickly and efficiently extract the information they need. They can export the data to Excel spreadsheets to conduct their own analysis and calculations and highlight changes between successive reports.

Last10K.com users can import data into an Excel spreadsheet for further analysis.

“One of our proprietary algorithms analyzes annual and quarterly reports and highlights anything that is the negative sentiment,” Kota said. “Then we turn it on multiple categories, and we can see the sentiment on accountability, the product, geography, revenue, and earnings,” Kota said. “We can create a matrix for the overall sentiment on that annual or quarterly report as being bullish, bearish, or neutral. If you’re in a time crunch, or if you want a high-level overview, we will give you a signal or rating on an entire 100-Plus page document.”

Kota likens that approach to a highlight reel from a football or baseball game. It’s not going to give investors all of the details, but it will help them surface the significant points necessary to understand the big picture and make a more informed decision.

“They’re able to get a much better understanding of what those 100-plus pages are all about using our features,” Kota said.

Regulatory Oversight Ensures Corporate Accountability

“At Last10K, we purposely focused on an annual and quarterly report,” Kota said. “That’s always been the foundation for these publicly traded companies. And that’s our concentration: identifying opportunities in those filings, but also making them easier to read.”

Last10K.com emphasizes quarterly and annual reports because these documents are carefully scrutinized and vetted by federal regulators. That ensures both current and potential investors receive accurate, honest information.

Take, for example, the information included in The Cheesecake Factory’s reporting in 2020. The company misrepresented the impact of COVID-19 on its operations and financial condition when it said its business was sustainable in the early stages of the pandemic.

In reality, it was hemorrhaging money at a rate of about $6 million per week. At the time of the report, it had only 16 weeks’ worth of capital remaining and had informed its landlords it wouldn’t be paying rent in April 2020. However, the company did not publicly disclose that information and instead painted a much more optimistic picture. As a result, The Cheesecake Factory was fined $125,000 by the SEC for misleading investors and the public.

The moral of the story is that it’s in a company’s best interests to report honestly. Regulators closely scrutinize those quarterly and annual reports, so there is a strong incentive for accurate financial representation, making them prime sources of reliable information for potential investors.

“There’s nothing more truthful than information that comes directly from the CEO of a company,” Kota said. “They know they’re being watched by the government. So with the annual and quarterly reports, there’s a solid governance behind that.”

Last10K.com: A Deeper Look at Expert Investment Choices

Last10K.com aims to always improve its offering to help people make smarter investments. One of its more recent features gives users the ability to quickly look up the portfolios of hedge fund managers. These are people who invest for a living, and seeing where the professionals choose to put their money can offer deeper insights for small or beginning investors.

“Within these portfolios, you can see if hedge fund managers are invested in ETFs and index funds,” Kota said. “If you look up Berkshire Hathaway, Warren Buffett’s company, you’ll see what stock he has in his portfolio. That’s a cool way to get an idea if you’re not sure what company to invest in.”

From there, potential investors can research companies in the portfolio, doing deep dives using Last10K’s other resources and analyzing them with the platform’s tools. Last10K’s features can be part of a powerful strategy to eliminate consumer debt or guard against future debt issues.

“It’s a nice starting point for the folks who do have some cash available,” Kota said.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.