If you go by TV commercials alone, you may never know that credit cards for bad credit exist. The popular advertised cards with great rewards and perks are easy to get — if you have good credit. The good news is that your bad or thin credit history need not prevent you from obtaining a basic credit card.

Owning a credit card makes shopping more convenient and gives you the opportunity to improve your credit score through responsible use. To that end, this article answers your most urgent questions about credit cards for consumers with less than fair credit.

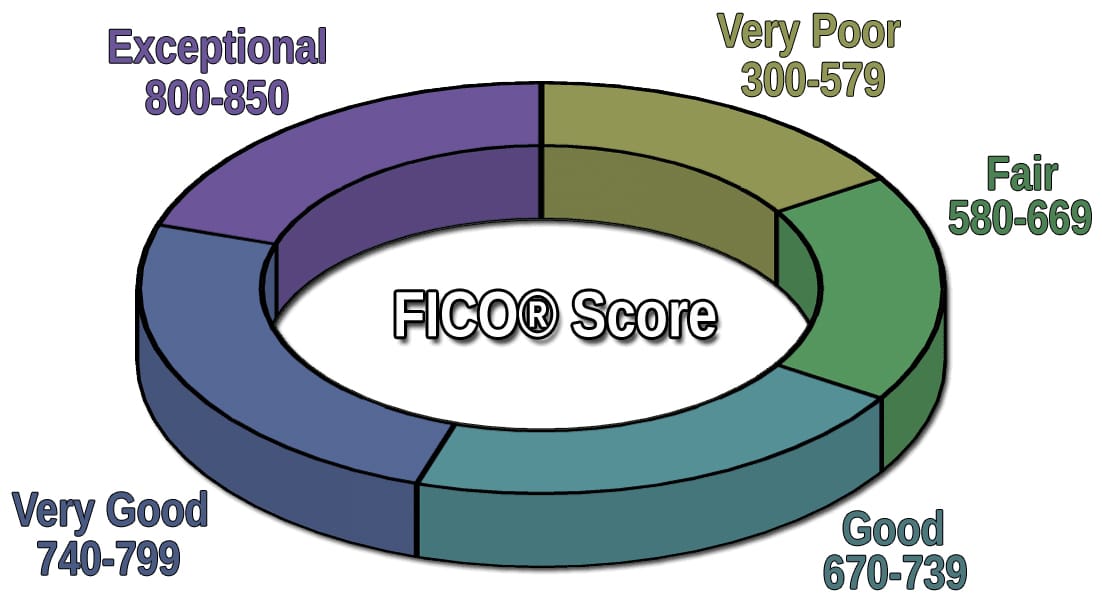

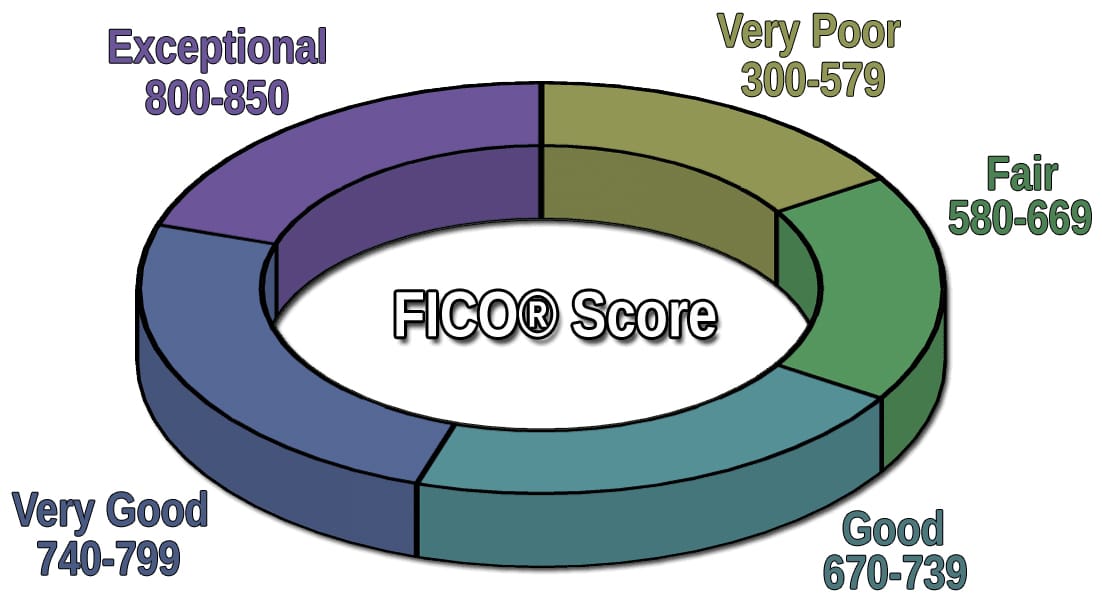

FICO scores range from 300 to 850. A credit score of below 580 is considered bad, according to the FICO scale. Approximately 16% of Americans have bad credit.

When you consider that 16% of consumers represents many millions of people with bad credit, you shouldn’t be surprised that credit cards are available for this sizable market.

Consumers who fall into this group have experienced financial problems, including late or missed payments, collections, account write-offs, bankruptcies, and other negative events. When you have bad credit, loans are expensive and hard to access, and credit cards available to you offer basic features and low credit limits.

Thankfully, you can rebuild your credit by adopting creditworthy behavior, including:

- Making timely payments: You can’t improve your credit rating if you don’t pay your bills on time. Timely payments are recorded on your credit reports and should help your score rise within six to 12 months. If you repeatedly find it hard to pay your bills on time, you should consider one or more actions to remedy the situation, including improving your debt-to-income ratio, receiving debt counseling, consolidating your debt, undergoing debt settlement, or filing for bankruptcy.

- Pay down existing credit card debt: Your credit utilization ratio (CUR), which is the sum of all your credit card balances divided by your total available credit, is an important factor in the calculation of your FICO credit score. CURs above 30% hurt your score, but you can improve your score by reducing your CUR below 20%.

- Fix your credit reports: Erroneous and incomplete information on your credit reports can hurt your credit score. You have the right to dispute and correct mistakes, either by yourself or with the help of a credit repair company. Your score should improve within a couple of months when inaccurate negative information is removed from your credit reports.

Even though major negative items remain on your credit reports for up to 10 years, the impact they have on your credit score diminishes after the first two to three years.

As our rankings above indicate, some credit cards are designed specifically for consumers with bad credit. Consumers with bad credit have three types of cards available to them:

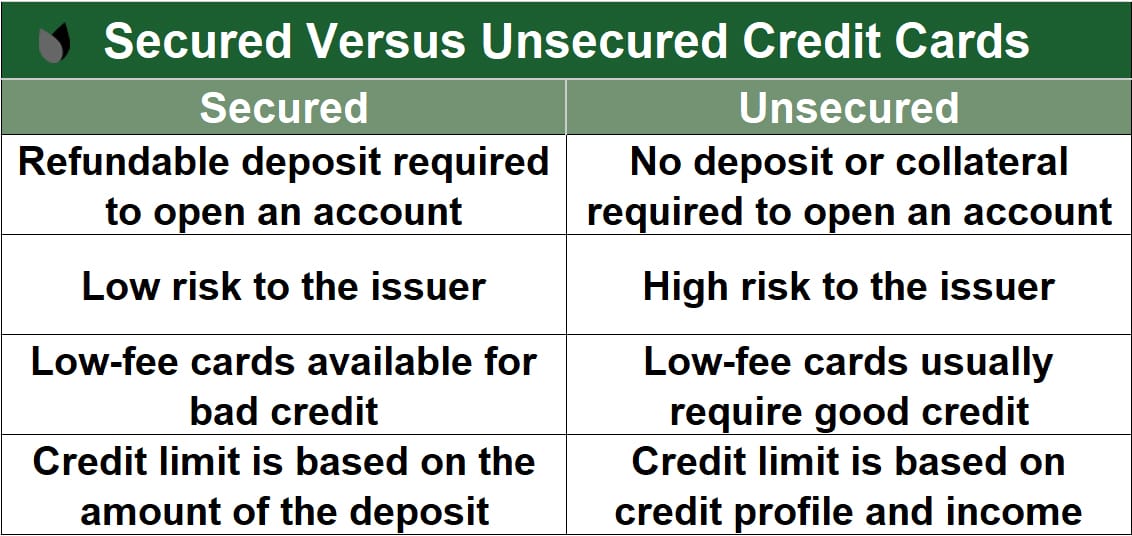

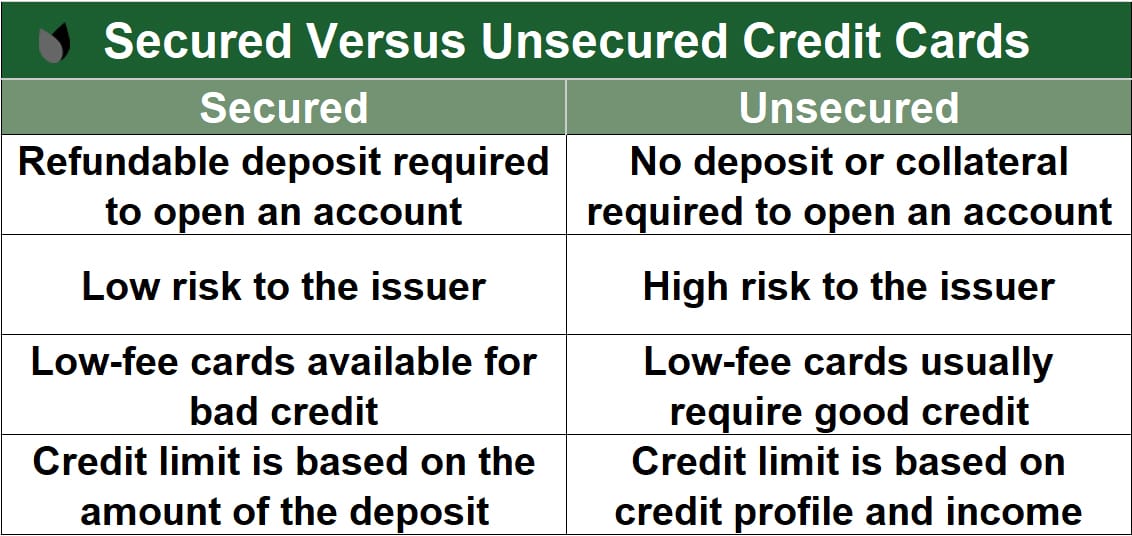

- Unsecured cards: These are traditional credit cards. An unsecured card does not require you to deposit any cash collateral.

- Secured cards: These cards require you to deposit cash to secure your credit limit. Secured cards are available to virtually everyone, and can serve as a first step when rebuilding your credit.

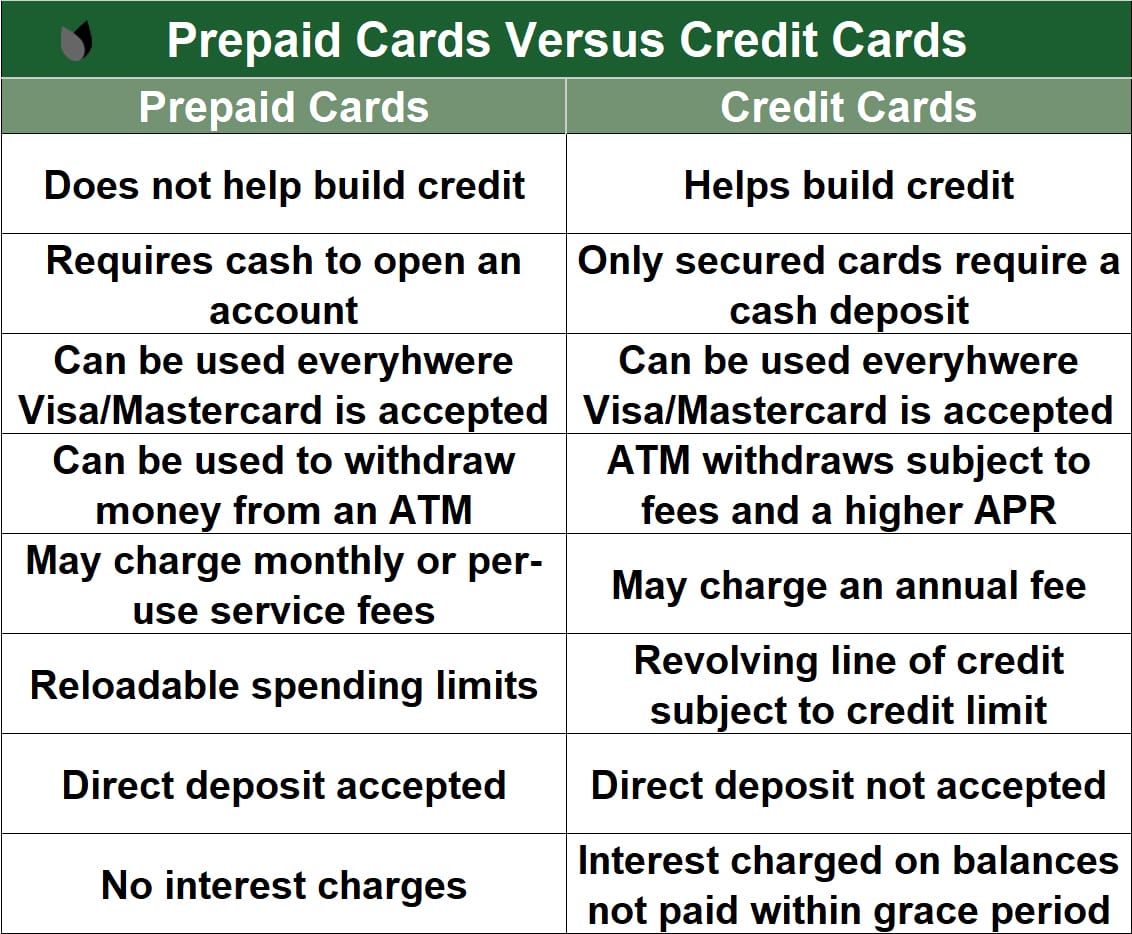

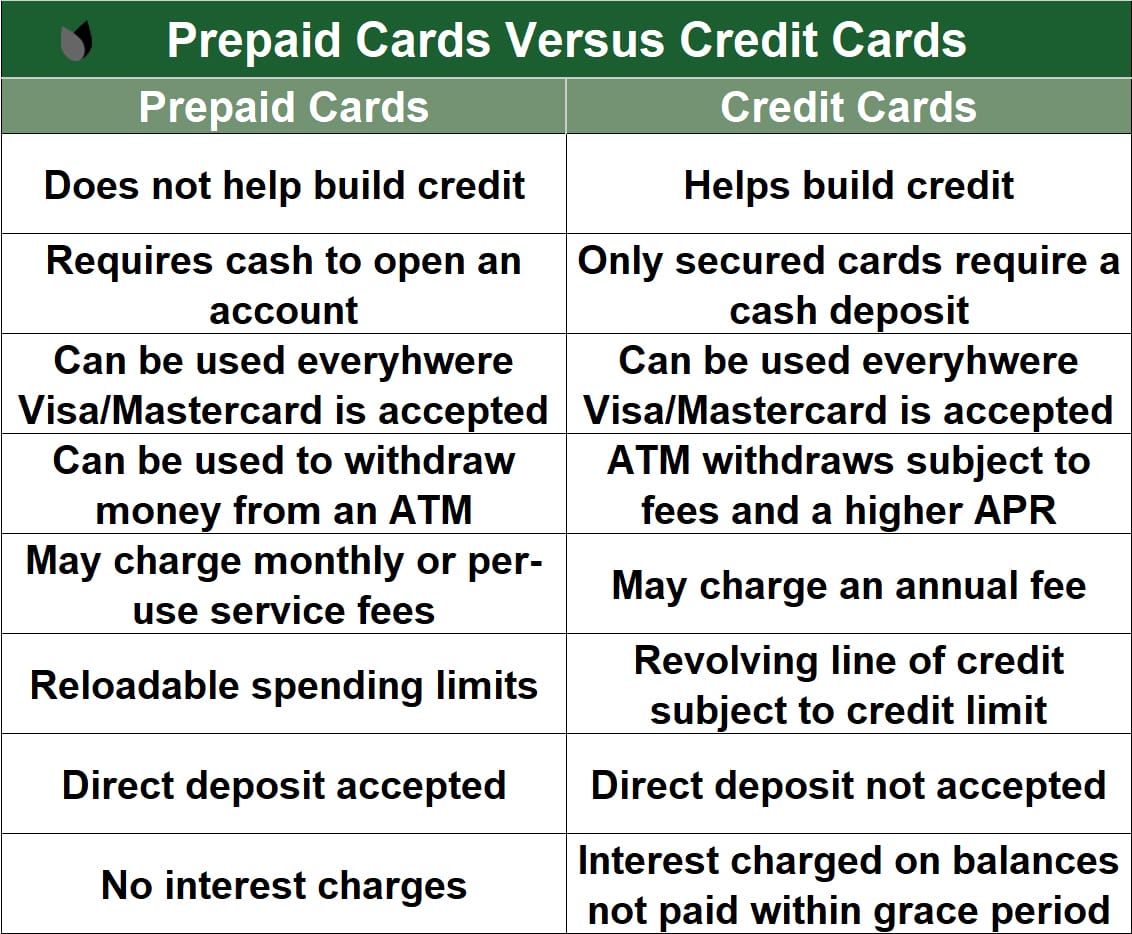

- Prepaid cards: These are more like debit cards except that they are backed by cash deposits rather than your checking account. Prepaid debit cards look like regular debit cards and are not subject to penalties for late payments or over-limit spending.

You can get an unsecured credit card despite a low credit rating if you meet certain criteria. If you choose a secured card, you may be automatically considered for an unsecured card by making on-time payments for six or more months in a row. When you close a secured credit card account, the credit card company will refund your deposit (minus any outstanding balance and fees).

Unsecured credit cards for bad credit represent a risky proposition to issuers. A bad credit score indicates you’ve had financial problems in the past, giving issuers reason to worry you won’t pay your bills.

To reduce their risk, issuers of credit cards for bad credit implement certain unique features, including:

- High fees: By charging you high fees, issuers receive cash flows that can compensate them for some of their losses if you default on your card. These can include setup, annual, and maintenance fees.

- High APRs: Many of these cards have an interest rate in excess of 25%, sometimes as high as 35%. These high interest rates generate a cash cushion against default. However, you can argue that high APRs increase the chances of default, so this represents a bit of a paradox.

- Low credit limit: By keeping your initial credit limit low (often to $200 to $300), the issuer limits the amount it may have to write off if you default on your card payments. Eventually, you may be able to qualify for a higher credit line if you pay your bills on time.

- Scant rewards and benefits: These cards are usually bare-bones, lacking miles, points, or cash rewards on purchases. They usually do not offer new cardmember promotions, such as signup bonuses or a 0% introductory APR period. By omitting expensive perks, the issuer can better afford to accept high-risk cardholders.

- No balance transfers: Many of these cards do not permit balance transfers, and virtually none offer a 0% introductory APR for a balance transfer.

- Expensive cash advance: Cards that permit a cash advance charge a high interest rate as well as a fee for each transaction.

- Expensive penalties: Expect to pay a penalty fee (often exceeding $30) each time your monthly payment is late or you spend more than your credit limit. You also may be assigned a high penalty APR for an indefinite period.

- Modest perks: Some cards in this category allow you to choose the design imprinted on your credit card from a limited selection. Virtually all offer $0 fraud protection and monthly reporting to each major credit bureau.

- Slow credit line increases: It may take over a year to earn a credit line increase. Some cards in this group may completely prohibit higher credit lines.

These cards are the most basic in the credit card universe. Generally, you’ll want to replace them with better cards when you boost your credit score above 600.

Nowadays, most issuers let you prequalify for a credit card before applying. Prequalification is useful because:

- It lets you know immediately whether you are eligible for the card. Prequalification doesn’t guarantee your application will be approved, but failing to prequalify rules out approval.

- You won’t incur a hard inquiry on your credit report. Hard inquiries can reduce your credit score by five to 10 points. The prequalification process usually involves a soft inquiry that has no impact on your score.

To prequalify for a card, compare the cards listed above and select the card that most closely matches your needs. Clicking on the link will transfer you to the credit card’s prequalification page, where you fill out an online request form with your basic identification, employment, and housing information. Submit the application form after completing it and expect an instantaneous approval decision.

Before applying, read and understand all the rate and term disclosures that the card company must provide. Should you choose to apply and be approved, you can expect to receive your new credit card in seven to 10 days.

If your card has a setup fee and/or annual fee, your credit limit will be initially reduced by the total fee amount. After you pay these fees, you’ll revert to a higher credit line.

Secured credit cards and prepaid debit cards are easy to get, no matter how low your credit score. These cards are collateralized by cash and don’t involve the credit card company providing you any unsecured credit. Since there is virtually no risk, issuers can afford to offer these cards to anyone who can deposit cash.

Unsecured cards are more problematic when you have a low (or no) credit score, but even so, a couple of unsecured bad credit credit card types are relatively easy to obtain. If you attend post-secondary school on at least a half-time basis, you can apply for a student credit card. This type of card doesn’t depend on credit score and usually offers points or cash rewards and benefits.

A cobranded store credit card is also fairly easy to get, especially one that can only be used at the issuing store. For example, the Fingerhut Credit Account is widely considered to be among the most accessible credit accounts. Other easily obtained cards are the Amazon.com Store Card and the Target RedCard.

Prepaid cards, which resemble debit cards, are extremely easy to obtain because you don’t need a financial institution account to get them. We give high marks to the PayPal Prepaid Mastercard® and the NetSpend® Visa® Prepaid Card. Because these are not credit cards, there are no interest charges, no late fees, and no overdraft fees.

Several general-purpose unsecured credit cards are specifically designed for consumers with bad credit. These cards offer rapid prequalification that won’t impact your credit score. Our favorite among this group is the Surge Mastercard®, which welcomes applications from all credit types.

Most secured credit cards give you instant approval. However, that approval is conditional upon receipt of the required cash deposit. Student credit cards also provide instant approval, but applicants must demonstrate eligibility (i.e., attendance at a post-secondary school).

Most unsecured credit cards offer instant prequalification. While not a final approval, prequalification is a pretty good indicator that your application will be approved. Prequalification is usually independent of credit score, but does involve several requirements:

- You must be at least 18 years old.

- You must have a Social Security number.

- You must provide your permanent address.

- You must provide your estimated gross monthly income.

- You must disclose your monthly housing costs (rent or mortgage).

In the prequalification step, the issuer doesn’t do a hard pull of your credit report. Instead, it performs a soft pull and can usually provide an instant decision. Once you prequalify, you usually provide additional information that the issuer uses to make a final decision, a process that can occur in less than a minute.

Indeed, in today’s competitive credit card environment, anything other than an instant decision is unusual. In addition, many cards prequalify prospective cardholders without request. In this type of marketing, the issuer mails or emails an invitation to the prequalified prospect that can be used to quickly apply for the card, often accompanied by a special promotion.

A 500 credit score is clearly not good, considering that the average FICO score is 711 on the 300 to 850 scoring system. Even though a 500 score creates some challenges, it does not necessarily disqualify you from getting an unsecured credit card.

But before you apply for one, we urge you to consider whether you’d be better served by a secured credit card. Relative to a secured credit card, an unsecured bad credit credit card will:

- charge higher fees

- have more types of fees

- charge a higher APR

- offer meager or no rewards

- offer meager benefits

- have a low credit limit

Nonetheless, we recognize that many consumers can’t shell out a $200 or $300 deposit for a secured card, which is why they apply for cards like the Surge Mastercard®, Indigo® Mastercard® Credit Card, or Total Visa® Card. All three are available to consumers with a 500 credit score and who have a checking account.

However, if you have a 500 credit score but can’t abide by the idea of using a financial institution, you are the perfect candidate for a prepaid card.

A prepaid card is like a debit card backed by a cash deposit rather than a checking account. You simply add cash to the card account and then use the card wherever debit cards are accepted.

Prepaid cards charge for their usage on either a monthly or per-use basis. You can’t overdraw these cards because you can only spend up to your balance. That means no interest charges and no late fees, although some cards charge for refilling your account.

Our top choice is the PayPal Prepaid Mastercard®, which lets you transfer money between the card account and your PayPal account. It accepts direct deposits, which means you can get paid up to two days faster than you would with a paper check. A nice feature of the card is that you receive cash back and personalized offers just for using it.

Your credit profile is reflected in the credit scores the three major credit bureaus (Experian, Equifax, and TransUnion) assign to you. The major ways you build your credit scores is by paying your bills on time and keeping your debt balances low. Naturally, your creditworthy behavior won’t improve your credit if a major credit bureau doesn’t know about it.

Therefore, you want to choose credit cards that report your payments to all three of the credit bureaus. This is normal practice — most credit cards report activity to the three bureaus. On the other hand, prepaid and debit cards do not send information to the credit bureaus, so don’t expect them to help boost your credit.

Credit card companies send your activity information to credit bureaus monthly, and it usually takes several months for your creditworthy behavior to be reflected in a higher score. In other words, paying your bills on time and keeping debt levels low will take time to help your credit score.

Here are some suggestions for faster results:

- Fix your credit reports: Negative information, such as delinquencies, collections, defaults, and bankruptcies hurt your credit score. If any negative information on your reports is incorrect, you can improve your score by removing it, either by yourself or with the help of a credit repair company. Credit scores rebound quickly when inaccurate negative information is scrubbed from your credit reports.

- Become an authorized user: You become an authorized user when another person adds you to their credit card account. You get a copy of the card with your name on it, allowing you to make purchases. You aren’t legally obligated to make payments on the account (although you’ll likely ruin your relationship with the primary cardholder if you don’t pay your share). To become an authorized user, you don’t need to qualify for your own credit card, which means you can start rebuilding your credit before getting your own card. Therefore, becoming an authorized user can accelerate your credit recovery.

- Get a secured credit card: Many secured cards let you open accounts with a large security deposit, up to $5,000 in some cases. That kind of credit limit is unlikely on unsecured cards for consumers with bad credit. A higher limit allows for more activity to be reported each month while helping to reduce your credit utilization ratio by increasing your total authorized credit. A lower CUR (below 30%) will help your credit score, so the new secured card is an immediate positive — as long as you don’t rack up a large balance on it.

- Ask for a higher credit limit: This is another way to reduce your CUR. As such, it should help your credit score quickly, usually within a month or two. Be careful not to use any of the additional credit line, as that will once again raise your CUR. In general, you will benefit most if you can get your CUR below 20%.

Paying your bills on time accounts for 35% of your credit score, and maintaining a low debt level is responsible for another 30%. These two actions alone are more important than anything else you can do, so they deserve your primary attention as you work to increase your credit score.

Several credit cards are appropriate choices for business owners with bad credit, but they are generally less familiar than the big name cards you see advertised on TV. The banks that issue these cards are not the giant ones like Chase or Citibank, but rather more obscure banks that specialize in subprime debt products.

As with consumer cards, it’s much easier to get a business credit card if it is secured. We’ve come across a handful of secured bad-credit business cards that are worth your attention:

- Wells Fargo Business Secured Credit Card: This card allows you to deposit up to $25,000 to support your credit line. It offers your choice of rewards: cash back or points. You can get up to 10 employee cards for free.

- BBVA Compass Business Secured Credit Card: This tiered cash back card is available in only seven states. Your credit limit will equal 90% of your BBVA savings account, starting with a $500 credit line. It offers free employee cards and many online business services that will please your bookkeeper.

- OpenSky® Secured Visa® Credit Card: While not specifically designed as a business credit card, it does have a high acceptance rate for business owners. No credit check is needed for approval, and you can secure a credit line from $200 to $3,000.

- Credit One Bank® Platinum Visa® for Rebuilding Credit: Unlike the others on this list, this card from Credit One Bank is unsecured. We like it for business owners because it offers flat cash back rewards on mobile phone, internet, cable, and satellite TV services, as well as on gasoline purchases. Credit lines from $300 to $3,000 are available.

The secured cards on this list are a good way to start rebuilding your credit. You may be able to graduate to an unsecured card in six to 12 months by always paying your bills on time, staying within your credit limit, and keeping your unpaid balances low.

We’ll be frank — it’s rare to find a rewards card available to consumers with bad credit. We can recommend three:

- Credit One Bank® Platinum Visa® for Rebuilding Credit: This card offers a flat cash back reward on eligible purchases for gas, groceries, mobile phone service, internet service, and cable and satellite TV services.

- Bank of America® Cash Rewards Secured credit card: This is one of the best secured cards available, offering cash back rewards similar to those of a card for good credit applicants. While you can be approved with bad credit, you’ll need to make a security deposit to open an account.

- Discover it® Secured: Another secured offering that requires a deposit for approval, this card offers cash back on purchases made at gas stations and restaurants on up to $1,000 in purchases each quarter.

Almost all other cards for consumers with bad credit offer no rewards and few benefits. Most offer $0 liability protection and some do not charge an annual fee, or if they do, they may waive the fee for the first year. Virtually all report your payments to all three credit bureaus so you can rebuild your credit score by paying your bills on time.

Even with bad credit, you can find many credit cards that offer same-day approval. In fact, this has become the service standard in the credit card industry for all credit types. While it may take a week to 10 days for your card to arrive in the mail, some issuers offer expedited handling and can get the card into your hands in three to five days.

If you really need your card ASAP, look for cards that offer virtual account numbers that you can use immediately for card-not-present (CNP) transactions. Virtual account numbers are different from the card’s regular account number. You get them from the card issuer after you are approved for the card, and you can use them right away for online, mail order, and phone purchases.

Virtual credit card account numbers are available from several issuers, including American Express, Capital One, and Citibank. In addition, you can use a cobranded store credit card, such as those from Target, Amazon, Walmart, and Apple, that offers a virtual account number.

In addition, you may be able to use a new credit card right away through a digital wallet. All four of the credit card networks (Visa, Mastercard, American Express, and Discover) offer Click to Pay digital wallets that provide numeric tokens that replace your regular account number when you check out at a participating store.

The Click to Pay Icon below indicates where you can use a compatible mobile wallet to make a purchase.

Because tokens are used, merchants and others can’t get hold of your real account number. The tokens can be set up for just a single-use, so they are of no further value once used. This is an important and effective security feature.

It takes time to build your credit history, so where do you start? Credit cards are a natural portal into the world of credit due to their relative ubiquity and availability. As it turns out, it’s easier to get your first credit card than you may think. Here are some options:

- Become an authorized user: As discussed earlier, a credit card owner can invite you to become an authorized user of the card. Your name will be added to the account and the credit bureaus will establish a credit file in your name. Card activity will be recorded in the owner’s and your credit files, allowing you to establish your credit history and eventually getting your own card.

- Recruit a cosigner: A cosigner can help you get a loan or credit card by guaranteeing payments. In fact, several card issuers accept cosigners, letting you qualify for a card and begin building your credit history. Normally, you alone use the card, and the cosigner figures in only if you miss a payment.

- Get a secured card: You don’t need a credit history to get a secured credit card. All you require is the cash security deposit to collateralize your credit line. By paying your bills on time every month, you may be able to upgrade to an unsecured card within a year.

- Get a student credit card: Many students arrive at college with no credit history. Card issuers cater to this group with student credit cards that require no history, allowing you to build your credit. You must attend a post-secondary school on at least a half-time basis to qualify for one of these cards,

- Get an unsecured card: Several unsecured credit cards don’t require a credit history. These cards offer basic features and low credit limits, but they do let you build your credit through timely payments. As your credit score improves, you’ll become eligible for better cards with more benefits and rewards.

If all else fails, you can always get a prepaid card. However, prepaid cards are not credit cards and they won’t help you build your credit history.

Another way to establish a credit history is through a credit builder loan from a community bank, online bank, or credit union. This “loan” is really more like a savings account.

When you take out a credit builder loan, the proceeds are deposited into a CD or savings accounts controlled by the lender. Then, each time you make a monthly payment that gets reported to the three credit bureaus. When you’ve fully repaid the loan, the lender will refund the original deposit plus interest, and you’ll have established a credit history.

You can get a prepaid card without a credit check, but that’s not really a credit card. Some secured credit cards, such as the OpenSky® Secured Visa® Credit Card, don’t require a credit check either.

It’s a lot harder to find an unsecured card that doesn’t require a credit check. In fact, we don’t know of any. But American ingenuity has spawned a few hybrid products that can put a credit card in your wallet without a credit check.

For example, Self offers a credit builder account that can get you a secured Visa credit card in as little as three months without a credit check. Eventually, you’ll be able to graduate to an unsecured credit card. Chime Bank offers a very similar product with no credit check required.

Many unsecured credit cards offer prequalification without a credit check. This is useful because it allows you to eliminate cards without submitting to a credit check. However, to complete the application, the card issuer will check your credit with a hard inquiry of your credit report, which can lower your credit score slightly.

Prepaid cards do not extend credit. They are instead similar to debit cards, except that you fund them by depositing money into the card’s account rather than using a checking account. In fact, a prepaid card is perfect for folks who prefer not to have fiscal relations with a bank.

You can use a prepaid card wherever debit cards from the same network (Visa, Mastercard, Discover, or American Express) are accepted. As described earlier, our top choice among Mastercard prepaid cards is the PayPal Prepaid Mastercard®. We also like the Mango Prepaid Mastercard® because of its low monthly fees.

Among the Visa prepaid cards, we give our top rating to the NetSpend® Visa® Prepaid Card, thanks in part to its handy mobile app. Another favorite is Unlimited by Green Dot, which offers cash back on eligible purchases and interest on deposited funds.

In the American Express universe, our first choice is Bluebird® by American Express, chiefly because it has eliminated monthly, transaction, and network ATM fees. The American Express Serve® prepaid card is similar — it offers more reloading options but also charges more fees.

Gift cards are somewhat similar to prepaid cards, although gift cards usually do not allow you to reload them with additional money. You can reload prepaid cards in several ways, including online and at designated retail locations.

The only card accounts that require a deposit are secured credit cards and prepaid cards. The deposit works differently for these two card types:

- Secured cards: The deposit is placed into a collateral account maintained by the card issuer. Normally, the money simply sits in the account — in fact, it probably won’t even earn you any interest. However, the card issuer can tap into your collateral account if you miss a credit card payment or exceed the credit limit.

For virtually all secured cards, the deposit amount is equal to the card’s credit limit. However, the Secured Mastercard® from Capital One gives you a $200 starting credit limit for as little as $49. The deposit, minus any outstanding balance, is refundable when you close a secured credit card account or graduate to an unsecured version of the card.

- Prepaid cards: Your deposit goes into the card account. This is the money you spend when you use the prepaid card. When that money is gone, your prepaid card won’t work — you have to add more money to the card account.

Unsecured cards do not require cash deposits. Some unsecured cards can be linked to a checking account from the same issuing bank. This allows the credit card to cover a checking account overdraft without triggering a penalty fee, although there may be a small fee for the cash transfer.