Students who complete state-mandated financial literacy courses in high school tend to have higher credit scores than those who receive no such education, according to a new study.

Written by researchers at the Federal Reserve Board and the University of Wisconsin-Madison, “State Mandated Financial Education and the Credit Behavior of Young Adults” analyzes more than 13 years of data from three states that implemented new mandatory financial literacy courses for the class of 2007.

Analyzing the credit behaviors of high school grads before and after the states implemented their new classes, the researchers found students who completed the state’s programs demonstrated more responsible borrowing and credit habits.

The study also addresses shortcomings in similar studies that didn’t appropriately measure financial literacy outcomes, according to the paper’s authors.

I spoke with J. Michael Collins, director of the Center for Financial Security at the University of Wisconsin-Madison, to explore his and his colleagues’ findings.

Measuring credit behaviors in Georgia, Idaho and Texas

The researchers focused on 18- to 22-year-olds in Georgia, Idaho and Texas — three states which implemented state-mandated financial literacy courses that first measured results for the class of 2007 without making any other significant changes to their schools’ coursework.

“They all implemented some kind of change and included some preparation so the teachers could get up to speed on how to teach the required curriculum,” Collins said. “These weren’t the only three states that implemented some sort of financial education curriculum, but they did it in a way that, from a research perspective, was very clean and really systemic.”

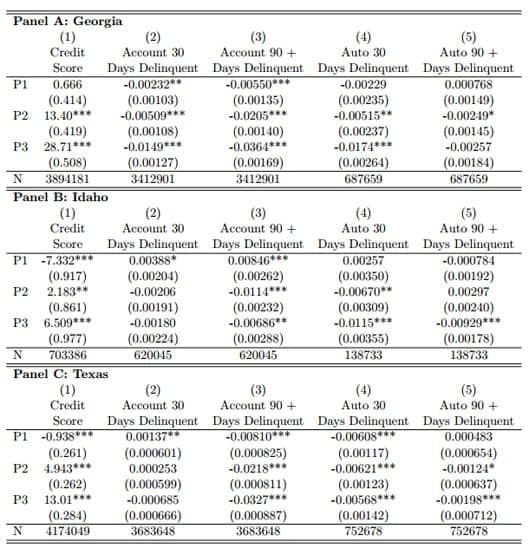

The researchers then aggregated the credit scores of each graduating class, as well as how often students were 30 days or 90 days late on credit accounts and auto loans. They then compared the data to students who graduated before 2007 and their peers in states without any financial literacy requirements.

“We find that young people who are in school after the implementation of a financial education requirement have higher relative credit scores and lower relative delinquency rates than those in control states,” the paper reads.

“We find that young people who are in school after the implementation of a financial education requirement have higher relative credit scores and lower relative delinquency rates than those in control states.”

Progressively improving credit behaviors

For the graduating class of 2007 in the study’s three key states, results were mixed: Georgia’s class of ’07 graduates only showed a marginal improvement of 0.666 points on their credit score, while ’07 graduates in Texas and Idaho actually registered lower credit scores by an average of 0.938 and 7.332 points, respectively.

P1 corresponds to the first graduating class affected by the requirement; P2 corresponds to

the following graduating class; P3 is two classes after the first graduating class.

However, as teachers and administrators worked out kinks in their programs, scores progressively improved in each state. By the third year of implementation, high school graduates in Georgia, Idaho and Texas were 28.71, 6.509 and 13.01, respectively. Likewise, delinquencies on credit and auto loan accounts declined across the board.

“The class of 2007 was the first class when some students were being exposed,” Collins said. “By 2009, the teachers had taught [the new curriculum] a couple times before, so they were more comfortable with the material. We actually see larger results with each year.”

Defining financial literacy for young adults

Researchers also noted the challenges in measuring the success or shortcomings of financial literacy programs for young adults. For example, previous studies began analyzing data from the date a program was mandated but not necessarily when it was implemented.

“It takes years for these new education curriculum mandates to actually show up on the street,” Collins said. “The time when you decide to do something and when things get implemented are different.”

“It takes years for these new education curriculum mandates to actually show up on the street,” Collins said. “The time when you decide to do something and when things get implemented are different.”

Another inherent difficulties in studies like these, Collins said, was choosing the most effective way to measure financial literacy in young adults.

“There’s been probably 10 to 15 years of studies done on ‘financial literacy,’ and there’s still disagreement about what literacy means,” he said. “What does it mean to be financially literate at age 18 than at age 75? What’s the financial domain that counts the most for them? Probably managing credit: Credit cards, auto loans, student loans and how they engage with lines of credit.”

Mary Johnson, director of Financial Literacy and Student Aid Policy at financial services company Higher One, shared Collins’ sentiment, adding students need more experience with practical matters, such as deciphering the fine print of their financial products like student loans or cell phone contracts.

“What does financial literacy mean? [For young adults] it’s learning to budget and understanding financial concepts and products,” Johnson said. “Part of being financially literate is being able to understand that fine print. I always tell students don’t be afraid to ask questions.”

Financial education challenges in the public school system

Despite the financial recession of 2007, financial literacy courses struggle to find time and support in many public school systems around the U.S.

“It’s not easy,” Collins said. “With the list of projects and content that could be included in the schools — obesity, fitness, gun safety, preventing violence — financial education is fighting among all these other topics for the limited time in a school day.”

Johnson also said teachers, many of whom are still recovering from the recession, may not feel confident enough in their ability to teach their students without additional training.

“There’s another challenge — how do you get students engaged in the subject in a way that’s going to stick with them, particularly in this app-based world students live in,” Johnson said. “There are a lot of financial literacy materials out there, but let’s be honest – it’s a dry subject.”

“There’s another challenge — how do you get students engaged… There are a lot of financial literacy materials out there, but let’s be honest – it’s a dry subject.”

But for the time being, those dry lessons may be doing the part to help instill responsible financial habits in the next generation.

“This study should give [other states considering financial education] a little reassurance that investing time in planning and implementation results in some positive benefits for the community and the students that come through the school,” Collins said.

Photo credit: rand.org

Data graphics: Brown, Collins, Schmeiser, Urban

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.