Though most credit cards are unsecured, many different kinds of unsecured cards are available for all credit ratings. Unsecured credit cards get their name from the fact that the debt is unsecured and not backed by collateral.

Here we’ll answer some common questions about unsecured credit cards and provide details on each type of credit card.

An unsecured credit card is a card that doesn’t require a cash deposit to secure the line of credit, unlike its secured credit card counterpart. While many different types of unsecured cards exist, your credit score will determine which unsecured cards you’re best qualified for.

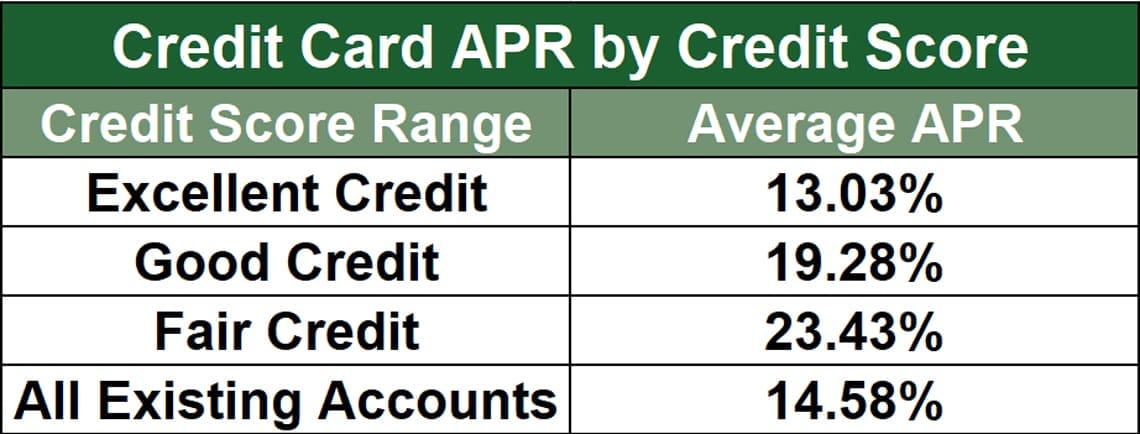

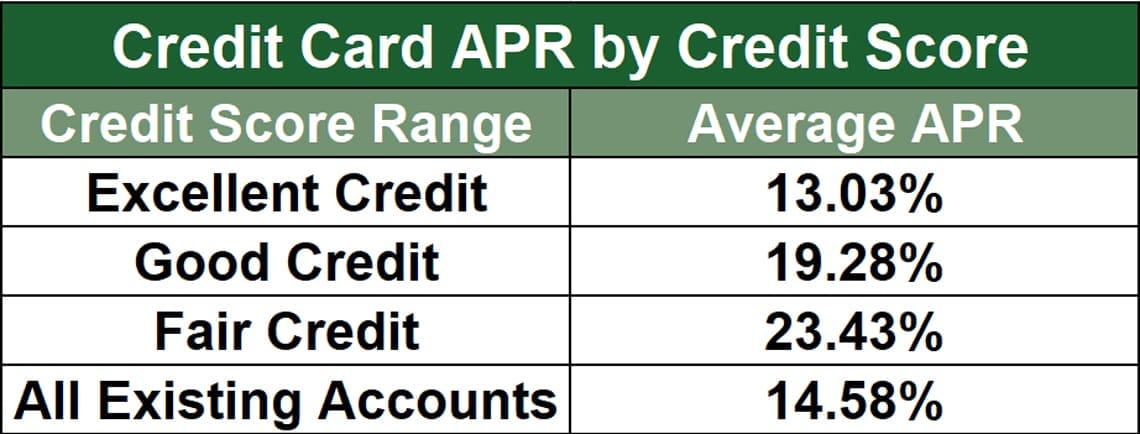

Unsecured cards for bad credit applicants generally charge higher interest rates and may impose fees that aren’t commonly found on cards for good credit applicants.

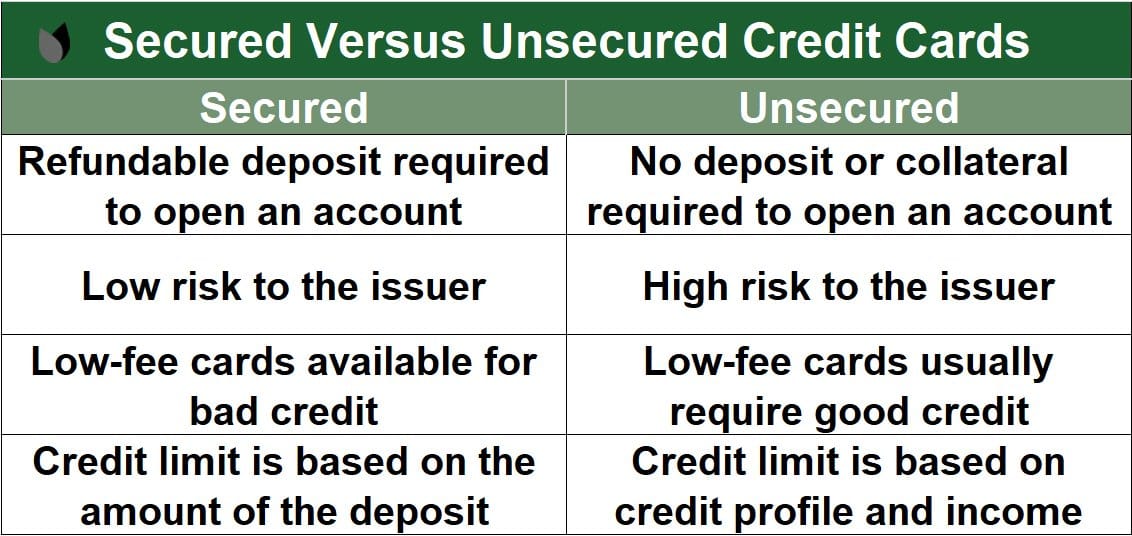

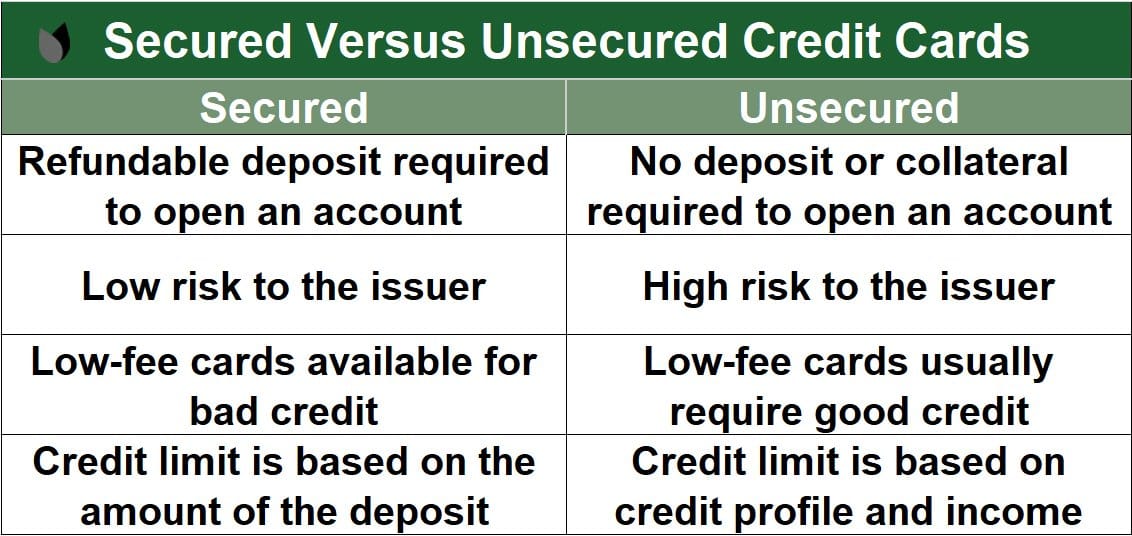

The main difference between secured and unsecured credit is that a secured credit card requires the applicant to make a deposit upon approval, which is the bank’s way of protecting itself if payments are not made. This amount typically varies between $49 and $300 and is usually equal to the amount of credit issued.

Secured cards are best suited for those with low credit scores or limited credit history.

Unsecured credit cards — cards that do not require a deposit — are also available to those with poor credit, but getting approved for an unsecured card can be more difficult than it is for secured cards. In terms of purchasing abilities, unsecured credit and secured credit work the same way.

Unsecured cards come in many forms, but there are two primary differences: rewards type and credit type.

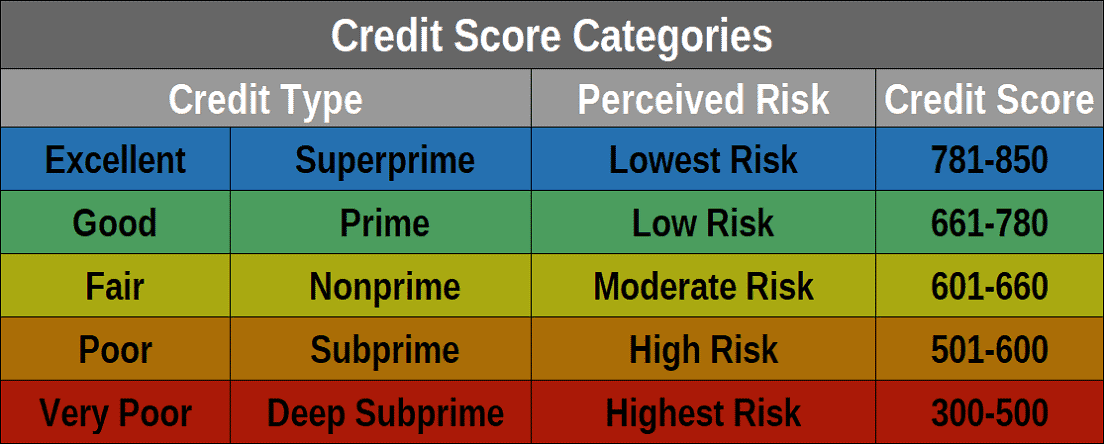

The better your credit, the better the unsecured card you’ll qualify for. Those with good credit scores (670 and above) will qualify for the best rewards programs, APRs, and signup bonuses.

Unsecured cards offer a variety of rewards programs for cardholders to earn air miles, cash back, points, and even 0% APRs for a promotional period after approval, usually up to 18 months.

With a lower credit score, you may not receive the same perks, but there are still options and advantages for subprime applicants.

For Poor Credit (579 Credit Score or Below)

Because banks view applicants with poor credit scores as the riskiest borrowers, these types of unsecured cards may come with other requirements, such as having a minimum gross annual income or a bank account with direct deposit.

Even so, some credit cards for bad credit still offer a modest 1% cash back on purchases, and, with responsible use, can improve your credit to help you qualify for better card offers in the future.

When applying for credit cards for poor credit, it’s important to read the terms and conditions so you don’t become a victim of predatory lending. Some lenders prey on applicants who are oftentimes in a situation of financial need and charge exorbitant interest rates and fees.

Always shop around for the best credit card offer. Many credit cards for poor credit allow applicants to see whether they prequalify online before submitting an official application.

For No Credit (No Credit History or Score)

Having scant or no credit history can actually give you an advantage over those who have a poor credit history. This is because you haven’t had the opportunity to prove yourself a creditworthy borrower yet, as opposed to someone who took out a line of credit and missed or defaulted on payments, causing them to have a poor credit score.

While you still won’t qualify for the very best unsecured cards until you show that you’re a responsible borrower, you have plenty of good card options available to you, especially if you’re a student.

Student credit cards offer rewards for good grades and cash back on purchases and most have no annual fee. This is true for non-students too — several credit cards for people with no credit offer rewards, no annual fee, and fair APRs.

For Fair Credit (580-669 FICO Score)

Fair credit applicants will see perks and terms similar to those offered to applicants with limited credit histories — not the best of the best, but certainly not the worst.

Unsecured credit cards for fair and average credit are available with rewards programs and introductory offers, but be sure to apply for just one offer, as each time you apply for a credit card a hard inquiry is placed on your credit report. Several inquiries will marginally affect your credit score and will remain on your credit report for up to two years, though their effect on your score will only last one year.

No Deposit or Processing Fees

As mentioned, an unsecured credit card is one that doesn’t require a deposit. Fees, however, can become a burden when you have bad credit. Many cards for poor credit charge processing fees, annual fees, and even monthly maintenance fees — this is why it’s important to read the terms and conditions of a card before applying.

Each of the cards above has a green “Apply Here” button that will take you to the corresponding page for those offers so you can easily compare cards and review terms and conditions.

The application process for all credit cards is fairly similar — you’ll be required to provide your personal identifying information, including your address and Social Security number, as well as your employment information and income. After the application is submitted, most issuers will let you know within minutes whether you’ve been approved for the card.

Knowing which cards are available to you based on your credit rating will help your chances of being approved. For example, if you have bad credit, don’t apply for a card for good credit because you’ll likely be denied.

All of the cards listed on this page are open to poor credit applicants, but if you have a really poor credit score, getting approved for a secured card may be easier.

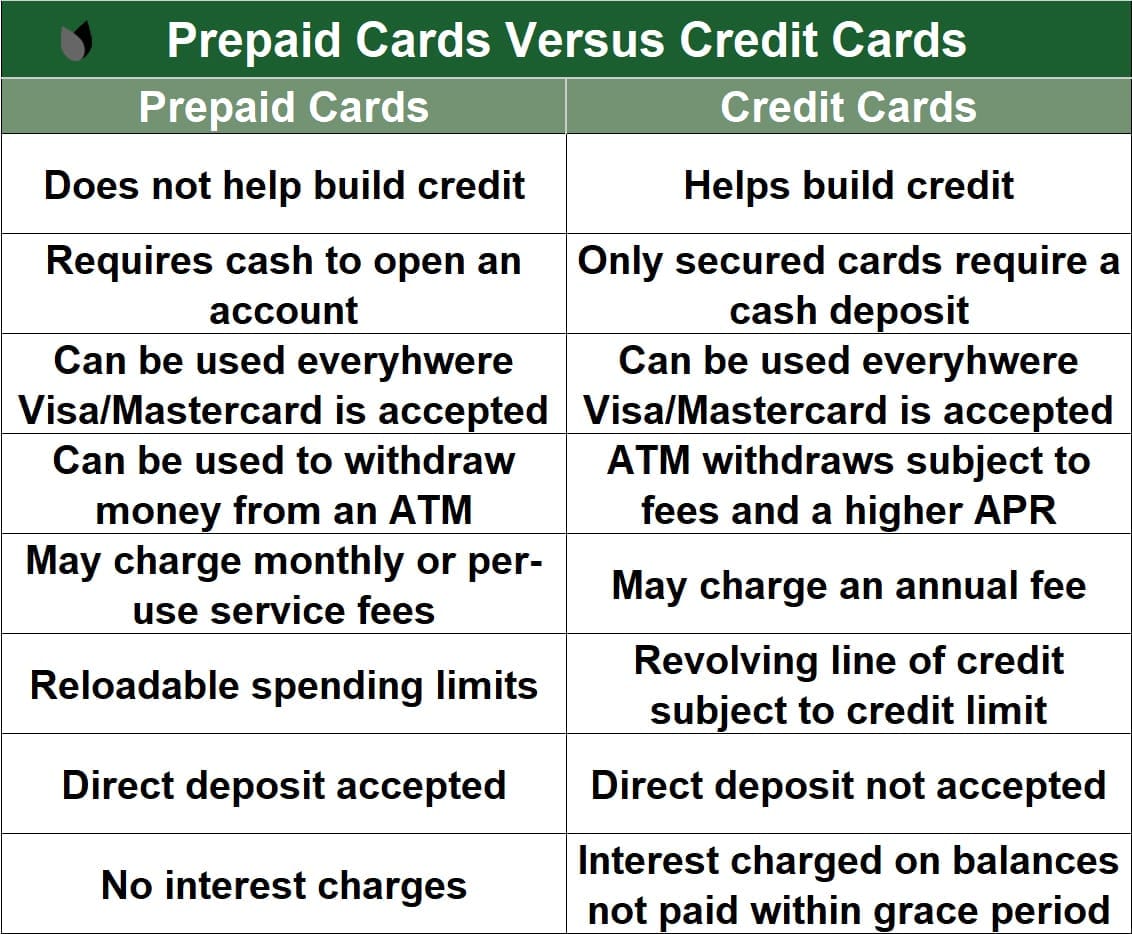

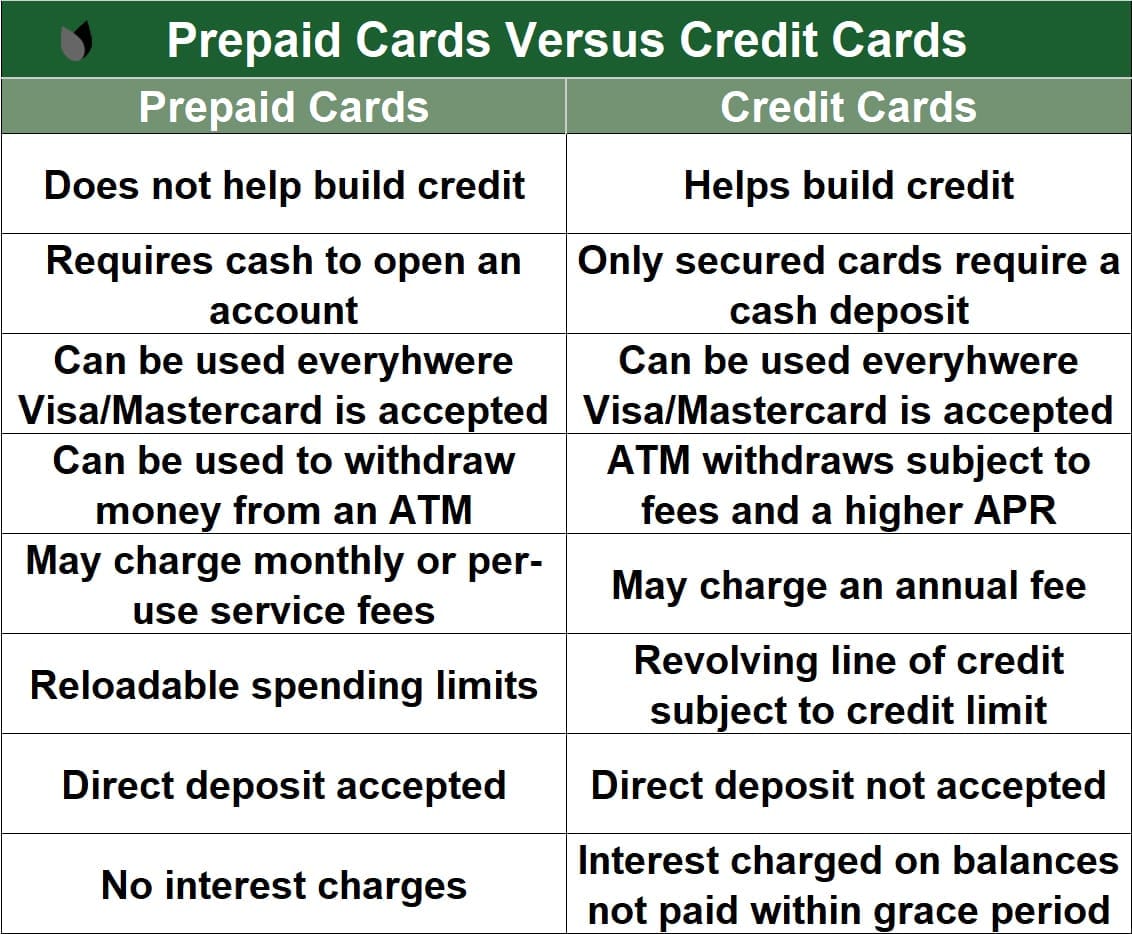

The only card that is guaranteed to anyone is a prepaid credit card that you can buy and load the money onto yourself.

Cards that tout themselves as offering “guaranteed approval” are usually the ones to watch out for, as they notoriously charge high interest rates and fees. These cards usually don’t require a credit check, which is the case for some secured cards.

As with any credit card, be sure to read the terms so you fully understand what you’re getting yourself into.

Yes, but only when it’s used properly. This means keeping your credit utilization low — most experts recommend below 30% — e.g. if you have a $1,000 credit limit, 30% of that would be a $300 balance. Generally, the lower your credit utilization ratio, the better.

And, even more importantly, always pay your bill on time. This has the biggest influence on your credit score.

- Payment history – 35% of your credit score

- Amounts owed – 30%

- Credit history length – 15%

- Credit mix – 10%

- New credit – 10%

Lastly, be sure to choose a credit card that reports to all three credit bureaus so your responsible borrowing behavior will lead to positive marks on your credit report. Most unsecured credit cards do, but it’s worth verifying with the issuer beforehand.

Just about any credit card that offers an online application can also provide a credit decision within seconds of receiving your application. This happens because banks that issue these cards use automated underwriting software to process your application.

This software scans your credit report and payment history, stated income, and monthly debt obligations to determine whether you’re a good candidate for the card. This process would take quite some time for a manual underwriter to conduct, but the automated software can process and view hundreds — if not thousands — of data points in a matter of seconds.

If approved, your application screen will update with the good news and tell you your approved credit limit. The bank will then begin the process of printing your new card and mailing it to you. You should receive the card within seven to 10 business days.

If the bank declines your application, it must send you an adverse action notice in the mail within seven to 10 business days. This letter outlines the bank’s reasons for rejecting your application. Some banks may provide helpful tips on things you can do to improve your odds of approval if you decide to apply again in the future.

On rare occasions, the automated underwriting software may flag your account. This signals for a human underwriter to review your application by hand. While this may seem ominous, it’s not always the harbinger of bad news.

It may be that the address, Social Security number, or other identifying information on your application does not match what’s listed on your credit report. The bank may simply need to confirm the income you submitted or verify your monthly rent or mortgage totals.

In some cases, the underwriter may request supporting documentation that makes it easier to come to a quick credit decision. The faster you supply these documents, the quicker you can possibly get your credit card.

Applying for a credit card once took days or weeks. Thanks to the power of the internet, you can now go from application to credit decision in five minutes or less, and receive your card in the mail within two weeks.

Once approved, the bank will process your new account, print your credit card, and send it to you in the mail. This could take seven to 10 business days.

Depending on the credit card company you choose, you may be able to request a virtual credit card number as soon as you’re approved. You can use this number to make purchases immediately with any retailer and service provider that accepts digital payments.

In most cases, you can use your virtual card number to make online purchases or pay bills through a website or over the phone. Many in-person merchants will only accept a virtual credit card if it is attached to a digital wallet.

While you can use your virtual credit card number until you receive your physical card, you may find that you’re limited as to how much of your credit line you can access virtually. The virtual card number is also unlikely to match the account number on your printed card, so don’t use your virtual number to set up recurring payments with any bill providers.

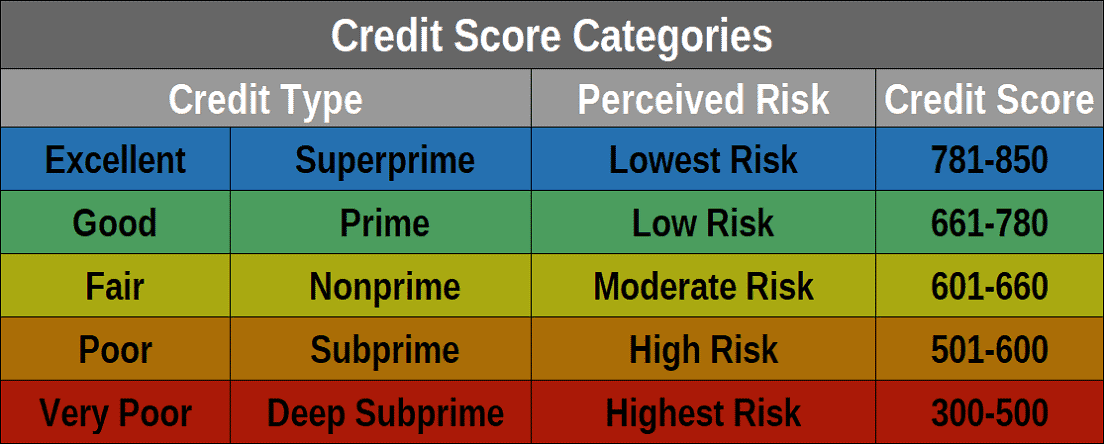

A credit score of 500 is well below the threshold that separates fair credit from poor credit. A 500 credit score represents a larger credit risk than most banks are willing to take.

But that doesn’t mean you’re completely disqualified from consideration for an unsecured credit card. The card issuers listed above have curated subprime credit card options for consumers who have poor credit — even with a 500 credit score.

Keep in mind, though, that your low credit score is but one factor that determines your creditworthiness. A credit card company will also look at:

- Your current income

- Your current monthly debt obligations — including existing loans and credit card debt as well as monthly rent or mortgage payments

- Your employment status

- Your recent payment history

You can possibly overcome a very low credit score by showing that you have enough monthly income to repay any new credit debt you take on. If you’re a low-income earner, you can bolster your income by including any recurring income you receive, including government benefits, Social Security payments, disability benefits, alimony, child support, structured settlement checks, and any other nontraditional income sources you may have.

By boosting your income and lowering any existing balances you may have before you apply, you can increase the likelihood that a bank will look past your bad credit score and give you a second chance at proving your financial responsibility.

Most unsecured credit cards for bad credit come with higher interest rates and fees. Consider the expensive cost of credit when deciding whether you want to apply for an unsecured card or a secured credit card.

Having no credit history will not disqualify you from credit card approval.

Quite often, those who have no credit history — also known as the credit invisible — are grouped with consumers who have bad credit. While there’s a pretty big difference between the two, each type of applicant brings a similar amount of risk to a lender.

Having bad credit means you’ve made financial mistakes in the past. Having no credit means you don’t have enough information on your credit report to generate a reliable credit score.

While that shouldn’t be cause for a penalty, banks often shy away from the unknown. If a bank chooses to extend credit to someone who doesn’t have a credit score, the offer will likely come with added fees or a higher interest rate to offset the unknown risk.

All the credit cards listed above consider applications from consumers who have no credit or limited credit. But someone who has no credit has an advantage over someone who has bad credit. With responsible use, which means making timely payments and maintaining a low balance, you can begin to generate a credit score in three to six months.

With that score, you can attempt to upgrade to a better card with your current credit card company or apply for a different card with a bank that offers a better rate and fee structure — including possible rewards.

Someone who has bad credit may need longer to rebuild his or her credit score to upgrade to a better credit card.

If you’re unsure about your ability to qualify for an unsecured credit card because you have no credit history, you can attempt to prequalify for a card without harming your credit through many of the card links above.

Both a secured card and an unsecured card can help you build your credit score with regular reporting of your balance and payment history to each major credit bureau. An unsecured credit card will have no upfront costs for approval, but a secured card is easier to get approved for with a poor credit score.

In most cases, you can choose your secured card’s spending limit by deciding how much of a refundable security deposit you will pay at the time you open your account. The amount of your deposit usually equals your credit limit. For example, a $1,000 deposit will net you a card with a $1,000 spending limit.

You will receive a full refund of your deposit when you close your secured card account as long as you have no outstanding debts on the card. You can use a secured card in the same ways you can an unsecured card — to make online and in-person purchases, to pay bills, to rent a car or hotel room, or any other purchase that requires a credit card.

The odds of acquiring a subprime credit card with a $1,000 or more initial spending limit are very slim. Some secured cards allow you to make a deposit of as much as $5,000, which can equal a card with a very respectable credit limit.

If you’re not looking to take on heavy costs before you even get your card, an unsecured card is the best bet for you. These cards don’t require a deposit but may feature much smaller initial credit limits and potentially higher fees — such as an annual fee or other charges.

Most consumers prefer an unsecured card because it doesn’t tie up their money with a security deposit. But you should expect that most unsecured cards for bad credit will have an initial spending limit in the $200 to $400 range. If you think you may need more credit than that, you may want to consider a secured card.

Credit cards come with all kinds of fees, but luckily, most can be avoided with smart planning and responsible credit use. Here’s an example of some fees you can expect on many credit cards:

- Annual fee: Not all cards charge an annual fee, but you may find that subprime credit cards or cards with high rewards rates will likely charge some sort of membership fee.

- Balance transfer fee: If you transfer an existing credit card balance from an old card to your new card, you can expect to pay a balance transfer fee that typically equates to a percentage of your transferred amount. This fee may be worth your while if you’re moving a balance to a card with a lower interest rate or to a card with a promotional intro APR.

- Foreign transaction fee: Some cards will charge a balance transfer fee if you conduct a transaction in a foreign currency. This fee typically equals a percentage of the transaction total and covers the cost of converting the currency. If you’re traveling overseas, this can get expensive — every time you swipe your card, you can pay as much as 3% or more to convert your currency.

- Late payment fee: Just about every credit card will charge a late payment fee if you submit your payment after the due date. Some cards may also impose a penalty APR that increases your interest rate after a late payment.

- Cash advance fee: This fee occurs when you withdraw cash from your card account at an ATM machine or bank teller’s window as you would with a debit card — also known as a cash advance. The fee is typically a set amount that varies by card type. A cash advance also has a higher interest rate than a regular purchase and no grace period — which means you start accruing interest charges as soon as you have cash in hand.

- Returned payment fee: If you submit a payment that isn’t approved by your bank — often because of insufficient funds in your checking account — you can expect to be hit with this fee.

- Over-limit fee: Many credit cards will decline any transaction that takes you over your credit limit. Some cards will provide a purchase cushion that lets you exceed your limit — for a fee.

Keep in mind that these fees are just examples of some of the fees most banks charge. Your card may not charge these fees or may charge other fees that are not listed above. Check your cardholder agreement document to get a better idea of your total cost of credit.

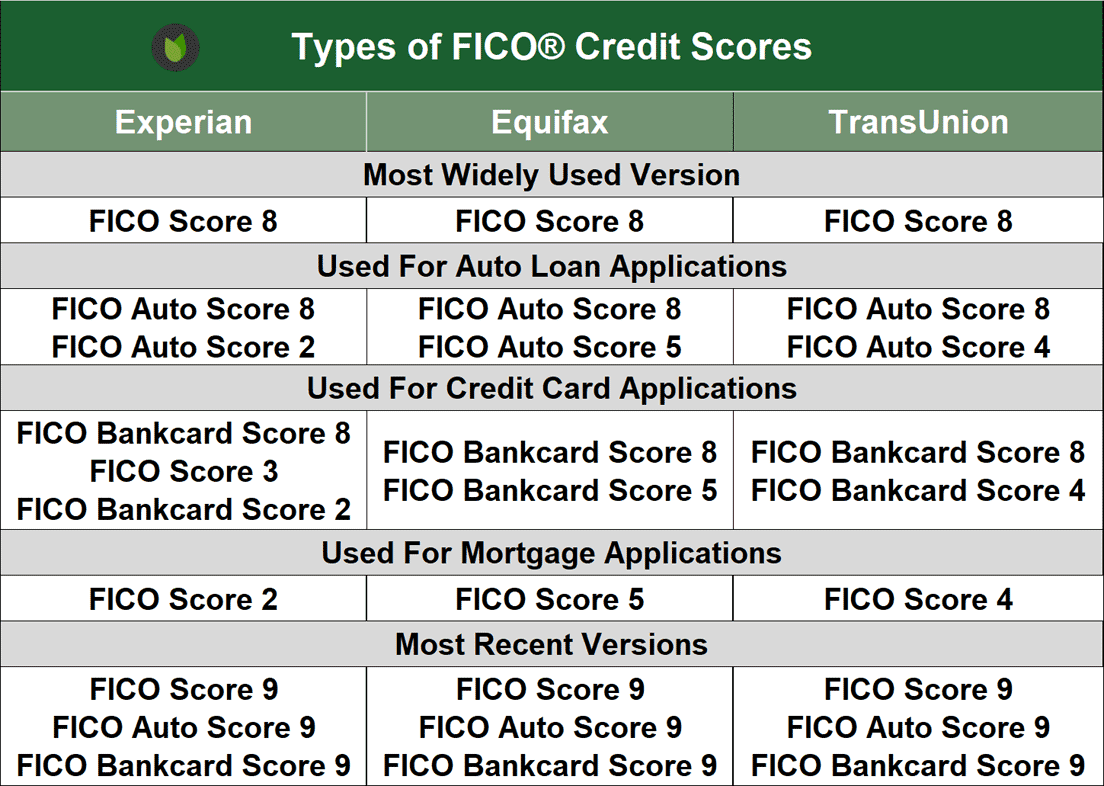

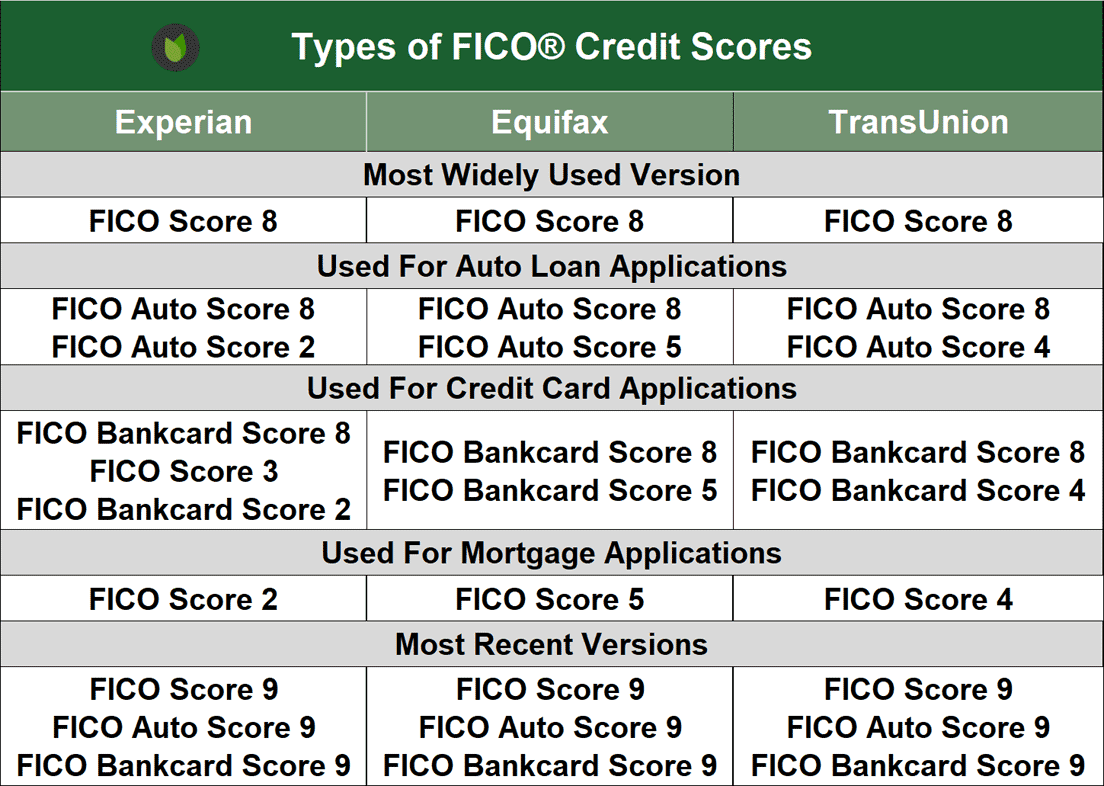

You may not realize it, but you have dozens of credit scores attached to your name. Banks use several different scores when processing credit card or loan applications, so there’s no way of telling which score you need to focus on to increase your chances of approval.

For starters, each major credit bureau — TransUnion, Equifax, and Experian — maintain credit scores in your name. Then there are peripheral credit scores, such as your VantageScore, that some credit monitoring services use.

And then there’s FICO — possibly the most common credit score used by banks, lenders, credit unions, and other financial institutions.

The problem with FICO is that it curates dozens of different credit scores under your name — and that number grows each year.

For starters, there are specialized FICO scores for mortgage lenders, auto lenders, and banks. Each financial institution must pay for access to a specific score.

Like most profit-seeking companies, FICO continually updates its scores each year — and charges each lender that wants access to the new version of the score. This can get expensive, so most lenders choose to stick with the score version they’ve paid for until it’s considered dated. That means one credit card company may use FICO Score 3, while another may use FICO Score 8.

The difference between each score likely won’t move you from one credit range to another. But it still makes the process more confusing if you’re looking to study your score before you apply for a credit card.

Every credit card gives you a credit limit that caps how much spending you can do with your card. This keeps you from accruing too much debt and limits the card issuer’s risk of over-extending credit.

For example, an unsecured card may have a credit limit of $500. In this case, the cardholder can’t charge more than $500 to the card. Any charge over the limit will likely be declined at the register.

Unsecured credit cards provide a revolving line of credit — meaning that you can use your available credit repeatedly after you make payments. So, that card with a $500 credit limit may only allow you to charge that much to the card, but you can reuse that credit after you make a payment.

If you max out your card and charge the full $500 to it, the card will no longer work. If you submit a payment in any amount, you will free up that much in credit to use again. For example, a $50 payment will give you access to that $50 in available credit.

Just keep in mind that credit card issuers make money by charging interest on any balance that you carry beyond the card’s grace period. Most cards come with an interest-free grace period of between 21 and 25 days after making a purchase. This means if you repay the charge before that period is up, you won’t have to pay any interest for the privilege of using credit.

This depends on your credit card issuer. Some issuing banks only offer cards for subprime applicants, so you may need to apply with a new issuer altogether.

But if you’re working with a bank that offers a range of card offerings, you can attempt to graduate to an unsecured card by requesting an upgrade through the bank’s customer service department. The bank will likely look into your account history to see whether you qualify to make the switch.

If the bank approves your request, it will automatically transfer you to a new card and refund your secured card’s security deposit. The bank will then print and mail your new unsecured credit card within seven to 10 business days.

Both cards build credit at the same pace — as long as you use your card responsibly and maintain a low balance.

Every month, your card issuer will report your balance and payment history to at least one of the three major credit bureaus. If you’re building credit, you may want to stick with cards from major banks that report to all three bureaus.

Any card that reports to the credit bureaus will help you build your credit.

The information that each bank reports will post to your credit report and become part of your credit score calculation. A low balance and on-time payments will help boost your score. A high balance and late payments will cause your score to drop.

This process is the same whether you have a secured or unsecured card. It also doesn’t change if you’re dealing with a personal credit card, student credit card, or business credit card. If you handle the things that are in your control — such as timely payments and low balances — you’ll make progress and begin to see a change to your credit score within a few months.

Just about every credit card issuer — including all of those listed above — provide online applications for new cardholders. This process is fast and provides a near-instant credit decision.

You’ll find the online application through the individual links to each card above. You’ll need to provide your name, home address, email address, phone number, Social Security number, employment and income information, as well as your current monthly rent or mortgage payment amount.

Once you submit this data, the bank will conduct a credit check under your name to get access to your full credit history. The credit check and application processing should take less than 30 seconds to complete.

In most cases, your processing screen will update with your credit decision. If you’re approved, the bank will show your account details and credit limit. Once your card arrives, you can activate it online or over the phone and begin using it immediately.

If you’re not approved, the bank will mail you an adverse action notice that will detail why it chose not to approve your application.

A store credit card is a form of unsecured credit card — but these cards are very different from traditional unsecured card offerings.

Neither card requires an upfront cash deposit for approval, and both provide a credit line that you can use to make purchases in person and online. But the similarities stop there.

Most store credit cards are branded by the store that issues the card. These cards typically limit cardholders to using the card only at that store and other brands it owns. This is referred to as closed-loop.

For example, the Express Credit Card lets you make purchases through the fashion chain, but you can’t use it anywhere else. Unless you’re a major fan of Express, this limitation will drastically reduce how useful the card is to you.

Many store credit cards also have a very high interest rate and low credit limits. Some offer rewards through the branded store — but you cannot use these rewards anywhere other than the store.

A positive is that store cards often have very relaxed acceptance standards — even for consumers who have bad credit.

If you’re looking for a card that offers more utility to your wallet, you’re better served with an unsecured card that you can use anywhere without worrying about the brand name or company logos.

Many consumers think that they start with a credit score of zero when they’re just starting out as adults. This isn’t only false, but it’s also impossible.

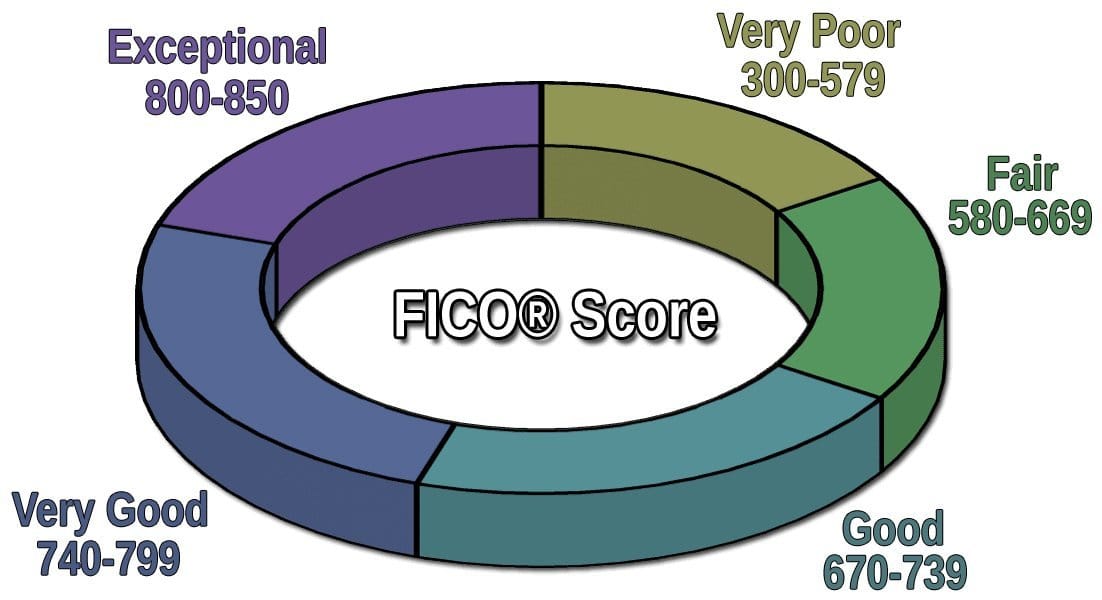

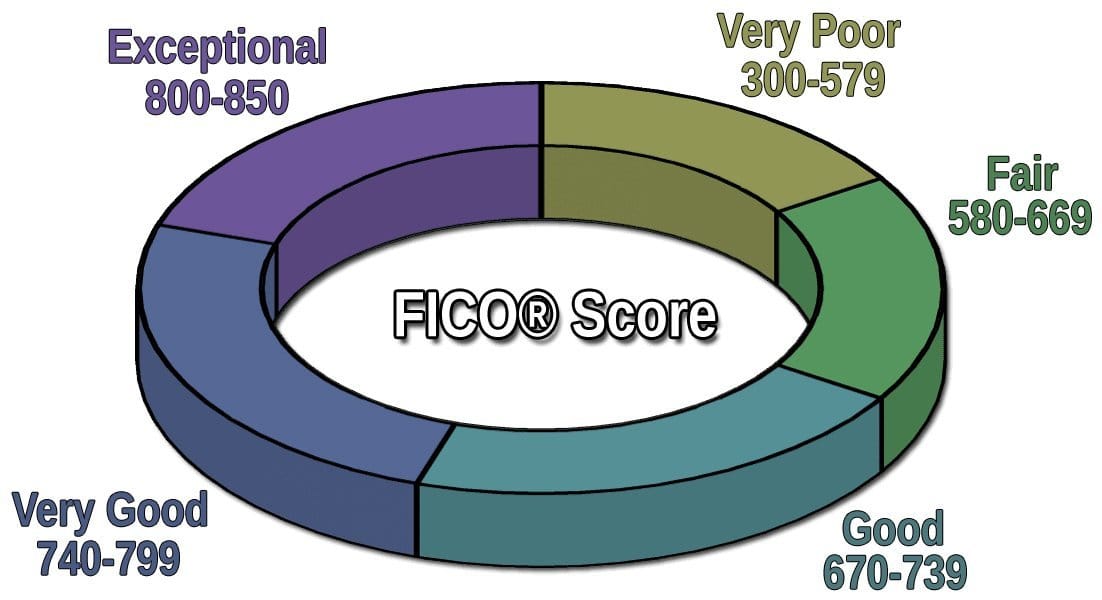

Your FICO score can range between 300 and 850. As you may expect, a 300 is as bad as it gets and a score of 850 is perfect credit.

When you’re just starting out, you’re credit invisible. That means you have no score at all. You won’t generate your first credit score until you have enough reliable information on your credit report, which takes between three and six months after you acquire your first credit card or loan product.

Your lender or bank will report your payment history and balance information each month to one or more of the three credit bureaus. Once you show a pattern of behavior after a few months, this information will factor into your first credit score.

If you’re responsible and maintain a low balance and make timely payments, your score will likely fall somewhere in the mid-600s. If you make mistakes early on, such as paying late, you could start off with a score in the mid to low 500s.

That’s why it’s important to start off on the right foot and make the best possible financial decisions. When you start with a good score, you’ll have little trouble continuing the climb as you establish positive behaviors. But one early mistake can set you up for a year or more of working to overcome the error to get back to a score that you could have had from the start if you had avoided the mistake.