Bank accounts for bad credit exist because there’s more than one way to screw up your finances. You may have fallen behind in your bill-paying and sent your credit score into a nosedive. Then again, your bank may have closed your checking account because of all those bounced checks or negative unpaid balances.

However you got there, you need a way to climb out of the financial ditch. You’ll want to rebuild your credit, and it wouldn’t hurt to reopen a checking or savings account at an understanding bank if only you could find one.

In that vein, we’ve assembled a list of banks and similar institutions that want to give you a second chance. We also answer 14 frequently asked questions about second-chance bank accounts that should help you navigate your way to higher financial ground.

Your credit is bad when you have trouble getting a credit card, cash advance, loan, or personal or business bank account because of previous financial challenges. Creditors classify consumers according to their creditworthiness, expressed as credit scores that range from excellent to very poor.

FICO, the leading credit scoring system, deems scores below 580 on their 300 to 850 scale as bad credit.

VantageScore, the second most-used scoring system, designates scores below 600 as poor and those under 499 as very poor.

FICO scores predict the degree of probability that you’ll default on a debt within the next two years. A low score reduces access to credit and makes it more expensive. It may also cause banks to reject your applications for a new account.

Even seriously derogatory items on credit reports (e.g., defaults, collections, bankruptcies, etc.), which are the basis for credit scores, disappear within seven to 10 years. The good news is that your credit score will immediately begin to respond to positive credit habits, such as consistently paying your bills on time and keeping your debt levels in check.

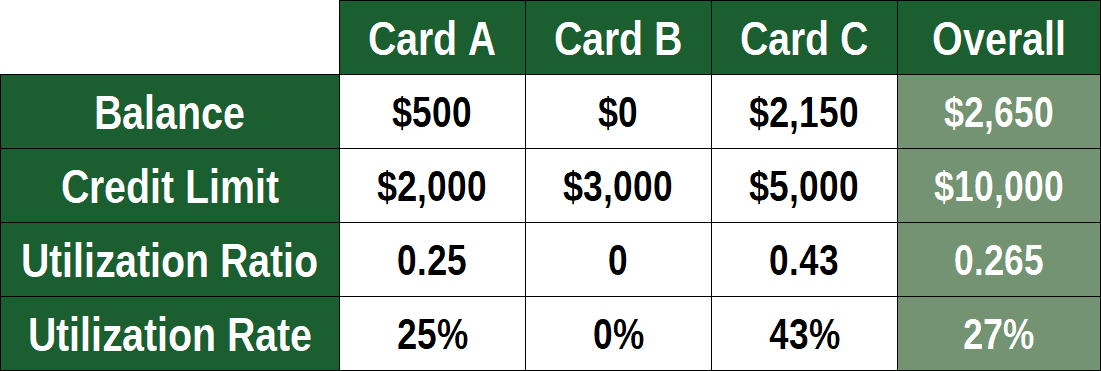

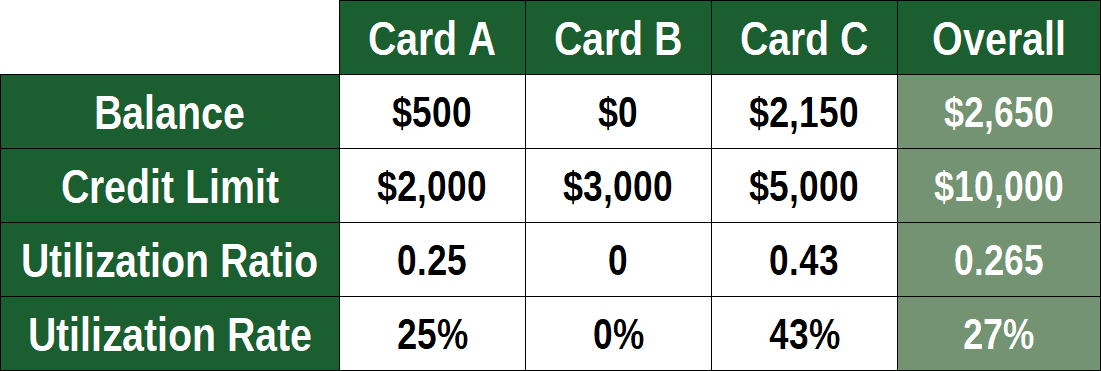

FICO uses the credit utilization ratio to quantify credit card debt. CUR is the amount you owe to your credit cards divided by the credit available.

You can get a fast credit boost by reducing your overall CUR below 30%. Timely bill paying takes up to a year to increase your score, but it is the surest path to good credit. It is never too late to improve your credit.

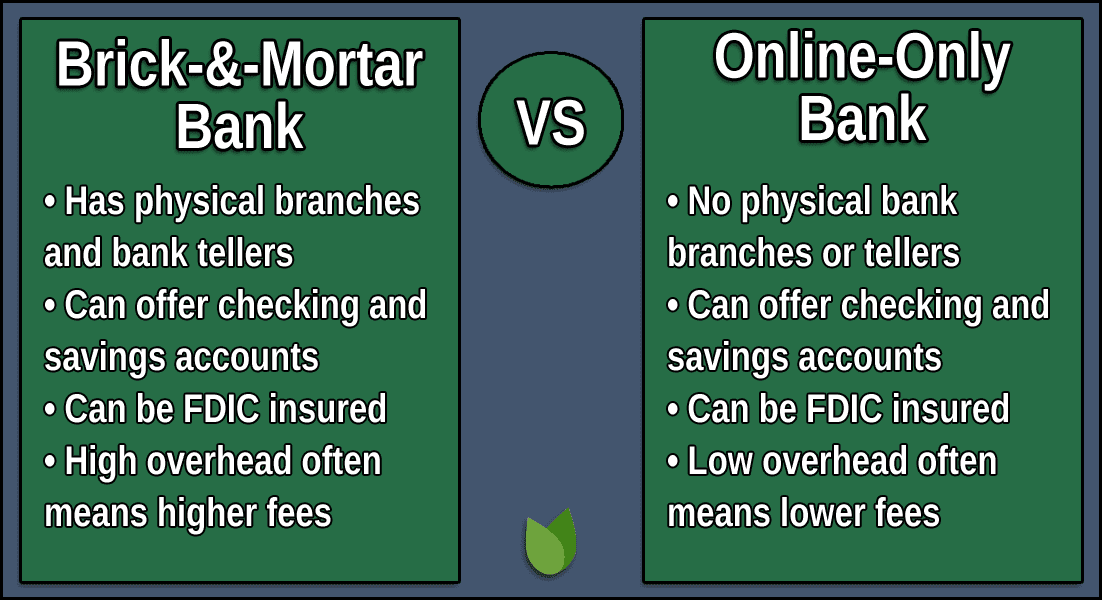

So-called second-chance banks provide checking and savings accounts to consumers with bad credit.

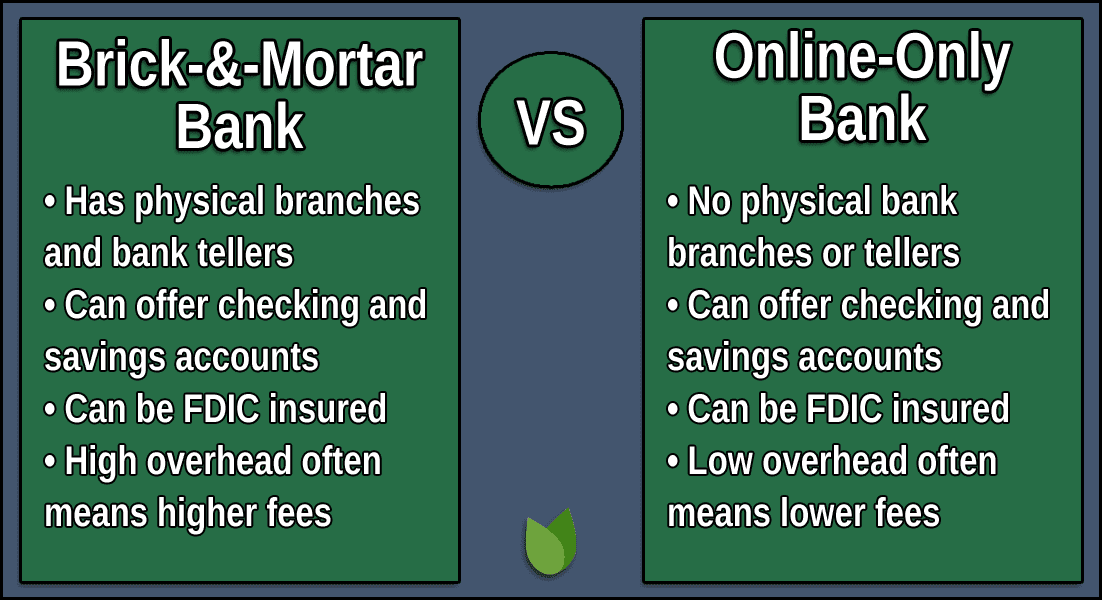

Many of these accounts are exclusively available from online sources and offer only essential services. Opening a second chance account allows you to rebuild your checking history. Success depends on your ability to follow the rules and avoid overdrafts and bounced checks.

Your poor credit shouldn’t prevent you from opening a second-chance checking, savings, or business bank account because these banks don’t check your credit or banking history.

There’s nothing remarkable about the workings of a second chance personal or business account other than the bank’s lack of physical branches. You can deposit money by mailing in checks, making direct deposits, or using a cellphone app that scans and transmits checks.

Some of these accounts offer paper checks, but others require you to rely on your debit card instead.

You can also arrange online bill payments and money transfers. ATMs let you access funds, but the network of machines that don’t charge transaction fees may be relatively small. Consider choosing a second-chance bank with a nearby no-fee ATM.

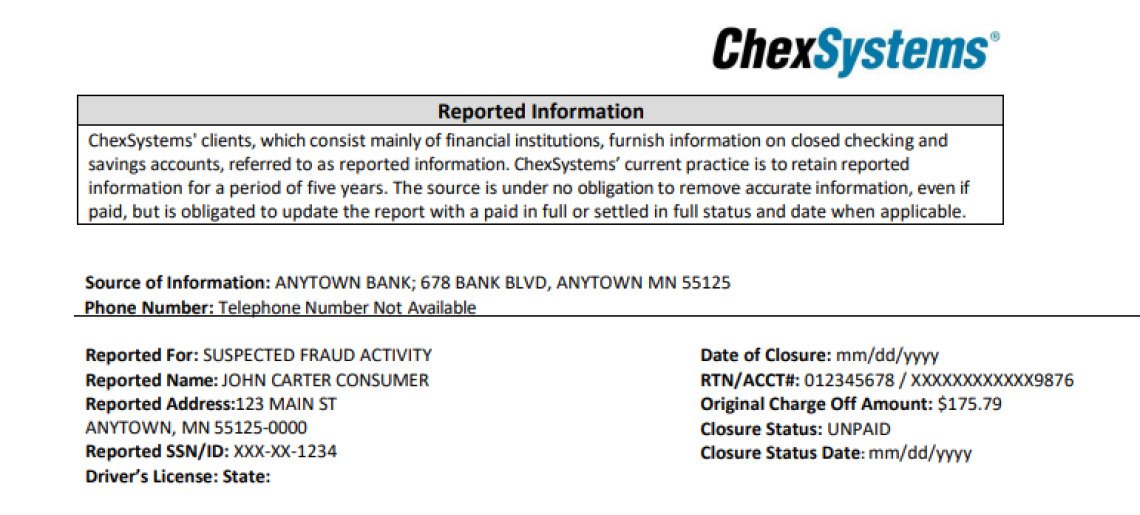

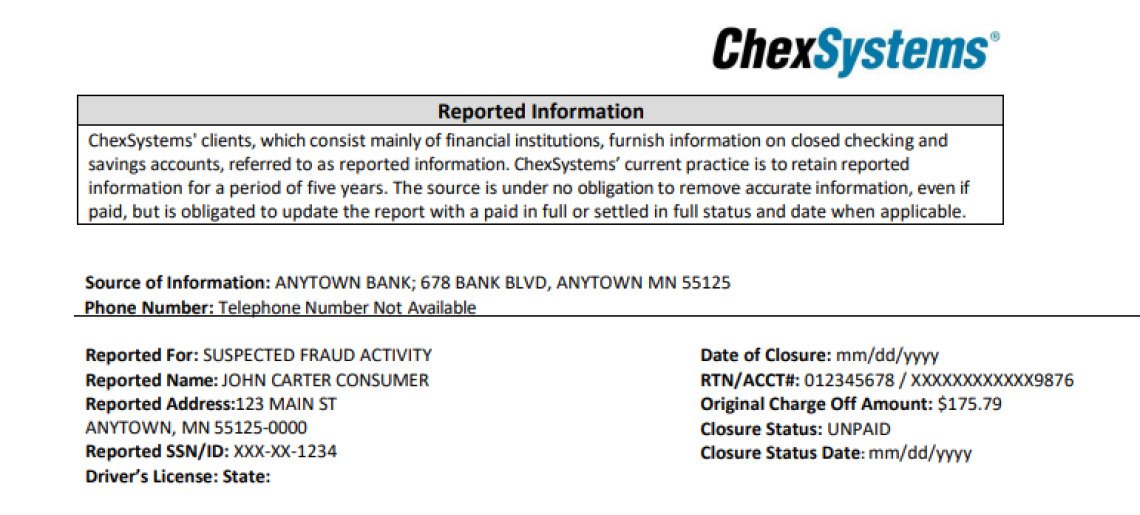

ChexSystems is to banks what the three credit bureaus are to credit cards. Both report consumer financial behavior. The credit bureaus (Experian, TransUnion, Equifax) concentrate on credit cards and loans, whereas ChexSystems focuses on banking history.

Specifically, ChexSystems collects demand account (i.e., checking and savings) information and sells it to its customers, including banks, credit unions, and thrifts. The collected data includes:

- ATM, debit/pay card, or account abuse

- Bank-initiated account closure

- Bounced checks

- Fraud or identity theft

- Number of recently opened accounts

- Overdrafts (assuming no overdraft protection)

- Unpaid negative balances

Traditional banks usually reject new account applications from consumers with negative ChexSystems reports. These reports contain only derogatory information — you get no recognition for being a responsible customer. Data remains in the ChexSystems files until purged after five years.

You have the right to review your ChexSystems report and dispute incorrect items. You can do so online at the company’s webpage.

Example ChexSystems Report

ChexSystems is not the only company that provides consumer banking information. TeleCheck maintains records of bounced and returned checks. A consortium of banks owns Early Warning Services (EWS), which records incidents of account misconduct.

Second-chance banks don’t generally check credit, so your bad credit score shouldn’t bar you from opening a basic bank account. The price for this convenience is the account’s limited services and relatively high costs.

In some cases, second-chance banks and credit unions use ChexSystems but accommodate consumers with adverse reports by offering “fresh start” checking accounts.

These are no match for the best free checking account offers and usually have high monthly fee requirements. After a probationary period (and optionally completing an online educational course), the financial institution may graduate you to a conventional checking account.

Banks that do not run credit checks are easy to identify because their search results inevitably contain phrases such as “No ChexSystems,” “No Credit Check,” “Clear Access Banking,” “Opportunity Checking,” or “Second Chance Banking.”00000.

The companies reviewed above all waive credit checks.

You may notice that several online accounts are the products of financial technology (fintech) companies. These companies contract with actual banks to provide services for personal or business bank account customers.

Second-chance banks may offer incentives to prospective customers. These may include cash back or point rewards, reduced or waived fees, and high-interest savings accounts (e.g., High-Yield Savings from LendingClub Bank, Personal Savings from Stride Bank, OnePoint Savings from Bancorp Bank, etc.).

Nearly all American bank and credit union accounts require an initial deposit, although the amount may be as little as $5.

Some second chance checking accounts require a sizable security deposit (for example, $200). The bank usually holds the security deposit in a savings account under its control, where it may generate interest. Your security deposit remains in a separate account until the bank is satisfied with your account usage and returns the money to your checking account.

Security deposits do not provide overdraft protection. If you write a check for more than your balance, the bank will return the check (and probably charge a whopping overdraft fee) instead of tapping into your security deposit to cover the shortfall.

If you close the account with a negative balance due to unpaid fees and penalties, the bank will use the security account to pay the amount due and refund the remainder.

Second chance and conventional checking accounts share many features. Both offer the ability to pay bills, accept direct deposits, and deposit, transfer, and withdraw money.

But second chance accounts have a few significant differences, including:

- Do not require credit checks

- Many are online only with no personal service at a physical branch

- Some do not offer paper checks

- May give you faster access to direct deposits

- May charge extra fees

- May not offer a credit card. If it does, it likely won’t be among the best credit cards available nor offer a high credit limit.

- May not provide overdraft protection

Almost all second-chance accounts work with a mobile banking app. You can use the app to scan and deposit checks remotely.

Competition among second chance accounts is fierce, so it pays to look for the best deal you can find. Points of comparison include:

- Fees: Ideally, you’d prefer the account waive or minimize monthly charges. Read the bank’s entire fee schedule before deciding.

- Requirements: Some second-chance accounts impose minimum balances and/or require direct deposits.

- Branches: Most of these banks are online only, but several traditional banks and credit unions offer second-chance accounts. This may be important if you want to establish a personal relationship with your banker.

- ATMs: The quality of ATM access varies widely. Look for banks or online account providers with large networks that have convenient locations and don’t charge fees.

- Services: Make sure the account offers the services you prefer. For example, you may want paper checks or overdraft fee protection.

- Reward cards: The debit cards for some second chance accounts provide purchase rewards. You may also want an account that offers a credit card with a signup bonus, rewards, and low costs.

- Apps: Some mobile apps offer superior functionality and are easier to use. Look for features such as mobile check deposit and digital wallet integration.

Several reviewed accounts offer extra services that may help sway your decision. For example, you may prefer an account that provides brokerage services or high-yield savings. One last consideration: FDIC or NCUA insurance is a must.

Each country has a regulatory authority for the banking sector. In the United States, the Office of the Comptroller of the Currency is responsible for all national banks and federal savings associations. In the United Kingdom, it’s the Financial Conduct Authority.

Accounts that do not use ChexSystems are the easiest to open. They don’t check your credit, allowing for nearly instant approval.

These second-chance accounts serve the needs of consumers who have had previous banking problems and want to make a fresh start.

These accounts are even easier to open if they don’t require an application fee, minimum deposit, or a set amount of direct deposits each month. Some do not require a Social Security number. You may prefer an account that offers a signup bonus, although these usually come with strings attached.

The answer depends on whether the new bank verifies your banking history. It won’t let you proceed if it is among the 80% that check credit.

Repaying your old or current account debts can help you rehabilitate your credit standing. Ask the bank to notify ChexSystems when you extinguish the debt and request a credit report from the agency to verify that it has removed it from your record.

Suppose your new local, regional, or national bank account requires a security deposit because of your old or current account bank. In that case, repaying the debt may prompt a refund and a promotion to a traditional personal or business bank account, including accounts with no-fee checking, such as:

- 360 Checking from Capital One

- Free Checking from Peoples Bank

- Rewards Checking from LendingClub Bank

- Clear Access Banking from Wells Fargo

- OnePoint Checking from Bancorp Bank

- Free Checking from Stride Bank

Be aware that even the best free checking account imposes some fees.

A bank may deny your account application due to negative information in your ChexSystems files, including:

- Involuntary closure of your bank account because of an unpaid negative balance, overdrafts, or bounced checks

- Suspicions of fraudulent behavior

- Opening multiple accounts within a short period

- Abusing your ATM or debit card privileges

An error on your ChexSystems credit report is a more innocent explanation for a rejected account application. For example, the report may conflate your identity with another’s.

Banks may go beyond ChexSystems and review your credit history and score from one or more major credit bureaus. A low credit score may be enough to doom your account application. If you have trouble opening a community, regional, or national bank account, consider the following steps:

- Review your ChexSystems reports and address any derogatory items you find. You can dispute any invalid items in your report. If your dispute succeeds, ChexSystems will remove the incorrect item. Otherwise, the derogatory item will drop off your report after five years have passed.

- Perform the same procedure on your credit reports, which you can get for free from AnnualCreditReport.com. If you can remove derogatory errors, the credit bureau will inform recent report recipients of the correction, and your credit score may increase.

- Apply for a second chance bank account. You should be able to open one regardless of your previous mistakes. Alternatively, consider opening a secured checking account if it offers more benefits than a second chance account.

Once you open a bank account, take the opportunity to demonstrate responsible behavior by avoiding overdrafts and similar problems.

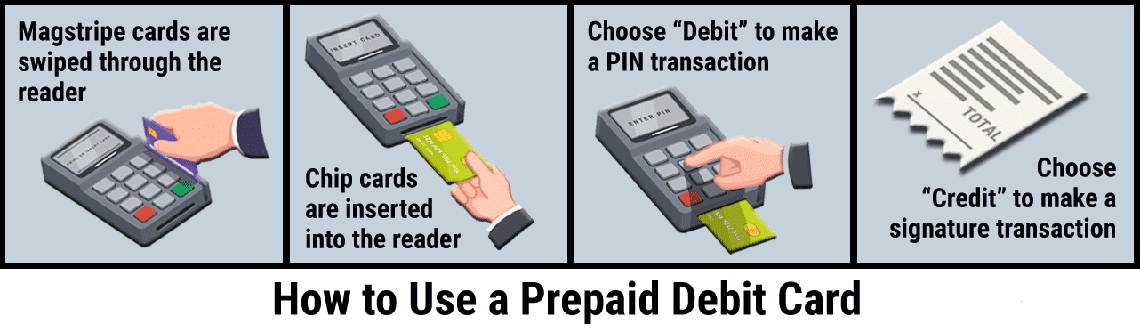

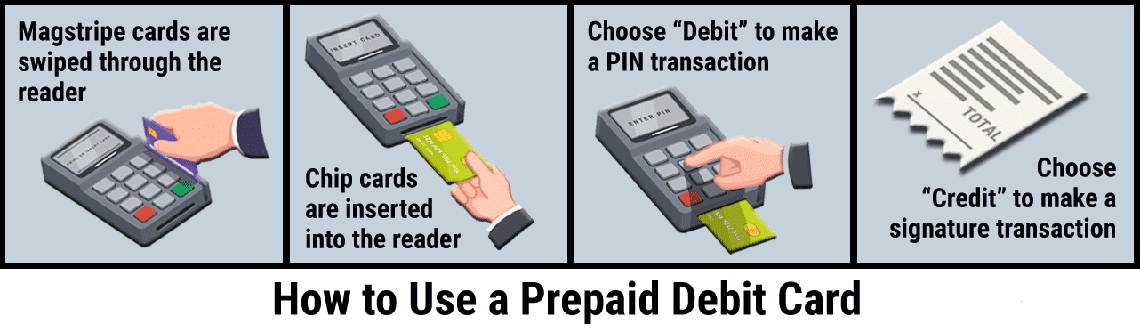

Consider reloadable prepaid debit cards if a second-chance checking account isn’t your cup of tea. They’re a favorite among unbanked consumers who enjoy the convenience of shopping without cash.

You load money into the card’s account (not a bank account) and then use it for purchases, transfers, and withdrawals.

Prepaid cards offer several of the benefits of second chance accounts, including:

- No credit checks required

- No late fees

- No minimum balance requirement

- Direct deposits

- Mobile check load

- Many offer rewards on purchases

- Recourse when your card is lost or stolen

On the downside, most prepaid debit cards impose either a monthly or pay-as-you-go fee. Other charges also apply. In addition, you can’t use these cards to build credit.

Another option is to use cash and money orders to cover your expenses. While cash doesn’t provide the rewards you get from the best credit cards (including cards from major issuers such as Chase, Citi, and Capital One), some merchants charge less for cash purchases.

You will be hit with fees when cashing paychecks and buying money orders. Moreover, there is no mechanism for recovering lost or stolen cash. And as with debit cards, cash doesn’t help you rebuild credit.

You can get a second chance bank account even if your banking record is less than perfect. It’s a case of what a bank doesn’t know won’t hurt you.

That’s OK in the short run, but if you want to graduate to a traditional personal or business bank account, pay any money you owe to your previous banks. Ask the bank to inform ChexSystems of your payments and verify by getting a copy of your report.

If your credit history leaves something to be desired, take steps to nudge your score higher. At the very least, pay your credit card and other bills on time.

You may consider getting a credit-builder account from a credit union or online source. With this type of account, you borrow money that the lender deposits into escrow. You then pay off the loan in monthly installments that the lender reports to the credit bureaus.

The lender refunds your money when the loan is repaid. It’s an excellent way to both rebuild credit and save up a small emergency fund.

Some consumers prefer to avoid banks and their fees. If you feel differently but can’t find a bank willing to overlook past transgressions, consider our reviewed bank accounts for poor credit. Most provide instant approval when you meet the minimum criteria and offer many traditional features.

These second-chance bank accounts don’t check credit. Many charge high fees and omit select services, such as overdraft protection. If that trade-off sounds reasonable, consider opening an account with the mix of features and costs that suits you best.

1 Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

2 Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

3 Chime SpotMe is an optional service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Conditions.