In a Nutshell: Providence Federal Credit Union was established to meet the financial needs of healthcare workers in the Pacific Northwest, but has since expanded to serve many others. The credit union’s low fees enable members to weather financial hardships more easily, and its counseling and educational resources help them learn how to manage their money. Providence FCU also provides financial support and volunteer hours to causes in its communities. For its dedication to healthcare workers in its service areas, Providence FCU has earned our Editor’s Choice Award™ for Community Commitment.

In 1962, a group of healthcare workers at a St. Vincent Hospital in Southwest Portland, Oregon, established an employee credit union. Seven years later, employees at a nearby Providence Health and Services hospital did the same for its workers. And in 1997, those trusted institutions merged resources to form an even stronger entity — Providence Federal Credit Union.

Providence Health and Services, a nonprofit healthcare system, still maintains multiple hospitals in Oregon, and instead of opening an individual credit union for each, it expanded Providence FCU to cover them all. And the credit union has since grown to encompass all Providence employees in Washington, as well. And the healthcare nonprofit continues to grow beyond the Pacific Northwest, with hospitals now in Southern California, Texas, New Mexico, and Montana.

“Not only do we want to serve the Providence employees in Oregon and Washington, we eventually want to serve them at all Providence locations in the U.S.,” said Shirley Cate, President and CEO of Providence FCU.

And because Providence FCU workers are also employees of Providence Health and Services, they keep in close contact with — and strive to understand the needs of — the people the credit union serves. Providence FCU also focuses its efforts on the communities in which its healthcare workers are serving Providence patients.

Providence FCU currently has 32 employees, three branches in Portland, 17 ATMs across Oregon and Washington, and a handful of service centers. And Providence Health and Services provides workers with access to the products, services, and educational resources they’d find at any other major financial institution — but with added benefits.

Providence FCU offers members helpful features, including low non-sufficient funds (NSF) and Courtesy Pay fees, access to the Helping Hand Fund, and financial literacy resources.

For its dedication to ensuring the financial well-being of the men and women who care for Providence patients, Providence FCU earns our Editor’s Choice Award ™ for Community Commitment.

Reduced NSF and Courtesy Pay Fees Help Members Avoid Financial Pitfalls

Overdrafts are often unavoidable, and many people can fall into a cycle of paying high NSF fees. They may find themselves facing hefty additional charges, meaning they need to spend more money that they don’t have.

Although financial institutions may save them from defaulting on payments or bouncing checks, those NSF charges can make it even more challenging to address the financial difficulties that caused them to overdraft in the first place.

That’s why, in June 2019, Providence FCU decided to lower its NSF fees from $30 to $15. That reduction makes the valuable service more affordable to people who can’t cover a $30 fee each time they have insufficient funds.

“We decided it would be a good way to give back to our members,” Cate said. “Also, after that, we decided to establish a Courtesy Pay program.”

The NSF service specifically covers checks and automated clearing house (ACH) payments — which include recurring bills by echeck. Providence FCU’s Courtesy Pay service expands NSF coverage from these types of payments to ATM and debit card transactions, as well.

Providence members must opt into the coverage, but when they do, they receive overdraft protection on those transactions for the same fee. This extended protection helps them avoid finding themselves short on cash and allows them to pay less while still receiving the funds they need when they need them.

Support for the Helping Hand Fund Enables Access to Money for Emergency Expenses

Providence FCU’s Helping Hand Fund was established to provide Providence Health and Services employees with emergency cash to cover unexpected expenses. Members can use money drawn from the fund to pay medical bills, payday loans, or to meet other vital expenses that can damage their financial security.

“They can apply for that funding, and there are also some financial education tools on the backend of it for them,” Cate said.

An employee giving campaign supports the Helping Hand Fund, and Providence FCU matches those donations up to a certain amount. In 2019, the match was $60,000.

Having the funds on hand benefits Providence employees, and its charitable objective fits with Providence’s profile as a Catholic nonprofit. But when the fund started to flounder due to a lack of donations, Providence FCU stepped up to help keep it afloat.

“There was a chance that the fund was going to go away because there wasn’t a lot of support for it. When we heard that, we thought, ‘We’ll step in and start matching so we can get that account and that fund held up, so these employees have someplace to go.’”

That decision energized donors and worked to replenish the fund while reaffirming Providence FCU’s commitment.

“That’s something we’re proud of and that the healthcare system really appreciates — especially here in Oregon,” Cate said.

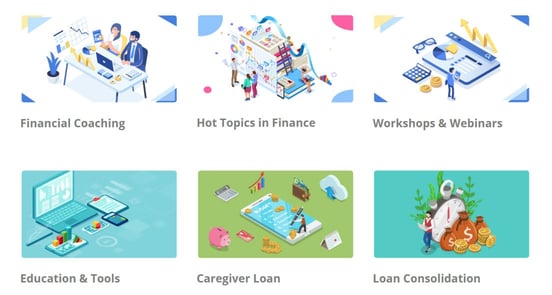

Educational Resources Empower Employees and Members

Having access to money to meet emergency expenses is a welcome financial safety net — as are Providence FCU’s NSF, Courtesy Pay service, and Helping Hand Fund. Together, these programs help members who are short on funds meet essential expenses. The same is true of the Caregiver Loans the credit union offers to Providence employees.

The customized program was established to provide Providence employees not only a low-interest loan, but also incorporate a savings component. And the Caregiver Loans page includes a calculator that helps borrowers see upfront how much they qualify for and what their payments will be.

But beyond helping employees get the money they need, Providence FCU understands that they may only treat the symptom of a deeper problem. That’s why Providence FCU provides financial education and counseling to members to help them manage their money and avoid shortfalls in the future.

Providence FCU offers a wealth of educational resources for members and nonmembers alike.

“That’s why we’re here. I’m glad the members are buying into the overdraft protection, but I’ve also been very proud of our financial education piece, and we have a financial coach on staff to help those people,” Cate said. “It’s not only helping them get the money they need in the short term but also providing that resource behind the scenes as well.”

Providence FCU’s financial counselor is available to talk to members via email and over the phone, and he also conducts webinars and in-person sessions that cover topics that include budgeting and homebuying. He also assists students enrolled in Providence University — the healthcare provider’s internal employee education program — to teach them about budgeting for their education, filling out scholarship applications, and other student-centric financial concerns.

That educational outreach, both in person and online, helps Providence FCU members manage their finances today and improve their prospects for a brighter future through education.

Providence FCU: Helping Communities through Volunteerism and Charitable Giving

Although Providence FCU has seen its fair share of growth, it remains committed to its core mission: Serving Providence Health and Services employees by helping them manage their money and achieve financial wellness.

Credit union employees get involved by volunteering their time in local communities.

“We’re just going to keep our focus on Providence and what we have going on in our own communities, whether it’s foundation events, employee events — things that are geared toward the employees because that’s who we’re here to serve,” Cate said.

But Providence FCU serves more than just its members. It also offers financial support for local and regional organizations that promote health and wellness. The credit union’s employees further support the hospital and its employees through organized volunteer efforts.

“We have an excellent volunteer program,” Cate said. “Employees volunteer at certain Providence events, whether it’s the Festival of Trees or the Bridge Pedal. There are so many things that Providence does in Oregon and Washington, and we want to be part of that.”

Providence FCU supports not only the financial wellness of its members but also, through charitable donations and volunteer efforts, the physical wellness of the communities the hospital network serves. Together, these efforts contribute to a brighter future for patients and employees alike.

“If we can make a difference inside Providence, that’s our main goal,” Cate said. “We can be one of the benefit programs that the healthcare system is proud to have.”

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.