Consumer interest in buy now, pay later (BNPL) purchasing continues to grow, and just about every credit card company is feeling the heat. BNPL apps, such as Affirm and Paypal Pay in 4, provide financing for online and in-store purchases. In addition, you can shop at BNPL online marketplaces using interest-free credit.

This Zebit review looks at a popular BNPL retail store that lets you stretch your payments without interest charges. But be sure to compare retail prices when shopping at the Zebit Market — high prices pay for its 0% financing.

Zebit Offers BNPL Financing With No Interest

Zebit attracts consumers of every credit stripe but is especially appealing to those with bad credit because it doesn’t check credit as part of the application process. You can buy something today, receive it within 10 days, and pay for it over the next six months with 0% interest.

How the Process Works

You can register for a Zebit account online by submitting information concerning:

- Your name and address

- Your job or other sources of income

- Your Social Security number

- Annual income

- Email address

- Your phone number

- Age

Zebit verifies your information without a hard credit check, so there is no impact on your credit scores. If Zebit approves your application, it will provide you with an initial spending limit, usually in the $750 to $1,500 range, based on your income, employment, and creditworthiness. Zebit does not charge interest or extra fees (i.e., no late fees, application fees, or membership fees).

Armed with your new credit account, you can shop online at the Zebit Market for more than 1,500 items. You can also choose from a wide gift card selection for other major retailers.

With the Zebit payment plan, you’ll pay 25% to 35% of the purchase price upfront and finance the remainder in six to 26 interest-free installments over the following six months. Zebit evaluates each purchase attempt and does not approve 100% of orders.

The Zebit spending limit differs from credit card credit limits in that it is not a revolving line of credit and does not replenish with each payment. Your available spending limit only refills after you pay your purchase in full. Zebit reevaluates your payment history every three to six months to see whether it will give you a higher spending limit.

Late payments may prevent you from getting a spending limit increase and may cause Zebit to freeze or terminate your account. The company recommends you to sign up for auto-pay to ensure timely payments. While Zebit does not report on-time payments to the three major credit bureaus, it does report late payments, which can hurt your credit score.

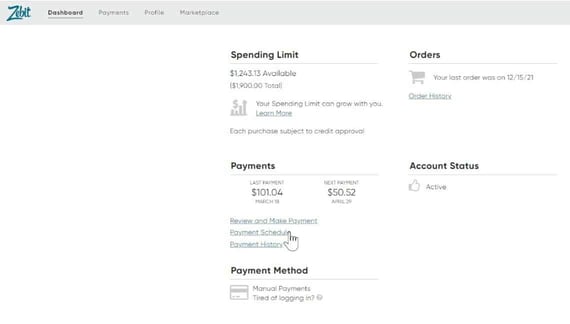

The Zebit Dashboard contains information about your account status, balance, spending limit, and payment dates.

Eligibility Requirements

Zebit requires applicants to meet the following conditions:

- Annual income greater than $18,000

- Minimum age of 18 years old (19 years old in Alabama and Nebraska and 21 years old in Mississippi)

- Verifiable income and employment

- Zebit may verify your checking or savings account with your financial institution

While Zebit does not verify your application through credit checks with the three major credit bureaus, it does use specialized databases to validate the information you provide.

Prices and Shipping Rates

The Zebit Market carries various product categories, including:

- Electronics

- Computers

- Furniture

- Appliances

- Health equipment

- Home goods

- Kitchenware

- Accessories

Zebit makes money by purchasing items at wholesale prices and selling them at retail, similar to other retailers. The most significant criticism from Zebit customers appears to be Zebit’s prices and customer service. For example:

“Zebit seems legit, but it’s like a rent-to-own place. They’ll finance items you want, but you generally pay way more than the item is worth, or way more than you can buy it for outright somewhere else. I’m sure the company is fine, but like payday loans, it seems to prey upon people who don’t have money.”

– Reddit Reviewer

If you are looking for rock-bottom prices, Zebit is not your best buy, as its retail-to-wholesale price ratio is unusually high. Zebit tacks shipping fees on top of its already high prices.

It ships via FedEx, UPS, and USPS. Zebit will deliver extra-large items, such as appliances and furniture, using a home delivery service to bring the item to your door. It also offers a white glove service to set up and install your purchase.

Zebit estimates shipping times of seven to 10 days on most items. It does not own warehouses, relying instead on a supplier network for direct shipments. Some Zebit customers complain that the shipping fees seem high.

Zebit may offer an optional extended warranty for up to three years on many items. The warranty price depends on the item cost and plan length.

Purchasing or financing an electronic certificate carries an 18% handling fee. For example, a $200-valued prepaid card will cost $236 (excluding any sales tax if applicable by state).

Zebit Rewards

You earn Z Reward points every time you pay off an order. Zebit’s four reward statuses start with Bronze, which it assigns to new members. Your status climbs as you make and pay off more purchases.

Silver Status Requirements

- Pay off one order

- Maintain account in good standing

- Earns points 10% faster than Bronze

Gold Status Requirements

- Pay off two orders

- Must be a customer for at least 12 months

- No late payments in the last six months

- Spent at least $100 in the previous six months

- Earns points 20% faster than Bronze

Platinum Status Requirements

- Pay off four orders

- Must be a customer for at least 12 months

- No late payments in the last six months

- Spent at least $350 in the previous six months

- Earns points 25% faster than Bronze

You can earn bonus points when you pay your bill early, buy specified products, or complete other tasks. Platinum members may receive more chances to earn bonus points, access to high-demand gift card offers, exclusive access to limited products, and special offers and discounts.

Zebit Returns Policy

Zebit doesn’t accept returns or exchanges on any of the products it sells. It doesn’t make exceptions, so you must ensure you’ve correctly selected the products you want before purchasing.

The company will work with you to resolve any problems with product damage or quality. You must notify Zebit of any issues within 10 calendar days of receiving your order. Otherwise, it will not be able to help you.

If parts are missing, Zebit will send replacement parts if available. For assistance with a product, email help@zebit.com. Zebit warns you not to return items to a vendor directly, as this will create delays.

Why Finance Through Zebit Instead of a Credit Card?

Zebit offers a few benefits over traditional credit cards. One example is no interest for six months, something you can’t get with a credit card for bad credit.

The following chart compares Zebit to an average credit card:

| Zebit | Credit Card | |

| APR | No interest | Up to 36%, revolving |

| Intro 0% APR | 0% for 6 months | Up to 21 months with good credit |

| Credit line | Up to $1,500 | $200 to $50,000 (or more from the best credit cards) |

| Payments | Weekly or monthly, fixed | Monthly, variable |

| Down payments | 25% to 35% | Not required |

| Fees | Shipping and gift cards, no hidden fees | Various |

| Credit check | No | Yes |

| Credit reporting | No | Yes |

| Shopping | Zebit Market | Anywhere |

| Prices | High | N/A |

| Returns/exchanges | No | Yes |

| Rewards | Yes | Yes |

| Benefits | Limited | Several |

Consumers may prefer Zebit to credit cards for several reasons:

- You can get a Zebit account without a credit check or security deposit

- 0% interest with Zebit

- Zebit charges fees only for shipping and gift cards; there are no hidden or extra fees

- You have up to six months to repay a purchase in fixed installments

Each top-ranked credit card company designs its best credit cards to deliver valuable perks and perform many functions, including purchasing goods and services from any merchant. Zebit has a much narrower scope and limits purchases to the Zebit Market.

Go hereThe scope mismatch means Zebit augments credit cards but doesn’t replace them.

Zebit resembles a bank debit card in some respects. As with a debit card, a Zebit account doesn’t impose interest charges and won’t impact your credit score. Zebit differs in that you have six months to pay the bill, whereas a debit card immediately subtracts the purchase amount from the account balance at your financial institution.

Does Zebit Affect My Credit?

Under normal circumstances, Zebit accounts have no impact on credit. First, Zebit doesn’t perform a hard credit check when you apply for an account. Secondly, it doesn’t report your timely payments to any of the three major credit bureaus.

But if you fail to make a payment on time, Zebit will report it to the credit bureaus once 30 days pass. This will lower your credit score and remain on your credit reports for seven years.

Contrast these practices with those of credit cards that check credit and report activity. Even though a credit card issuer will perform a hard credit pull when you apply, the impact on your score is uncertain.

A new account also has positive effects — it may lower your credit utilization ratio (i.e., CUR, equal to credit used / credit available). A CUR below 30% will help boost your credit score, perhaps more than a new account depresses it.

Credit cards build credit when you consistently pay your bills on time. Of course, they can harm your score if you miss payments. Overall, credit cards have upside and downside score impacts, whereas Zebit can only damage your score and never improve it.

The lack of Zebit reporting has a couple of secondary effects:

- Length of account history: FICO rewards consumers when they maintain credit accounts over a lengthy period (typically seven or more years). Zebit doesn’t affect this manner because it doesn’t report your account activity to the credit bureaus (unless you miss payments).

- Credit mix: 10% of your FICO Score stems from your mix of credit cards and loans. A BNPL account increases your credit mix, but only if the lender reports it to the credit bureaus. Several BNPL apps and accounts do this, but Zebit does not, so it can’t help you build credit by broadening your credit mix.

Ultimately, you must decide whether Zebit’s lack of credit checking and reporting is a pro or con. If you have bad credit and can’t find a credit card issuer willing to qualify you for the card you want, you may find that having a Zebit account is a helpful way to finance purchases.

Is Zebit Legitimate?

Zebit is located in San Diego and receives backing from several venture capital firms, including Crosslink Capital, Wildcat Venture Partners, Leapfrog Ventures, Ulu Ventures, and Correlation Ventures. It has an A+ rating from the Better Business Bureau, and Trustpilot rates it as “Great.”

From all the evidence, Zebit appears to be solidly legitimate, but it is not perfect. Zebit’s major disadvantages include its low credit limit, shopping limited to the Zebit Market, and high prices.

But not all products from the Zebit Market are grossly overpriced, especially after you factor in the 0% interest rate. Setting up a Zebit account costs nothing, and it may come in handy when you need to finance a big-ticket purchase.

To bolster its legitimacy, Zebit claims to be a leader in fraud prevention. Nicknamed “Vulcan,” this fraud prevention technology “takes large, complex streams of data from multiple sources to form inferences that are superior to using the data streams individually.” Zebit says Vulcan reduces online fraud by 90%.

Enjoy Payments on 1,500+ Brand-Name Items With Zebit

This Zebit review should help you decide whether an account with the company will fit your lifestyle. It is free to use and may help you save hundreds of dollars each year in financing costs.

In addition, you can get a Zebit account with no, limited, or poor credit, and applying won’t harm your credit score. If you are looking for a way to finance purchases via fixed, interest-free payments, Zebit Inc may be zebest option for your budget.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.