What Should You Do with Unused Credit Cards? (Feb. 2024)

If you’re carrying around old, forgotten plastic in your wallet, and wondering exactly what to do with unused credit cards, you’re not alone. According to 2014 Gallup data on credit card ownership, 18% of Americans have as many as three to four credit cards. It stands to reason that some of those cards aren’t being used regularly, and are simply taking up space in your wallet or are laid to rest at the bottom of your purse.

Many consumers think if a card hasn’t been used in a long time, it’s best to get rid of it. But before you close an account, it’s important to understand that canceling any credit card — whether used or unused — can impact your credit score. To avoid any undue negative consequences of closing an account, it’s important to consider your options. Keep reading to learn more about the pros and cons of closing a credit account versus leaving it open.

Some Cards Can Be Safely Canceled

If your credit card has no annual fee, then it doesn’t hurt to keep it open, even if you haven’t used it in a long time. In this instance, the card isn’t necessarily doing you any good, but it’s not causing any harm either. As long as the credit card has no effect on your finances, consider tucking it away and keeping it for a rainy day.

However, the likelihood of a completely neutral card is pretty slim. In most cases, credit cards have annual fees, so even if you’re not using the card, it will cost you over time without offering any value. If you’re paying fees to keep a card you never use, then it might be time to cancel it.

But, not so fast. First, consider how long you’ve had the account because credit history is one of many factors that make up your FICO score. If you’ve had the card for a long time, you need to weigh your options: 1. Leave the card open, pay fees, and never use it, or, 2. Keep it open and build your credit score.

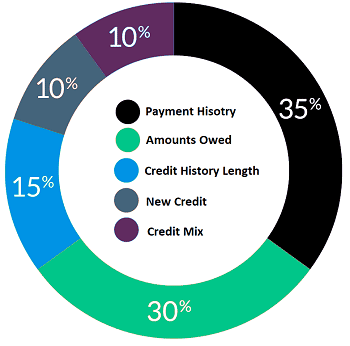

Your FICO credit score is based on a number of factors, including the length of your credit history.

This brings us to another point: your credit score is determined, in part, by the length of your credit history. If your unused credit card is one of your oldest accounts, the established history will be disregarded if you close the card. Carefully consider the impact of older cards on your credit history before you close them.

Your credit score is also determined in part by the total amount owed on your credit cards relative to their limit. Let’s say you have three credit cards, with one being an unused card, and you decide to close the unused one with no balance. If the card had a large credit line, you’ve just eliminated that available credit and inadvertently increased your credit utilization percentage. That means whatever you owe on your other two cards will show up as a larger ratio of your now-reduced available credit.

Rewards May Make a Fee Worthwhile

Many people have credit cards they don’t use often enough to justify the fees, but what if the card happens to offer some great perks? Maybe it incurs airline miles, gas points, hotel credit, an annual gift, or some other reward that you have come to depend on. In this case, it’s important to consider if those benefits outweigh any fees that may be associated with keeping the account open.

Depending on the state of your credit score, it’s possible you might be eligible for an even better credit card, at a lower interest rate, with the same rewards. In all likelihood, your credit score has changed (hopefully, for the better) since you first opened the card in question. Before canceling a card, explore other credit cards you could swap the inert card for that might offer similar rewards but at a lower interest rate. You might be more likely to use a different card and still get those coveted airline miles.

Start Canceling the Starter Cards

One credit card you can generally feel good about canceling is a starter card. Maybe you were in college when you got your first credit card with a small credit line, just $500 or so. As you established good credit over time, the cards (and credit lines) offered likely improved dramatically. In these cases, eliminating the small credit line of your starter card will generally have little overall credit impact.

The caveat here is if your starter card is an older card that will influence your average account age if canceled. The length of your credit history — and age of each account — can be worth up to 15% of your score, so consider the consequences before canceling an old card, regardless of its limit.

3 Cards You Should Avoid Canceling

Before you go canceling every unused credit card you own, you should know there are a few credit cards that should never be casually canceled — or else you risk a major dip in your credit score. These special circumstances include:

- Credit cards with a balance on them — If you close a credit card with a balance, your total available credit and credit limit are reported as $0 which makes it look like you maxed out your credit limit. This can have a disastrous effect on your credit score.

- Your only credit card — 10% of your credit score is determined by type of credit, which means you need to diversify lending. If you cancel your only credit card you won’t have proof of your ability to handle multiple credit accounts when your credit score is calculated.

- A credit card with a lot of available credit — Just like closing a credit card with a balance, closing a credit card with a fair amount of available credit can also negatively affect your credit score. Part of your credit score is determined by credit utilization (how much credit you have vs. how much you’re using) so if you cancel a card with a high credit limit, your credit utilization will likely take a hit.

Canceling cards without a proper understanding of the results can have a huge impact on your financial well-being. Professional credit repair services can help you address the gaps, inaccuracies, misunderstandings, and mistakes that may be hurting your credit score.

So, before you call up your credit card issuer or pull those scissors out of the drawer, be sure to carefully weigh the pros and cons that factor into whether canceling your credit card would be worth it.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.