5 Ways to Set Your Kids Up for Future Credit Success (Feb. 2024)

Knowing the ways to set your kids up for future credit success will put your little ones ahead of the curve in many ways, as financial education is often a topic left wanting in the household, and it will set them up for a healthy financial foundation. Establishing and maintaining good credit is a process that can begin early in life. Of course, when your children are still young enough to be living at home, they aren’t typically thinking about how to establish a good credit history of their own — but you should be thinking about it on their behalf.

By law, young adults cannot get a credit card until they are 18 and can prove their own source of income beyond an allowance from mom or dad. However, there are ways you can begin showing them the ropes of responsible credit management even before that. This will help your children understand the role a good credit score will play in their ability to reach their personal and financial life goals.

In this article, we’ll explore some of the best ways to set your kids up for success in the world of credit, including how to get them a prepaid debit card, being a financial role model, helping them apply for their first credit card, and more.

1. Get Them a Prepaid Debit Card

While prepaid cards won’t help your child establish a credit profile, a prepaid debit card can help your child begin learning how to manage money, including how to keep track of spending and stay within his or her budget. An open-loop prepaid card with a Visa or Mastercard logo can be used just like a credit or debit card in most cases, making it a safe, convenient way to start learning how to swipe responsibly.

Since minors can’t typically have their own prepaid accounts, you’ll likely need to establish an account and add your child as a user on a sub-account. Put a set amount of money on the card that your child can use for his own expenses, such as gas for his car, or activities with friends. Start with the expert-rated picks below to start exploring prepaid card options.

| |

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

- See official site, terms, and details »

| Interest Rate | N/A (Prepaid) |

| Reports Monthly | No |

| Application Length | 5 minutes |

| Reputation Score | 9.5/10 |

| |

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

- See official site, terms, and details »

| Interest Rate | N/A (Prepaid) |

| Reports Monthly | No |

| Application Length | 5 minutes |

| Reputation Score | 7.5/10 |

| |

- Greenlight is a debit card for kids, managed by parents Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money Feel secure knowing Greenlight blocks unsafe spending categories Receive Mastercard’s Zero Liability Protection Upload a photo of your choice to create a unique custom card Debit cards are FDIC-insured up to $250,000 Easily turn your Greenlight card on or off and receive real-time spending notifications

- See official site, terms, and details »

| Interest Rate | N/A (Prepaid) |

| Reports Monthly | No |

| Application Length | 5 minutes |

| Reputation Score | 7.0/10.0 |

Before handing over a new prepaid card, be sure to sit down with your child and discuss how the card should be used. Talk to your child about how to budget this set amount to make it last for a specified period of time, such as two weeks or a month. By doing this, you will help your child establish a sense of money management and responsible spending.

2. Set a Good Financial Example

Like it or not, our children emulate our actions. This includes how we manage our finances and debts. The lessons your children learn about money and credit management start when they’re growing up, and the things they see you do will shape the way they handle their own finances as adults.

And it extends well beyond building credit. Research from The Journal of Consumer Affairs confirms that parents’ financial behavior impacts their children directly — and indirectly — and impacts the development of general self-control skills.

If you are constantly living beyond your means or overextending yourself on credit, there is a good chance your children will repeat those bad habits as adults. Saving, budgeting, and properly managing your finances will not only help your own credit, but also set a better example for your children.

3. Help Your Child Apply for a Credit Card at 18

At 18, your child can apply for his or her own credit card with you as a cosigner. Good options for a first credit card are those that are targeted towards students or those with no or limited credit histories. A secured credit card, which requires a deposit against the credit limit for the account, is another good option for those just starting out.

Once they have a credit card of their own, make sure to talk to them about the importance of paying as much of the balance as possible each month, and doing so on time. For many children, their first credit card can feel like “free money,” so it’s important for them to understand that balances must be repaid — and that carrying a high balance can lower their credit score.

Once your child opens his or her first credit account, make sure that they understand the five factors that impact their credit score. Credit balances and payment history carry the most weight, combining to make up 65% of your overall FICO cred score.

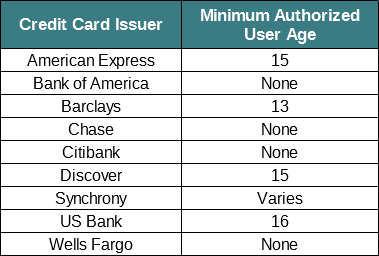

If you’d rather not wait until your children turn 18 to help them establish a credit history, you may be able to add them to your current credit card account much earlier. In fact, while some credit card issuers require authorized users to be at least 16, other issuers have no age restrictions for authorized users.

Since most credit cards will report account information to the credit bureaus for both primary and authorized users, adding your child can help establish your child’s credit profile. And although authorized users are issued a card in their own names, that doesn’t mean they need to use that card if you’d rather simply keep it in a drawer and just enjoy the credit-building benefits.

4. Let Them Learn from Their Mistakes

Once you’ve given your child the responsibility of budgeting some of their own money, you can expect that — just as we still do in adulthood — they’ll probably make some mistakes along the way. But these mistakes can actually be a good thing.

That’s because a $50 or $100 mistake while your child is a teenager is much easier to recover from than a $3,000 mistake once they’re out on their own. As tempting as it can be, don’t “rescue” them from their mistakes. Instead allow them to correct the mistake and learn from it now, hopefully preventing bigger, more costly mistakes when they’re older and the stakes are higher.

5. Increase Your Child’s Financial Responsibility as They Age

This can be a tough one. We often want to do everything for our kids, pay for all of their needs, and fix all of their problems. However, if you want to raise a financially mature adult, it really comes down to helping them develop a high level of responsibility.

As your child gets older, consider having them take over more of their own financial obligations, such as their cell phone bill or car insurance payment. By gradually increasing what your child is responsible for, you’ll be better preparing her or him to eventually support themselves. A boost in allowance or a part-time job as your child gets older can help cover these additional financial responsibilities.

It’s also important to increase your child’s financial knowledge as she gets older. This means going over basic personal finance skills, like how to understand their first paycheck, how taxes work, and how to start saving for retirement.

Teaching good credit habits is one of the best things you can do for your children to help them succeed. It’s important that they understand that it’s far easier to maintain good credit than to have to repair damaged credit later on in life. By following these steps, your child should have a good understanding of how to best manage their own credit by the time they head out into the “real” world.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.