No credit check loans pose a pretty big risk to the lender, and that is why many lenders don’t offer them. But if you know where to look, you can find options that not only provide you with the money you need — but also offer fast approval and funding.

Online lending networks have taken the financial world by storm. These services partner with lenders from around the U.S. to offer near-instant approval with the potential to receive multiple loan offers from a single loan request.

And since each loan request is sent to several lenders, you could ignite some competition for your business, which may mean a lower interest rate and monthly payment.

Best Same-Day Loans With No Preliminary Credit Check

Each of the online lending networks below will send your single loan request to every lender it partners with. This request runs a soft credit check — which won’t affect your credit score — to determine your eligibility. If you qualify, you could receive an email with multiple loan offers to choose from within minutes of submitting your request.

The lender you choose to work with will have its own rules as to how to proceed with your application. While some lenders may still approve your application without a credit check, others may require one before processing your request. But you’ll have already prequalified for the loan through the network, so you’ll only be matched with lenders willing to work with you, meaning there’s no need to fret the credit check.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

CashUSA maintains one of the largest online lending networks and offers short-term loan options from reputable lenders that make loan decisions in minutes. If you qualify, you could receive your loan proceeds by the next business day.

Qualified applicants must be 18 years or older, have an active bank account, and provide proof of current employment and income of at least $800 per month. Individual lenders may provide other requirements for loan approval.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group doesn’t perform a credit check to match you with a lender. Just fill out its quick form to see which lenders are willing to fund your loan based on the info you provide.

After you choose a loan offer, you’ll be directed to the lender’s website to complete the application. It is at this point where you may have to undergo a credit check, but considering you’ve already been preapproved, the odds of getting the loan are in your favor.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com can prequalify you for a loan without a hard credit check. Its easy online form takes just minutes to complete, and you will be presented with the exact fees and interest rate of your loan offer before you can choose to accept it.

The basic eligibility criteria listed on its website include being at least 18, a U.S. citizen or permanent resident, employed for 90+ days, and having a bank account, work and home phone numbers, and a valid email address.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

Every direct lender that partners with InstallmentLoans.com offers bad credit loan options for consumers who need cash fast. These loans allow you to repay your debt over time and keep your monthly payment low.

A qualified borrower will need to provide a valid state driver’s license number, Social Security number, home or cellphone number, bank account information, home address, and employment or benefits income information. Applicants must be at least 18 years old and a U.S. citizen or permanent resident.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan has more than two decades of experience in finding loans for consumers who have bad credit or no credit at all. With this free service, you can go from loan request to loan offers within a matter of minutes.

CreditLoan will not accept applications from consumers who have a pending bankruptcy case. Before you apply for a loan, make certain that your case is fully discharged and that the judge has signed off and completed your paperwork.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

As its name suggests, BadCreditLoans focuses solely on finding loan offers for applicants whose bad credit score may keep them from getting a traditional loan through a bank or credit union. While a bad credit loan may have a higher interest rate than a loan for a consumer who has good credit, it still provides a credit-building opportunity, as well as access to cash when you need it most.

The network’s lenders will accept loan requests from any consumer — and will even consider applications that show a recent bankruptcy. Just make sure your case is finalized before you submit a loan request.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

The beauty of a personal loan is that you can use the loan proceeds in any way that you choose. This is not the case with an auto loan, student loan, or mortgage loan. You can also repay your loan over a series of monthly payments that work with your income and financial situation.

Qualified applicants must also be at least 18 years or older with a valid Social Security number and checking account. The network also requires applicants have no accounts more than 60 days late, no active or recent bankruptcies, no pattern of late payments, no debt that can’t be covered by current income, and no recently charged-off accounts.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com is another lender network that can net you a loan offer of up to $20,000. Though a loan that large will certainly require a credit check, the network’s lenders also offer loans as small as $100, which may instead rely on proof of income for approval.

There’s no obligation to accept any loan offer you receive, but be sure to read the fine print of each loan so you can choose the best deal.

9. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

A cash advance loan from CashAdvance.com — also known as a payday loan — will rarely require a credit check. Instead, the payday lender will only check to make sure you have sufficient income to repay your debt on time. These loans typically have a short repayment term that requires payment in full — including interest — usually within seven to 30 days.

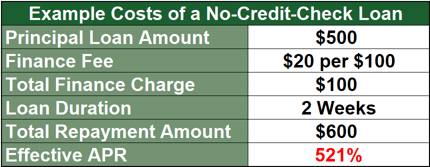

And the interest could be quite substantial. The average cash advance interest rate starts at around 400%. You should expect to repay at least $15 for every $100 you borrow. And if you can’t repay the loan on time, the amount you owe will quickly multiply.

Can You Get a Loan Online Without a Credit Check?

You may struggle to find an online loan that doesn’t require a credit check. Since most online lenders are not local to you, they rely on a credit check or background check to verify your ability to repay your debt.

The online lending networks listed above will run a soft credit check when you submit your initial loan request. This initial credit pull gives the lender access to a modified version of your credit report and doesn’t place a hard inquiry or cause any damage to your credit score.

Lenders use this information to prequalify you for a loan. If you accept a loan offer, the online lender may require a hard credit check for final approval.

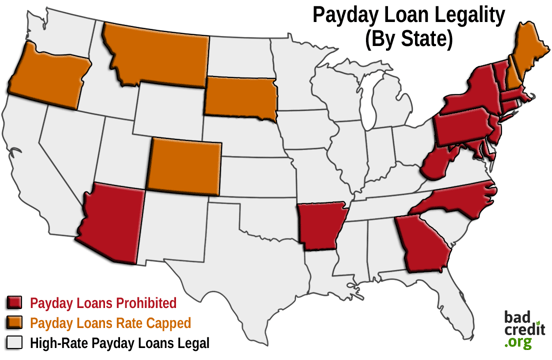

If you need to bypass a credit check altogether, your only option may be a local payday loan lender or a title loan agency in your town. Just keep in mind that the convenience of skipping a credit check comes with a cost — and that price will include a very high interest rate and other fees.

An in-person or online payday loan — or cash advance — is the most expensive option you may have. These lenders will want to see proof of income to verify that you can repay your debt within 15 to 30 days. As long as you can pass that test, you will likely qualify for a short term online payday loan.

But with an interest rate that will likely start around 400%, these are not loans that you should jump into without considering your other options.

A title loan may also skip the credit check process because it requires you to use your vehicle’s title as collateral in case you stop making payments.

If that happens, the lender can — and will — repossess your vehicle and sell it to recoup the money that he or she lost in the deal. These loans also feature high interest rates and other fees that make them very hard to pay off.

And, if you do not pay it off, you could find yourself out of money — and without a vehicle to get to work.

Can You Get a Loan on the Same Day That You Apply?

Most online lenders can approve your loan the same day you apply. Many can prequalify you in minutes and grant final approval once you finish your online loan paperwork — which often takes less than an hour to complete.

At that point, the online lender will release your money to a linked checking or savings account. Those funds could take up to one business day to arrive in your account. Some lenders offer a wire transfer option for a fee. This could put the money into your account in a matter of minutes.

If you need an instant cash loan, you may have to look at local lenders that can accept and process your loan application in person. This will allow the lender to pay out your loan on the spot via cash or check.

Another option would be a local bank or credit union where you maintain an account. While these financial institutions offer many traditional loan options with instant payouts to your account balance, they also rarely consider applications from account holders who have a bad credit score.

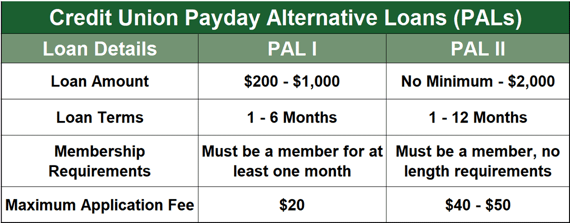

One exception is a Payday Alternative Loan (PAL) from your local credit union. These loans are designed to help consumers avoid the high fees associated with payday loans, and they often consider applications from consumers who have bad credit.

With a PAL, you can borrow between $200 and $1,000 in a quick loan that gives you from one to six months to repay the debt. You will have to open an account — or already have an account — at the credit union to qualify. You can have up to three PALs during a six-month period, but you can’t have more than one active PAL at a time.

A credit union can only charge the actual loan application processing costs as a fee on your PAL. This typically results in a $20 to $30 origination fee.

What Are the Requirements to Apply For a Loan?

Different lenders will require different information from applicants based on the type of loan they seek.

For example, a business loan will require background information about your business. An auto loan will require information about the car you’re purchasing. A mortgage loan will want to know a lot about the home you’re buying.

All personal loan lenders require certain information to process your application. This may include, but isn’t limited to:

- Your name

- Your Social Security number

- Your address, phone number, email address, and other contact information

- Your employment history

- Your current income information (with check stubs or other data)

- Your collateral (if seeking a secured loan)

- Proof of U.S. citizenship or legal residency

You may also have to provide a government-issued form of identification, which can include a passport, state identification card, driver’s license, or Social Security card.

What Can You Use an Online Loan For?

If you qualify for a personal loan, you can use the money in any way you choose. Unlike other types of loans, a personal loan has no limitations on how you use your loan proceeds.

You will not find that sort of freedom with other traditional loan types. For example, you can only purchase a vehicle with a car loan. You can’t use your student loans to buy a house.

A lender will still likely ask what your plans are with the quick loan proceeds. While your answer may not disqualify you from the unsecured loan, the lender may use the response to gauge your responsibility level.

For example, if your credit history states that you have many unpaid debts and you have a history of late payments, a lender may not want to lend you $5,000 to take a vacation. But that same loan may look more realistic if you are seeking money for household improvements or car repairs.

What is the Easiest Loan to Get Approved For?

Payday advance loans remain the easiest loans to qualify for. But just because these loans are easy to obtain doesn’t mean that they are your best options.

In the financial world, easy usually equates to expensive. That’s the case with payday advance loans. This form of emergency loan is meant to be a bridge between paydays. That’s why you only have between seven and 30 days to repay your debt.

The interest on these loans is often tremendous — and your interest rate increases if you can’t repay your debt on time. Therefore, most payday lenders suggest that you only use their services as a last resort.

Many consumers feel that a payday loan with a high interest rate is their only option because of their bad credit score. That is not always the case. Many online lenders specialize in bad credit loans and will compete with other lenders for your business.

That’s a great thing for consumers because it provides opportunities for loans that were once difficult to obtain. Even better, these loans often provide quick loan application decisions and the funds can be deposited within one business day.

Before you turn to your local payday loan center for same-day loans with no credit check, consider one of the online lending networks above. Although you may have to undergo a hard credit check to complete your official application, you’ll only be matched with lenders willing to work with you, so you may have a better chance of approval than you think.

Where Can I Borrow Money Fast Without a Credit Check?

If you need a small loan fast, your best bet is to find a local lender. Although an online lender can provide a quick loan application decision and easy approvals, you will need to undergo a credit check and will have to wait at least one business day for the money to arrive in your bank account.

If you do not want to submit to a credit check, consider a local payday loan center or look for secured loan options that require collateral to back your loan in case you stop making payments. These loans can include:

- Title loan: A title loan uses your vehicle’s title as collateral to secure your loan. Just remember that if you stop making payments, the lender can repossess your car and sell it to get his or her money back.

- Pawnshop loan: A pawnshop will accept certain items of value in exchange for a small loan that you must repay — with interest — typically within 30 days. If you fail to repay your loan, you will lose your pawned item and any of the money you paid toward the loan.

- Home equity loan: These loans may not be the fastest to complete, but they can use any equity you have in your mortgage to unlock a loan or revolving line of credit.

Secured loans may not require a credit check through a traditional credit bureau since you have a valuable item backing your loan. Even though you will have to collateralize something that is more valuable than the amount you borrow, these loans still charge high interest rates to make up for the lack of a credit check.

Keep that in mind when deciding which path you want to take when looking for a personal loan.

What Should I Consider Before Applying for Emergency Payday Loans?

Before you apply for a payday loan, you should make certain that you can repay the debt on time. Failing to do so could create a very large problem for you.

Payday loans are a short term loan product that requires repayment in one lump sum between 15 and 30 days. These loans start off with very high interest rates that typically generate approximately $15 worth of debt for every $100 you borrow.

But they get far more expensive if you can’t repay the debt on time. When your loan becomes past due, the lender will roll the debt over into a new loan for 30 days with an even higher interest rate and fee structure.

Your loan amounts owed can increase rapidly at this point. The loan will continue to roll over for every 30 days you can’t repay the debt.

These rollovers have serious consequences. One borrower took out five payday loans for $500 each and, after several rollovers, had to pay more than $50,000 to pay off the debt.

In addition to the interest rate, consider your loan term. Payday loans are a short-term loan. Instead of making payments to repay your debt, you must make one lump-sum payment for your entire amount owed in between seven and 30 days.

Although these loans may not require a credit check for approval, they will report your late payments and balances to the major credit bureaus, which can lower your credit score as your loan amounts increase. In short, never accept a payday loan unless you are certain you can repay the debt on time.

Obtain Same-Day Loans with No Credit Check Online

Online lenders have made it easier than ever to get a fast cash loan without ever leaving your home. These loans have flexible terms and will consider your application, even if you have bad credit.

The online lenders listed above will only conduct a soft credit check to preapprove your loan request. This will not affect your credit score and can help you obtain multiple loan offers to choose from.

Once you accept a loan offer, the lender you work with will have its own rules for your official application. While some may process your loan request without any further credit checks, others may require a hard credit check before approving your loan.

But don’t let that scare you away from seeking the loan you need. While you may have a bad credit score, your odds of approval may not be as bad as you think. Many online lenders will give you a second chance to rebuild your credit while granting you access to the loan you need to live your life.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.