There once was a time when you had to drag yourself to a bank branch to apply for a loan. This quaint practice is a fading memory to the millions of consumers who have filled out online loan applications.

The market for online lenders received a big boost during the Great Recession when banks became very reluctant lenders. Now, you can apply for a loan from the comfort of your favorite armchair, as witnessed by the lending companies we review here.

Online Personal Loan Applications

Personal loans require you to complete an online loan application and sign a credit agreement. You don’t need to post collateral for an online personal loan, and the lending services we review here can hook you up to a lender in a matter of minutes through a short online loan request form.

Online lenders save you time and energy searching for the best deal. The price of this convenience is that you must have a checking or savings account.

Short-Term Personal Loans For Bad Credit

These five lending services facilitate short-term personal loans. You can apply to them to find a lender who will provide you with a cash advance you repay on your next payday.

If approved, your loan proceeds will arrive promptly in your checking account, which the lender will access for repayment on the due date.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual is a loan-matching service with a short online loan request form. You can request a short-term cash advance of up to $5,000, and MoneyMutual will circulate your request to its lender network.

You then finish applying for the loan by completing the lender’s online application. The process should give you a decision within a few minutes and your loan proceeds by the next business day.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

The InstallmentLoans.com network of lenders can fund a short-term cash loan as soon as the next business day. The service may find you several loan options of up to $5,000.

This service doesn’t check your credit when you prequalify your loan request, so a poor credit score needn’t prevent you from applying. The website guards your privacy with AES 256-bit encryption.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com finds lenders that specialize in bad credit loans of up to $5,000. This company is happy to work with subprime consumers, having matched loans to more than 750,000 customers since 1998. Expect funding within a business day or two if you are approved for a loan.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com has an instant prequalification process that can immediately match you to multiple direct lenders. To prequalify, you must collect a regular income of at least $1,000 monthly.

SmartAdvances.com belongs to the Online Lenders Alliance (OLA), an organization committed to a responsible lending policy that complies with the letter and spirit of federal law.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% – 2,290% | Varies | See representative example |

CashAdvance.com lets you apply for a short-term loan of between $100 to $999 that you repay on your next payday. You can fill out its short loan request form to prequalify. You must be 18 years old, a US citizen, and have an income of at least $1,000 monthly after taxes.

Note that CashAdvance.com may not operate in your state, but it will alert you to that fact before you spend any time applying for an online personal loan.

Installment Personal Loans For Bad Credit

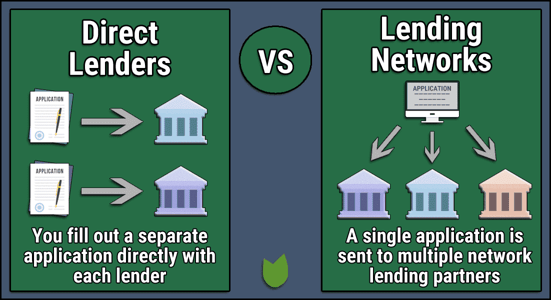

These four companies can prequalify your bad credit loan requests in minutes. They circulate your information to networks of lenders helping financially challenged borrowers looking for short- or long-term installment loans. A personal loan lending network is your best option when you want to reach dozens of lenders through a single request.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

The direct lenders on the 24/7 Lending Group network will promptly extend rate quotes to prequalified borrowers. The website doesn’t specify the required minimum income for a personal or business loan.

This loan-referral service works exclusively with lenders that adhere to the Fair Debt Collection Practices Act. 24/7 Lending Group earns a high rating from Trustpilot.

7. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com provides a short online form for you to fill out to request a loan of $500 or more. If you are a US citizen, age 18+, with an income of at least $1,000 per month, CashUSA.com can find you an installment loan provider.

The lender can approve the loan quickly after you fill out the application form and will deposit the funds into your checking account. Your loan proceeds could be available as soon as the next business day. Loans typically have a repayment term of three to 72 months.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com has long experience matching borrowers with installment loan providers, dating back to 1998. The lenders on the Bad Credit Loans network can get you a loan from $500 to $10,000, and all you need to do is fill out a short request form to get started.

You must be at least 18 years old and have regular income to qualify. You can use your loan for any purpose, including debt consolidation. Some sole proprietors use it as a business loan.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com can arrange an installment loan for as little as $500 to as much as $35,000. Unlike some other online services, PersonalLoans.com operates in all 50 states.

Its short online loan request form can put you in touch with a lender that can provide an installment loan with three- to 72-month terms. To qualify, you must be 18+, have US citizenship or residency, and receive a regular monthly income. After filling out the lender’s online loan application form, you’ll receive a decision quickly and your money as soon as tomorrow.

Online Car Loan Applications

The three following online loan services can prequalify your loan request and put you in touch with a local car dealer within minutes. You can apply for a new loan to purchase a vehicle or a cash-out refinance loan to put money in your hands. The financed car serves as collateral for your loan.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% – 29.99% | 1999 | 3 minutes | 9.5/10 |

It takes only three minutes to fill out the Auto Credit Express online loan request form. You provide basic information about your residence and income, and the matching service finds you a local dealer willing to work with you.

Auto Credit Express is happy to help borrowers of any credit type, as evidenced by its record of more than $1 billion in loans arranged since 1999. The dealer found by this lending service will complete the online application process and quickly decide on your loan.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com Auto Loans has one of the largest dealership networks in the United States. It takes only a couple of minutes to complete the online loan request with information such as your income, address, and Social Security number. Bad credit is OK and has been since 1994 when Car.Loan.com went into business.

The dealer provided by this matching service will explain your options and take your application. Expect a quick decision once you submit the online application.

12. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

The LendingTree network can put you in touch with up to five bad credit car loan offers within minutes. Each lender sets its own unique set of loan terms.

You can accept an offer and complete the loan process on the same day. You may be able to purchase your next vehicle within 24 hours of submitting your finance application form.

Online Home Loan Applications

Online home loans include mortgage and home equity refinancing loans. Two of the following companies help you find a loan or home equity line of credit, while the third is a direct loan provider. The application process is much more convenient than a trip or two to your local bank branch to get a loan.

13. eMortgage

- Get today’s mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

eMortgage arranges bad credit loans to consumers looking to purchase or refinance a residential property. The company uses a home loan lender network to identify suitable offers.

You can complete the eMortgage® online loan request form in only a few minutes and receive multiple competitive offers immediately.

14. Rocket Mortgage

- America’s largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

Rocket Mortgage is a direct loan provider and winner of the JD Power Customer Satisfaction Award for eight consecutive years. It offers mortgage loans on residential properties to buyers with any type of credit. You can also get a home equity line from Rocket Mortgage.

Applying for bad credit mortgage loans takes only minutes — just answer a few questions about what kind of property you want and when you want it. You must also provide information about your credit and finances. The entire process is entirely online, quick, and easy.

15. FHA Rate Guide

- Options for home purchase or refinance

- Get 4 free refinance quotes in 30 seconds

- Network of lenders compete for your loan

- Trusted by 2 million+ home loan borrowers to date

- Interest rates are near all-time lows

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2004 | 4 minutes | 8.5/10 |

FHA Rate Guide provides you with the information you need to find a suitable provider of FHA-guaranteed home loans. It takes about 30 seconds to answer a few questions that can get you multiple quotes.

FHA Rate Guide will perform a soft credit check that will not affect your credit history or score. Armed with the information provided by this service, you can apply to one or more lenders online.

Why Should I Apply For a Loan Online?

Nothing beats the ease and convenience of applying for a loan from a comfortable location. That’s the advantage of loan-finding online services, but they offer many other advantages,

including:

- Prequalifying you for a loan: For example, a lending service can verify that you have a US address and Social Security number and have reached the minimum age. Prequalifying requires no obligation or cost. The loan matching services receive fees from lenders, not borrowers.

- Providing one-stop shopping at a website rather than visiting a bank: Some matching services provide a single lead, while others offer multiple matches. You can compare loan rates and terms easily from the comfort of your home.

- Providing fast applications and decisions: The initial loan request takes three minutes or less, and the whole process can be completed within another few minutes. In contrast, banks are notoriously slow and are known for extensive paperwork.

- Underwriting beyond credit scores. Many online lenders specialize in loans to bad credit consumers. They can do this by looking beyond your FICO score and credit history to factors such as income and co-signers. Indeed, some lenders provide no-credit-check loans, and others require only a soft credit check that preserves your credit score.

- Providing convenient money transfers: Many lenders will transfer the loan proceeds to your checking or savings account after approval. Then, when the loan payment is due, the lender will remove the money from your bank account — no trips to the bank are necessary.

- Offering educational resources: Check out the websites of the lending services. You may be pleasantly surprised by the amount of educational material typically provided by these websites. You can learn about your rights as a borrower and how the loan service works.

These factors make online lender-matching services convenient, fast, and accessible.

What Is the Easiest Loan to Get Approved For?

Loans that do not require a credit check are the easiest to obtain. They include:

- Pawnshop loans: Pawnshops contain shelves of items that once collateralized loans. You can bring in personal property (e.g., watches, cameras, musical instruments, jewelry, guns, etc.) and receive a short-term loan for about 30 to 50 cents on the dollar. You’ll receive a pawn ticket to reclaim your property by a specified date.

These loans are expensive, with triple-digit APRs and additional fees. The pawnbroker will put the item up for sale if you fail to redeem your ticket before the end of the repayment term. To qualify for a loan, you must be 18, have a valid state ID, and provide your Social Security number.

- Payday loans: Online payday loans provide cash to folks who collect a steady income from a job or government benefits. You can get a payday loan without a hard credit check. You’ll face triple-digit loan rates and a lump-sum repayment in one to four weeks (i.e., on your next pay date).

The lender will automatically roll over your loan if you fail to repay it on time, adding additional fees each time. Repeated rollovers can send you into a debt spiral that could lead to bankruptcy. - Car title loans: A car title loan uses your fully paid vehicle for collateral. To get one, you grant the lender a lien, enabling it to repossess your vehicle if you fail to repay. Unfortunately, 20% of title loans result in repossession. These loans also come with astronomical interest rates and short repayment periods. You can usually borrow up to half of your car’s value through a title loan.

- Credit card cash advances: Once you own a credit card, you can get a cash advance for up to the permitted limit without a credit check or paperwork. You incur daily interest on cash advances (with a maximum APR of 36%) and a transaction fee of 3% to 5%. Credit cards report your payments to at least one credit bureau. This reporting lets you use your timely payments to help you earn a higher credit score.

- Loans from friends and family: Your friends and family may agree to lend you money when you need it quickly. Frequently, these loans don’t have any interest charges or repayment deadlines. But take care not to ruin your relationship with the lender by failing to repay the loan.

Clearly, you have multiple options when you need to borrow money quickly. But some are very expensive (such as pawnshop, title, and payday loans) and are best avoided when possible.

How Can I Get a Loan Immediately?

An online matching service offers one of the fastest ways to find a loan provider. These companies work with a network of lenders, many of which specialize in subprime loans that issue funds by the next business day.

The reviewed personal loan lending networks follow a standard process. You begin by submitting an online loan request with data about your income, job, and monthly rent or mortgage payments.

The loan-matching services check your information but do not pull your credit, which means your credit score will not suffer damage. If you prequalify for a loan, the service will connect you to a lender’s website or send you the links of willing loan providers.

Next, you must disclose any additional required information, including proof of income and other loan documents — bank statements, pay stubs, 1099s, W-4s, tax returns, etc. The lender will usually perform a hard credit inquiry before deciding whether to OK your application.

If your loan documents and information meet the prerequisites, you’ll receive a loan agreement with all the details, including the loan amount, fees, interest rate, and loan term. Offers for installment loans will also specify your monthly payment amount.

You need to read all the information before agreeing to the loan offer. You can then e-sign the loan agreement if the terms are acceptable. Your funds should appear in your checking account on the same or next business day.

Can I Apply Online For a Bank or Credit Union Loan?

An individual or small business with bad credit will find it challenging to obtain a loan from a bank loan officer. Most banks are risk-averse and focus on financial protection and require collateral when dealing with subprime borrowers.

You may have better luck asking the loan officer for an auto or home equity loan since the underlying assets act as collateral. If you qualify for an FHA-guaranteed loan, you should have no problem borrowing from an approved bank.

A credit union is a friendlier financial institution. That doesn’t necessarily mean they will grant you a personal loan if your credit is bad, but they are more likely than banks to do so.

Credit unions also offer Payday Alternative Loans (PALs) that do not require good credit. The National Credit Union Administration created these loans to protect members from predatory interest rates.

The two types, PAL I and PAL II, require credit union membership. You must wait 30 days after joining a credit union to apply for the PAL I, but the PAL II has no such delay. A PAL II lends up to $2,000 at an attractive interest rate and a low fee.

You can take up to a year to repay the loan, and there is no prepayment penalty. Only members of the National Credit Union Administration can offer PALs.

Is Getting a Loan Online Safe?

The internet introduced a new era of convenience and speed. Unfortunately, it also raises safety concerns that can affect anyone.

Getting a loan online can be pretty safe when you deal with a reputable loan company, such as the ones we review in this article. But some no-name lenders may be crooked.

You may be vulnerable to these particular threats from a dishonest lender:

- A fraudulent lender can extract high fees and then fail to deliver a loan. You must never pay a fee before receiving a loan — use lenders that subtract any upfront fees from the loan proceeds and ensure you have the fee schedule in writing.

- A shady lender may charge you too much money for your loan. You can end up paying thousands more than necessary.

- Identity theft is a genuine concern when you work with a no-name lender. Think of all the confidential information (i.e., bank account number, Social Security number, etc.) a lender collects and how having that information can enable a fraudster to steal your identity.

You can rest assured that any lending company we recommend is an honest and safe financial institution. They all use encryption techniques to ensure thieves don’t steal your data, and all provide a clear statement of their privacy policies online.

Of course, consumers can also take steps to increase the safety of online commerce. For example, consider getting a virtual private network (VPN) service that protects you from data theft when using public wifi.

Online Lenders Provide Many Options

You no longer have to rely on your bank or credit union to get a loan. Online lenders have carved out a significant portion of the loan market. They offer online loan applications that are convenient and fast.

As you can see from the lending companies reviewed here, you have plenty of options for a cash advance, installment loan, car loan, or home loan. You should emphasize financial protection by patronizing only reputable lenders.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.