No-Denial Payday Loans in 2024

In the best of all possible worlds, you would always have surefire access to borrowed money. Our world is far from the best, yet some loans come close to guaranteed approval without collateral.

These are no-denial payday loans, with only age and income requirements separating you from fast cash. In other words, payday lenders will never deny you loan approval because of your poor credit.

This review covers the best online lending networks for payday and personal loans. We also describe other no-denial loans that will approve you when no one else will. Read on to learn how to avoid rejection, at least in this small portion of our imperfect world.

Best No-Denial Payday and Personal Loans

Most of these lending networks can find you personal or payday loans with next-business-day funding. They will prequalify your loan request and locate one or more direct payday loans without cost or obligation.

| |

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews

- See official site, terms, and details »

| Loan Amount | $500 to $35,000 |

| Interest Rate | 5.99% – 35.99% |

| Loan Term | 60 Days to 72 Months |

| Loan Example | Representative example |

| Our Expert Review | 4.7/5.0 (see review) |

You can contact 24/7 Lending Group whenever you need an easy-to-get personal loan. By filling out a short loan request form, you may receive multiple offers within minutes. 24/7 Lending Group earns an “Excellent” rating from Trustpilot, and the company only uses lenders that comply with the Fair Debt Collection Practices Act.

2. Avant

| |

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details »

| Loan Amount | $2,000 to $35,000 |

| Interest Rate | 9.95% – 35.99% |

| Loan Term | 12 to 60 Months |

| Loan Example | Representative example |

Avant invites loan requests from borrowers who need fast cash right away. It can get you approved for a loan the same day you apply, and you can see the money in your bank account as soon as the next business day. The flexibility of installment loan terms may help you afford monthly payments without breaking your budget.

3. Upstart

| |

- Personal loans of $1,000 to $50,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 580+ FICO

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details »

| Loan Amount | $1,000 to $50,000 |

| Interest Rate | 6.40% – 35.99% |

| Loan Term | 3 or 5 Years |

| Loan Example | Representative example |

Upstart can get you a personal loan to fit your requirements even if your credit score is low. To prequalify, you must earn at least $1,000 monthly income from work, government benefits, or other reliable sources. As is true of all the reviewed lending networks, Upstart will not pull your credit to see if you prequalify for a loan offer.

4. MoneyMutual

| |

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details »

| Loan Amount | Up to $5,000 |

| Interest Rate | Varies |

| Loan Term | Varies |

| Loan Example | Representative example |

| Our Expert Review | 4.8/5.0 (see review) |

MoneyMutual finds both personal and payday loans online. The prequalification process is the same for either loan type. After you prequalify, MoneyMutual usually takes only minutes to connect you to a direct payday lender. You must be 18 or older with a monthly income of at least $800 to be eligible for a short-term loan.

5. CashUSA.com

| |

- Loans from $500 to $10,000

- All credit types accepted

- Loan requests can be approved in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details »

| Loan Amount | $500 to $10,000 |

| Interest Rate | 5.99% – 35.99% |

| Loan Term | 3 to 72 Months |

| Loan Example | Representative example |

| Our Expert Review | 4.7/5.0 (see review) |

CashUSA.com locates providers of short-term loans through its extensive online network. You must be 18+ years old with a monthly after-tax income of at least $1,000 to prequalify. CashUSA is a good alternative when you need a personal installment loan of up to $10,000 and next-day funding.

| |

- Personal loans from $100 to $20,000

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details »

| Loan Amount | $100 to $20,000 |

| Interest Rate | Varies |

| Loan Term | Varies |

| Loan Example | Representative example |

| Our Expert Review | 4.6/5.0 (see review) |

SmartAdvances.com helps you quickly connect with a direct lender. You must have a monthly income of at least $1,000 to prequalify for a personal loan. SmartAdvances.com is an Online Lenders Alliance (OLA) member and actively complies with federal fair-lending laws.

| |

- Loans from $500 to $10,000

- Helping those with bad credit since 1998

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next day

- See official site, terms, and details »

| Loan Amount | $500 to $10,000 |

| Interest Rate | 5.99% – 35.99% |

| Loan Term | 3 to 60 Months |

| Loan Example | Representative example |

| Our Expert Review | 4.6/5.0 (see review) |

BadCreditLoans.com can prequalify you for a personal loan, whatever your credit history or score. The company, founded in 1998, can help you borrow loan amounts of up to $10,000. The direct personal loan lenders on this network charge interest rates much lower than those of payday lenders.

What Is a No-Denial Payday Loan?

No-denial payday loans do not perform a credit check and will not deny a loan request because of no, limited, or bad credit. You repay these short-term loans when you receive your next paycheck in one to four weeks.

You are typically eligible for an online payday loan if you:

- Are a US citizen or permanent resident

- Are at least 18 years old

- Have a steady income from employment or government benefits

- Have a Social Security number

- Have a valid checking account, email address, and phone number

As you can see, a credit check is unnecessary, and you can get a loan even with very poor credit.

How Do Payday Loans Work?

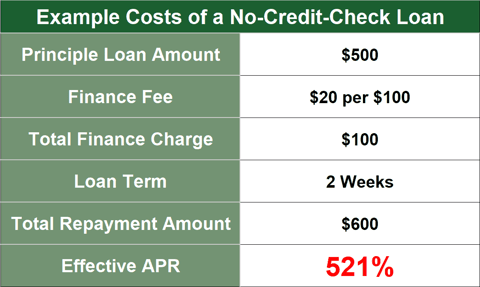

Storefront and online payday loans work by extending short-term cash advances on your wages that you repay on your next pay date. These loans charge 300% and higher APRs, but their small size and short deadlines limit their overall cost.

You apply to a network that facilitates online payday loans by submitting a short loan request form with information about yourself and your income. The loan-finding service prequalifies your bad credit loan eligibility and locates one or more direct payday lenders. You can then provide any other required information and submit the final loan application.

If the online payday lender approves your request, you’ll receive a loan agreement that specifies the loan amount, financing fee, and repayment due date. It also describes the consequences of failing to repay the bad credit loan on time, at which point the lender will:

- Add another financing fee to your loan principal

- Calculate your new financing fee

- Roll your loan over to your next pay date

Since payday loan rollovers increase your loan principal, you can fall into a debt spiral if you repeatedly fail to repay on time.

You can e-sign the agreement if you find the terms satisfactory. The lender will dispatch the proceeds to your bank account, where they may arrive as soon as the next business day.

Guaranteed payday loans do not build credit because payday lenders don’t report your payments to the major credit bureaus — Experian, Equifax, and TransUnion. But payday loans can hurt your credit by reporting the following:

- Loans more than 30 days overdue

- Loans sent into collection

- Collection lawsuits

The most substantial damage occurs if you must seek bankruptcy protection. Your credit score can significantly decline, and the bankruptcy will remain on your credit reports for up to 10 years.

Because of the riskiness and high interest rates of payday loans, it’s best to consider them an emergency loan for use when you don’t have better alternatives.

How Do You Borrow Money When No One Will Approve You?

The following offer the easiest loan approval:

- Pawnshop Loans: You can quickly obtain a pawnshop loan by pledging personal property such as watches, handguns, jewelry, electronics, and musical instruments. The loan amounts are about half the value of your collateral, and APRs are often 300% or higher. The pawnshop will sell your property if you fail to repay the loan by a set date.

- Loans From Friends and Family: These informal loans usually charge little or no interest. But you risk harming your personal relationship with the lender if you don’t repay the loan.

- Cash Advance Apps: These apps give you early access to pay you’ve already earned. Typically, you link the app to your work time sheet and bank account. Cash loan limits usually start at $100 and can increase to $500 over time. Fees may apply, but most of these apps do not charge interest. The apps automatically draw repayments from your bank account on your next pay date.

- Auto Title Loans: You can use the title to a car as collateral for an expensive title loan. The title must be clear, without any outstanding auto loan debt or liens on the vehicle. Expect to pay APRs of 300% or more for a title loan. The lender will repo a car if the borrower fails to repay on time.

- Credit Union PALs: Payday Alternative Loans (PALs) let you borrow at a fixed APR no higher than 28% for cash loan amounts up to $2,000. To qualify for a PAL, you must belong to a National Credit Union Administration (NCUA) credit union. PALs are much cheaper than payday loans but not necessarily easier to get.

All these options can tide you over when you need an emergency loan. But the long-term solution is to live within your means through some combination of increasing your income and reducing your spending.

Avoid Rejection With a No-Denial Payday Loan

No-denial payday loans are popular with several population segments, especially lower-income individuals and recent immigrants. But they are available to just about anyone over 18 with sufficient income. They, pawnshop, and auto title loans should be your last choices since all three charge triple-digit APRs.

Nonetheless, no-denial payday loans can provide fast cash when you need to borrow now.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.