The following quote from the Federal Trade Commission should send a chill down your spine:

“Debt relief service scams target consumers with significant credit card debt by falsely promising to negotiate with their creditors to settle or otherwise reduce consumers’ repayment obligations. These operations often charge cash-strapped consumers a large up-front fee, but then fail to help them settle or lower their debts – if they provide any service at all. Some debt relief scams even tout their services using automated “robocalls” to consumers on the Do-Not-Call List.”

Given this environment, it can be hard to know which debt settlement companies to trust. It’s valid to wonder whether National Debt Relief is legit.

Yes, National Debt Relief Is a Legitimate Company

National Debt Relief is the nation’s leading debt management company. It is a legitimate, widely-admired company that has earned thousands of “Excellent” reviews from past clients. The company prides itself on its transparency and honesty in dealing with its clients, refraining from quoting inflated statistics or setting expectations radically high.

To that end, it assesses potential clients individually before enrolling them in its program. Sometimes, the company will conclude that other options, such as debt consolidation or bankruptcy, may be better. It will recommend the debt management plan most appropriate to your needs.

- Requires $10,000 or more in credit card debt

- Free, no-obligation debt analysis

- Specializes in credit card and medical debt

- Also handles debt from personal loans, private student loans, lines of credit, and collections

- Does not handle IRS, utility, federal student loans or mortgage debt

- Long-term program to relieve debt over 24-48 month period

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Free Consultation? | Reputation Score |

|---|---|---|---|

| A+ | 2009 | Yes | 9.5/10 |

You can sign up for a debt relief plan without contracts or penalties and cancel anytime. Furthermore, the company doesn’t charge any up-front fees. Instead, it waits to collect its fee until you see results.

How the Process Works

National Debt Relief assigns you a certified debt counselor when you sign up for the service. These counselors are professional debt arbitrators who understand how to negotiate a debt settlement. Your counselor is responsible for drawing up a debt management plan customized to your situation.

Your enrolled debt is the total debt (excluding a home equity loan, car loan, and other secured debt) you owe when you sign up for debt relief. The types of unsecured debt that National Debt Relief can help with include:

- Business debts

- Credit cards

- Lines of credit

- Medical bills

- Personal loans

- Private student loan relief

- Referral to a debt collector

- Repossessions

NDR does not handle federal student loan relief, secured debt, or IRS back taxes. If you wish your creditors to forgive some of your enrolled debt, your certified debt counselor will have you stop paying your creditors, instead redirecting payments to an NDR escrow account.

This arrangement will continue for several months until you have accumulated a significant sum in escrow. At that point, your counselor will begin to negotiate with your creditors. The quid pro quo is this: If the creditor is willing to forgive part of your debt (i.e., up to 50%), you will repay the remainder from your escrow account over the next two to four years.

The implicit (or sometimes explicit) threat is that you will file for bankruptcy if the creditor doesn’t play ball. Should this happen, the creditor may end up collecting nothing.

Outcomes

Creditors may decline a debt settlement offer, instead sending the unpaid debt to a debt collector. Alternatively, a creditor can propose a different deal, or if the debt is large enough, file a lawsuit against you.

On the other hand, a creditor may agree to the counselor’s debt settlement offer. You and the creditor sign an agreement specifying all the terms, including the amounts to be forgiven and repaid, and a promise by the creditor never to sue you for the amount forgiven. The process repeats for each creditor to whom you owe money.

If you reach an agreement with a creditor, you will continue to make payments to the escrow account set up by National Debt Relief. The credit counselor will make monthly payment disbursements from escrow as per the signed agreements. The anticipated outcome is that you’ll discharge all your enrolled debt within 24 to 48 months.

Costs

There are monetary and credit score costs when you settle debts. National Debt Relief will receive a fee equal to a percentage (typically 15 to 25%) of the enrolled debt.

For example, if the company reduces your total debt from $40,000 to $20,000, you’ll pay National Debt Relief a percentage of the $40,000 enrolled debt. If the company receives fees equal to 20% of the enrolled debt (i.e., 0.20 x $40,000 = $8,000), then your net pre-tax savings will be the forgiven debt minus the fees (i.e., $20,000 – $8,000) or $12,000.

Debt settlements significantly damage your credit score. Your credit reports list settlements for seven years, after which the credit bureaus must delete the entries.

You should expect unpaid creditors to assess late fees. Even the best credit card is likely to charge late fees of up to $41 per occurrence.

Customer Reviews

National Debt Relief takes pride in its reputation among its debt management customers. The facts seem to bear it out. For example, Trustpilot gives NDR an “Excellent” rating of 4.7 out of 5, with more than 21,000 five-star reviews.

The Better Business Bureau named NDR an accredited debt relief company in 2013 and currently assigns it an A+ rating. Customer reviews posted on the BBB website earn a score of 4.58 out of 5. NDR closed 256 BBB complaints in the last three years and 86 in the previous 12 months.

Additionally, Top Consumer Reviews named NDR the best debt consolidation company in 2022, and ConsumerAdvocate.org named it a Top Pick. NDR is an accredited member of the American Fair Credit Council, demonstrating its commitment to the highest operational standards.

The NDR website shares some of the feedback it receives from customers. Not surprisingly, those examples are uniformly positive, such as this customer’s National Debt Relief review:

“From the first call, National Debt Relief wanted to help me and showed me how I could be successful and get debt free without being judged.”

Best Alternatives to National Debt Relief

While National Debt Relief work products are highly-rated, it competes with several other legitimate debt settlement companies. Here are two to consider if you’d like to investigate another debt relief option.

- 100% confidential, no-obligation consultation

- Specializes in unsecured debts over $10,000

- In business since 2000

- Options for debt settlement, consolidation, and tax debt

- Get a 100% free, personalized savings estimate from a debt professional

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Free Consultation? | Reputation Score |

|---|---|---|---|

| (No Grade) | 2000 | Yes | 9.0/10 |

CuraDebt has helped more than 200,000 consumers since its founding in 2000. It offers debt-relief options in most states, except for the following: Connecticut, Hawaii, Idadho, Kansas, Louisiana, Maine, Montana, New Hampshire, Nevada, Oregon, South Carolina, Tennessee, Utah, Vermont, West Virginia, and Wyoming. CuraDebt predicts that clients can reduce their debt costs, after fees, by 30% over a two-to-four-year period.

This debt settlement company belongs to the Netcheck Commerce Bureau, Online Business Bureau, and Honest Online. CuraDebt’s Trustpilot score is 4.1 out of 5. It is not an accredited debt relief company with the BBB, but it does earn an A+ rating.

- Toll-free assessment: 1-855-299-9573

- Minimum $10,000 in debt required

- Learn about your debt relief options

- AFCC accredited member

- Resolve debts in as little as 24 to 48 months

- $5 Billion in debt resolved – #1 in America

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Free Consultation? | Reputation Score |

|---|---|---|---|

| A+ | 2002 | Yes | 9.5/10 |

Freedom Debt Relief has enrolled more than 650,000 clients and resolved more than $10 billion in debt. The company arranges unsecured debt settlement (it does not handle secured debt) and can settle debts for as little as 50% of the amount owed. The company’s Trustpilot score is 4.5 out of 5. This debt relief option is BBB-accredited and earns an A+ rating.

Fees range from 15% to 25%, depending on where you live. You may receive assistance from the company’s Legal Partner Network if you make your escrow deposits on time.

Frequently Asked Questions About National Debt Relief

We answer several of your frequently asked questions about National Debt Relief.

So, What Are the Pros and Cons of National Debt Relief?

The pros of National Debt Relief are:

- Deferred billing: NDR does not charge an upfront fee but waits until it delivers results

- Free consultation: Prospective clients receive a free, no-obligation initial consultation

- Good ratings: NDR has positive ratings from TrustPilot and the Better Business Bureau

- Convenient online portal: You can track your current progress online

The cons of National Debt Relief are:

- Steep fees: NDR charges 15% to 25% of your enrolled debt

- No guarantees: NDR doesn’t guarantee that your creditors will negotiate with it. Nor does it ensure that your creditors won’t refer you for debt collection or sue you when you stop paying your bills.

- Credit score damage: Settlements significantly damage credit scores and remain on credit reports for seven years, although your bad credit score should start to recover once you’ve completed the program.

- Lacks a mobile app: Several competitors of NDR offer mobile apps.

NDR’s pros and cons are on par with those of several other leading debt settlement service providers.

Does Debt Relief Damage Your Credit?

Yes, debt relief can cause your credit score to drop by dozens of points, perhaps more. Creditors are usually wary of extending credit or lending to consumers who have used debt relief, as it increases the risk of not getting paid. Your resulting bad credit score will complicate your future credit applications.

Settled accounts remain on your credit reports for seven years, but you’ll usually complete your relief program in two to four years, at which time your credit score should begin to recover.

Credit damage can occur even if your attempts to negotiate a settlement fail. Your credit reports may include entries for delinquent accounts, debt collection referrals, and, in the worst-case scenario, bankruptcy.

What Are the Alternatives to Debt Relief?

The three main alternatives to debt relief are credit counseling, debt consolidation, and bankruptcy.

Credit Counseling

Free credit counseling is available throughout the country. It is an attractive option for consumers who don’t want to risk damage to their credit scores.

Enlisting a counselor can help you prepare and follow a budget. You learn responsible credit habits, such as scheduling your payments well in advance and living within your means. Credit counselors, who need not be professional debt arbitrators, can also help you obtain a debt consolidation loan.

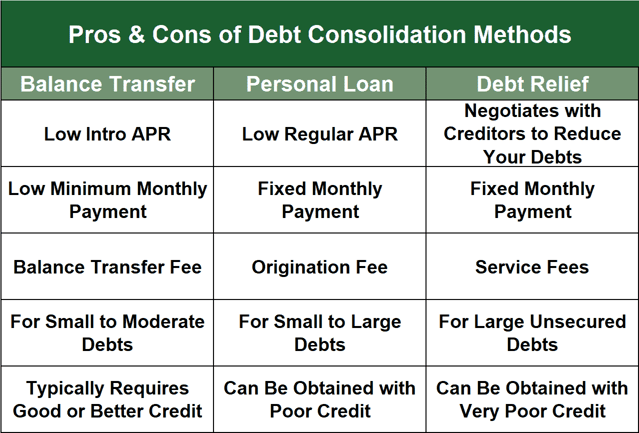

Debt Consolidation

You probably won’t receive any debt forgiveness if you consolidate your debts through balance transfers or a personal loan rather than settle them. On the positive side, the effect on your credit will be considerably less.

Debt consolidation requires you to use a new loan (or a new credit card) to pay off existing loans and credit card balances. Hopefully, the new debt’s interest rate is less than the weighted average of your existing debt. In the process, you reduce your monthly payment obligation to one you can afford.

Bankruptcy

Bankruptcy can relieve your debt, but it severely damages your credit score and remains on your reports for up to 10 years.

Chapter 7 bankruptcy removes your debt, but you may lose property in the process. Essentially, Chapter 7 wipes your financial slate clean, although the negative mark remains on your credit report for 10 years.

Chapter 13 bankruptcy reorganizes your debt, which means you will pay back part or all of what you owe according to a court-imposed schedule. In return, you get to keep your property. Chapter 13 bankruptcy remains on your credit reports for seven years.

Do You Have to Pay Taxes on Debt Relief?

You must pay income taxes on any canceled debt amounts. Let’s extend our previous example in which the forgiven debt is $20,000, and you saved $12,000 after fees. If you are in the 12% federal tax bracket, the tax bill will be $2,400 (i.e., 0.12 x $20,000). Your after-tax savings will be ($12,000 – $2,400), or $9,600.

Debt settlement fees are usually not deductible. However, if you own a business that uses a debt settlement service, the costs may be deductible – consult your tax advisor or lawyer.

How Can I Spot a Debt Relief Scam?

Debt relief scams can assume several guises. A scam artist may promise to negotiate debt forgiveness with creditors but steal the money meant for escrow instead. Others may dishonestly guarantee results or illegally collect up-front fees.

Be on the lookout for the following signs of a dishonest debt relief program:

- Advises you cut off all communications with creditors

- Demands upfront fee payments

- Guarantees results

- Uses high-pressure tactics to act quickly

- Minimizes the risks involved in debt settlement

- Requests for access to your bank accounts

- Unwillingness to put promises in writing

If you run across a phony debt relief program, immediately try to stop any check or credit card payments you made. You should also file a complaint with the local police. The FTC asks you to report your experience online to any of the following sites:

- The FTC Report Fraud website

- The Consumer Financial Protection Bureau complaint portal

- The FBI’s Internet Crime Complaint Center

In addition, check whether a debt relief scammer has stolen your identity. You can do so by checking your credit reports for any activity you don’t recognize.

You Can Trust National Debt Relief

The answer from this National Debt Relief review to the question, “Is National Debt Relief legit?” is a solid yes. Trustpilot, Top Consumer Reviews, ConsumerAdvocate.org, and the BBB give it high marks. Furthermore, it belongs to organizations that promote ethical conduct.

While NDR can’t guarantee that every customer will save money, we do not doubt that this debt settlement company will deal with you in an honest and straightforward manner.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.