How Having Good Credit May Help You Get a Job (Feb. 2024)

Did you know good credit can do more for you than help you get approved for a loan? For some people, good credit may help you get a job. While not every state allows it — in fact, 10 states actually prevent or restrict credit checks on employees — a potential employer could look up your credit report as part of their hiring process.

While a potential employer accessing your credit report doesn’t automatically mean you’ll be turned down for a job if your credit report isn’t perfect, some employers may weigh your credit history in their hiring decisions. We’ll explore this topic in the article below by looking at why good credit matters to employers and steps you can take to improve your credit if it has taken a dive.

Good Credit Matters | Employers Can’t See Credit Scores |

Credit Repair and Good Credit Behaviors

Why Good Credit Matters to Employers

When employers go through a hiring process, they want to know they’re selecting from a pool of trustworthy candidates. Accessing a job seeker’s credit report helps the employer determine:

- 1. If you are a potential risk. If the job seeker is overextended with debt, in the middle of a bankruptcy, or experiencing some other financial trouble, it could indicate that the person may be a potential financial risk for the company.

- 2. If you are responsible. Credit reports can show whether the job seeker has a record of paying bills and debt on time. Having a positive payment history indicates you are reliable and responsible — both traits that get two big thumbs up from employers.

One of the biggest red flags for potential employers is a bankruptcy discharge, which can indicate that you don’t handle your finances well. Even if a bankruptcy is recent, however, many employers won’t automatically discount you as a job candidate without giving you a chance to explain your situation; a bankruptcy can mean a lot of things.

For example, maybe you went through a divorce or a serious medical issue that resulted in a struggle with your finances. In that case, employers understand that it was not caused by poor financial decisions or management.

Other types of data from your credit report that may interest a potential employer are your utilization rates and payment history. A high utilization rate can mean financial problems or irresponsibility, just as a history of late payments or an account in collections can be a sign of carelessness or a lack of organization.

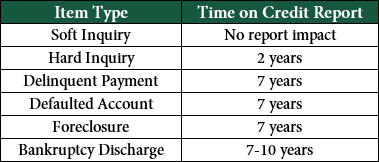

On the plus side, most negative accounts have an expiration date, and won’t stick around forever. For example, let’s say you had a bankruptcy in your past, which places a flag on your credit report. Once the bankruptcy is far enough behind you, that flag gets removed and no longer appears on your credit report.

Depending on the type of bankruptcy filed, it should naturally be removed from your credit after seven to 10 years. If you’ve had a past bankruptcy, it’s important to check your credit report to make sure the bankruptcy has been removed after the determined amount of time. If an old bankruptcy has not been removed as it should, you will need to dispute the error with the credit bureaus.

Employers Can’t Access Your Credit Score

While having an employer delve into your credit history may feel unnerving, there is one thing that remains off-limits to them: your credit score. Despite the misconception that if an employer checks your credit report, they must be accessing your credit score, this isn’t true. A credit report and credit score are two different things.

Your credit score is a number derived from all the information in your credit report. And while employers can access your report, they aren’t able to see your credit score. However, don’t assume that the lack of a credit score means employers won’t be able to tell if you have poor credit. Since your credit score is based on your credit report, a poor score indicates you have negative items on your reports.

Maybe you missed a credit card payment or two, paid your bills late, defaulted on a loan, or gotten yourself into too much debt. Any of those issues will be captured in your report and visible to an employer. Therefore, doing your best to improve your credit is advised. If an employer checks your report, they’ll notice your efforts.

Behaviors that Lead to Good Credit

Having good credit doesn’t guarantee you’ll get hired, just like bad credit doesn’t automatically disqualify you from a job. But since good credit is important to so many aspects of our lives, practicing the behaviors and attitudes that earn good credit is essential. You’ll also find that, when it comes to employability, those same behaviors and attitudes tend to earn high marks, too.

-

- Pay on time. The largest percentage of your credit score is attributed to your history of making payments when they’re due. Late or missed payments will lower your credit score and show up on your credit report. Being scrupulous with your bills and debts shows potential employers that you’ll likely be scrupulous on the job, too.

- Reduce your debt. Living above your means or relying on a credit card to pay for life’s necessities eventually catches up with you. For one, approaching your credit limit hurts your credit score. It also shows employers that you may not be able to stick to a budget or curb your spending impulses. It’s best to make small purchases on credit and pay them off every month. If you do carry a balance on your credit card, keeping it at 30 percent or less of your available credit will have a positive impact on your credit score.

- Check your credit report regularly. Even if you think you have a spotless credit history, there could be errors lurking on your credit report that you don’t even know about. Unfortunately, credit bureaus can make mistakes, which means the mistakes need to be found and fixed to avoid further impact on your credit. There are professional credit repair services that can help you find and address any errors with the credit bureau.Lexington Law is one of our top choices for credit repair services out there. And fixing a mistake on your report can go a long way toward improving your score if your report is in good shape otherwise.

- If you’ve had past issues, take steps to improve. No one is perfect. If you made some mistakes with money in the past, there’s no reason why you can’t make up for them now. The silver lining with poor credit is that nothing is permanent and everything can be improved. Set a budget for yourself and stick to it. Pay off past debts and negotiate payment plans if you have to. Do what it takes to tidy up your credit issues and stabilize your finances. That same fortitude and patience will be rewarded on the job, too.

| |

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details »

| Better Business Bureau | See BBB Listing |

| In Business Since | 2004 |

| Monthly Cost | $99.95 |

| Reputation Score | 8/10 |

| Our Expert Review | 4.9/5.0 (see review) |

If a job hunt is in your future, be sure to take an inventory of your credit health before applying. Doing so will work to your advantage. Knowing what’s on your credit report and what a potential employer may ask you means you’ll be prepared and ready to respond.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.