This collection of secured and unsecured credit cards for rebuilding bad credit should interest American consumers who have messed up their credit for any number of reasons. If your credit score makes you uncomfortable, take heart — these cards can help you regain your mojo.

Unsecured Credit Cards to Rebuild Credit

Obtaining an unsecured credit card does not require a deposit. That’s good and bad — good because unsecured cards don’t tie up your money, but bad because they are harder to get approved for.

Within the unsecured credit universe, the following cards make it their business to approve applicants with bad credit.

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Mastercard® Credit Card is our top unsecured credit card for consumers looking to rebuild* their bad credit.

You can get a cash advance with this card, a feature some of its competitors lack (See Provider Website for full Terms & Conditions). Don’t be bothered if you’ve never heard of the issuer; it has won Mastercard’s coveted Performance Excellence Award four times.

*Build credit by keeping your balance low and paying all your bills on time every month.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Aspire® Cash Back Reward Card lets you prequalify without harming your credit score. A rarity in the unsecured subprime market, this card allows you to earn cash back at a rate of return comparable with cards for good credit.

The interest rate is high, but remember that you can avoid it altogether by paying your balance off every month.

- You don’t need good credit to apply.

- We help people with bad credit, every day.

- Just complete the short application and receive a response in 60 seconds.

- You can build or rebuild your credit: apply for a PREMIER Bankcard credit card, keep your balance low, and pay all your monthly bills on time.

- Don’t let a low FICO score stop you from applying – we approve applications others may not.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Grey Credit Card is another unsecured card that can help you build* credit with responsible use. This card charges fees based on your initial credit limit that you can find in the terms and conditions (See Provider Website for full Terms & Conditions).

This card is also available in different colors for no added cost.

*Build credit by keeping your balance low and paying all your bills on time every month.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

Continental Finance’s Surge® Platinum Mastercard® has your back, thanks to Mastercard Zero Liability Protection that guards against unauthorized charges. The accompanying mobile app lets you view statements, check due dates, set up direct deposits, or pay a bill whenever you like.

You can also use the mobile app to track how your creditworthy behavior improves your Experian VantageScore.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Fortiva® Mastercard® Credit Card comes from the same issuer as the card above, which means the two offers are very similar. The rewards are generous and the APR isn’t as high as that of other cards on this list.

But the annual fee and account maintenance fees are quite pricey — read the summary of credit terms for a list of fees this card charges.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 8 minutes | 29.99% APR (Variable) | Yes | 8.0/10 |

The Reflex® Platinum Mastercard® from Continental Finance closely resembles the Surge® Platinum Mastercard®. This card may reward your consistent on-time payments by raising your credit limit.

Reflex® Platinum Mastercard® waives its monthly maintenance fee for the first year. It also offers strong fraud protection.

Secured Credit Cards to Rebuild Credit

We don’t regard secured cards as inferior to their unsecured kin. Secured cards frequently have better perks, lower costs, and are arguably more effective tools for building credit.

Most secured cards reward creditworthy behavior by refunding security deposits. In other words, secured credit cards give you back-door access to unsecured cards even if your credit score is in the ditch.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

The OpenSky® Secured Visa® Credit Card provides the fraud protection and worldwide acceptance common to all Visa cards. The card allows you to set up email alerts for upcoming payment dates and available credit.

The four-step application process takes less than five minutes. The card charges a relatively low APR, and its fee schedule is more forgiving than that of other cards on this list.

- 1% Cash Back Rewards on payments

- Choose your own credit line – $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 8 minutes | 15.24% (V) | Yes | 7.5/10 |

The First Progress Platinum Prestige Mastercard® Secured Credit Card is a solid choice for anyone who wants a low interest rate. This issuer offers three secured cards, each with different benefits.

This particular card is a good balance between low interest and fees, and you can use it to build credit over time when you consistently pay your bill on time.

- Better than Prepaid…Go with a Secured Card! Load One Time – Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR – Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit – Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 9.99% Fixed | Yes | 7.5/10 |

The Applied Bank® Secured Visa® Gold Preferred® Credit Card can approve your application in a minute or less. The card doesn’t charge an application fee, and there is no penalty APR for late payments.

In addition, you won’t face fees for monthly maintenance or credit limit increases. This card’s low interest rate takes some of the sting out of its zero-day grace period.

What Is a Credit Card For Rebuilding Bad Credit?

We live in a time where various numbers characterize our identities. Consider how your salary, ZIP code, and, yes, your credit score, all reveal something to the world. Sometimes, a number tells an unflattering story, as is the case when your credit score is low.

One tool that can help you rebuild your score is the credit card. If you own a small company, you can use a business credit card to help attain better credit.

In most respects, cards for rebuilding credit operate like traditional cards. When you acquire a new card, you receive a credit line that controls how much you can charge on it. A credit card lets you make purchases up to your credit limit and then pay the amount owed over one or more months.

The Credit Reporting System

The FICO credit scoring system considers a score below 580 bad. The FICO scale runs from 300 (the worst credit) to 850 (perfect credit), with the average American’s score just north of 700. Scores above 800 signify excellent credit.

If your score is below that for fair credit (669 or lower), your access to cheap credit, or any credit, is compromised.

The major credit bureaus (Experian, TransUnion, and Equifax) generate credit reports and calculate scores based on information from creditors and lenders. When you consistently pay your bills on time, you tend to have a good credit score.

But when a credit bureau starts receiving delinquency notices (i.e., that you are 90 or more days behind on a payment), your credit score can plunge. Your score can easily drop from good to fair credit with just one late payment and then to the poor range with repeated infractions. Moreover, missed payments remain on your credit record for seven years.

Nothing good comes from poor credit, which is why rebuilding it is so important. Most cards report your credit activity to at least one credit bureau, but cards designed for consumers with bad credit usually report your activity to all three bureaus.

The significance of triple reporting is that your three scores reinforce each other’s assessment of your creditworthiness. You want to see all three of your scores rise simultaneously to reflect your better financial habits. If one score is out of line, you’ll want to find out why.

A rogue score can arise from data appearing in only one of your credit reports. To investigate, you can order free copies of your three credit reports at AnnualCreditReport.com. You can then review each to discover why your credit scores don’t line up and then attempt to fix mistakes by filing disputes with the credit bureaus.

Alternatively, you can hire a credit repair company to fix errors in your reports that may be damaging your scores.

How a Credit Card Can Rebuild Credit

The consequences of a bad credit score are many and unfortunate. You’ll have trouble getting a loan or a credit card, and if you do, the interest rate and other details will be undesirable. Negative information on your credit reports can even threaten your ability to rent an apartment or land a new job.

Good credit habits begin with timely credit card payments. Card issuers generate monthly billing statements detailing, among other things, a minimum payment amount and when it is due. Your task is straightforward: Pay the bill before the due date and pay more than the minimum if possible.

Paying all your bills on time is the most important thing you can do to rebuild your credit score.

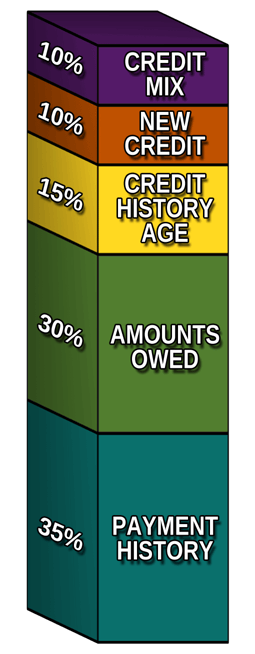

Your payment history is responsible for 35% of your FICO score. Your record also chronicles collections, defaults, repossessions, foreclosures, bankruptcies, and other unfortunate items.

Another critical factor for rebuilding your score is your credit utilization ratio (i.e., CUR, the percent of your credit card limit currently spent), which accounts for 30% of your FICO score. You can help your score by keeping your CUR below 30%. FICO interprets higher values to signal possible financial distress.

For example, if your credit card grants you a $1,000 credit limit, having an unpaid balance of $300 or more will hurt your score. You can leverage credit reporting to improve your score by paying down your outstanding balances.

You can also use credit cards to rebuild your FICO score by keeping your old credit accounts open, refraining from applying for new credit, and employing a diversified mix of credit accounts and loans.

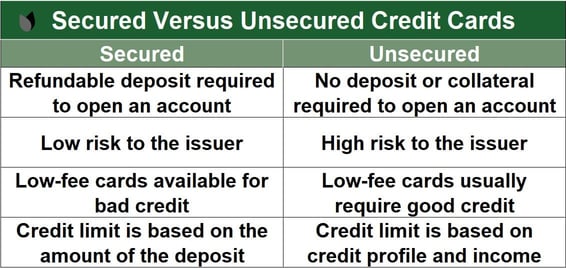

How Do Unsecured and Secured Credit Cards Compare?

Secured credit cards serve consumers who have a poor or limited credit payment history. You must deposit cash collateral to open a secured credit card account. The deposit protects card issuers from loss if you don’t pay your bill, and a low credit score won’t prevent you from getting a secured account.

Unsecured credit cards are more traditional and trusting of applicants, requiring only their signature. Issuers risk losses when they offer unsecured cards, and that risk is highest when applicant credit scores scrape the bottom. That’s why unsecured cards for bad credit usually have high interest rates, steep fees, and few perks.

If a card issuer approves your application for a secured card, you must make a cash deposit to an escrow account maintained by the issuer. Typically, the deposit size must equal the card’s credit limit.

Your deposit remains frozen until you close your account or the issuer refunds it (i.e., when you “graduate” to an unsecured card). Many secured cards issue a refund after you pay your bills on time for a set period. Others may instead increase your credit line without requiring an additional deposit.

How Can I Get a Credit Card With Bad Credit?

All the cards in this review cater to consumers with bad credit. That’s a good thing in light of the following statistics concerning American consumers:

- 11.1% have a FICO score below 550.

- 34.8% have a FICO score between 580 and 669.

- 22% have no FICO score.

- 25% of low-income individuals don’t know how to improve their credit scores.

- About 20% were delinquent at least once for more than 30 days.

These statistics help explain the demand for subprime credit cards. The importance of these cards is that they offer the easiest way to improve your credit.

Minimum Credit Score Required

Most secured credit cards have no credit score requirements. Your security deposit is sufficient to gain approval from the card issuers, although some may check your income to verify your ability to make payments.

You can get some secured cards without a hard credit check. Secured cards are an excellent solution for consumers with poor or limited credit.

Unsecured cards are more selective of applicants than their secured counterparts. It’s hard to find many issuers of unsecured cards that will approve applicants with scores below 550. This reluctance is understandable, given that credit scores predict a person’s chances of going 90+ days past due within the next 24 months.

Credit card issuers face several risks from low-score cardmembers, including:

- Not collecting some or all of a cardmember’s outstanding balance.

- Not collecting interest and fees.

- Being forced to spend more on collections and write-offs.

- Adapting to reduced cash flow.

You may think that these risks would prevent issuers of unsecured cards from seeking consumers with low scores. However, actuaries at the credit card companies quantify default risk in dollars, allowing the issuers to adjust a card’s rates and terms to overcome the predicted losses.

You can see the risk-mitigation factors at play by reading the fine print accompanying offers for unsecured credit cards tailored to subprime applicants. In almost all cases, you’ll find the following:

- Steep interest rates, often higher than 25% APR.

- High fees and lots of them. Some charges are unique to these cards, including a setup fee, a monthly payment for maintenance, and credit limit increase fees. In addition, these cards will likely charge an annual fee, a fee for additional cards, a foreign transaction fee, and a penalty APR for late payments.

- Tight credit limits are the rule, sometimes as low as $200. Moreover, a card is likely to deduct your setup and annual fees from your initial credit limit and restore it only after receiving the required payments.

- Scant or no rewards. Occasionally, you’ll run across a subprime card, such as the Aspire® Cash Back Reward Card, that features a modest cash back offer. Furthermore, signup bonuses are as rare as hens’ teeth.

- No introductory 0% APR. Consumers with good credit are accustomed to this incentive for new cardmembers. Our summary boxes for subprime credit cards don’t even bother to list this perk.

- Few benefits. You can count on these cards to provide fraud protection and credit reporting to all three major bureaus. Many cards offer free access to your credit score (not necessarily your FICO score, however). Some cards may promise to review your credit performance to see whether you qualify for a higher credit limit. In this credit card category, anything else is gravy.

- No support for balance transfer transactions. With their tiny credit limits, these credit cards would be poor candidates for balance transfer transactions, even if the cards offered them.

- Cash advances are restricted. These cards often set meager limits for cash advances, and a few don’t allow advances for the first three months. On the plus side, a few cards waive the cash advance fee for the first year.

One other feature that makes a couple of the reviewed cards less attractive is the lack of a grace period for eligible purchases. Most cards give you at least 21 days between the end of a billing cycle and the payment due date to pay your bill without accruing interest. But check the fine print – some cards begin charging interest on the day of purchase.

Application Procedures

It’s not unusual for a credit card company to offer a prequalification step to potential applicants. While prequalification can tell you whether your application has any chance of approval, it is not a guarantee.

You can attempt to prequalify online by submitting basic information about yourself, including your income and housing expenses. Generally, you’ll receive an instant decision.

Whether it’s thumbs up or down, your credit score will not suffer from the attempt. Credit card companies do not perform hard credit inquiries when you attempt to prequalify, which means you avoid the slight point loss that accompanies hard pulls.

If you prequalify (or skip the step), you can submit an application form that closely mimics the one used for prequalification and receive a quick decision. However, unsecured cards will do a hard pull when you apply. Your application can cause your already bruised credit score to drop by five to eight points and linger on your credit report for two years.

If the issuer approves your application, you will be asked to e-sign a credit agreement spelling out all the accompanying rates, terms, and conditions. We urge you to read the entire thing before signing – you may be surprised at what lurks there.

At this point, the issuer will ship you your new card. Expect it within seven to 10 days.

If you apply for a secured card, your final approval is paused until you submit a cash deposit. Once the payment clears, your card will ship.

After the card arrives, sign the back and tell the credit card company that you received it, either online or over the phone.

What’s the Easiest Credit Card to Get With Bad Credit?

Careful readers know by now that secured cards are by far the easiest to get. We suggest you compare the rates and terms among the secured credit cards reviewed above to see which charge the least and deliver the most.

The OpenSky® Secured Visa® Credit Card is a secured card that doesn’t require a credit check for approval, making it one of the easiest cards to get.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

The search for the most accessible unsecured card requires you to flip the secured-card playbook. Rather than looking for the best deal, consider the cards that really stick it to you. These cards have the most expensive fees, highest interest rates, fewest perks, and sometimes no grace period.

While these cards may be tough to live with, they should be the easiest to get. That’s because their issuers built in so many provisions to reduce risk that they can afford to take the biggest chances. Don’t despair — as your credit score improves, better credit cards will become available.

Which Credit Cards to Rebuild Credit Offer Instant Approval?

No card offers instant approval, but virtually all cards provide an instant decision. When you apply for an unsecured card, the issuer (actually a computer working for the issuer) will immediately pull your credit file and make a judgment based on the company’s criteria. You’ll likely have your decision in just a few minutes.

Can I Be Denied a Credit Card?

No credit card guarantees approval, including secured cards that loudly proclaim otherwise. Here are some reasons why an issuer may deny your card application:

- You fail to meet the card’s minimum credit and income standards.

- You are under 18 years old.

- You lack a Social Security number.

- You’ve reached the issuer’s card quota.

- You’ve recently applied for the same card.

- You are undergoing bankruptcy proceedings.

- You owe money to the issuer or previously received a write-off.

- You reside in a correctional institution.

- The card has stopped approving new applicants.

Regulation B of the Equal Credit Opportunity Act requires issuers to respond to card applications within 30 days. If you received a rejection, the issuer must send you a written Adverse Action Notice (or declination letter) by the response deadline.

The Notice can offer two types of responses, including:

- The chief risk factors for the denial, or

- Your right to request the reasons for denial within 60 days after receiving the Adverse Action Notice.

The Notice should contain the following information:

- The credit bureau that provided the report that led to your denial.

- Your credit score and the scoring system used.

- The risk factors that figured into your denial.

- Notification that you can get a free copy of your credit report within 60 days.

- Notification that you can dispute the information on which the denial depended.

The Adverse Action Notice is helpful because it explains which items you need to address, such as late payments.

You may be able to qualify for a store credit card even if other unsecured cards reject your applications. You usually can get a store credit card even if your credit score is lousy.

If you find it impossible to qualify for a credit card, consider a prepaid card instead. You can get a prepaid card without any reference to your credit score.

What Fees Do Credit Cards to Rebuild Credit Charge?

Credit card companies make money through fees and interest. If you need to rebuild your credit, you will face a phalanx of fees, including some that only subprime cards charge:

- Signup fee: This is a one-time processing fee you pay if you accept the card. The amount varies, but one card has a $99 signup fee, about half of the minimum credit limit. Cards usually deduct the signup fee from your initial credit limit. The card will restore your limit after you pay the charge.

- Maintenance fee: This is a monthly payment, typically $6.25, whose purpose is, well, we don’t really know its purpose. Cards for fair or better credit never charge this fee. Subprime cards usually waive the maintenance fee for the first year, which creates a strong incentive to find a better card before the fee kicks in.

- Credit limit increase fees: A card to rebuild credit may offer you a higher credit limit after a period of on-time payments. Before jumping at the offer, check to see whether the card charges a fee for the increase.

- Extra card fee: Many cards in this category charge a fee when you order an additional card for your spouse or an authorized user. Better quality cards usually waive this fee.

Cards for building credit also charge the conventional fees that accompany most credit cards, including an annual fee. Other charges are those for foreign transactions, cash advances, and late or return payments. In addition, expect high regular and penalty APRs from these cards (one card’s regular APR exceeds 33%).

These fees help issuers of subprime unsecured cards make a profit, even if the occasional cardowner defaults.

These fees may seem severe, but they permit millions of consumers their only access to unsecured credit cards.

In summary, unsecured cards for building credit charge high fees and interest, provide low credit limits, and give almost no perks.

Choose the Right Card to Build Your Credit

Our review identifies over a dozen credit cards for building bad credit (or, more appropriately, rebuilding bad credit). Whatever their flaws, these cards are tools you can use to improve your credit and enhance your lifestyle.

Getting the card is just the beginning. The hard work is to use your credit cards responsibly. Always pay your bills on time, keep your debt levels low, and don’t apply for too much credit. These are the simple rules by which anybody can begin rebuilding their credit.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.