There were no credit card offers for bad credit when I first embarked upon my career. Too bad — I could have used a credit card for low credit scores back then.

But the Fair Isaac Company didn’t implement FICO, the first credit-bureau-based credit scoring system for consumers, for another 16 years, so distinctions like good and bad credit were subjective when I entered the workforce.

Today, we live in a world flooded with credit cards. Choices abound, even if you have bad, limited, or no credit, so we’ve identified the best subprime unsecured, secured, post-bankruptcy, and store credit cards to help you select the one that best fits your needs.

Best Unsecured Credit Card Offers For Bad Credit

Unsecured cards provide credit to cardholders without requiring a security deposit. Their issuers designed these five cards for consumers with poor, thin, or no credit. While all of these cards come with high fees and interest rates, they offer the advantage of relatively easy approval standards.

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Mastercard® Credit Card is a genuine Mastercard accepted worldwide and is designed for consumers who’ve experienced credit problems. Mastercard has awarded this credit card issuer its Performance Excellence Award four times.

- You don’t need good credit to apply.

- We help people with bad credit, every day.

- Just complete the short application and receive a response in 60 seconds.

- You can build or rebuild your credit: apply for a PREMIER Bankcard credit card, keep your balance low, and pay all your monthly bills on time.

- Don’t let a low FICO score stop you from applying – we approve applications others may not.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Grey Credit Card is almost identical to its sibling card except for its lower credit limit, making it a better fit for applicants worried about overspending. The card’s grace period is relatively long, allowing you extra time to avoid interest payments (See Provider Website for full Terms & Conditions).

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

Continental Finance offers the Surge® Platinum Mastercard® with Mastercard Zero Liability Protection to safeguard you from charges you didn’t make. The card comes with a mobile app that lets you view statements, pay bills, check due dates, and specify direct deposits. You also get free tracking of your Experian VantageScore.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Aspire® Cash Back Reward Card offers free credit scores, transaction alerts, and tiered rewards on all eligible purchases. The application process is easy, and cardmembers gain around-the-clock online access on any device.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

**Fraud liability subject to Mastercard® rules.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

You earn bonus cash back from the Fortiva® Mastercard® Credit Card on spending for gas, groceries, and utilities, with standard cash back on all other eligible purchases. The card offers zero fraud liability protection and doesn’t charge an initial deposit or program fee. You can prequalify for a moderate credit limit without affecting your credit score.

Best Secured Credit Card Offers For Bad Credit

Secured credit cards enjoy a few advantages over unsecured cards for bad credit. Secured cards usually do not perform credit checks yet offer lower interest rates and better benefits. The biggest obstacle you may experience is affording the refundable security deposit.

6. Secured Sable ONE Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

The Secured Sable ONE Credit Card actively encourages you to qualify for an unsecured card by completing a few milestones, including on-time payments and minimum purchase requirements. The card does not charge a foreign transaction fee.

7. PREMIER Bankcard® Secured Credit Card

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

The PREMIER Bankcard® Secured Credit Card offers a moderate annual fee, a relatively low interest rate, and an affordable minimum deposit (See Provider Website for full Terms & Conditions). The issuer may graduate you to an unsecured card if you pay your bills on time. The card lets you draw cash advances from Cirrus ATMs across the country, an important resource when you need an emergency loan.

8. Surge® Platinum Secured Mastercard®

This offer is currently not available.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| N/A | N/A | N/A | N/A |

You earn rewards from the Surge® Platinum Secured Mastercard® as you build credit. The card doesn’t charge fees for setup or maintenance. You can opt for a credit protection plan to cover your payments when you experience specified losses.

- Better than Prepaid…Go with a Secured Card! Load One Time – Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR – Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit – Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 9.99% Fixed | Yes | 7.5/10 |

The Applied Bank® Secured Visa® Gold Preferred® Credit Card promises an instant decision on your card application. The card charges no setup fees nor a penalty APR for late payments. This Applied Bank secured card lacks a grace period but charges a low purchase APR.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

The OpenSky® Secured Visa® Credit Card features worldwide acceptance, fraud protection, and email alerts. You can apply online for this card in four short steps without a credit check. The card has relatively low interest rates and moderate fees.

Best Credit Card Offers After Bankruptcy

This list is a mix of unsecured and secured cards that do not necessarily reject applicants for their past bankruptcies. It does not include any business credit card offers. These card issuers expect you to have a low credit score after enduring one or more bankruptcy proceedings.

11. Total Visa® Card

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

- See Total Card Visa Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 35.99%* | Yes | 8.5/10 |

The unsecured Total Visa® Card from the Bank of Missouri accepts applicants that other card issuers reject. Prequalification is easy and won’t damage your credit score. The card provides fraud protection against unauthorized use.

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

- See First Access Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 35.99%* | Yes | 8.0/10 |

The First Access Visa® Card also comes from the Bank of Missouri and targets consumers with less-than-perfect credit. This unsecured card promises an online decision in as little as 60 seconds. This card charges a program fee upon approval to access your credit line.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

You don’t need a good credit history or high score to obtain the OpenSky® Secured Visa® Credit Card from Capital Bank. This card reports to all three major credit bureaus to help you improve your credit with regular on-time payments.

- Choose your own credit line based on how much money you want to put down as a security deposit.

- Initial deposits can be from $200 to $3,000. You can increase your credit line at any time by adding additional money to your security deposit, up to $3,000.

- After 9 months, we review your account for a credit line increase. No additional deposit required!

- Secured Credit Cards are great for people looking to build or rebuild credit and are available to people with all kinds of credit backgrounds.

- Unlike a debit card or a pre-paid card, it helps build your credit history. We report your payment history to all three major credit-reporting agencies.

- Get your FICO® Credit Score for free each month.

- Fraud coverage if your card is lost or stolen. Access your account 24 hours a day, 7 days a week. Get help staying on track with available Auto Pay and account alerts.

- Card issued by Merrick Bank, Member FDIC.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 22.70% Variable | Yes | 7.5/10 |

The Merrick Bank Secured Credit Card requires applicants to post a minimal security deposit to qualify for the card. It imposes no maintenance or setup charges and offers a nice, low variable interest rate.

- 1% Cash Back Rewards on payments

- Choose your own credit line – $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

The First Progress Platinum Select Mastercard® Secured Credit Card is one of three similar secured cards from Synovus Bank. This Platinum secured credit card has no minimum credit score requirements for approval, but you do need a bank account to qualify. First Progress secured cards generally charge relatively low fees and interest rates.

Best Store Credit Card Offers For Bad Credit

Stores push their credit cards hard, even to consumers with prior bankruptcies. The reason for this aggressive marketing is to build a store’s customer base. Stores distribute credit cards that feature low credit limits and high interest rates.

Many store cards are closed-loop, meaning you can use them only at the issuing store. Other stores offer open-loop cards that work wherever merchants welcome the payment network (i.e., Visa, Mastercard, American Express, and Discover). Most closed-loop store cards are easy to get approved for.

- Easy application! Get a credit decision in seconds.

- Build your credit history – Fingerhut reports to all 3 major credit bureaus

- Use your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWalt

- Not an access card

- Click here for official site, terms, and details.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 Minutes | See issuer website | Yes | 9.0/10 |

The closed-loop Fingerhut Credit Account lets you shop at the Fingerhut online store and enjoy occasional special deals and no annual fee. If you don’t qualify for the account, the issuer may offer you Fingerhut’s Fresh Start Installment Loan. Fingerhut may then open a credit account for you once you repay the bad credit loan.

17. Amazon.com Store Card

The Amazon.com Store Card provides Prime members with cash back on eligible purchases. The store may offer you an unsecured or secured version of this card.

- Cardholders who are also Amazon Prime members earn 5% cash back on Amazon.com purchases

- Receive special financing on purchases over $149

- Pay $0 annual card fee; Prime fee may apply

The card may offer deferred interest on selected purchases. You must pay off deferred-interest balances within a set period to avoid retroactive interest charges.

18. Target RedCard

The Target RedCard offers instant discounts on eligible purchases. You can combine the card’s discounts with store and manufacturer’s coupons.

- Get 5% off your order at checkout for eligible in-store and online Target purchases

- Receive exclusive deals and discounts

- Pay $0 annual fee

The card withholds discounts for certain types of merchandise, including pharmacy items, gift cards, and Target Optical™ eye exams.

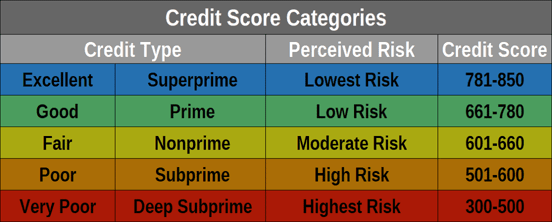

What Is Bad Credit?

Bad credit means high risk in the eyes of potential lenders. The risk is that a borrower will fail to repay a debt (such as a credit card balance, business credit account, or personal loan), causing a creditor or lender to suffer a loss.

Lenders use scoring systems to quantify the risk associated with a bad credit consumer, and credit card issuers develop products for different risk categories.

Credit scoring is the cornerstone for the entire risk assessment industry that credit card companies depend on, and FICO is the leading scoring system for consumers, followed by VantageScore.

In both leading credit scoring systems, credit scores run from 300 (worst credit) to 850 (perfect credit).

These systems predict the likelihood a borrower will default on a debt in the next two years. Excellent credit represents to credit card companies and other lenders a low default risk. But card issuers arm their credit cards with safety measures to anticipate a default risk when dealing with borrowers who have poor credit.

If you have a bad credit score and want a credit card, you’ll have to contend with the issuers’ safety measures, such as high fees, steep interest rates, and low credit limits.

Can I Get a Credit Card If I Have Bad Credit?

Approximately 16% of Americans have bad credit, a sector of consumers far too large to ignore. That’s why credit card companies provide a few ways for subprime consumers to own credit cards.

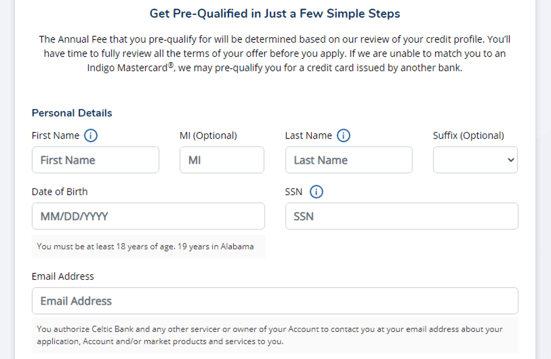

Prequalifying For a Credit Card

Virtually all issuers allow you to prequalify for a credit card before formally applying. Prequalification is a preapproval step that tells you whether you have a chance to successfully obtain a card.

You can attempt to prequalify for a card without harming your already bad credit score because the process does not involve a hard inquiry (or hard pull) of your credit reports. FICO treats hard inquiries as a minor negative since they represent an attempt to increase one’s available credit, which may indicate potential financial distress.

You must submit a short online form containing information about your income and expenses to prequalify for a credit card. Card issuers usually respond immediately to prequalification requests.

Note that preapproval is not a guarantee that you’ll be approved–it just indicates that you meet the preliminary qualifications. The hard credit check that follows may turn up something on your credit reports that prevents approval.

Applying For a Credit Card

You can apply for a credit card with or without first prequalifying. The application step collects pretty much the same data as prequalification does, although it may require more details, such as your Social Security number. The whole online process takes about five to 10 minutes.

Your application authorizes the credit card company to do a hard pull of your credit, causing your score to drop by one to eight points for up to one year. The more card applications you file within a short period, the greater the cumulative impact.

While the credit card company may give you an instant decision, it’s not unusual for it to take longer, up to two weeks, to receive an answer.

The credit card company must send you a written Adverse Action Notice if it rejects your application. The notice will outline the reasons for the denial, including the sources of the credit scores and other information it used to reach its decision.

You should use the notice as a tool to help you identify and fix problems with your credit. For example, you may first have to reduce your debt before reapplying for a credit card. You may also want to consider applying for a secured credit card instead, as issuers of these cards do not rely on credit scores.

Many unsecured cards for bad credit require you to submit a signup fee before the credit card issuer ships the card. The issuer will cancel your application if you don’t pay the charge by a set deadline (usually 60 days).

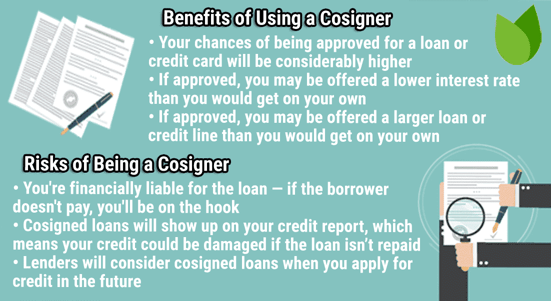

Recruiting a Cosigner

You can significantly increase your prospects for getting a credit card by recruiting a cosigner, an individual who shares card ownership. However, not all card issuers welcome cosigners.

You may be able to get a credit card for good credit by recruiting a cosigner. While cosigners do not necessarily become users of the joint credit card account, they are equally responsible for repaying card debts.

The credit bureaus attach the card account to each owner’s credit report, so late payments on a cosigned card affect both cardowners.

Becoming an Authorized User

You can use someone else’s credit card by becoming an authorized user, something most credit cards allow. You’ll receive your copy of the card with your name embossed on it. You can then use the card as if it were your own, although the primary owner may limit your spending.

Authorized users cannot authorize additional users or request credit limit increases.

The credit bureaus assign the card’s activity to the primary and authorized users. Unlike a cosigner, an authorized user is not legally responsible for paying the credit card bill. Some issuers relax the minimum age requirement for authorized users.

What Should I Look For in a Card For Bad Credit?

When choosing a subprime card, your task is to avoid the worst of the lot – those with the highest purchase APR ranges, most extensive fees, tightest credit limits, and fewest perks.

Interest Rates

When choosing a subprime credit card, interest rates are an important factor for two reasons:

- You intend to finance your credit card balances over multiple months. Credit cards don’t usually charge interest if you pay your entire balance by the payment due date. Any balance unpaid after that date accrues interest daily until paid.

- Your card doesn’t offer a grace period. Most cards offer an interest-free grace period extending from the end of the billing cycle (i.e., the statement date) to the payment due date, a period of at least 21 days. Cards that don’t grant grace periods immediately charge interest on purchases until they receive payment. Although these cards usually feature low APRs, consumers should avoid them when looking for a new credit card.

Unsecured subprime cards typically have APRs between 24.99% and 36%, and those high interest rates can considerably increase the cost of purchased items. Secured cards usually have lower APRs because they present less default risk to card issuers.

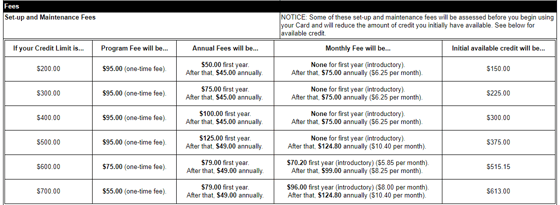

Fees

Unfortunately, the unsecured credit cards designed for the worst credit scores have the highest fees. Avoid cards that charge a setup or monthly maintenance fee when possible.

Both of these are nuisance charges that issuers impose to collect your money, thereby reducing the net cost of default. Most subprime unsecured cards charge annual fees – you want to stick to cards with low or no yearly fees.

Credit Limits

Larger credit lines allow you to make more expensive purchases. But subprime unsecured cards typically have tight credit limits that start at $200 to $300. These low limits are another way for issuers to reduce the cost of defaults. Some unsecured cards for bad credit may raise your credit limit after a period of timely payments.

Your deposit on a secured credit card establishes your credit limit. Some secured cards allow only a low initial limit, but most cards let you increase your deposit and raise your credit limit, sometimes as high as $5,000.

Issuers of secured credit cards are usually eager to promote you to an unsecured card. You’ll receive a refund of your security deposit, but be careful – the unsecured card may have higher costs than your current card.

Rewards

Issuers may entice new cardmembers by issuing cash back, bonus points, or miles. Some cards offer unlimited flat rewards for all qualifying purchases, while others provide a mix of reward rates for different types of merchants.

Several of the cards in this review, including the Secured Sable ONE Credit Card and the Aspire® Cash Back Reward Card offer rewards on eligible purchases. Signup bonuses and 0% APRs are not generally available from subprime credit card issuers.

Benefits

Don’t expect many benefits from subprime credit cards beyond fraud protection and credit bureau reporting. To gain goodies like travel insurance, free baggage check, and airport lounge access, you’ll need to improve your credit score enough to qualify for cards for good credit.

The Secured Sable ONE Credit Card stands out because it offers perks that include cellphone damage protection, purchase assurance, and rental car insurance.

How Do Secured and Unsecured Cards Compare?

Secured credit cards require you to deposit cash into a locked account that acts as collateral to guarantee the card’s credit line. Issuers design these cards for consumers with bad credit who don’t qualify or don’t want to pay the fees for unsecured cards.

A secured credit card may be a better deal than a subprime unsecured card because many secured cards charge less interest and lower fees.

In addition, secured credit cards may offer better perks to subprime consumers. They are easier to obtain because issuers approve secured cards based on collateral rather than credit score. Most secured cards report your payments to all three credit bureaus, which builds credit when you pay your bills on time.

Secured credit cards tap your refundable security deposit and reduce your credit limit if you miss payments or exceed your spending limit. You must replenish your security deposit to restore your full credit line, but multiple infractions may prompt the credit card issuer to close your account.

Most secured-card issuers are willing to upgrade you to an unsecured card after a set number of on-time payments. Your timely payments may elevate you from a bad to a fair credit score. If you receive an upgrade, the issuer will refund your deposit and may grant you a higher credit limit.

How Do Store Credit Cards Work?

Store credit cards harken back to earlier times when shopkeepers would extend credit to their best customers. Today’s store cards come in two forms:

- Open-loop: These store cards operate just like regular credit cards, except they usually offer extra rewards for purchases from the issuing merchant. These co-branded cards carry the logo of their payment network: Visa, Mastercard, American Express, or Discover.

- Closed-loop: You can use these cards to make purchases only at the issuing store. They do not carry a payment network logo and are usually easier to get than open-loop cards. Generally, closed-loop cards offer store-specific benefits but charge high interest rates and have low credit limits. Many closed-loop cards report activity to the credit bureaus so you can use them to build credit.

Store cards usually provide extra perks, such as special financing deals, purchase rewards, immediate discounts, and exclusive offers. These valuable extras can quickly add up if you frequently shop at the issuing store.

Some of the biggest retailers, including Amazon.com and Costco, now offer branded open-loop cards that you can use to purchase items wherever merchants accept the payment network.

Bear in mind that open-loop cards are harder to get than their closed-loop cousins and typically offer the best rewards when making purchases. The narrow scope of perks limits the advantage of open-loop store cards over their closed-loop versions.

Can I Get a Credit Card After Bankruptcy?

You can indeed get a credit card after bankruptcy, but chances are the card will not be very attractive. It will probably have a high interest rate, many fees, a tight credit limit, and few rewards or benefits.

Nonetheless, getting a post-bankruptcy credit card is a significant step in rebuilding credit.

You can apply for a personal credit card soon after your bankruptcy is discharged, although your chances of acceptance will increase as time goes by. Six to 12 months is a reasonable amount of time to wait before reapplying for a credit card. The optimal waiting period depends, in part, on the type of bankruptcy you filed for.

Happily, the blow to your credit score from your bankruptcy fades over time. FICO weighs the newest information on your credit report most heavily when calculating your credit score.

Before applying for a post-bankruptcy card, you’ll want to fix any errors in your credit reports and pay down any remaining debt not discharged by the bankruptcy court.

Which Credit Card Offers For Bad Credit Have the Best Rewards?

These reviewed cards offer good rewards:

- Aspire® Cash Back Reward Card

- Fortiva® Mastercard® Credit Card

- Secured Sable ONE Credit Card

- Amazon.com Store Card

These four cards offer exceptional value to consumers with bad credit, especially when compared with the other reviewed cards.

How Can I Rebuild Credit With Credit Cards For Bad Credit?

The two most important actions you can take to rebuild credit are to make payments on time and keep your debt levels relatively low.

FICO bases 35% of your score on your payment history. To bump up your score, you must pay your bills on time, every time, without fail. Issuers report payments 30 or more days overdue to the credit bureaus, causing considerable damage to your credit scores which lingers for seven years.

Another 30% of your FICO score derives from the amounts you owe. FICO rewards you for keeping your credit utilization ratio (i.e., credit used divided by your total credit available) below 30%. Reducing your card balances below this threshold results in a lower credit utilization ratio and a higher credit score.

You can also help (or at least not harm) your credit score by refraining from new credit applications and keeping old credit card accounts open.

How Long Does It Take to Get a Credit Card?

Issuers may take anywhere from one minute to two weeks to decide whether to approve your card application. They may require extra time because your qualifications are marginal or your information from different sources doesn’t match.

Once approved, your card should arrive in seven to 10 days. Some issuers offer expedited delivery, either for free or for a fee. Your card may offer virtual account numbers you can use for card-not-present transactions until your physical card arrives in the mail.

Compare the Best Credit Card Offers For Bad Credit

Our review of credit card offers for bad credit reveals a nice variety of choices, no matter how low your credit score. If you have really bad credit, consider getting a secured card because they require only a security deposit for approval.

You can gather more information about any of the reviewed cards by clicking on the APPLY HERE button and reading the fine print that accompanies each offer. Make sure you understand all the terms and conditions before accepting a credit card, just in case some deal-killers (such as no grace period) dwell within the cardmember agreement.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.