Are Your Finances Safe Using Mobile Payment Apps?

Are your finances safe using mobile payment apps? In the article below, we’ll tackle this common question by exploring the history of mobile payments, the potential risks involved, and some tips on how to make mobile payments safely and securely.

Not so long ago, making a payment nearly always required some sort of paper, be it paper money or paper check. As with many other paper-based systems, however, the payments space has seen some big changes with the rise of digital technology.

Indeed, just as emails and text messages have replaced much of our paper-based correspondence, digital payments and credit cards have replaced many of our physical transactions. These days, millions of our transactions are completely digital, with nary a paper in sight.

The Rise of Mobile Payment Apps

Mobile payment apps are so accepted nowadays that even Girl Scouts selling cookies use them as a payment option. In fact, statistics from Sage Mobile Payments (an avid partner of the movement) show that Girl Scouts who accept mobile payments sell more cookies than those who do not.

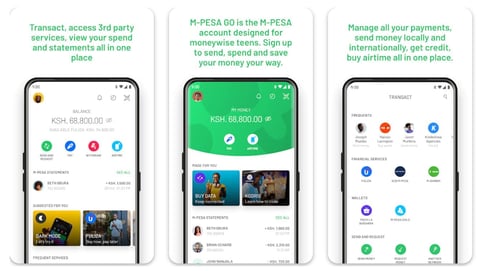

More and more of the world’s population is turning to the convenience offered by mobile payment methods. It truly is a way to bank the unbanked. In Africa, a mobile payment platform called M-PESA from Kenya has more than 26 million users and has won several global awards for its convenience and efficiency.

The mobile app allows its users to transfer and receive money from other countries, including the U.S. and E.U. member nations This trend of mobile money movement is so pervasive, it can even be found in developing countries that may not have with less banking prowess than their First World counterparts.

In the U.S. for example, several mobile payments methods are so popular they have become a way of life. The Starbucks mobile payments platform is so widely used that it outperforms even the big brand names such as Apple Pay and Google Pay.

Almost 55 million Americans make an in-store payment using any one of the mobile payment apps available to them. The Starbucks app has about 24 million users and counting! These are all people who would rather get value from the convenience of paying using their phones as opposed to any other payment methods.

The popularity of mobile payment apps is not in question. Numbers seldom lie, and the numbers here indicate that people love this payment method. However, you need to ask yourself: just because these mobile payment apps are so popular, does that mean that they are safe?

The Dangers Associated with Using Mobile Payment Apps

While millions of people are jumping on the digital payments bandwagon, many are raising questions about the security of such methods. After all, if your money is simply ones and zeroes, how can you keep track of it as well as physical currency in your pocket?

Think about it for a second; the fact that you have a mobile payment app on your phone means that you have substantial personal financial information loaded on that little device.

What happens if you become one of the hundreds of people every day whose phone is lost or stolen?

It means that without the right kind of protection, whoever ends up with your phone has access to some of your most sensitive financial information.

Information that they could use to ruin you and even steal your identity. That is just one danger associated with using mobile payment apps. There are a few more risks that should cause you some concern.

Many People Use Ineffective Security Measures

According to a survey from Google and The Harris Poll, 66% of Americans use the same password for more than one online account, from their emails to their social media accounts and even their bank logins.

The fact is, people are wary of having to remember the myriad passwords required to get access to their various day-to-day accounts. It is just easier to use the same one over and over to limit the possibility that you forget your password.

The problem is it’s also riskier!

And that’s especially true when dealing with mobile devices. Having just one password for your phone and the data therein is a significant security risk.

At the very least, you need to have a two-stage authentication method when it comes to your mobile devices: one to access the phone and a different one to access the mobile payment app.

Apps Request Direct Links to Bank & Credit Accounts

While it is often part of the sign-up process, linking any mobile payment apps directly to your bank accounts is usually frowned upon by cybersecurity professionals. Should any hackers intercept your transactions or get access to your mobile app details, then they have access to your checking or savings accounts and can do a lot of financial damage with that kind of information.

Try as much as possible to use mobile apps that do not require you to link directly to any of your bank accounts. It is often best to transfer money from your bank account to the mobile app and then go from there as opposed to giving the app permission to directly withdraw money from those accounts.

Most importantly, never input your banking information into an app that you don’t 100% trust. Your information is only as secure as the app’s encryption software, so make sure the app has the chops to protect your data.

Fake Apps Can Steal Data

Today, many criminals are a little more sophisticated than they used to be. Since mobile payment apps — and apps in general — have become so popular, criminals have resorted to creating some of their own apps to phish for data from unsuspecting users.

Google recently carried out a purge that removed over 50 fake apps from its marketplace. These are apps that were found to contain malware that allow criminals to get into your system and steal your information or take it over.

The truth is, there are millions of apps out there, and the typical users wouldn’t know which ones are safe — and which ones are not.

Short of avoiding apps altogether, the best you can sometimes do is to keep an eye out for the little telltale signs of possible risks. These include things like spelling errors in the app’s description or requests for permissions the app shouldn’t need. Additionally, avoid clicking any pop-up ads within whatever app you are using.

Tips to Making Safe Mobile Payments

It is true that the most trustworthy mobile payment platforms have some of the most stringent security measures in place. These measures are meant to protect your information and data once you download, sign up, and start using the mobile app.

However, the app developer can’t make your phone 100% secure. That’s because the biggest risk to your own security is often you.

It is how you use the mobile payment apps and the things you do with your phone that put your information at risk. But, you can take steps to help keep your data secure.

First, only download trustworthy mobile payment apps; think big names known for their security, like PayPal, Venmo, and Google Wallet.

While there are no hack-proof apps, these apps are generally trusted to have the proper security measures built into them on the developer’s end to make sure they are safe to use without worrying that your data is at risk.

Beyond the payment app itself, don’t forget about the rest of the programs on your phone; most people have dozens of apps on their phones. Any app that you download could have spyware designed to capture the information you put into your phone.

So, in addition to using trustworthy payment apps, make sure every app you download is trustworthy. Read up on its reviews, check its description, and even go as far as asking Google or other app stores what they think of it before you download it.

In the event the worst happens, remotely lock your phone when it is stolen or lost. When that happens, you can simply head over to android.com/devicemanager, iCloud.com, and windowsphone.com to lock it remotely.

Remotely locking your phone makes it more difficult, if not impossible, for the thief to get into your personal data. In many cases, you can even use the same portals to locate the phone (though you shouldn’t track your phone down yourself, as this could be dangerous).

Furthermore, the kind of authentication measures you use can be a big help. It is advisable to have a combination of authentication methods.

For example, one step of the authentication can be a PIN that you can easily remember — but is not easy to guess — and the other can be biometric: your fingerprint, an iris scan, or facial recognition will do just fine.

Don’t make payments over public wifi connections; any information transferred over a public wifi connection is easily accessible to anyone who has the know-how. Professional hackers often use these connections to gain access to people’s computers and take them over.

When making payments through your mobile app, it is often best to use your carrier’s internet connection as opposed to logging into the store’s free and public WiFi.

Keep an Eye on Your Finances

While doing what you can to keep your financial data safe when using mobile payment apps is important, don’t neglect the other end of things, either. Monitor and reconcile your credit statements regularly to spot signs of fraud or unauthorized purchases.

You can use apps designed to give you a receipt as soon as you make a mobile payment. This way you can always check your current balance against what you have spent to see if there are any discrepancies that could signal that someone else has unauthorized access to your account.

You should also monitor your credit reports for signs of unauthorized use and report any concerns to the relevant authorities as soon as possible. If you’re concerned about identity theft, you can use a number of credit tracking and monitoring services to keep an eye on your credit.

The truth is, most mobile payment apps (at least the trustworthy ones) are very safe to use, and you should not worry about being hacked or swindled. That does not mean, however, that security breaches cannot happen.

Often, the best your best bet is to be vigilant and to take all the precautionary measures to ensure that you are as safe as can be from fraudsters and hackers. If you do find signs of fraud or identity theft on your credit reports, take action immediately.