In a Nutshell: Paying off credit cards can improve credit scores substantially as outstanding debt is the second most heavily-weighted factor in calculating credit scores. We examine factors that determine credit scores and evaluate two case studies where loan seekers paid off credit card debt to improve their scores. If negative marks on your credit report are the cause of your low score, it is advised to find a credit repair service to help remove them.

A survey conducted by the Consumer Federation of America found that a startling number of Americans know little about credit scores, including more than a quarter of respondents not knowing ways to raise or maintain their scores.

It seems that a common question among Americans would be, based on the evidence in the study, “How much will paying off credit cards improve a score?”

There are many ways to improve credit scores and paying off revolving debts is one of them. Credit card balances and other outstanding debts are the second-most important factor considered used to determine your FICO score — the most widely used credit score by lenders. Therefore, reducing the amount you owe will boost your credit scores, but by how much is determined by other factors.

There’s No Fixed Amount of Points Your Score Will Improve

Because each individual’s credit report is unique and several factors determine one’s scores other than credit card debt, there’s no set amount of points your score will improve from doing any one action that applies to everyone.

How Much Your Score Improves Depends on Your Outstanding Balance

Someone who pays off $1,000 on a card with a $5,000 limit isn’t going to see the same score hike that someone paying off a maxed out card will. This is because of your credit utilization ratio.

The generalized rule is for every open account you have, you want your credit utilization to be below 30%.

How Long it Takes You to Pay Your Credit Card Debt Also Matters

The manner in which you pay your credit card debt also contributes to the rate at which your score improves.

For instance, if you stop using the card and continue to pay it down month after month until it is eventually at a $0 balance or at least below 30% utilization, your score will gradually increase over time, assuming all your other credit accounts are in good standing. If you pay the balance in full, you’ll notice a significant point increase much sooner.

The best way to determine which actions can improve your credit score and by how much is to use a credit simulator tool. A credit simulator can tell you how to improve your score based on the amount of cash you have on hand to pay your debts, as well as how much of a point increase to expect per action.

Experian and TransUnion — two of the major credit bureaus — provide simulator tools you can use to estimate the result of changes to your account.

Real Examples of Score Hikes from Credit Debt Repayment

We looked at two case studies provided by Mid Oregon Lending to see just how much a credit score could improve by paying off credit card debt.

Case 1: Credit Score Increase of 42 Points

Mr. & Mrs. Doe were in the market for a new home and needed a mortgage lender in the month of October. Their credit score was 678, but to receive the best rates, a 740 or above is needed. Without a better credit score, the mortgage would cost them an additional $4,500 on a $200,000 loan amount.

To determine the easiest and quickest way for the Does to increase their score, a credit simulator was run and three actions were suggested (in order):

- Pay down the balance on Credit Card 1 of $3,595 to $231 – Score impact: +44

- Pay down the balance on Credit Card 2 of $1,583 to $173 – Score impact: +8

- Pay off Credit Card 2 of $1,582 to $0. This reduces the number of accounts with a balance. Score impact: +3

The reason paying down Credit Card 1 had a much higher score impact for the Does was because they were using 119.8% of their limit, beyond maxed out.

When all was said and done, the Does decided to pay Credit Card 1 in full, and their score was raised to a 720 by December. The Does did not receive the full credit score impact because of other accounts on their credit reports, including running up more debt on Credit Card 2.

By raising their score from 678 to 720, they saved $5,000 on a $250,000 mortgage loan.

Case 2: Credit Score Increase of 81 Points

In July, a borrower requesting a $200,000 loan had a steady income and a 20% down payment ready. His student loans were paid off, and he had no derogatory marks on his credit report. But when his credit was run, his score was 698. The same credit analyzer tool was used and determined he could potentially increase his score by 102 points.

Here is what the credit analyzer found:

- Pay down the balance on Credit Card 1 of $3,629 to $652 – Score impact: +84

- Reduce the total debt of non-mortgage accounts by paying down the balance on Credit Card 1 of $3,629 to $300 – Score impact: +18

The borrower paid his card to a $0 balance. When his credit was re-run in August, his score was 779, an increase of 81 points. The case study states that the borrower likely didn’t receive the full credit score impact because of a lack of reported balances on credit accounts.

By raising his score from 698 to 779, he saved $3,000 on a $200,000 mortgage loan.

The Other Factors That Determine Your FICO Credit Score

By now you know that paying your credit card debt will improve your credit score, but what else makes up your FICO score?

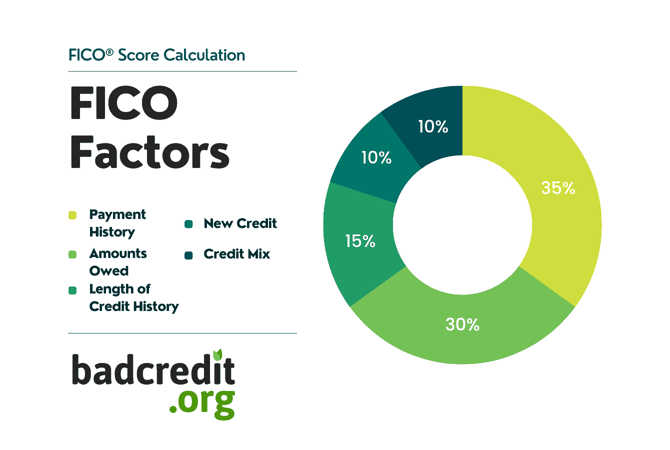

FICO uses five factors to calculate credit scores, in order of importance:

1. Payment History – 35%

Payment history is the largest factor used to determine your FICO score, i.e, whether you make your payments on time. If you’re trying to improve your score, whatever you do, don’t make a late payment on any of your accounts, or worse — miss several payments, known as default.

2. Amounts owed – 30%

This represents your outstanding balances, e.g., your credit card debt. Owing money on a mortgage loan, student loan, auto loan, and other types of debt will impact this metric.

3. Length of Credit History – 15%

A longer established credit history results in a better score, assuming the accounts are in good standing. The general guide is that a credit history of seven or more years is best for your credit scores. FICO looks at the age of your newest account, oldest account, and the average age of all of your accounts combined.

4. Credit Mix – 10%

What types of accounts do you currently have open or have had in the past? A mortgage, student loans, credit card debt, medical bills, retail accounts, etc. — all of these are considered and referred to as your credit mix. Lenders prefer to see a variety of accounts in good standing on your credit reports because it means you can handle managing various loans.

5. New Credit – 10%

You generally don’t want to open too many new accounts within a short amount of time. According to FICO, “Research shows that opening several credit accounts in a short period of time represents a greater risk – especially for people who don’t have a long credit history.”

The Road to Recovery: How to Boost Your Score

By boosting your credit score, you’ll receive lower interest rates and increase your chances of approval for all types of loans and credit.

Your credit report information is updated frequently, usually monthly, so when you begin making positive changes, it won’t take very long to notice improvements if you’re consistent. Other than paying down your credit card debt, you can:

- Consistently pay bills on time every month.

- Do not max out, or even coming close to maxing out, credit cards or other revolving credit accounts.

- Pay down debt and not open several new accounts within a short period.

- Regularly check your credit reports to make sure they are error-free.

You can get free copies of your credit reports — one from each credit bureau — once per year from AnnualCreditReport.com, the only federally authorized resource for credit reports. This guide can teach you several additional ways to improve your credit.

Photo credits: blog.creditkarma.com, myfico.com