Your credit score is a reflection of the age, type, size, and general standing of the myriad accounts that make up your credit report. Maintaining and updating those reports is the general purview of the three major nationwide consumer reporting agencies (NCRA), also known as credit bureaus, Equifax, Experian, and TransUnion. Unless something, such as a medical bill, is reported to one of these agencies, it won’t be a part of your credit report, and won’t affect your credit score.

However, when your medical bills get out of hand, become delinquent while you dispute an insurance claim, or otherwise go unpaid, they can end up in the hands of a collections agency. In an attempt to encourage you to pay those bills, the collections agencies will often report your delinquent account to one or more NRCA, resulting in a collections tradeline on your report and a corresponding decrease in your credit score.

Nearly 20% of Consumers Have Medical Debt in Collections

If you’re feeling overwhelmed by delinquent debt, you’re certainly not alone. In a study published by the Consumer Financial Protection Bureau (CFPB), Consumer credit reports: A study of medical and non-medical collections, researchers determined that, “In our sample of credit reports from one NCRA, collections tradelines appear on the credit reports of almost one-third (31.6 percent) of consumers.”

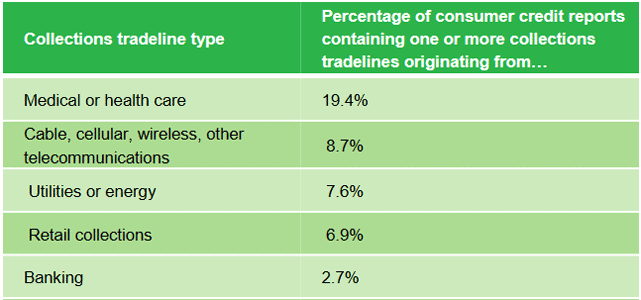

Across the nearly 220 million consumers with credit reports, that one-third represents around 73 million people whose credit scores have been impacted by a collections tradeline. What’s more, the study also found that more than half — a whopping 52% — of all the collections tradelines were from medical debts.

“Nearly one in five consumers (19.5%) has a credit report containing one or more collections tradelines that originated with a medical provider. Among [those] consumers who have medical collections tradelines, the median consumer has two such tradelines.” So, why do so many Americans seem to have difficulty paying their medical bills? According to the report, the system may be as much — if not more — to blame as the consumer.

This chart from the CFPB report shows almost one-fifth of consumers have collections tradelines due to delinquent medical bills.

“Lack of price transparency, and the complex system of insurance coverage and cost sharing, means many consumers — including those who have health coverage — receive medical bills that are a source of confusion. As a result, they can incur medical debts in collections without certainty about what they owe, to whom, when, or for what. This uncertainty could affect any consumer, regardless of their financial condition.”

Additionally, the report found that, even had consumers disputed or otherwise taken care of some of these delinquent accounts, credit reports were rarely updated.

“Industry guidelines for reporting to the NCRAs instruct furnishers to update information on all accounts every month. We observed that, while most lenders furnishing data on active tradelines observe this reporting standard, most collectors furnishing collections tradelines do not. During a six-month period from December 2013 to June 2014, only a small fraction of medical, utilities, and telecom collections tradelines were updated on a regular monthly basis. The majority were never updated during this time period.”

Medical Debt Can Be a Poor Indicator of Consumer Risk

In the end, the report determined that the occurrence of collections tradelines, particularly those originating from medical services providers, were, indeed, a poor indicator of a consumer’s circumstances and overall creditworthiness.

“Both the complexity and confusion that accompanies the medical billing process, and the variety of financial conditions of the consumers who incur medical debts, indicate that the appearance of a medical collections tradeline on a credit report can reflect uniquely diverse financial circumstances and behavior among consumers with medical collections tradelines. Our research on medical collections tradelines demonstrates that a large portion of consumers with medical debts in collections show no other evidence of financial distress and are consumers who ordinarily pay their other financial obligations on time.”

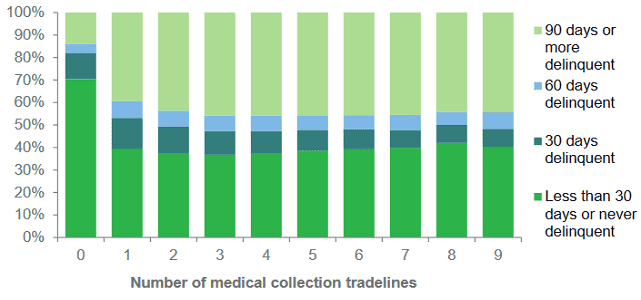

This chart shows the worst non-collections delinquency on the credit reports of consumers whose only collections tradelines are from medical services providers. The chart indicates these consumers are actually very likely to have an otherwise “clean” — no accounts more than 30 days delinquent — credit report.

The report went on to discuss traditional credit scoring, which counts medical and non-medical collections tradelines as the same when calculating a credit score. “Leading credit score developers report that until recent years, their models have treated the presence of collections tradelines as a one-dimensional attribute and have weighted the presence of collections tradelines the same, regardless of type of debt, amount owed, or unpaid versus paid status.”

As a result, it said, credit score models often underestimate the creditworthiness of those with collections tradelines from medical services providers. “Consumers with medical debt were more likely to pay their future loan obligations on par with consumers scoring at least ten points higher. In cases where the consumer’s medical debt was paid off, the scores underestimated the consumer’s creditworthiness by an average of 22 points.”

The FICO 9 Score Brings Big Changes

The final recommendation of the study included rules or industry best practices to standardize billing policies as a way to limit consumer confusion and unknown delinquencies. It also suggested an improved credit score model to better reflect consumer creditworthiness. “Credit scoring models that differentiate medical collections from other collections are likely to more accurately reflect the actual creditworthiness of consumers.”

One such model referenced in the study is the most recent FICO 9 score. Unlike other scoring models, including previous FICO versions, the FICO 9 score actively differentiates between medical and non-medical collections tradelines. In addition, the new scoring model will no longer count paid collections as negative accounts and will take positive rental history into consideration when determining scores. While most lenders have been slow to adopt the new model, and mortgage lenders are unlikely to ever do so, FICO 9 is a good step toward an accurate, modern model.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.