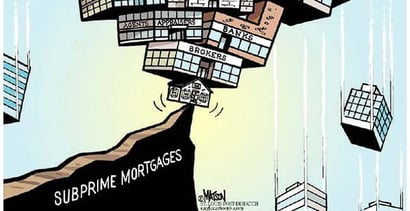

When the American housing bubble burst, it led a financial panic and the collapse of the American economy.

Wall Street made problems even worse by investing a large amount of money in new investments based on housing loans. This caused some to wonder if bankers may have seen the crash coming and misused this information to make a profit.

A new study out of the University of Michigan and Princeton seems to suggest the opposite. Bankers not only didn’t profit off the market crash, they actually came out worse than other investors.

The study looked at the housing investments of 400 mid-level managers in the securitization departments of banks – people that understood housing trends and the new Wall Street securities well.

The researchers looked at whether these managers were buying or selling homes during the bubble.

“Bankers not only didn’t profit off the

market crash, they actually came out worse.“

During this time, the managers as a group were buying up properties. Many took on a second home as an investment or upgraded to more expensive homes.

As a result, they took a big financial hit when the market eventually crashed.

This is strong evidence against the theory bankers knew a crash was coming. If they were aware of the problems with subprime borrowing, these managers would have been looking to sell.

In fact, this group did worse than a control group of equity analysts and non-real estate lawyers – people in a similar income bracket that weren’t as close to the housing market.

It seems Wall Street was just as caught off guard by the housing crash as the rest of the country.

While Wall Street’s actions likely made problems worse, it seems they acted out of misinformation like everyone else rather than bad intentions.

Source: University of Michigan and Princeton. Photo source: presidiopenthouse.com.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.