In a nutshell: Debt Quencher is a no-nonsense program that helps you visualize your credit card debt and develop your very own payoff plan. Its simple interface and ‘what-if’ scenarios help empower users like few other personal finance apps can.

Credit cards are a double-edged sword. On one hand, they provide ordinary people quick and easy access to money, but they also can pull us into debt that, if not managed properly, leads to late payments and penalties to our credit scores.

With the average card user having more than three credit cards in their wallet, not to mention more than $872 billion in credit card debt nationwide, tackling credit card debt may seem like a difficult, agonizing challenge.

Luckily, consumers can turn to programs like Kevin Hoctor’s Debt Quencher, a desktop app that allows consumers to develop their own personalized payoff plan to conquer their credit card debt once and for all.

Customizing Your Own Debt Payoff Plan

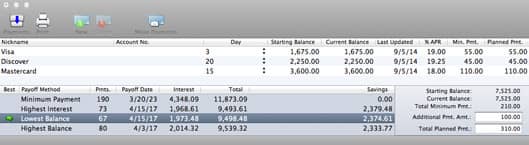

Debt Quencher neatly organizes the details of your credit card debt payoff plan.

“Back in early 2006, I was using a similar type program on my Mac to get rid of my own credit card debt,” said Kevin Hoctor, the mastermind behind Debt Quencher and No Thirst Software LLC. “After using it for a while, I wanted to see if the developer had any updates coming and offer suggestions, but I couldn’t find the company anymore so I decided to write my own and include the ideas I had wanted.”

Debt Quencher’s main selling point is the customization and flexibility users have to craft their own credit debt payoff plan. It follow a simple three-step process:

- Enter your credit car balances

- Pick your payment method

- Follow the payment plan

Users enter basic information about each of their cards: the outstanding balance, interest rate, minimum payments and any additional payments he or she might want to make.

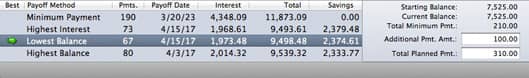

In our hypothetical scenario, Debt Quencher recommended we pay off our lowest balance credit cards first.

A window below your card information shows you the scenarios for the four methods of paying off debt: paying only the minimum payment, paying the highest interest loan first, the lowest balance first or the highest balance first.

Based on the information for the user’s cards, Debt Quencher will highlight the estimated number of payments, payoff date and total interest paid.

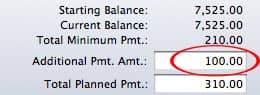

Don’t forget to add additional payments on top of your minimum payments, or you’ll be stuck in debt forever!

The program then recommends the most cost-effective plan for the user’s unique debt situation. The “savings” column illustrates just how much money the user will save if they choose another method and pay more than just the minimum payment (which is generally the worst way to get out of debt).

“The goal was to quickly show how paying the minimum amount would play out and how much faster you could get out of debt by using one of the other methods,” Hoctor said.

“The goal was to quickly show how paying the minimum amount would play out and how much faster you could get out of debt by using one of the other methods.”

Follow any of the plans and you’ll start to see a snowball effect, Hoctor said.

“When you pay off a credit card, you apply that amount to the next one on your list,” he said. “Pay off two cards and now you have both those amounts applied to another card payoff. You keep paying the same amount each month, but your payoff accelerates as you pay off each credit card balance.”

Helping Visualize Your Future

Since Debt Quencher doesn’t actually link to your creditors, you’re free to manipulate your payment amounts and interest rates in a limitless number of ‘what-if’ scenarios. Debt Quencher calculates loan amortization in a flash, letting you know how much interest and time it’ll take you to pay off any kind of loan.

Its simplicity makes it a great tool for people who may not be mathematically or technologically inclined.

Kevin Hoctor

“When I designed Debt Quencher, I wanted it to be as simple as possible to understand,” Hoctor said. “Other packages had so many steps – the process felt cluttered. Debt Quencher shows you everything you need to know on a single window… I wanted to see if I could pay off my debt in as few payments as possible, so I designed the interface to allow me to watch the payoff date as I tossed just a bit more money at the debt. This instant feedback was a critical part of the design.”

“When I designed Debt Quencher, I wanted it to be as simple as possible to understand… User experience is everything.”

Debt Quencher is a supremely practical app that lacks the advertisements and distractions of similar debt management programs. Its one goal is to help people visualize and plan their debt payoff plan — and it does it very well.

“User experience is everything,” Hoctor said. “Very few people enjoy managing their personal finances, so giving them a quick and easy way to plan their debt reduction is important… Money problems and debt are oppressive factors in people’s lives and eliminating that kind of stress can be very liberating. Getting customer feedback like, ‘Debt Quencher has improved my life dramatically and I’m finally free of debt,’ is incredibly rewarding.”

As of now, Debt Quencher is only available on Mac OS X 10.7 (“Lion”) or newer.

You can try a free trial of Debt Quencher or purchase the full version directly from No Thirst or the Mac App Store.

Photo credits: nothirst, appstories4girls.wordpress.com

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.