In a Nutshell: Establishing or rebuilding a good credit score can be tricky, especially if you’re on a tight budget. Options like secured credit cards exist, but require a chunk of money to be deposited up front to serve as your credit limit. Self Lender offers an alternative way to improve your credit while accruing personal savings. By using a Credit Builder loan deposited in a certificate of deposit account, Self Lender reports your monthly payments to the credit bureaus, helping to build a good credit history with on-time payments. At the end of the 12- or 24-month term, the money in the CD is yours, along with your improved credit score.

When I got my first well-paid job after college, I remember thinking to myself: “Wow, that’s a lot of money. I’m going to be making that much money — and more — every year from now on. I’m rich! What should I buy first?”

Of course, perspective is everything, and I soon learned the lesson so many people eventually discover. No matter how much you earn, if you spend more than you make, you’ll wind up in trouble.

So there I was, two years into my dream job, and I was already buried under a mountain of debt. All of those credit cards that had been so easy to acquire and use were now a weight around my neck. I did what I could to pay down my debt, but it took a long time, and my credit score suffered … badly. Left in my wake were an untold number of delinquencies, charge-offs, canceled cards, and even a repossession.

My credit score was abysmal, and I really didn’t know how to start fixing it. On top of it all, I had no savings and nothing close to an emergency fund. I eventually clawed my way out of that hole, and the difficult lessons I learned through that experience have stayed with me through the years. I now try to pass along those hard-won lessons to anyone who is interested in hearing them.

Things have changed considerably in the years since I single-handedly fought my way out of credit purgatory. Resources are now available for people who find themselves with bad or no credit, but establishing good credit can be tricky, especially if you’re on a tight budget. A secured credit card is one way, but it requires a chunk of money up front, and many charge additional fees. Luckily, there’s an alternative.

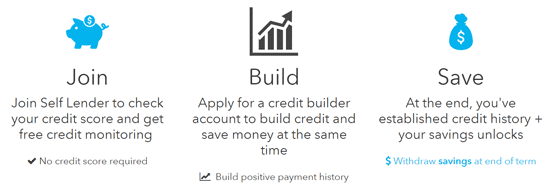

Self Lender is an online platform with a different approach to helping people build or rebuild their credit profiles. This unique system lets people with no credit or poor credit histories open a Credit Builder savings account that can help establish or repair their credit scores. We recently spoke with Jeremy Zafiros, Director of Partnerships at Self Lender, who shared the story behind this unique concept.

“The platform was developed by our CEO, James Garvey, as a way to improve his own credit score,” Zafiros said. “He wanted to offer people with damaged or no credit scores a way to build credit and fix some of their past mistakes.”

Self Lender was rolled out to the public in 2016. To date, more than 80,000 accounts have been opened across America, and the platform has helped customers improve their credit scores and accumulate over $50 million in actual savings.

Invest in Yourself with a Credit Builder Account

Credit builder accounts have been offered by community banks and credit unions for decades, but they are often difficult to find or qualify for. A Credit Builder account from Self Lender is different. It is relatively easy to qualify for because there is no requirement that you have a credit history, or even a bank account. However, you do need a Social Security number, an email address and phone number, valid permanent US resident status, and you need to be at least 18 years of age.

One thing to keep in mind with a Credit Builder account from Self Lender is that this is essentially a loan. But unlike other personal loans where the cash goes to you, this loan goes toward the purchase of a CD. A CD, or certificate of deposit, is a savings instrument with a fixed rate of interest and a fixed payout or maturity date.

The process starts with you choosing the amount of money you’re comfortable paying each month.

“The customer picks a monthly payment amount of between $25 and $150, depending on how much they want to save,” Zafiros said. “They make the payments each month, and we report to the three major credit bureaus. Then, at the end of the loan period, they’ll receive a check for the amount they’ve saved.”

So, what happens if you’re unable to make a payment on time? Or, what if you are unable to continue with the Credit Builder account at all? Self Lender recognizes that sometimes life gets in the way. Payments that are more than 15 days late will incur a late fee of 5% of the payment due but won’t be reported as late to the credit bureaus. If a payment is more than 30 days late, it will be reported as late on your credit report.

So, what happens if you’re unable to make a payment on time? Or, what if you are unable to continue with the Credit Builder account at all? Self Lender recognizes that sometimes life gets in the way. Payments that are more than 15 days late will incur a late fee of 5% of the payment due but won’t be reported as late to the credit bureaus. If a payment is more than 30 days late, it will be reported as late on your credit report.

If you decide you are unable to continue paying into the Credit Builder account but have made at least one payment, you can close the account. If you do this, the money you have paid into the account will be returned to you, minus an early cancellation fee and/or early withdrawal fee for the CD proceeds.

The Effects of Timely Payments on Your Credit Score

A Credit Builder account from Self Lender is reported to the credit bureaus as an installment loan. If you make monthly payments on time, this payment history becomes part of your credit profile. And, since payment history accounts for 35% of your FICO credit score, making these payments on your Credit Builder account can lead to a steady rise in your score.

“Our average customer starts off with a credit score in the mid- to high-500s, and within six to nine months, we typically see a sizable increase,” Zafiros said.

“I was extremely pleased with Self Lender. Not only did I save $1,100, but my credit score went up 43 points. Because of this I was able to obtain a credit card and now I am on my way to better credit scores. Thank You!! Self Lender!!” — Mmagallon, Self Lender client

Most people who choose a Credit Builder loan can expect to begin seeing improvements to their credit score in as little as 45 to 60 days. Continue through the full term of the loan, and you can expect to see your score continue to increase. At the end of the payment period, the amount held in the CD is released to you, and you’ve built both a credit history and extra savings. It’s as simple as that.

Self Lender’s Future Plans Include a Secured Credit Card

Many consumers who are looking to improve their credit scores want to do so to get a credit card. Self Lender recognizes this need and is currently testing a new program designed just for those folks. Zafiros explained how this new feature will work.

“This is a new program for customers who have made it through the loan process and are ready to move forward with building their credit further,” he said. “We will soon be able to roll them directly into a secured credit card if they’re interested. So, for example, rather than receiving a $500 check at the end of the loan, we can take $300 from that and open up a secured card for them and send them the remaining $200.”

Credit rating agencies like to see different types of credit in someone’s credit history. Having paid off an installment loan, and now having a revolving credit line, can add even more points to your score. Also, maintaining a credit relationship with an institution and continuing to make on-time payments is further proof of your creditworthiness.

With its Credit Builder account available to almost anyone in the US, Self Lender is putting improved credit within reach of thousands of Americans. This unique concept is teaching consumers the value of maintaining a good payment history, while helping them build credit and grow savings.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.