What Credit Score is Needed to Lease a Car? Minimum Approval Score (Feb. 2024)

If you’re wondering what credit score is needed to lease a car, well, like so many things in the finance world, the answer isn’t completely definitive. A lot of different factors are at play, so the minimum score needed for one person may be different than the score needed for another.

The decision to lease a car can be a very practical one for many people — and especially for those with less-than-perfect credit. That’s because leasing often has lower credit score requirements than if you were to try purchasing the same vehicle.

If you’ve decided that leasing a car is right for you, you’re probably wondering about the minimum credit score you’re going to need to get approved. Again, as with most things related to finances, the answer depends on many variables. Even a bad credit score doesn’t automatically disqualify you from getting approved for a car lease; it just means you have to educate yourself on the options available. Let’s take a look at what the data says about credit scores and leasing. We’ll also explore some of our top picks for auto lenders who regularly work with subprime borrowers.

Sources Suggest 620 is the Average Minimum Score

Banks and other lending institutions rely on a potential borrower’s credit score in deciding whether to approve a lease and under what terms. The better your credit score, the better the leasing terms and the less money you’ll typically need to put down on a vehicle.

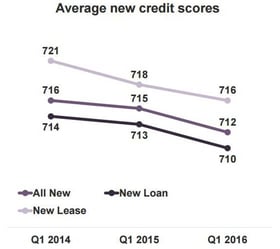

This chart from the Q1 2016 Experian State of the Automotive Finance Market Report shows the average credit score of new leases year over year.

Leasing industry trade groups generally agree that a FICO score of 620 is the average minimum score for approving a lease application. Of course, that’s not to say someone with a lower score can’t lease a car; it just means they will have a harder time qualifying, and will likely pay more for the lease.

A Credit Score Below 600 is Considered a Subprime Lease

According to most experts in the field of auto financing and leasing, the best lease terms are reserved for those with credit scores above 700. For those with scores lower than this, leasing options still exist in the subprime financing category.

A subprime borrower will generally have to put more money toward the vehicle in up-front costs, and a security deposit may even be required. The lower a credit score is, the more onerous these terms can become. A score below 600 or so is often referred to as deep subprime or super subprime, and may entail even more restrictions and higher lease payments.

4 Tips for Bad Credit Approval

The good news for folks with bad credit who want to lease a car is that there are ways to get around the subprime leasing trap. Here are some easy tips to follow if you find yourself in this predicament.

- Shop dealerships and car brands. Often a particular car dealership or manufacturer will have a need to get vehicles out of their inventory and can be more flexible because of this.

- Consider a co-signer. If you have someone with good or excellent credit who can co-sign for a lease, this can help get you approved at much better terms and payment levels.

- Review and fix errors on your credit report. This can take a few months to fully affect your credit score, but by removing erroneous entries on your report you can raise your number to a more acceptable level.

- Be flexible in your choice of vehicles. You may have your sights set on a top-of-the-line model, but by choosing a less expensive or popular car, you may be more likely to get approved.

Whenever making a big purchase, such as a car, research is key. By utilizing these tips, you’ll increase your odds of finding the best deal, regardless of credit score.

Consider a Subprime Auto Loan if Your Score is Below 620

Although leasing is generally considered the better choice for people with low credit scores, this is not always the case. Sometimes it can make more sense to purchase a vehicle rather than leasing it. One reason for this is simply that lenders approve more bad credit auto loans than they do bad credit leasing agreements.

Fully 80% of all new vehicles are financed rather than leased — which means subprime auto loans are more competitive. There is also more flexibility in getting a subprime loan than there is in leasing. Often by putting a little more money down on the vehicle, it can lower the interest rate you pay on the loan. And this can make your car purchase more affordable.

| |

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy, and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See official site, terms, and details »

| Interest Rate | 3.99% - 29.99% |

| In Business Since | 1999 |

| Application Length | 3 minutes |

| Reputation Score | 9.5/10 |

| Our Expert Review | 4.9/5.0 (see review) |

2. LendingTree

| |

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See official site, terms, and details »

| Interest Rate | Varies |

| In Business Since | 1998 |

| Application Length | 4 minutes |

| Reputation Score | 9.5/10 |

| Our Expert Review | 4.7/5.0 (see review) |

| |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See official site, terms, and details »

| Interest Rate | Varies |

| In Business Since | 2003 |

| Application Length | 2 minutes |

| Reputation Score | 8.5/10 |

| Our Expert Review | 4.6/5.0 (see review) |

Final Thoughts on Subprime Leasing

Leasing a vehicle can have its advantages, but when your credit score is considered subprime, this can be a challenge. Now that you know all of the requirements and subtleties of subprime leasing, you can decide whether this is the right choice for you. You can also decide whether waiting for your credit score to improve is a better choice. Finally, consider getting a subprime auto loan, and purchasing the vehicle you’re interested in. As with most financial decisions, knowing your options puts you in a better position to decide.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.