At the most basic level, consumer loans can be placed into one of two categories: those that must be repaid in a single lump sum, and those that are repaid over time through multiple payments — also called installments.

Although lump-sum loans have their uses, installment loans are the go-to loan of choice for many in need of funds.

Installment loans typically come in three main types: personal loans, auto loans, and home loans (also known as mortgages). While some differences exist between the three types, such as unsecured versus secured loans, all installment loans will have a few things in common.

For instance, any installment loan will have specific loan terms, including the length of the loan and the repayment rate, which will establish the frequency and amount of each installment. They’ll also have credit and income requirements that vary by lender and the specific type of loan.

Direct Lenders vs. Networks | Personal Loans | Auto Loans | Home Loans

Lending Networks Work With Thousands of Direct Lenders

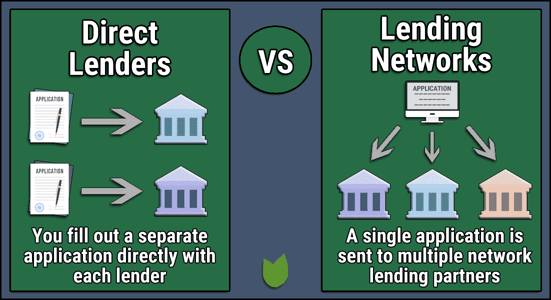

Several decades ago, before the advent of the internet, most loans were obtained from direct lenders, meaning straight from the financing party, be they banks, credit unions, car dealerships, or specific mortgage lenders. Because these lenders had limited competition, borrowers were at the mercy of the rates, fees, and qualification standards set by the lenders.

Over time, the lending landscape has shifted, going digital alongside many other aspects of consumer finance. Today’s borrower is no longer limited to the local direct lenders; instead, those in need of a loan can go online and request offers from direct lenders across the country.

How? Through the power of online lending networks.

Lending networks are a nexus of tens, hundreds, even thousands of direct lenders, connecting you with companies from all parts of the industry. No matter your credit situation or loan needs, lending networks are often the best place to find a variety of competitive loan offers.

The Best Providers for Personal Installment Loans

Personal loans are individual installment loans that can be used to finance just about anything you need, including consolidating other debt, paying medical (or veterinarian) bills, or furnishing your new apartment. These loans generally range from $1,000 to $35,000 and typically have terms of 12 to 60 months, dependent on the size of the loan.

Applicants will need to have a regular income to qualify for a personal loan, with minimum income requirements usually around $800 a month, though the requirement may increase for larger loan amounts.

Our top picks for personal loan networks have quick online applications and lending partners with flexible credit requirements.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% - 35.99% | 12 to 60 Months | See representative example |

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn't impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% - 35.99% | 3 or 5 Years | See representative example |

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

5. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

Although personal loans can technically be used for whatever you like, some uses are simply a bad idea. At the top of the bad-idea list is using a personal loan to purchase a home or vehicle.

Why? Because personal loans, particularly those for consumers with poor credit, will have significantly higher interest rates than either auto or home loans, with personal loan APRs typically exceeding auto loan APRs by 10 percentage points or more.

Why the difference in interest rates? The main reason is that personal loans are unsecured loans, meaning they have no collateral, such as a car title, to secure them against default. Consequently, the lender has no way — short of taking you to court, which is expensive — to recover their money if you can’t repay your loan.

To make up for the increased financial risk, lenders charge higher interest rates for personal loans than they do for other types. Of course, while interest rates will vary with your credit score, they’ll also vary based on the lender, so be sure to shop around to ensure you get the best possible rates.

The Best Providers for Auto Installment Loans

For most people, a car is a necessity, not an option, and when one falls apart, it needs to be replaced. Given that even used cars now have an average price of $33,000, replacing your old vehicle often means taking on an auto loan.

Similar to personal loans, auto loans are installment loans. But, unlike personal loans, auto loans are secured installment loans, meaning the vehicle you purchase secures the loan; if you default, your vehicle goes to the lender.

The length of a typical auto loan is fairly similar to that of a personal loan, generally ranging between 24 and 72 months. The size of the loan you are offered will depend heavily on your creditworthiness, as will the specific requirements, including the required minimum income to qualify. Our top auto loan providers include lenders who specialize in borrowers with rocky credit histories.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

7. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

Unlike personal loans, which can be acquired and used for just about anything, auto loans require that you have a specific vehicle in mind before you apply. You will need to provide information about the vehicle at the time that you apply, and your ability to qualify for the loan will depend on the specific financials of the vehicle as well as your own creditworthiness.

The Best Providers for Home Installment Loans

Home loans often have the longest terms of any installment loan, typically offered as either 15-year or 30-year loans. As with auto loans, home loans are secured loans, with the property itself standing as surety against default.

Whether you dream of buying your first home or seek to refinance your current mortgage, having poor credit can make it much more difficult to find a lender — but not necessarily impossible. Our top-rated providers have large networks of partners to help those with poor credit find the best lenders for their circumstances.

- America's largest mortgage lender

- The entire process is completed online

- Options for new mortgages and refinancing existing mortgages

- Award-winning customer service and cutting-edge digital platforms

- More than 90% of clients would recommend us

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

10. Quicken Loans

- Best for cash-out refinance

- Utilize your home equity with America's #1 lender

- eClosing allows customers to close electronically, greatly speeding the process

- A+ rating with the BBB

- Receive cash for home improvements, college tuition, or paying off debt

- 24/7 access to your loan through the Rocket Mortgage app

- See application, terms, and details

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1985 | 5 minutes | 9.5/10 |

11. eMortgage

- Get today's mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

As with secured auto loans, home loans require applicants to have a specific home selected when they apply. Furthermore, your chosen property may have to meet certain requirements — beyond your own creditworthiness and down payment — when going through the mortgage process, with specific requirements varying with the type of mortgage.

For instance, when applying for an FHA loan, you will likely need to have an appraisal performed on the property to determine its actual value. This is to ensure that the property you purchase, which will act as collateral for the secured home loans, is actually worth the amount the lender is offering you.

If the house is not worth the loan for which you are applying, you will likely be rejected for the loan or be required to provide a larger down payment amount. Some loans may also require that certain repairs be made to the property before the loan can be completed.

The Right Network Can Make All the Difference

No matter how efficient a saver you are, some purchases require the ability to pay over time rather than having to scrounge up a large lump sum. Whether you need to consolidate your bills, get back on the road, or refinance your home, the help of a good lender can make these important long-term purchases possible.

While finding the right lender can be a challenge when you have poor credit, options are out there for those who do a little research. A quality lending network can make the job of finding a flexible lender much easier by connecting you with dozens of lending partners from around the country.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.