PREMIER Bankcard® Credit Card Reviews & Top 3 Alternatives

If you put yourself in the right perspective, just about everything has pros as well as cons. For instance, an all-you-can-eat pizza buffet sounds like it’s all pro — until two hours later when you can’t move for being so full. Found the con.

The same can be said about the wealth of choices available for bad-credit credit cards for damaged credit. On the one hand, options allow for more customization and provide room for competition. On the other hand — how do you choose?

A big name in the subprime credit card market, PREMIER Bankcard® may be on your list of options. Below, we’ll dive into PREMIER Bankcard® credit card reviews, explore the pros and cons of this common card, and learn about a few alternative options worth considering.

The Pros | The Cons | Top 3 Alternatives

The Pros: Bad Credit and Bankruptcy OK

(See Provider Website for full Terms & Conditions)

PREMIER Bankcard® provides credit cards designed for consumers with less-than-perfect credit histories. Popular for its subprime credit card offerings, the PREMIER Bankcard® credit cards cater to the poor-credit (credit scores below 580) consumer market.

This means that those with low credit scores who would be turned down for unsecured credit from most mainstream issuers are more likely to qualify for a PREMIER Bankcard® credit card.

Interest Rate See Provider Website Reports Monthly Yes Application Length 4 minutes Reputation Score 9.0/10

Interest Rate See Provider Website Reports Monthly Yes Application Length 4 minutes Reputation Score 9.0/10

This offer is currently not available. PREMIER Bankcard® Secured Credit Card

Credit requirements for a PREMIER Bankcard® credit card are extremely flexible, and the issuer will consider applicants with a variety of credit backgrounds, including those who have recently undergone bankruptcy.

The Cons: High APRs and Low Credit Limits

(See Provider Website for full Terms & Conditions)

Of course, as with most things in life, not everything about PREMIER Bankcard® credit cards is perfect. For the most part, however, the cons presented by the cards are inherent in just about any unsecured subprime credit card, and they aren’t necessarily limited to PREMIER Bankcard®.

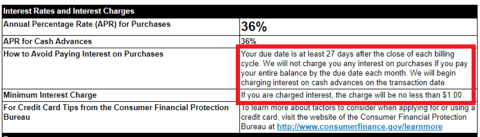

One example of a con universal to subprime cards is the high interest rate you’ll be charged for carrying a balance from month to month. That said, PREMIER Bankcard® charges a particularly high rate even for a bad-credit credit card, charging a 36% APR on new purchases and cash advances alike.

The low credit limit may also be a bummer for some customers, as subprime credit cards, PREMIER Bankcard® included, tend to limit your available credit line to avoid the risk you’ll default on a large amount. Don’t expect a credit limit higher than $500 for your card (or most other unsecured subprime cards). If you need a higher limit, try a secured credit card.

Another negative you’ll experience with a PREMIER Bankcard® card will be the fees associated with opening and maintaining your credit card account, starting with the one-time program fee charged when you open your account. You’ll also see an annual fee, the size of which will vary with the size of your opening credit limit. Expect to pay at least $75 for the first year’s annual fee (See Provider Website for full Terms & Conditions).

3 Additional Credit Card Options For Bad Credit

For all that the cons may be similar across the subprime credit card market, that doesn’t mean each card is the same as the next. You should consider all of your options before choosing a card to ensure you select the best card for your individual financial situation.

Among our other expert-rated options for credit cards for bad credit are other unsecured credit cards, store credit accounts, and secured credit cards, with something designed to help just about any credit scenario.

Interest Rate 35.90% Fixed Reports Monthly Yes Application Length 9 minutes Reputation Score 8.5/10

Interest Rate 35.90% Fixed Reports Monthly Yes Application Length 8 minutes Reputation Score 8.0/10

This offer is currently not available. 3. Indigo® Mastercard® Credit Card

+See More Credit Cards for Bad Credit

Once you’ve made a selection, only apply for one new credit card, rather than trying to increase your odds by applying to many cards. Every new application for credit can result in a hard credit pull, the likes of which are included in the new credit factor of your credit score. This factor is worth 10% of your FICO score, so each hard credit inquiry on your report can ding your score several points.

If you’re unsure of your chances of approval for a certain card, you can often check for pre-qualification offers. While not supported by all issuers, pre-qualification uses a soft credit pull to estimate your approval chances. Pre-qualification doesn’t guarantee you’ll be approved when you apply, but it can be a good indicator, and soft credit pulls won’t negatively impact your credit score, making the process a win-win.

How Do PREMIER Bankcard® Credit Cards Work?

(See Provider Website for full Terms & Conditions)

PREMIER Bankcard® currently provides two credit cards for consumers with poor credit. One is a secured card that requires a collateral deposit. The other is an unsecured card that has the same terms and conditions but allow you to choose your card art.

You can use all three cards to make purchases online, at stores, over the phone, and in apps.

The cards offer a 27-day interest-free grace period, which is longer than many cards for bad credit. The grace period extends from the end date of a billing cycle to the payment due date. You don’t accrue interest during the grace period if you did not have an unpaid balance at the start of the billing cycle.

You must pay at least the minimum required payment by the end of the grace period. If you pay less than the total balance due, you’ll begin accruing interest on your outstanding balance.

The trio of PREMIER Bankcard® credit cards allows you to take out a cash advance of up to 50% of the overall credit limit assigned at account opening. The two unsecured cards scale their annual, setup, and monthly fee schedules based on your credit limit. PREMIER Bankcard® credit card offers do not support balance transfer transactions.

All three cards charge fees for cash advances, foreign transactions, and late or returned payments. The PREMIER Bankcard® Secured Credit Card has lower fees than the bank’s unsecured cards (See Provider Website for full Terms & Conditions).

What Kind of Benefits Do PREMIER Bankcard® Credit Cards Offer?

(See Provider Website for full Terms & Conditions)

The best benefit of PREMIER Bankcard® credit cards is their willingness to approve applicants despite their abysmal credit. The unsecured cards’ high APRs and fees allow them to accept cardmembers too risky for other card issuers. These cards do not offer rewards, but you can increase your credit limit by paying your bills on time for 12 consecutive months.

The card trio carries the Mastercard logo, ensuring worldwide acceptance and fraud protection. In addition, the cards offer robust customer support via its domestic service agents, 24/7 online account access, and a mobile app.

You’ll also benefit from the credit card issuer’s policy of reporting all your credit activity to the major credit bureaus. Start building credit by keeping your balance low and paying all your bills on time each month.

Moreover, the cards provide you with automatic payment reminders, free access to your FICO credit score from the Fair Isaac Corporation, alerts for purchase limits and PIN changes, and paperless statements. You can select your favorite card design without an additional fee.

Which PREMIER Bankcard® Credit Card Is the Easiest to Get?

The PREMIER Bankcard® Secured Credit Card is the easiest to obtain from this credit card company. The biggest stumbling block is the refundable security deposit. But the card saves you money by not charging setup or maintenance fees, both of which are nonrefundable (See Provider Website for full Terms & Conditions). You can use the money you save to pay for purchases.

PREMIER Bankcard® Secured Credit Card

This offer is currently not available.

PREMIER’s cards are among the most accessible to consumers with bad credit. If the card issuer declines your application, you may want to get a prepaid debit card instead. Prepaid cards do not check your credit score because they don’t extend credit.

How Can I Increase My PREMIER Bankcard® Credit Limit?

PREMIER Bankcard® follows an explicit policy for considering credit limit increases. You may qualify for more credit if you keep your account in good standing for 12 consecutive months after opening the account. In practice, you must pay your bills on time every month and refrain from spending more than your credit limit.

Make note that the unsecured cards assess a credit limit increase fee (See Provider Website for full Terms & Conditions).

Does PREMIER Bankcard® Give Instant Approval?

When you apply for one of its cards, PREMIER Bankcard® will give you a response in 60 seconds but not necessarily instant approval or instant decision. While these cards are among the easiest to get, no credit card issuer can guarantee it will approve all applicants.

Sometimes, card issuers cannot immediately decide whether to approve your application. Often, the delay stems from missing or conflicting data.

Whatever the reasons for the holdup, Regulation B of the Equal Credit Opportunity Act requires issuers to respond within 30 days. If the issuer rejects your application, it must send you an Adverse Action Notice (AAN) by the end of the response period.

The notice can contain two types of responses:

- The chief risk factors causing the issuer to reject your application, or

- Notice of your right to request the reasons for denial within 60 days after receiving the AAN.

The notice should provide the following information:

- The credit bureau supplying the report that helped cause your denial

- Your credit score and the scoring system used

- The risk factors responsible for your denial

- Notice that a free copy of your credit report is available within 60 days

- Notice that you can dispute any information contributing to the denial

The Adverse Action Notice is helpful because it tells you what to fix before reapplying for a credit card. For example, a credit card may deny your application if you carry too much debt. If you can’t quickly correct the problem, consider getting a secured credit card instead, as this card type doesn’t rely on your credit history.

Should PREMIER Bankcard® approve you for an unsecured card, you will have to pay a one-time setup fee before receiving the card. The card’s annual and maintenance fees will appear on your billing statements.

You must send in a security deposit after receiving approval for a PREMIER Bankcard® Secured Credit Card. The card initially reduces your credit line by the annual fee amount, but your payment restores the full credit limit.

Use PREMIER Bankcard® Cards Responsibly

The pros and cons of many situations will strongly depend on how you choose to look at them. I choose to see pizza buffets from the best-invention-ever perspective, rather than the one in which they’re horrible traps designed to make you overdose on mozzarella.

Along that same vein, if your perspective on a new credit card is to rebuild your poor credit through the responsible use of your new card, then the PREMIER Bankcard® line of credit cards presents a solid option. You can build or rebuild your credit: apply for a PREMIER Bankcard credit card, keep your balance low, and pay all your monthly bills on time.

Within this perspective, you should only charge what you can afford to repay right away and pay off your entire balance each billing cycle to avoid interest.

At the same time, if your perspective is that you should be able to find a low-interest, low-fee credit card with high limits that will just happen to overlook your bad credit, well, prepare to be disappointed by PREMIER Bankcard® — and by life in general.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.