8 Best Dental Loans for Bad Credit (Feb. 2024)

Despite being one of the smallest critters on the dental radar, snails are a mouthy marvel among munchers. The typical snail has tens of thousands of teeth, and some species of snail sport more than 20,000 microscopic masticators. And forget regular dental visits to maintain all that toothy goodness; snails simply replace their worn-down teeth with brand new ones as needed.

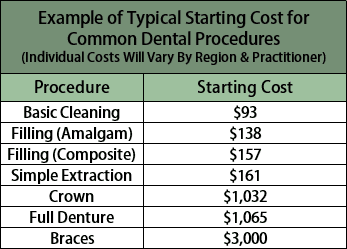

Unfortunately, humans don’t have the incredible incisors of our slimy friends. Instead, we rely on the expertise of our local neighborhood dentists to keep our bicuspids at their best. But even a basic dental procedure can get costly — and it only goes up from there, making financing a necessity for many, particularly the 23% of Americans without dental insurance. With poor credit, financing major dental procedures can be a challenge, but options are out there for most consumers.

Keep reading for information on dental loans for bad credit — we’ll explore a number of options, including personal installment loans, short-term loans, using credit cards a type of loan, and making payment arrangements with the dentist.

Installment Loans | Short-Term Loans | Credit Cards | In-House Plans

Best Personal Installment Loans for Dental Financing

Although the average filling will only set you back a couple of hundred dollars, a major mandibular malfunction could easily skyrocket you into the four-digit range. The lifetime cost of braces, for example, ranges between $3,000 and $8,000 when you include the material costs and subsequent dental visits.

Personal installment loans are often ideal when you need to finance larger purchases, as they are repaid through a series of regular monthly payments (or installments) over the course of the loan. Installment loans also tend to have lower interest rates than other types of financing, but you should still shop around for the best rate, such as with an online lending network like our picks below.

1. CashUSA.com

| |

- Loans from $500 to $10,000

- All credit types accepted

- Loan requests can be approved in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details »

| Loan Amount | $500 to $10,000 |

| Interest Rate | 5.99% - 35.99% |

| Loan Term | 3 to 72 Months |

| Loan Example | Representative example |

| Our Expert Review | 4.7/5.0 (see review) |

| |

- Loans from $500 to $10,000

- Helping those with bad credit since 1998

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next day

- See official site, terms, and details »

| Loan Amount | $500 to $10,000 |

| Interest Rate | 5.99% - 35.99% |

| Loan Term | 3 to 60 Months |

| Loan Example | Representative example |

| Our Expert Review | 4.6/5.0 (see review) |

| |

- Loans from $250 to $35,000

- Bad credit is no problem

- Available in all 50 states

- Use the loan for any purpose

- Fastest approval and funding

- See official site, terms, and details »

| Loan Amount | $250 to $35,000 |

| Interest Rate | 5.99% - 35.99% |

| Loan Term | 3 to 72 Months |

| Loan Example | Representative example |

| Our Expert Review | 4.3/5.0 (see review) |

+See More Personal Loans for Bad Credit

A typical personal installment loan will have a duration of at least six months, though they are often available with lengths as long as 72 months (six years). Since they are designed to be repaid over time, installment loans are often available in larger amounts than other types of financing, with some bad-credit loan providers offering qualified borrowers up to $35,000 — more than enough to cover Junior’s braces.

Best Short-Term Loans for Dental Financing

A four-figure dental bill may be a common reality, but the more frequent dental dilemma is likely of a more diminutive nature — but of much more immediate concern. From abscess-driven toothaches to accidental incisor incidents, these problems can not only be quite painful, but can frequently turn into a major disaster if not addressed in a speedy fashion.

Short-term cash advance loans are intended to finance smaller purchases — most short-term loans max out at $2,500 — over a short period of time, typically less than six months (but as short as seven days). These loans tend to have the highest APR of most credit products, but you can use an online lending network, like those below, to comparison shop rates and fees.

| |

- Short-term loan of $100 to $1,000

- Bad credit is no problem

- Large network of lenders

- Loan decision as fast as a few minutes; funding as soon as next business day

- Required: Income of $1000+/month and at least 90 days on job

- See official site, terms, and details »

| Loan Amount | $100 to $1,000 |

| Interest Rate | 200% - 2,290% |

| Loan Term | Varies |

| Loan Example | Representative example |

| Our Expert Review | 3.9/5.0 (see review) |

5. MoneyMutual

| |

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details »

| Loan Amount | Up to $5,000 |

| Interest Rate | Varies |

| Loan Term | Varies |

| Loan Example | Representative example |

| Our Expert Review | 4.8/5.0 (see review) |

+See More Personal Loans for Bad Credit

Unlike installment loans, short-term cash advance loans are repaid as a single lump sum at the end of the loan period. This sum will include the entire principal amount plus all applicable finance fees. The finance fees charged by a short-term cash advance loan are generally based on the size and duration of the loan, and these flat-rate fees often equate to three-digit APRs.

Best Credit Cards for Dental Financing

In the digital day and age, most dental offices will likely happily accept major credit cards as a form of payment, making your favorite plastic payment card a solid option for financing smaller dental procedures. While credit cards for bad credit won’t have the lowest APRs on the block, they will usually be less expensive than a short-term loan if you can pay off the balance quickly.

In fact, depending on how long you need to repay your dental bill, credit cards may even offer an interest-free way to finance your fillings. That’s because most credit cards offer a grace period — the time between when you are billed and your due date — to pay off your purchases before you are charged interest fees on those purchases. Our expert-rated picks all have at least 21-day grace periods.

| |

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

- See official site, terms, and details »

| Interest Rate | N/A |

| Reports Monthly | Yes |

| Application Length | 5 minutes |

| Reputation Score | 9.5 |

| |

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply

- Monthly reporting to the three major credit bureaus

- Initial Credit Limit of $400.00 (Subject to available credit)

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Checking Account Required

- See official site, terms, and details »

| Interest Rate | 29.99% |

| Reports Monthly | Yes |

| Application Length | 10 minutes |

| Reputation Score | 7.5/10 |

| |

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®† *See Program Terms for important information about the cash back rewards program. ** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required. † Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

- See official site, terms, and details »

| Interest Rate | 29.99% or 36% Fixed |

| Reports Monthly | Yes |

| Application Length | 7 minutes |

| Reputation Score | 8.0/10 |

+See More Credit Cards for Bad Credit

One thing to look out for when applying for a new credit card to finance a pressing dental bill is that most subprime credit cards come with an annual fee that will be charged as soon as you open the account. This means your initial available credit will be reduced by the size of your annual fee until that fee is paid.

Additionally, be careful accruing a balance that is too close to your credit limit, as this can be damaging to your credit score thanks to an increased utilization rate (the ratio of how much credit you are using over how much you have available). As a rule of thumb, utilization rates above 30% (give or take) are considered to be less-than-ideal for your credit score.

Your Dentist May Offer In-House Payment Plans

Another option for some patients may be to set up an in-house payment plan with your dentist/care provider. These can either be financed by the practice itself or financed through a third party, and often charge low — or even 0% — interest rates (though this can depend on the nature of the lender). While some payment plans will not require a credit check to obtain, this may vary by the individual care provider.

Even if you are offered a zero-interest deal, be sure to ask whether the payment plan charges deferred interest. In a deferred interest loan, the borrower isn’t charged any interest fees so long as they pay off the entire amount before the end of the financing period. If any portion of the balance remains after that time, however, you may be on the hook for interest fees for the entire balance. If you choose this route, just be sure you’ll be able to pay off the balance before those interest fees kick in. Otherwise, you may be in for a surprise when the new balance is billed to you.

Additionally, many in-house payment plans not handled by a third party are unlikely to report the line of credit to the major credit bureaus (unless you miss a payment). While this means the debt likely won’t damage your credit score so long as you stay current, it also means that the credit line won’t help you build your credit score, either.

In-house payment plans are often easiest to obtain in cases where the patient will require multiple visits over a period of time, such as in the case of braces or dental implants, but may also be available for smaller procedures. You may be required to provide a down payment before or at the time of the (first) procedure, with regular payments due at predetermined intervals thereafter.

Financing that Helps You Smile

Not only does the typical snail have an impressive 12,000-tooth smile, but those tiny teeth are chewing powerhouses, with enough strength to excavate rock while they snack. If we all had chompers that choice, the dental profession would certainly run out of patients.

Sadly for most of us (minus the dentists), human teeth aren’t quite as hardy as those of your average slime secretor. Our less-resilient ruminators instead require regular maintenance — and the help of dental professionals — to keep in tip-top shape. While that help isn’t always affordable, particularly when battling both dental problems and bad credit, you can often find effective ways to finance those important procedures and get your smile back at full shine.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.